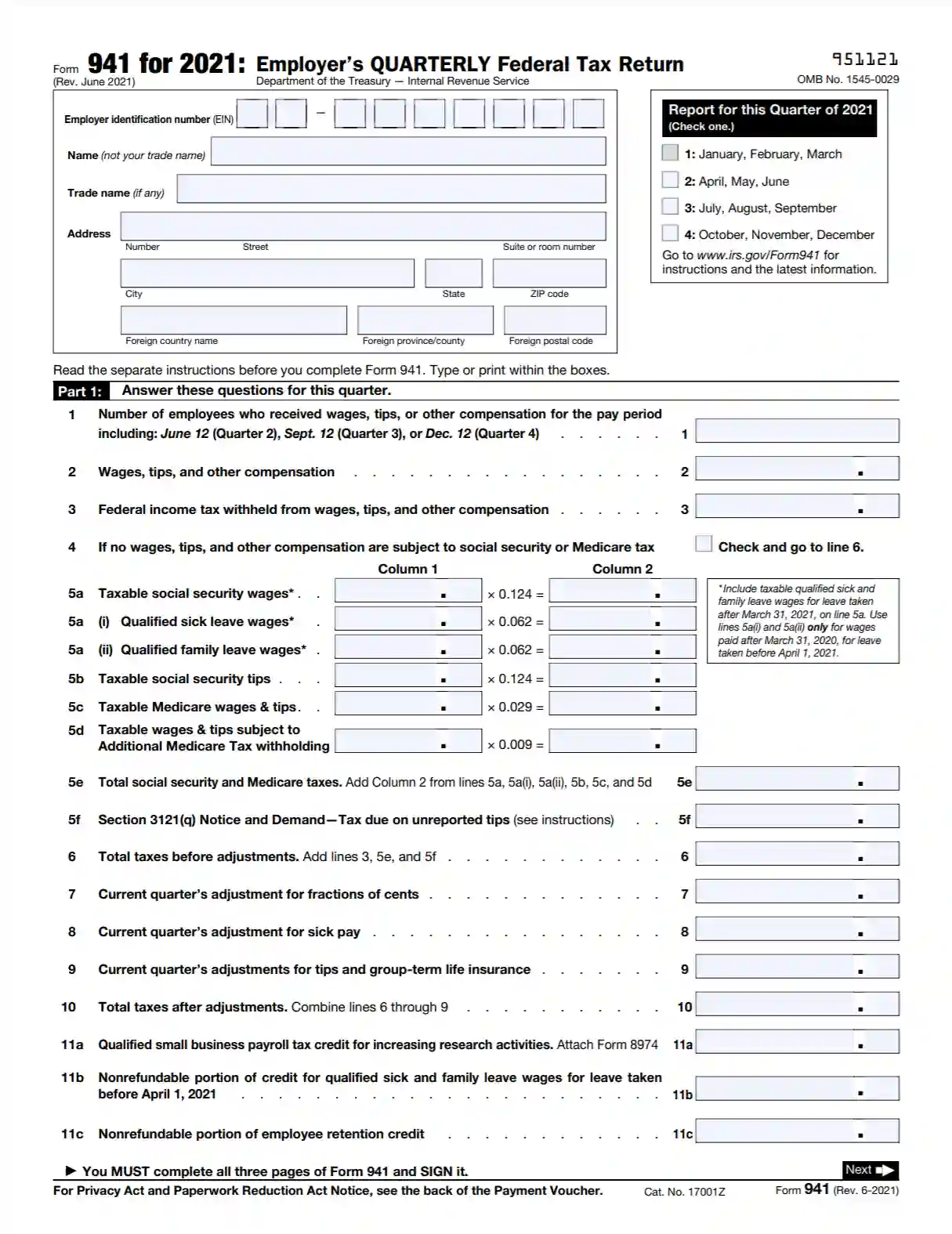

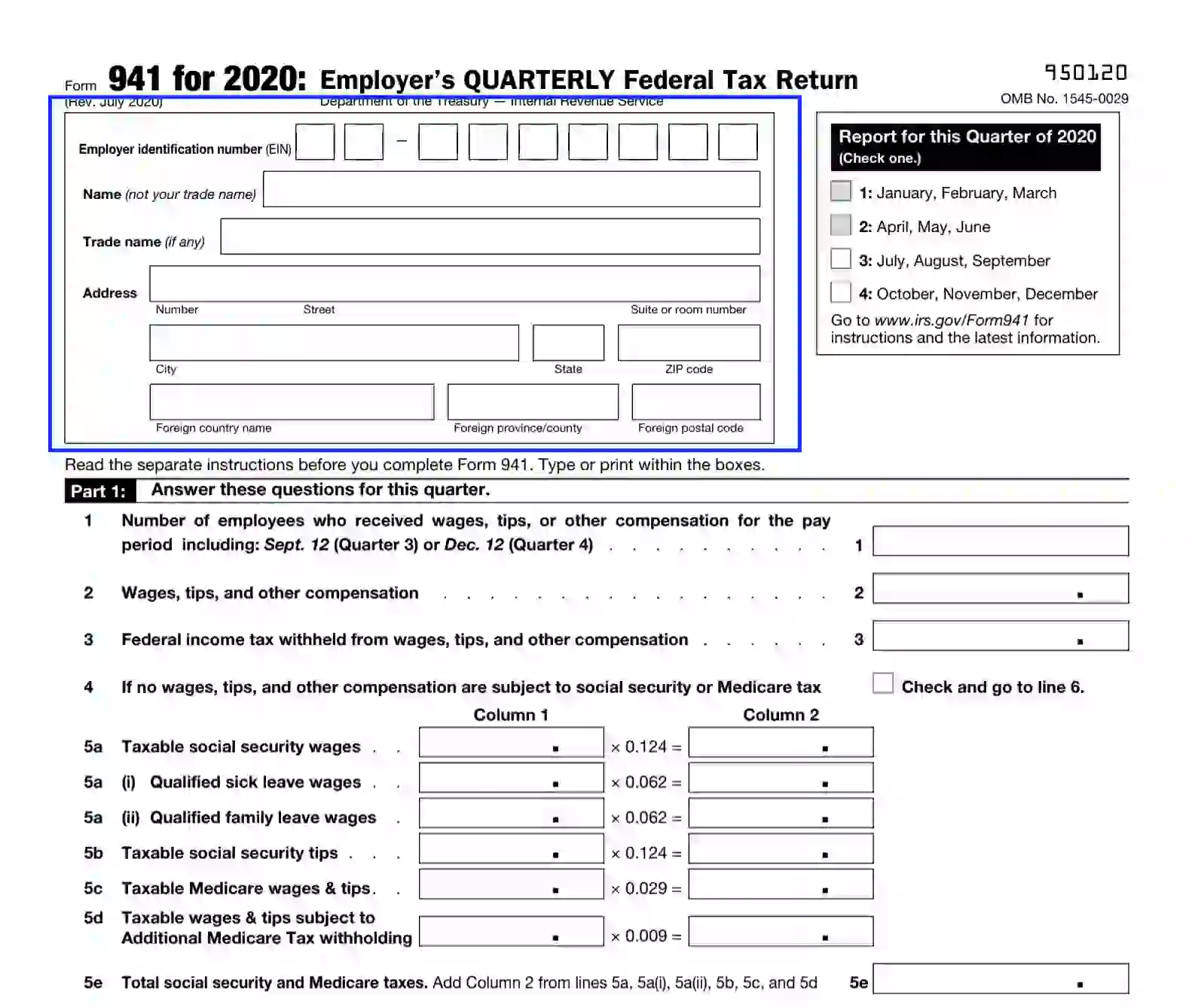

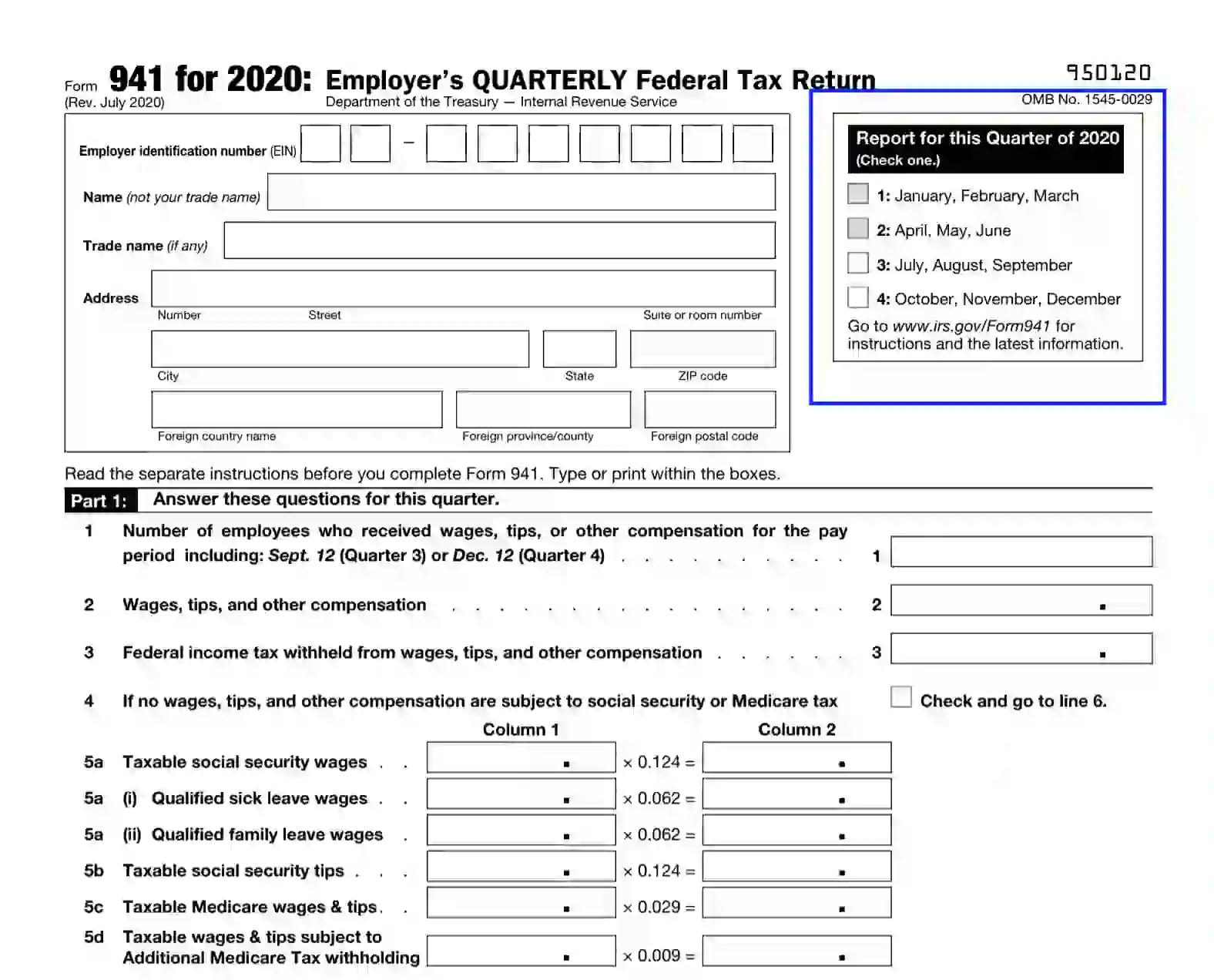

IRS Form 941 is a tax form employers use to report quarterly federal payroll taxes, including withholdings from employee wages for federal income tax, Social Security, and Medicare taxes. It is also used to report the employer’s portion of Social Security and Medicare taxes. Employers must file this form quarterly to reconcile the taxes withheld from employees’ paychecks with the total tax liability owed to the IRS.

The purpose of Form 941 is to ensure that employees’ income taxes, as well as Social Security and Medicare contributions, are collected and transmitted to the federal government on time. This form is critical for maintaining accurate tax records for employers and employees, ensuring that the correct amounts are reported and paid throughout the year.

Other IRS Forms for Partnerships

With a plenty of IRS forms the Service requires businesses to file, it is easy to get confused. Read about other forms businesses typically file with the Internal Revenue Service.

How to Fill Out Form 941 and 941-V

Completing official forms might seem intimidating. Therefore, follow our thorough guide to avoid possible difficulties. We recommend using our latest software to create a relevant PDF file of Form 941.

The US Internal Revenue Service Form 941 is divided into five parts and requires comprehensive information about the petitioner. Also, the document contains a payment voucher (941-v) as the inherent part of the record. Let us review each component and its subsections.

Identify Yourself

Before the petitioner starts filling out the form, they should identify themselves, including the following:

- ID number as an employer

- Legal name

- Entity’s name, if applicable

- Specify your residency and address, including street and room number, city, state, and ZIP. Should you be residing in a foreign country, ensure to provide the correct details.

