IRS Form 1040 is a standard U.S. federal income tax form individuals use to file annual income tax returns. It’s the primary form that taxpayers use to calculate and report their income, deductions, and credits to the Internal Revenue Service (IRS). The form includes sections to declare various types of income, such as wages, salaries, dividends, and interest, as well as deductions and credits that can reduce the amount of tax owed.

The purpose of Form 1040 is to determine the amount of federal income tax that an individual owes each year or to confirm the amount of refund due to the taxpayer. The form is designed to accommodate many different financial situations, offering specific lines for reporting additional taxes like self-employment tax, alternative minimum tax, and payments like estimated tax payments and tax credits. Each year, the form may undergo updates to reflect new tax laws or adjustments in tax policy.

Other IRS Forms for Partnerships

If you have already filed the Form 1040, you might need to file more forms, depending on the complexity of your finances. Check what IRS forms are often filled out by our users along with the standard tax return form for individual taxpayers.

What Do I Need to Fill Out the Form 1040?

Of course, you can compose form yourself; this is not quite realistic. Correct filling of the 1040 form will guarantee that you correctly draw up the paper, and therefore the correct taxes. When filling out the 1040 form, you will need to present a lot of data, take many steps. For best results, we advise that you use our form-building software. If you have any doubts concerning any of the phrasing, it is better to seek professional legal advice. Below you will find a detailed step-by-step guide on how to build and fill out a 1040 form.

1) Download The Form

First, you need to download the paper. You can do this on our website by choosing a format convenient for you. Once downloaded, you can fill out the document online using our form building software. You can also print the document and fill it in manually if you prefer.

