IRS Form 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This tax provides funds for unemployment compensation to workers who have lost their jobs. Most employers pay federal and state unemployment tax, but only the federal tax is reported and paid via Form 940.

The form is required for any employer who paid wages of $1,500 or more in any calendar quarter or had one or more employees for at least some part of a day in any 20 or more different weeks in a year. The information on Form 940 helps the IRS determine if the employer has paid the correct unemployment taxes throughout the year.

Other IRS Forms for Partnerships

Employers in the US have to file numerous IRS forms on a regular basis. Look what other forms might be necessary for your type of business.

How To Fill Out IRS Form 940

This report consists of two pages and seven blocks of the questions that can be difficult to fill out by yourself. For this reason, we prepared a manual about the completion of IRS Form 940. Follow the steps below, and you will not make a mistake in this document.

You can print it or enter all information online — select the most convenient option.

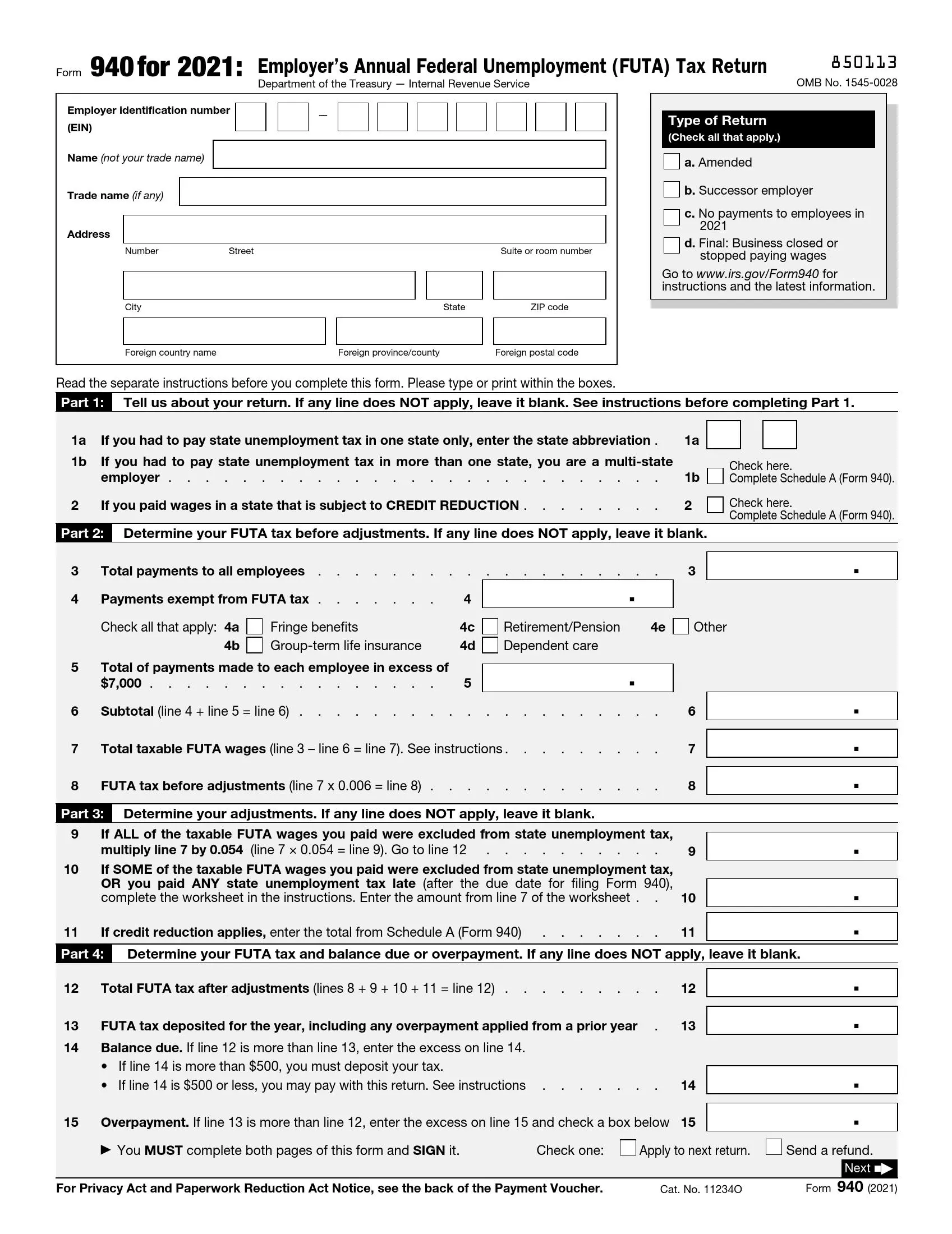

1. Fill Basic Information About You

You should provide EIN, personal name, name of your organization, and its physical address in the window on the top of the first sheet.

2. Choose the Type of Return

You should specify the goal of your return by checking an appropriate type in the box in the upper right corner of the form. The type depends on the content that you include in the form. There are four primary types of them:

- Amended

Select this one when the purpose of the declaration is to correct a mistake in the previous one.

- Successor employer

If you are a new organization owner and you hire employees who used to work with your predecessor, you should mark this option.

- No payments

If you have a legal right not to pay federal unemployment tax and you have not done it for the last year, select this variant and sign the contract missing other fields.

- Final

This option is available for employers who will not continue the business activity and will not file this form next year.

Remember that you can choose more than one variant in this box.

3. Repeat EIN and Personal Name On Other Pages

You can forget about this step when you will fill out the second or the third pages. That is why you should fill in your identification number and personal name on the next sheets.

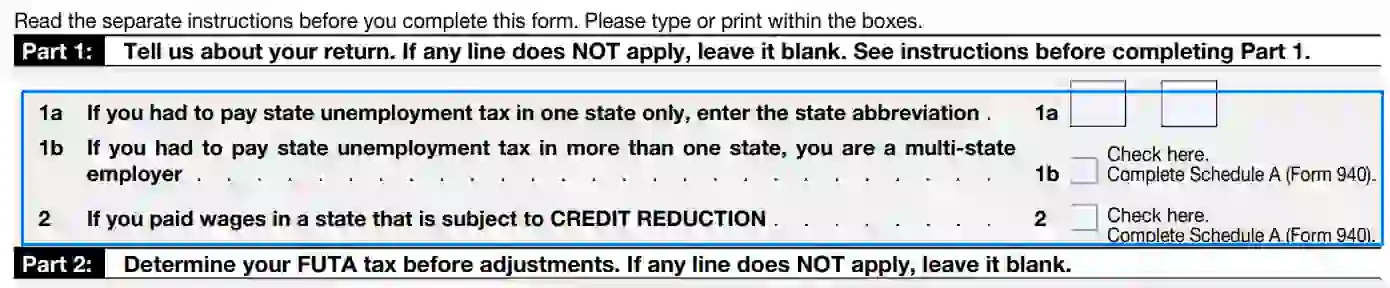

4. Describe State Taxes

It is obligatory to complete lines one and two in all cases, except for one when the income of your employees is not taxed by the state. To complete part one, you should write in an abbreviation of the state or states where the taxation system for your company works and point out whether the state is under the program of credit reduction or not. You can find the list of abbreviations below.

When the government is trying to reduce the credit amount of the state, it increases tax rates for residents of this state.