In the event you haven’t got any entity ID, you should register an application at the IRS via online services, fax, or mail. If the pleading is still in progress, please, ensure you enter “Applied For” in the employer ID section.

Also, define the period you are reporting for.

As the document consists of several pages, you need to insert your legal name and entity ID at the top of each page.

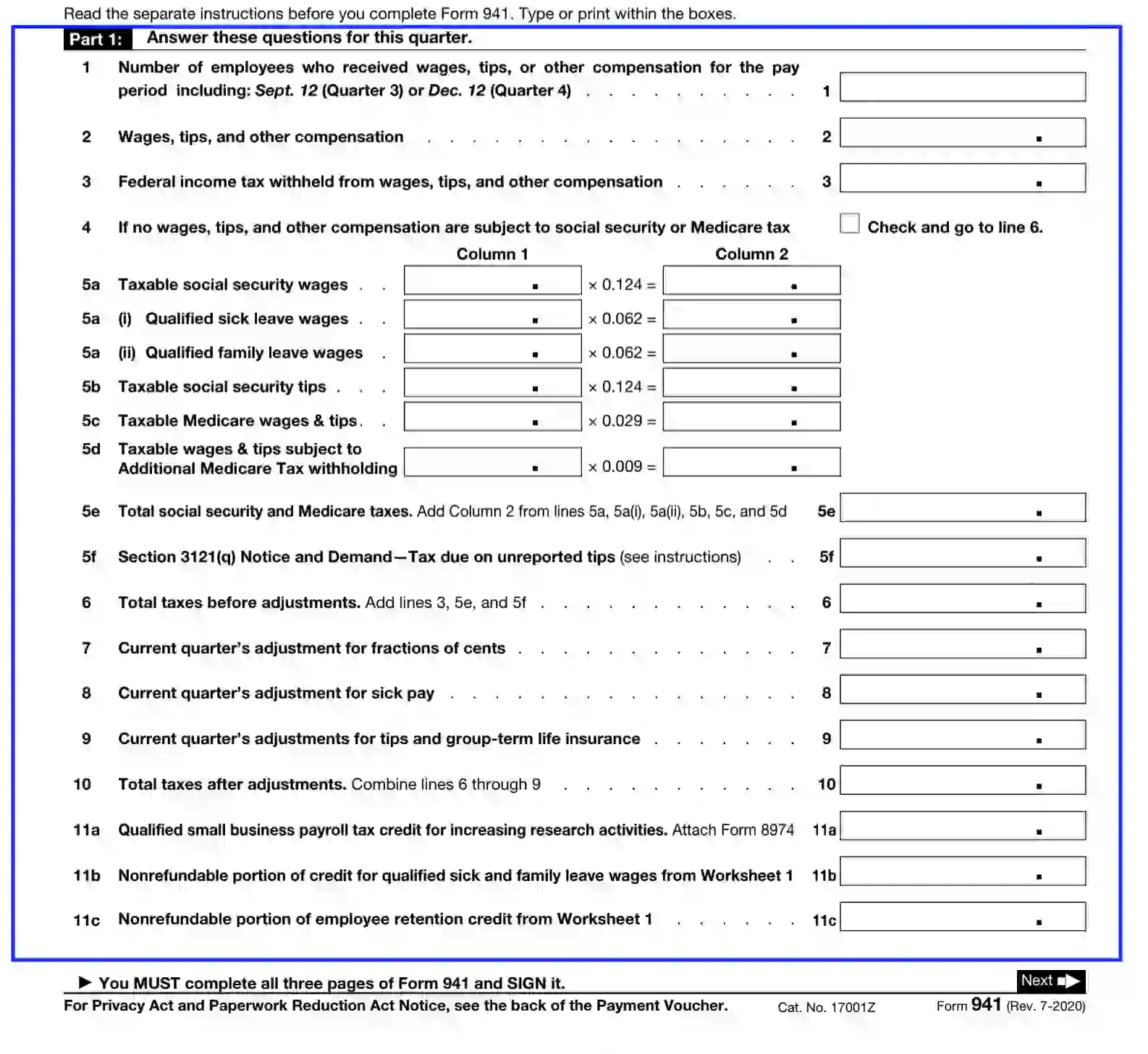

Complete Part I Questionnaire

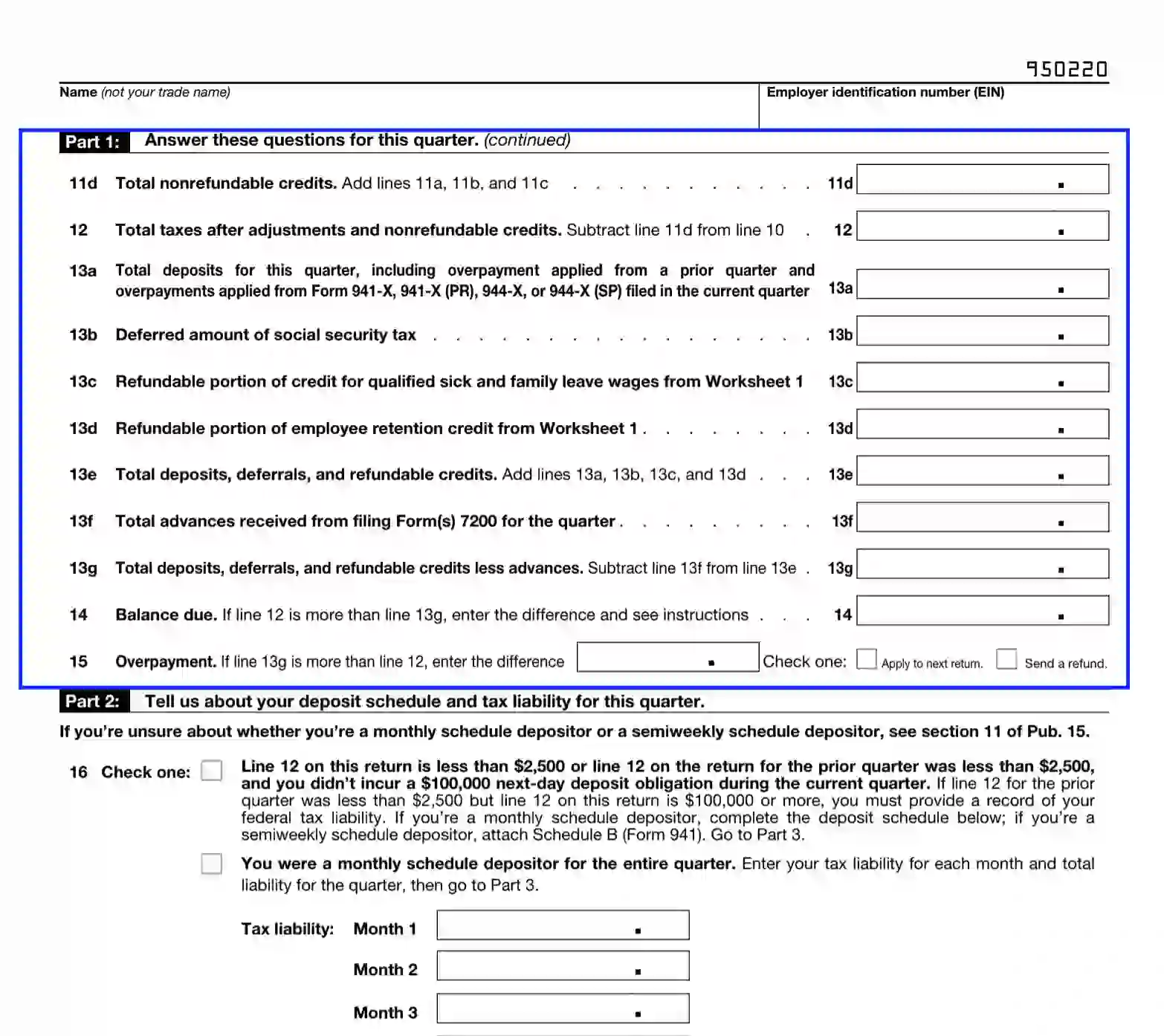

This part contains 15 questions with subsections regarding the designated report period. You should print or type the relevant data into the blank slots before proceeding to the next part.

Continue the completion on the next page, and make sure to enter your legal name and ID number at the top of it.

Specify the Deposit Preferences and Tax Obligations in Part II

In this part, you should complete question 16. You are offered to choose one alternative and check the corresponding variant.

Select the first alternative if:

- total taxes submitted in subsection 12 don’t exceed 2,500 USD

- total taxes introduced in subsection 12 of the preceding quarter report don’t exceed 2,500 USD

- the next-day deposit obligation for the running period doesn’t exceed 100,000 USD

Select the second box if your deposit schedule for the running quarter is monthly. Also, fill out the tax obligation slots for each month.