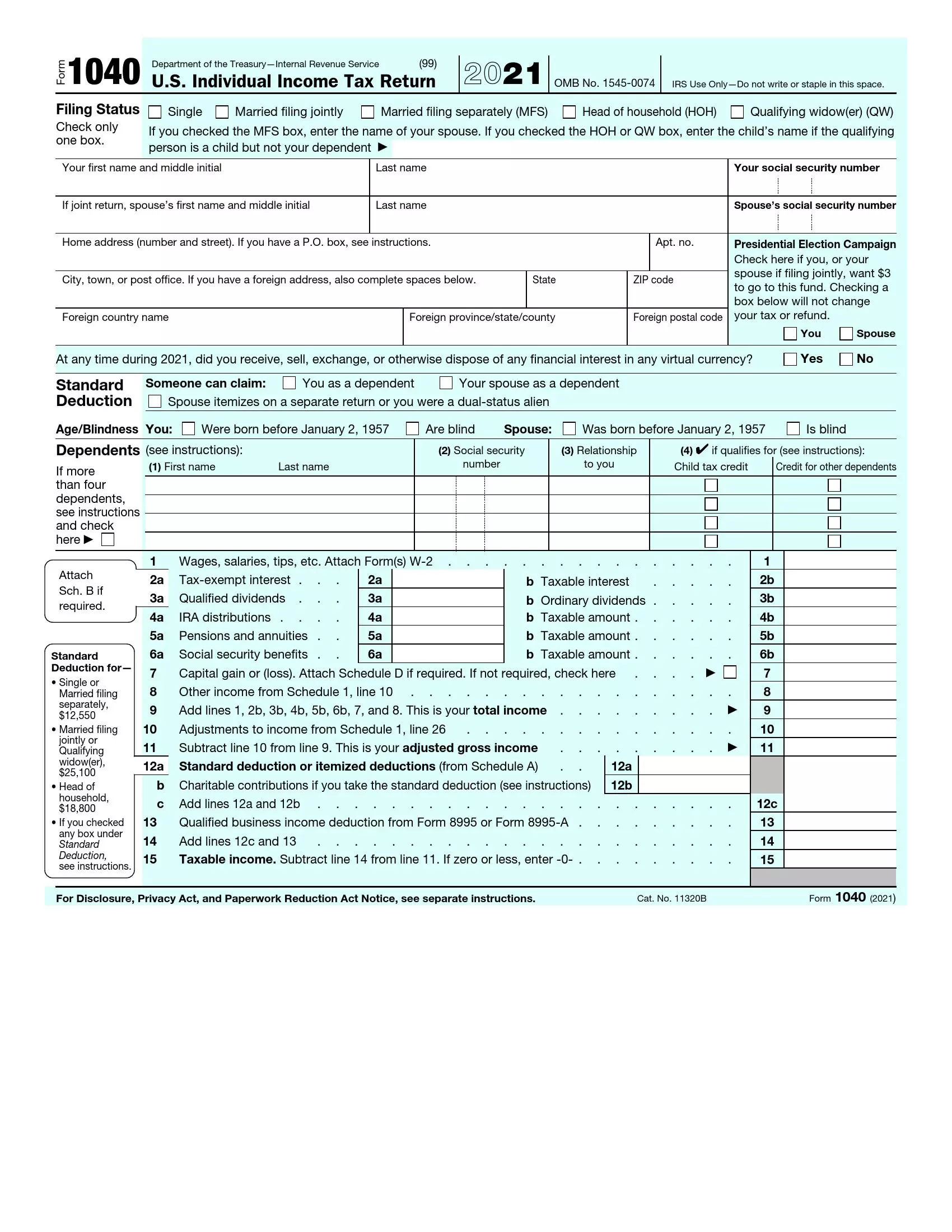

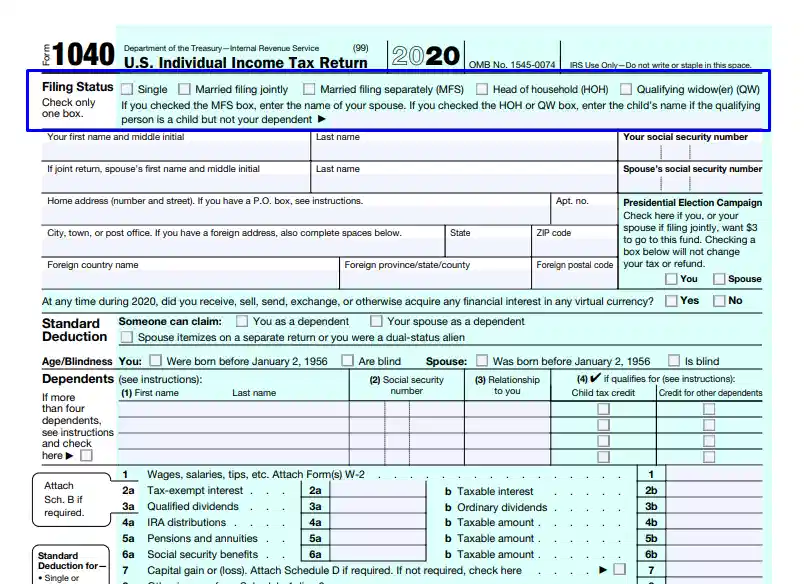

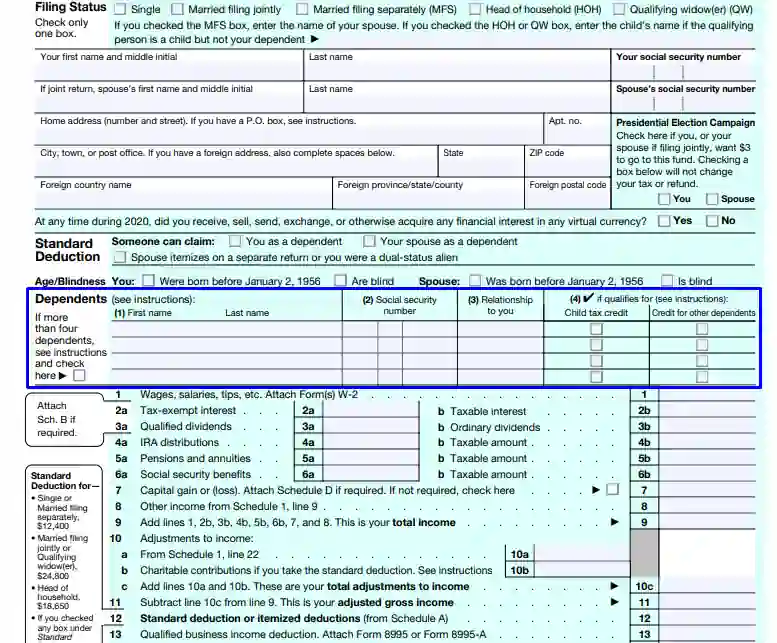

2) Indicate Your Marital Status

In the very first part of the document, you need to determine your marital status. You will have five options to choose from: single, married (joint filing), married (separate filling), head of household, widower (widow). Based on the choice of one or another option, you will need to fill out the subsequent parts of the document.

