Car Sale Contract with Payments

A car sale payment agreement is a legal document executed between the buyer and seller of a car in which the buyer agrees to pay the price of the car in installments. This way, the buyer does not have to pay a portion of the purchase price upfront and agrees to pay off the full amount in installments with or without interest.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Car Sales Contract with Payments?

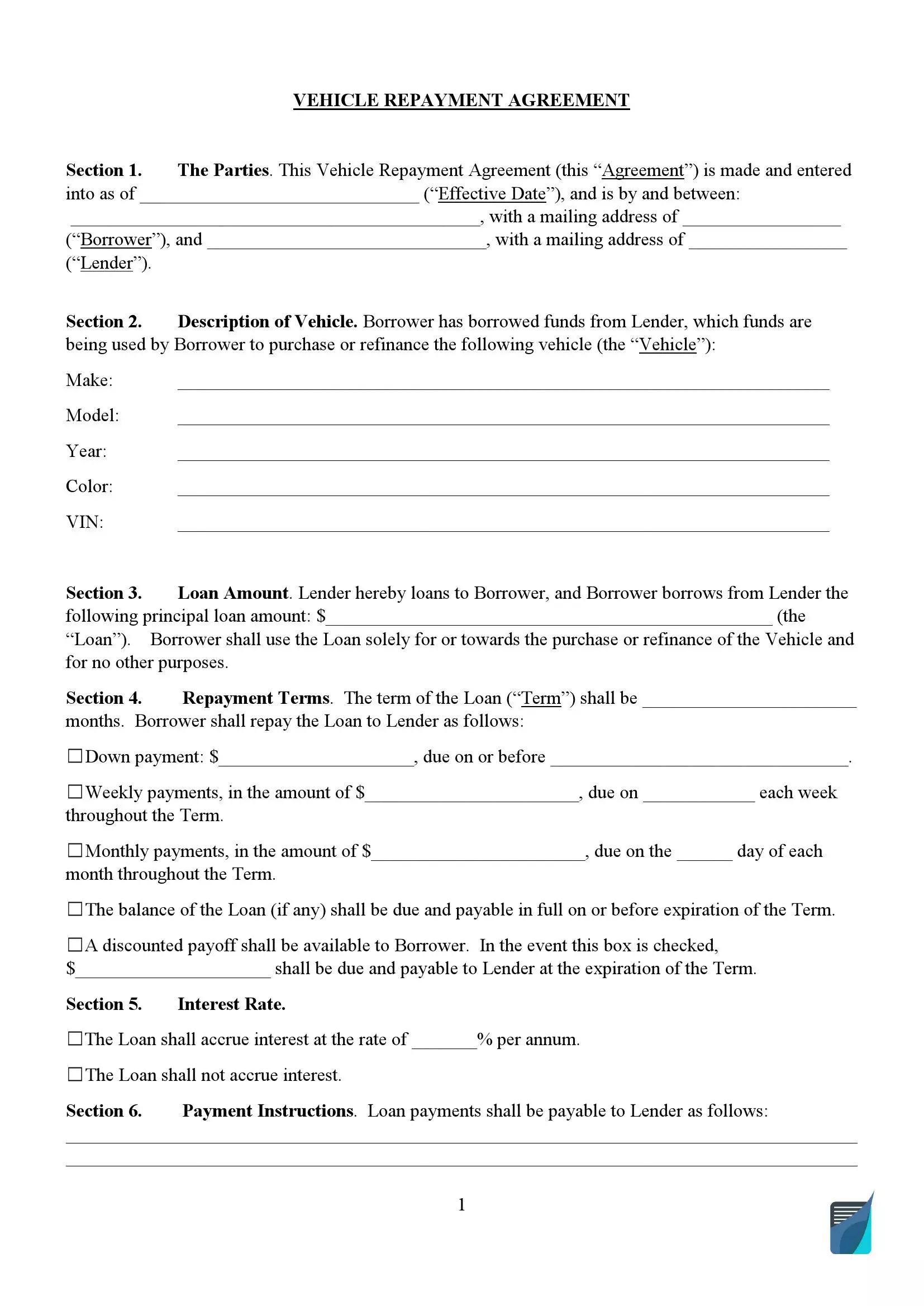

A vehicle purchase agreement with payments is a legal document used in a private vehicle sale where the buyer is unable to pay the full price or value of the car upfront. When a sale takes place directly between the parties rather than through a dealership, it may not be possible for the buyer to pay off the car upfront. The parties can devise a payment plan by using a repayment agreement. This loan agreement template will provide the details of the parties, the details of the automobile, the amount lent, the payment structure, and other details regarding the private car sale.

When You Should Use the Contract

A car sale agreement must be used when the buyer’s financial capacity is not enough to pay the full price of the car upfront in a private sale. If the buyer plans to pay the amount in installments, repayment agreements serve as legal documents that record the terms and conditions of the payment plans for private car sales. The buyer and seller should keep one copy each so that they can refer to it in case a legal issue arises later on.