Select the third alternative if your deposit schedule is on a semiweekly basis.

Make sure to fulfill all requirements listed in Section 16.

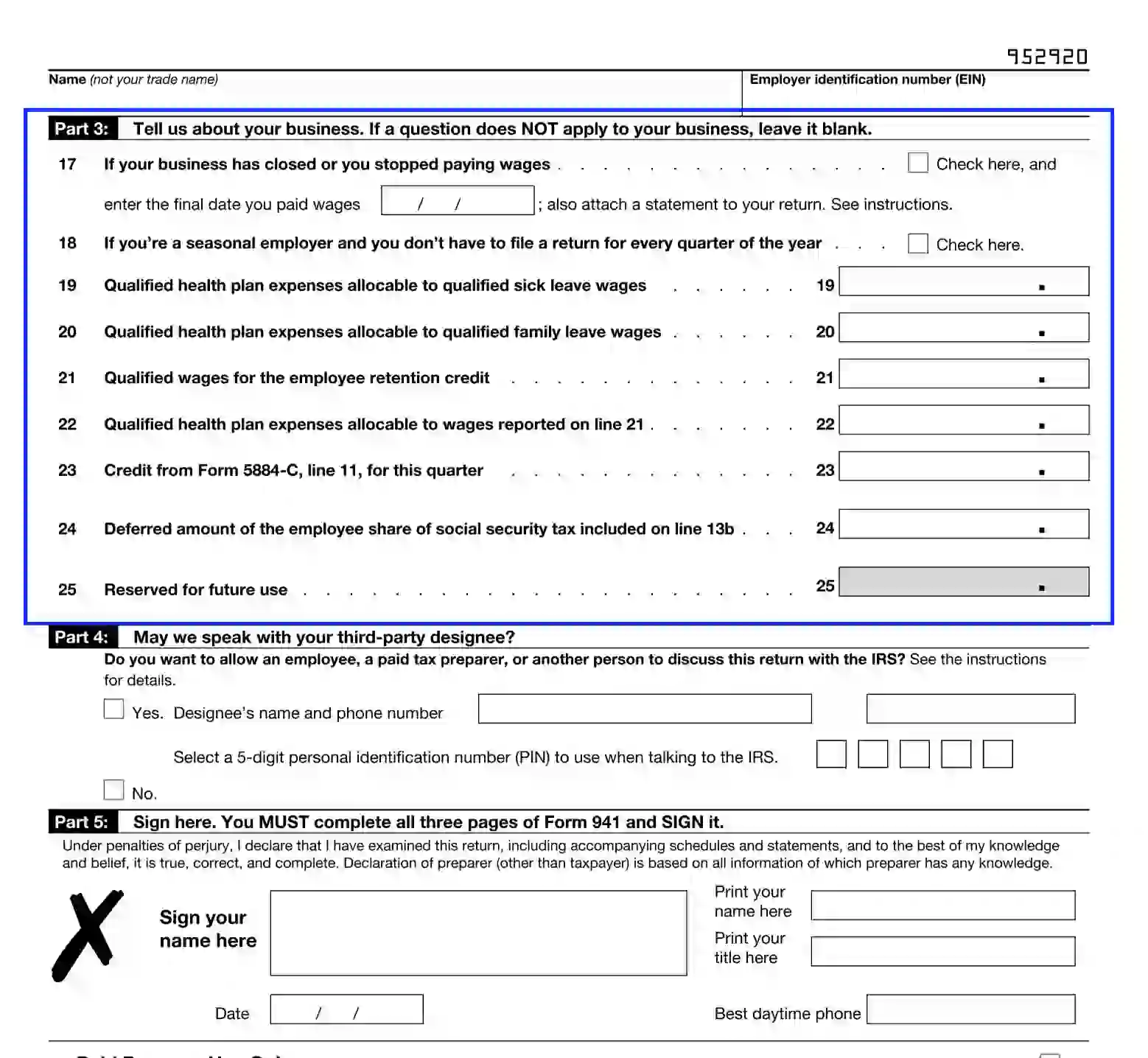

Complete Part III Questionnaire about the Business

This section contains questions 17-25 and requires info about your business. Complete each point if appropriate. If the question doesn’t apply to your situation, leave the slot blank.