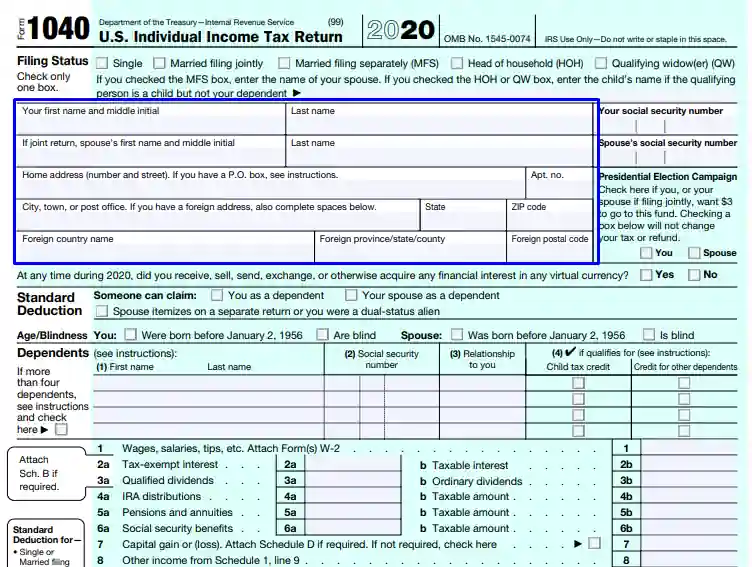

3) Enter Your Name and Contact Info

To get started, enter your first name and the initial of your middle name, and in the next box, enter your last name. If necessary, write your spouse’s name under your name. Under the name(s), enter your contact info. First, enter the street, then the building number, and then the apartment number. After indicating the street, house, and apartment, enter the state and your zip code. If required, you can also indicate the address of a foreign country at this stage.

4) Enter Your Social Security Number

You will see two fields under the social security number to the right from the fields for the name and contact data. Print your social security number first, and below it, print your spouse’s social security number (if applicable).

5) Define the Presidential Election Campaign

If you or your spouse are willing, you can tick the box by participating in this fund. This field is optional and will not affect your final tax amount.

6) Answer Whether You Have Used Cryptocurrencies

At this step of filling out the form, you need to answer whether you have practiced virtual currencies this year. Just check “yes” or “no” according to your answer to this question.

7) Check Standard Deduction

Choose one of three options for who can claim. That can be your spouse, you, or you (your spouse with dual citizenship). Below you will see the “age or blindness” column. In this column, it is important to note if one of the form’s compilers is over 65 years old or a blind taxpayer. Termin “blind taxpayer” means someone whose vision makes them blind. These taxpayers can qualify for special deductions, just like individuals over 65. It can affect the result of your income tax.

8) Specify Dependents

At this step, you need to file all the dependents (family members). If there are five or more dependents, check a box. So, to enter information about each of the dependents, you need to fill in four fields: name, social security number, relationship, “is suitable for a child tax credit or is suitable for another tax credit.”

9) Enter Income Info

Provide info about all your income, including dividends, support, and other returns. During the same step, enter gross income information, standard deduction, or itemized deductions. After filling in all the columns, indicate the total income.

10) Specify Taxes and Credits

At this step, you need to file your total gross income, as well as all your tax credits, self-employment tax included. This step is very important because tax credits can change the amount of your total tax.