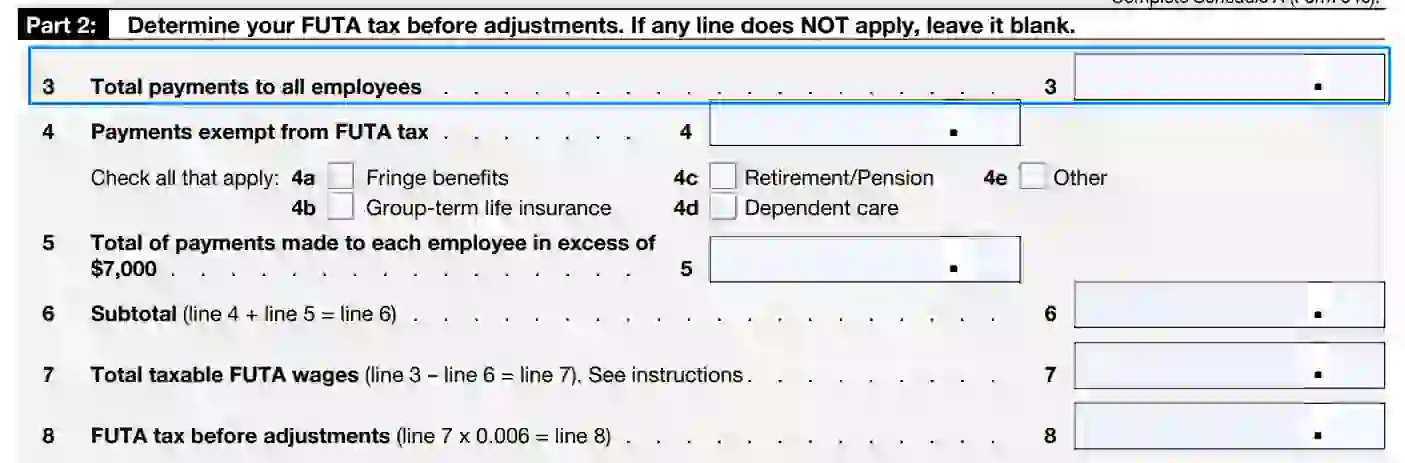

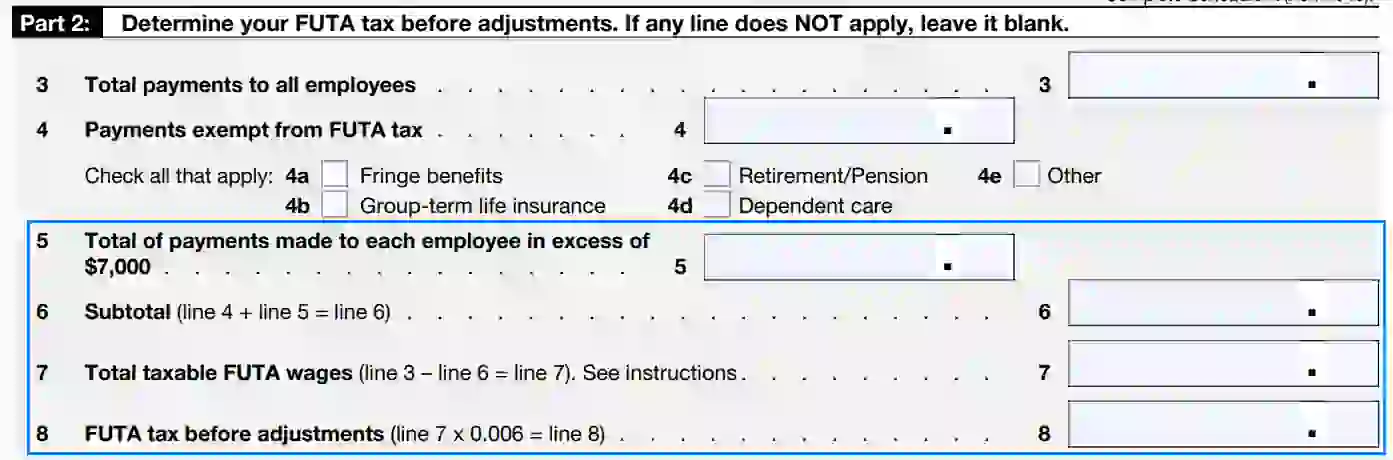

5. Summarize All Fees Made in a Year

Fill in the sum you have paid to your employees for the last year in line 3. Make sure you compute not only wages but also pension and various benefits. Do not put the sign of dollar in this and other similar lines.

6. Give Data About Non-Employment Payments

You should calculate the amount of money you have paid to workers for the last year that is not connected with wage and enter it in line 4. They can be compensations, services, and other categories of fees listed in boxes 4a-4e. Use these fields to check the types of payments you include in the total amount.