Why Is It Beneficial to Use the Contract?

Using a car sale agreement is beneficial when a car sale takes place without involving a dealership. The legal documentation of such a sale is extremely important. Using a sale contract for a private sale contract formulates a legal relationship between the seller and the buyer and the buyer becomes legally bound to pay the amount to the seller. Once the payment plan is recorded, the seller has legal recourse against the buyer in case of default. The agreement also serves as proof of the sale of the automobile for the DMV.

What Should Be Included in the Contract

A car sale contract can be modified as per the needs of the parties but the following details must be included:

Borrower

The agreement must provide the full name and address of the borrower or the buyer. The borrower is the person who is buying the automobile and the funds provided by Lender can only be used to purchase or refinance the automobile.

Lender

The agreement must also provide the name and address of the lender. Usually, in a private car sale, the seller himself is the lender.

Loan Amount

The agreement should also specify the principal amount. Usually, during private car sales, a part of the price or value of the car is paid upfront as a downpayment and the rest is considered as a loan given by the seller to the buyer.

Car Description

As this agreement solely for the purpose of purchasing or refinancing the car, the details of the car must also be mentioned in the agreement. These details may include the vehicle’s make, model, year, color, and vehicle identification number or VIN.

Interest Rate

The form should also mention the interest rate applicable to the principal amount. The parties can also choose to not include any interest on the principal amount.

Payment Schedule

The payment schedule shall include all the details regarding the time and manner in which the payment is to be made. This also includes the amount of the downpayment and the due date for the same. The payment schedule should also provide how and when the remaining amount should be paid by the buyer, for instance, monthly payments, weekly payments, or a discounted payoff.

Late Fees

Late fees are the fees applicable in the event of default by the buyer. If the parties choose to include late fees in the agreement, the same should be mentioned in the agreement.

Governing Law

The parties buyer and the seller also mention the state whose law will govern the agreement.

Filling Out the Vehicle Sale Contract with Payments Template

FormsPal’s easy to use and understand car sale agreement can be completed by following these simple steps:

Fill In the Date and Details of the Parties

The first step is to mention the date on which the agreement is made and entered into in the blank space provided before the term “Effective Date” in the first paragraph.

After that, the name and address of the borrower or the buyer must be mentioned in the corresponding blank spaces provided before the term “Borrower.” The name and address of the lender should be mentioned in the corresponding blank spaces provided before the term “Lender.”

Provide a Description of the Car

Under Section 2 of the agreement, the borrowing party and the lending party must provide a description of the car that is being sold. Mention the car’s make, model, year, color, and VIN respectively under the blank spaces provided under Section 2 of the document.

Specify the Loan Amount

Specify the principal amount in the blank space provided under Section 3 of the document.

Stipulate the Repayment Terms

The buyer and seller must also stipulate the repayment terms for the agreement under Section 4 of the document. Write down the term of the loan in the first blank space provided under Section 4. Mention the amount for the down payment and the date on which it is due in the second and third blank spaces provided under Section 4.

After that, choose a repayment option out of the ones mentioned in the form. These options include monthly payments, weekly payments, payment in full, and a discounted payoff. Mention the amount for each kind of payment in the corresponding blank space provided under each option.

Mention the Interest Rate

Under Section 5, choose the first option and mention the rate of interest in the corresponding blank space, if applicable. If there is no interest applicable, choose the second option.

Provide Payment Instructions

Under Section 6, write down any additional payment instructions in the blank spaces provided, if applicable. This can include instructions about how the payments are to be made or the mode of payment.

Choose the Collateral Security

The next step is to choose the collateral security for the loan. Choose the first option under Section 7 if it is secured by a first priority lien on the car. Select the second option if it is secured by a second priority lien on the car. Choose the third option if it is secured by a lien on another asset of the borrower and mention the asset in the blank space provided under the third option. Choose the fourth option if the loan is unsecured.

Specify the Governing Law

In the blank space provided under Section 13, mention the name of the state under the laws of which the agreement will be governed.

Mention the Details of the Guarantor

If the agreement includes a guarantor, choose the first option under Section 16 and mention the name of the guarantor under the blank space provided there. If there is no guarantor, select the second option under Section 16.

Include Additional Terms and Conditions

If there are any additional terms and conditions, mention the same in the blank spaces provided under Section 17.

Sign the Form

Once all the details have been finalized, the borrower and lender must sign the form. The lender and borrower must put their signatures and print names under the corresponding blank spaces on the last page of the form.

If there is a guarantor, then he or she must put his or her signature and print name in the corresponding blank spaces at the end of the form.

FormsPal’s easy-to-use vehicle repayment agreement form can be downloaded for free.