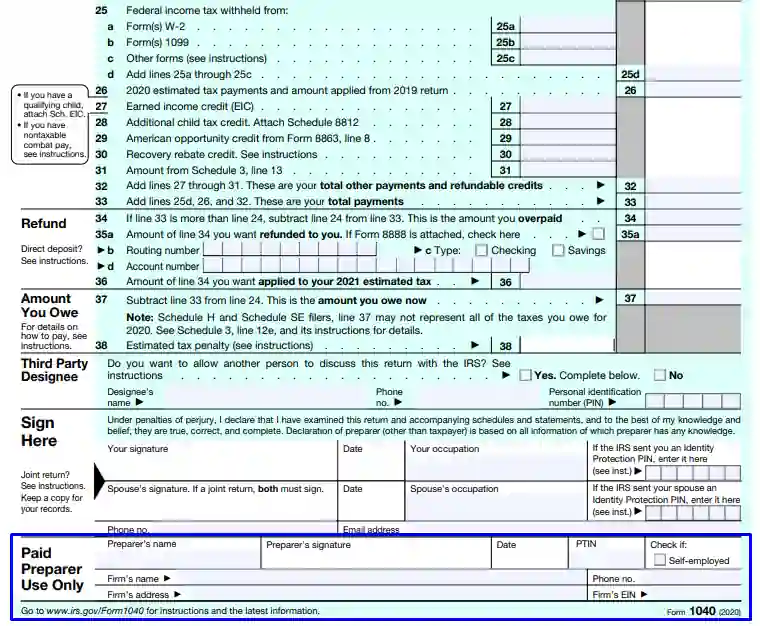

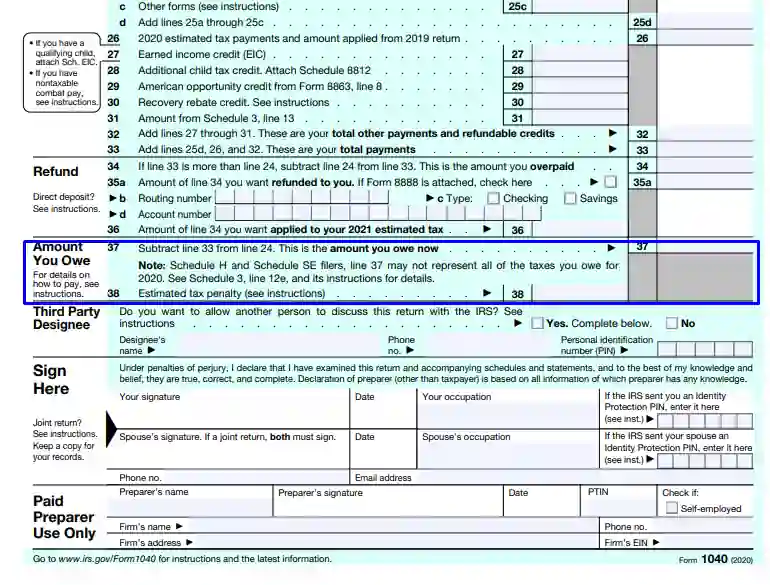

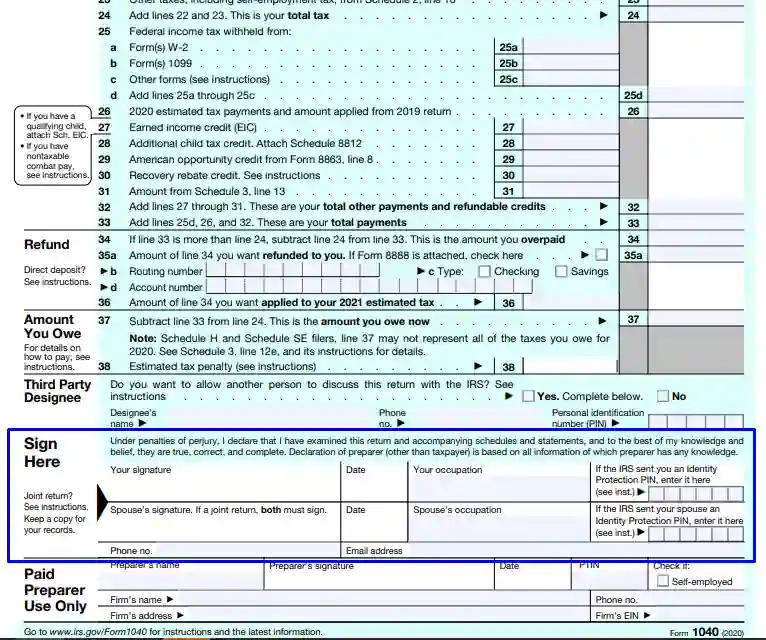

11) Enter Payments Info

At the same step, list all your payments, including federal income tax. After filling in lines 25-32, you need to add lines 32, 26, 25d. The result of this addition is all of your payments for the past tax year.

12) Calculate Your Tax Refund

Here you need to enter the amount of the overpayment you want to return and the amount you want to spend on paying taxes in the next year to get a tax refund. This move can significantly reduce the amount of taxes you have to pay this year and the next. Sometimes the recalculation can cover about 100 percent of the tax payments for the year.

13) Calculate How Much You Owe

At this step, you need to estimate how much taxes you should pay this year, taking into account all deductions and credits. It is quite easy to do so, and it is enough to deduct all your payments from your total tax.

14) Enter The Third Party Info

Fill in the designee’s name, contact phone number, and personal identification number (PIN).

15) Sign The Document

Enter your name and your spouse’s name, place the date, enter your locations, and enter your identification number (if any). Do not forget to include your contact phone number and email. You will find the fields for recording your contact info under the fields for recording names and addresses.

16) Enter the Paid Preparer Info

It is necessary to enter the paid preparer’s name, sign the form, and date it. If you have filled out the paper via a company, you must record the company’s name and data.