7. Compute Values for Different Categories of Payments

Lines 5-8 require some calculations from you.

- You should subtract fees not related to wage from total payments for each employee. Then, you need to subtract $7,000 from the previous value for each person and sum these numbers to get the overall amount of payments without service fees and FUTA wage base. Write this number in line 5.

- Add up values from the fourth and the fifth lines and write the result in line 6.

- Subtract the result of the sixth line from the value of the third line and put it in line 7.

- Make a pre-calculations of tax amount by multiplication of value in line 7 by 0.006 and fill it in line 8.

8. Compute Amount of Federal Tax

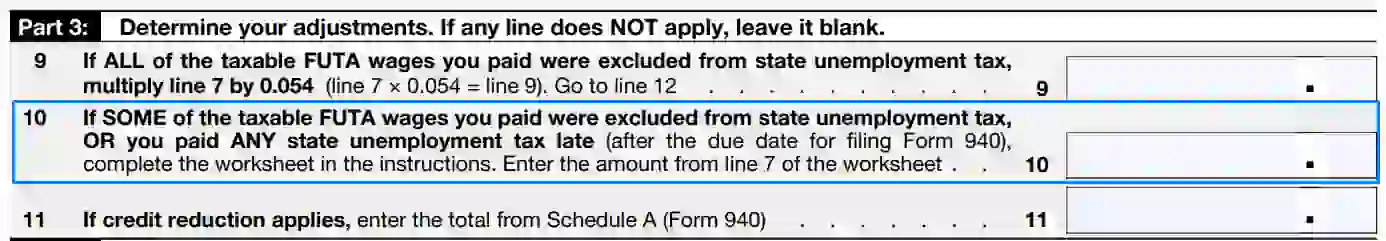

You have to complete line 9 only if you did not pay state unemployment tax. Leave this field empty if it is not your case.

Multiply the number in line 7 by 0.054 and enter the result in line 9. It will be added to the sum in line 8 part of the tax.

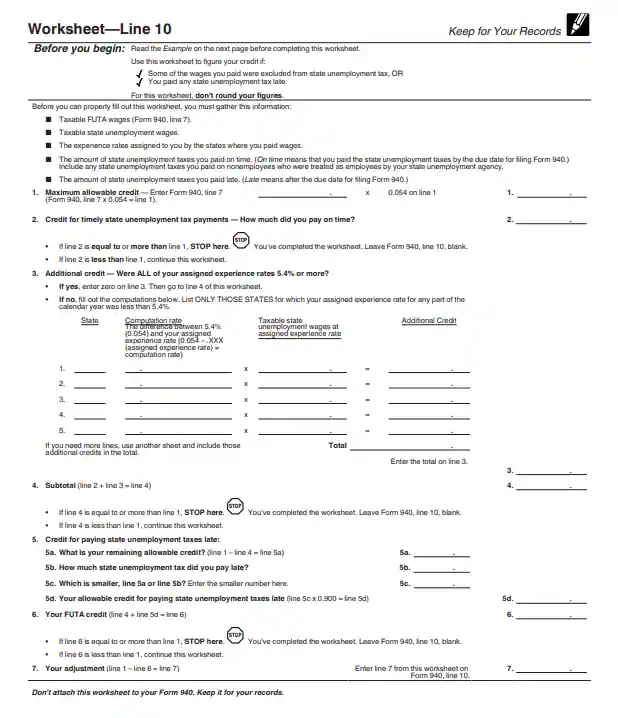

9. Use worksheet and Calculate Your Tax

You should calculate the sum of the federal tax that should be added to your payments if not all state taxes were eliminated. It is not easy to estimate this number, so you have to apply the worksheet in the instructions. Follow the procedure described in the worksheet and fill in the result you have in line 10. Remember that you should skip lines 10 and 11 if you completed line 9.