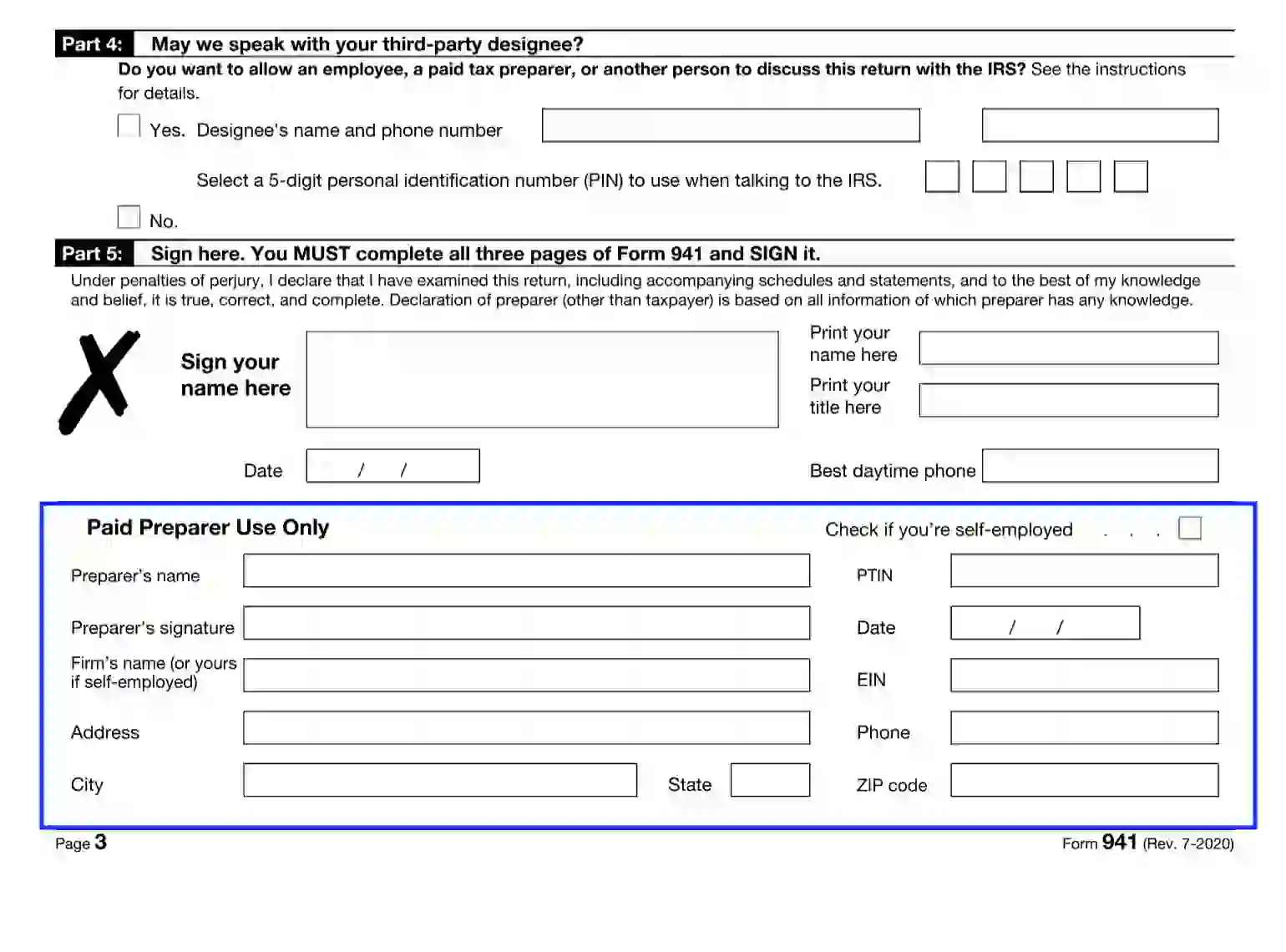

Third-Party Representative Assignment

If you decide to empower the person responsible for the report preparation to negotiate with the IRS, please, check the “Yes” box, submit the individual’s name, contact phone number, and PIN.

If you wish to deliberate the report yourself, please select “No.”

Authorize Form 941

Once you have filled out the necessary info, re-read the form to avoid any possible mistakes and proceed to authorization. Append your signature, submit the printed name, title, and phone number, and specify the calendar date.

If you have assigned a preparer, let this person complete the corresponding section. Let them insert the required data completing all slots.