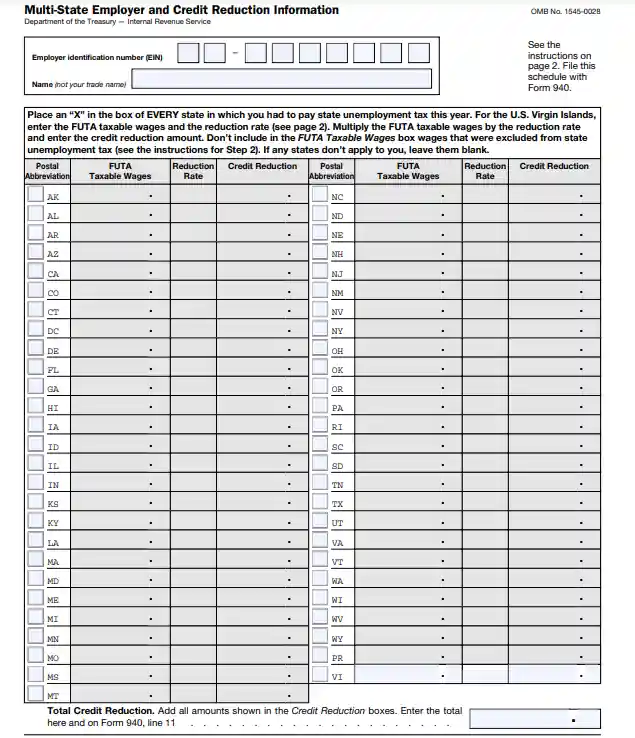

10. Clarify Credit Reduction

Make sure you use additional form Schedule A Form 940 for tracking credit reduction applied to your business. Make computation in this form and put the answer in line 11. Do not fill it if all payments were not taxed by the state.

11. Fill In Total Federal Tax

Now you have to sum your previous calculations and put the outcome in line 12. Then you should write the amount of your federal tax deposit in line 13. When you get both numbers, select line 14 or 15 based on the difference between values in lines 12 and 13; if line 15 is suitable for your case, choose the way you want to use your overpayments, checking the appropriate box.

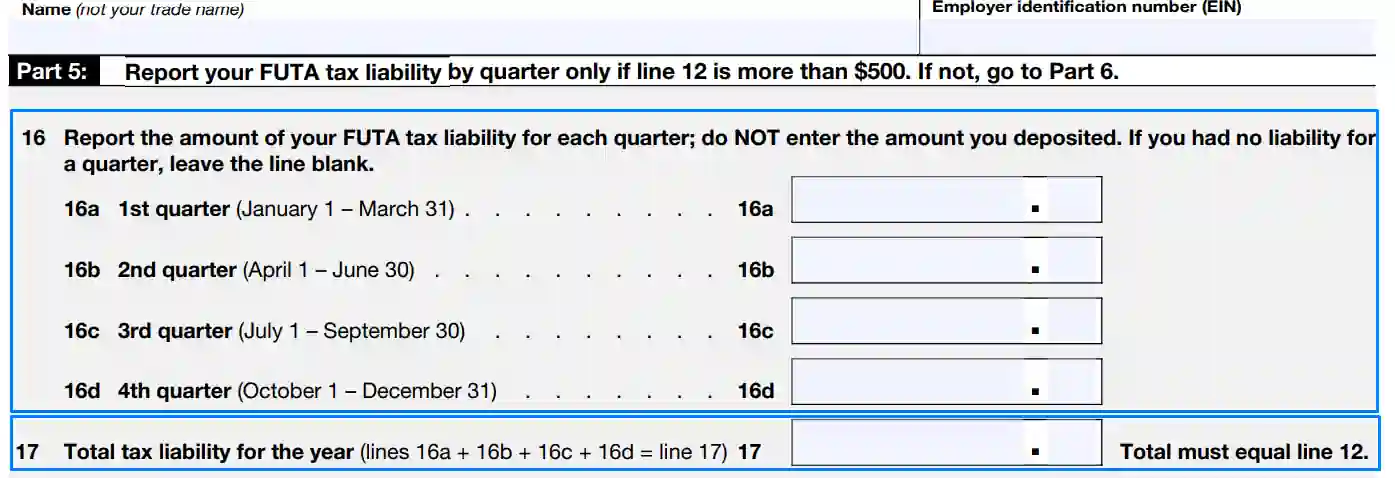

12. State Your Financial Responsibility

If the tax after adjustments is greater than $500, you have to describe FUTA taxes without deposits for each quarter in lines 16a-16d. You can leave the line empty if you did not have liability in a particular period. Then calculate the sum of these values and put the outcome in line 17.