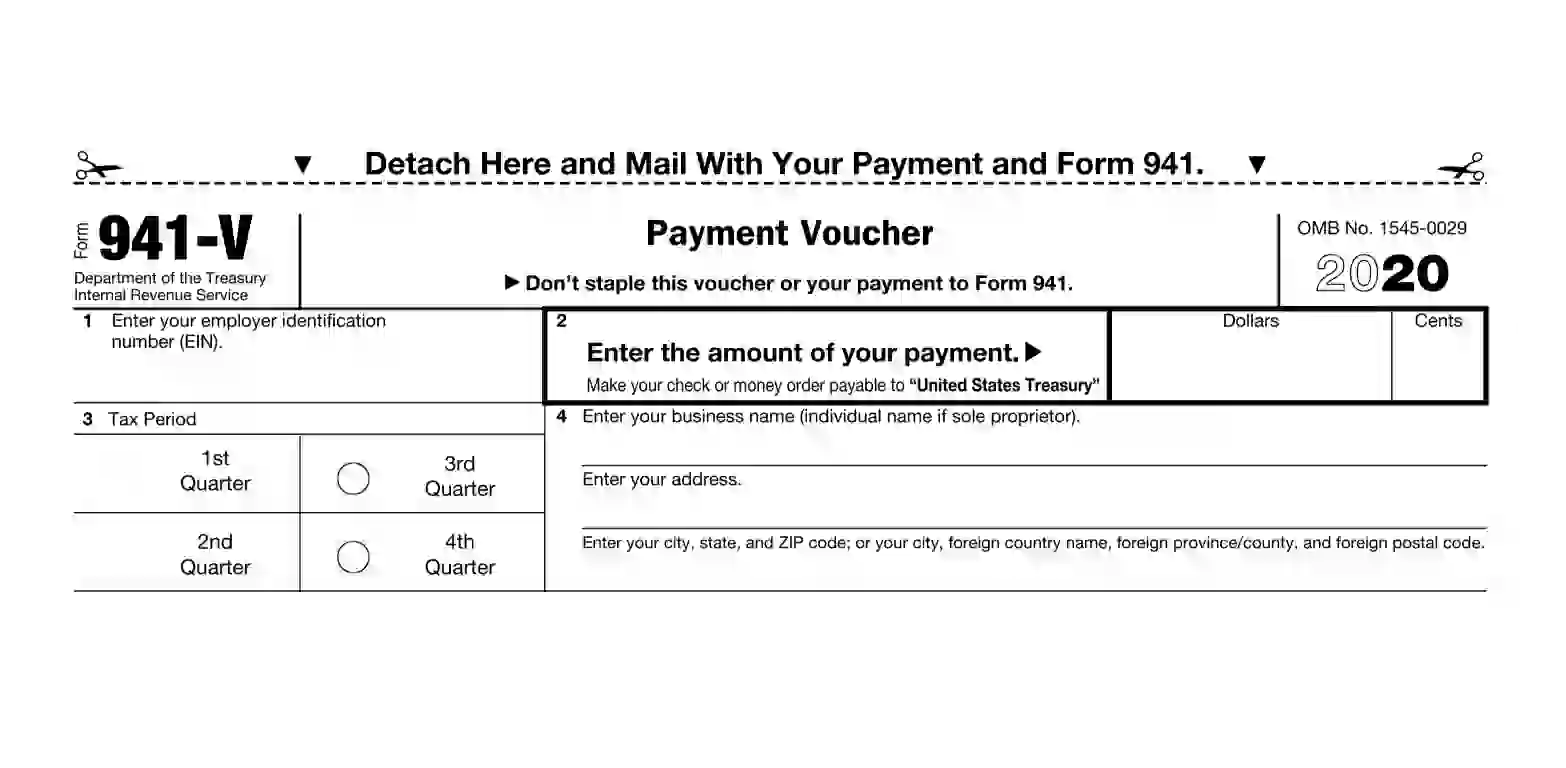

Execute the Payment Voucher

This section is an indispensable part of IRS document 941 if the business makes a payment with Form 941. The voucher contains instructions and recommendations. If you want to avoid penalties, make sure you read them all to accurately prepare the 941-V section. Also, make sure you don’t staple or glue this voucher to Form 941.

Here are the inherent steps you should follow to fill out the 941-V:

- submit your entity ID number

- specify the amount in US dollars

- determine the period and check the corresponding box

- submit your entity’s name

If not applicable, you should enter your legal name. Also, specify your business address.