13. Give Your Opinion on Third-Party Involvement

Select one of the options given in the sixth part based on your preferences. A third party can be a person who will be able to answer questions about tax returns in your company. If you want to involve someone in this activity, provide the name of this person, phone number, and create an identification number. The IRS will use this PIN as proof of identity.

14. Check The Form And Sign It

Make sure all required fields of the form are completed and sign this document in part 7. Also, give your name, the name of your organization, and the available telephone number here. Put the date of completion in the box.

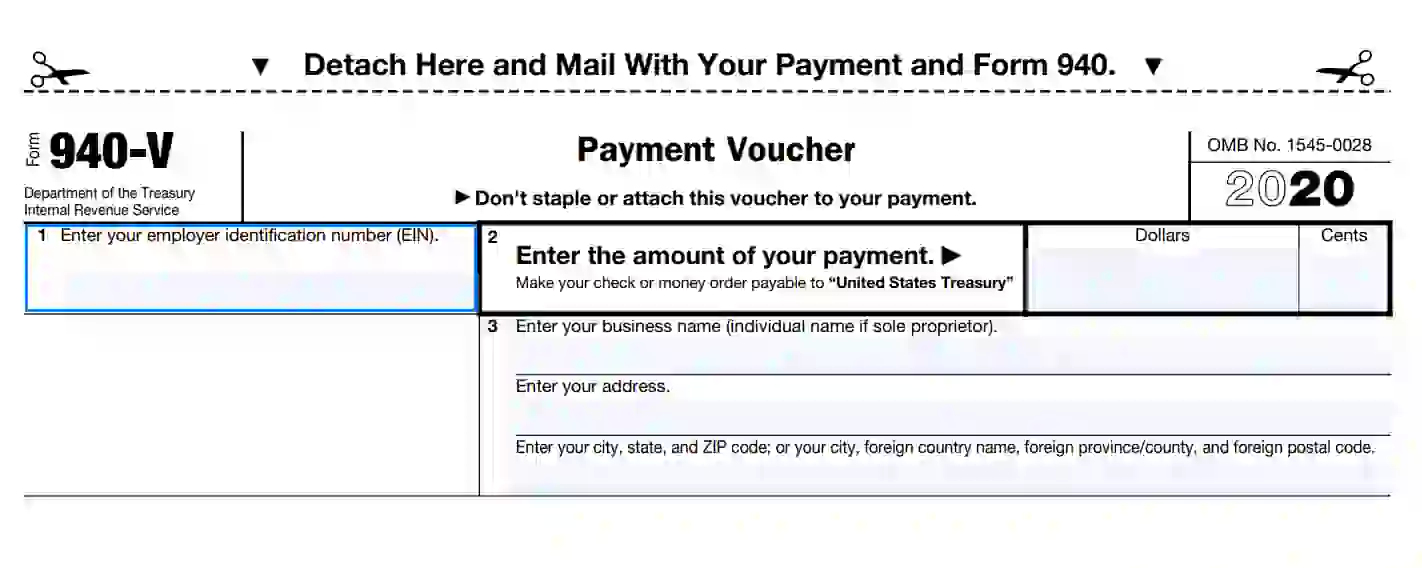

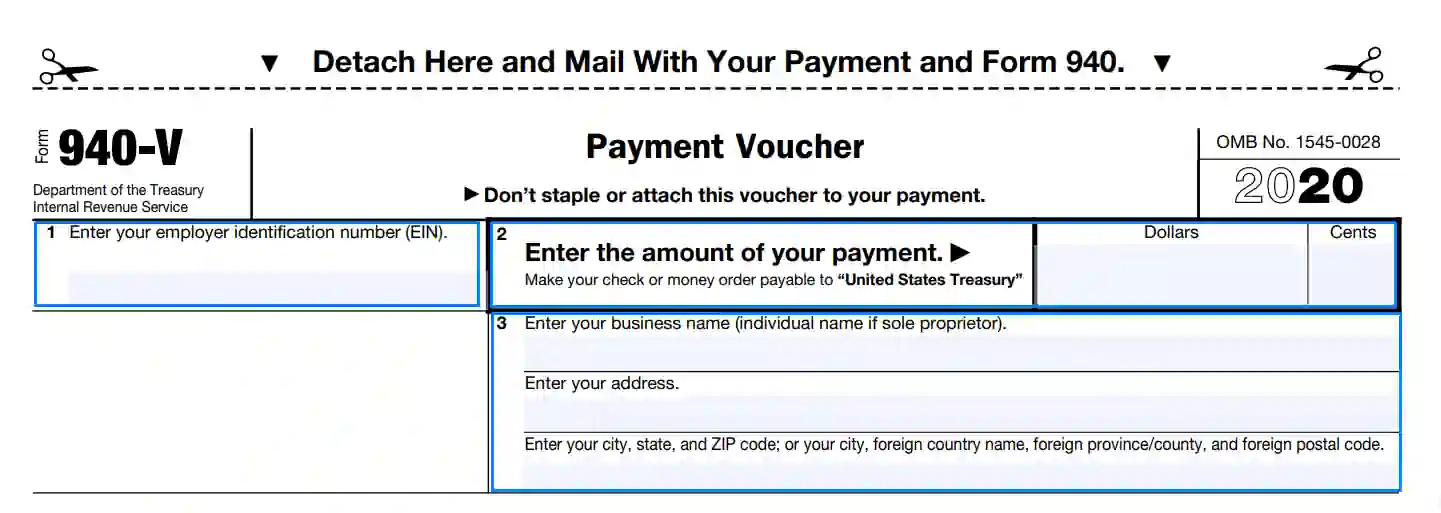

So, now you finish filling out IRS Form-940. There is an option to make a payment to the IRS, complete with the form itself. If you need to make a fee, you should complete Form 940-V. Include information about your EIN, the name of the organization, and its contacts in the payment voucher. You cannot use this approach but need to use an electronic one if your payment is bigger than $500.

We offer you to apply our building software to filling out this form as it will speed up this process and make it easier for you.

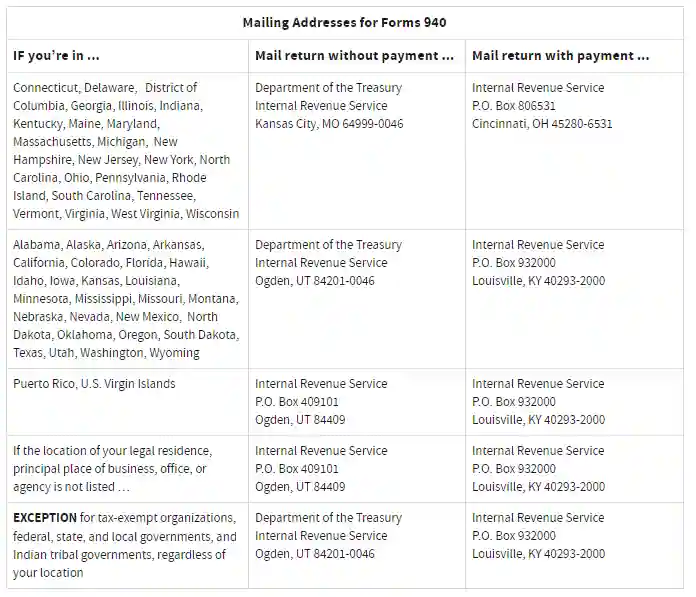

Where to Send the IRS Form 940

As usual, there are two ways to submit the report to the IRS: online using their website or using a post. If it is more convenient for you to mail this document find the address in the table below according to your physical address.