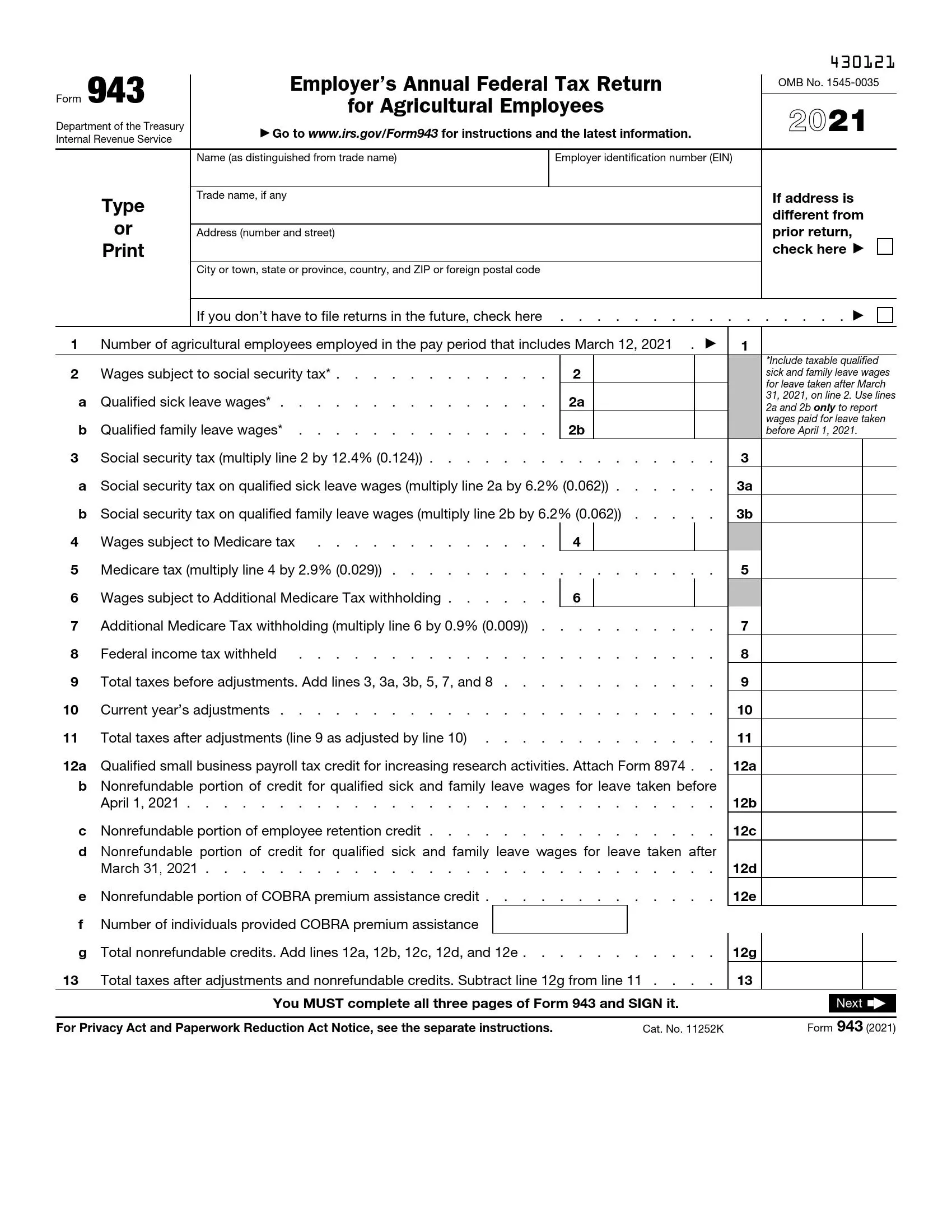

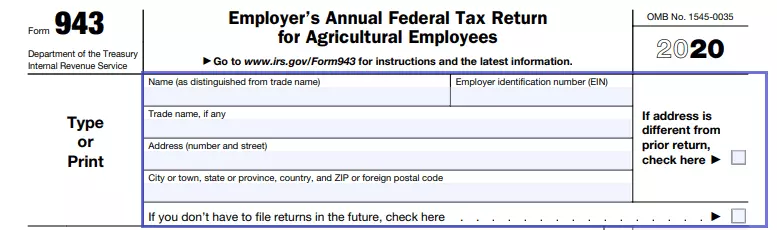

IRS Form 943 is a tax form titled “Employer’s Annual Federal Tax Return for Agricultural Employees.” Employers use this form to report annual federal payroll taxes withheld from farmworkers’ wages when those wages are subject to social security and Medicare taxes and withheld federal income tax. It’s the agricultural counterpart to Form 941, used by non-agricultural employers.

The purpose of Form 943 is to facilitate the reporting of tax withholdings and contributions specifically for agricultural workers. It ensures that these withholdings are properly documented and paid to the federal government. Employers in the agricultural sector must file this form annually if they have paid wages to one or more farmworkers and those wages were subject to any employment taxes. This reporting is crucial for maintaining the accuracy of tax records and ensuring compliance with federal tax laws relating to agricultural employment.

Other IRS Forms for Partnerships

The IRS sets different requirements for businesses from various business spheres. Learn more about forms devised for specific categories of employers.

Filling-Out Procedure

Complete Introductory Section

One has to type or print their full name, EIN (apply to get one if you still have not), company name (if applicable), and a complete mailing address. Do not forget to check the box on the right in the event of having your previously mentioned address changed.

The last box in this section is only checked if you no longer intend to continue submitting this form annually (resume filing if you restart paying wages).

Specify How Many Workers You Have Had

Insert a number of employees who have been providing you farming-related services during this tax year.

Attention! All amounts you will write next to a particular line below cannot be rounded to whole dollars. Never skip cents, even if you will write “zero.”

Enter SS-Taxed Wages

There are two types of leave wages herein you must indicate. Remember that work providers must pay at least 66,7% of employees’ regular pay rate for every hour the latter have not been performing work duties due to an acceptable excuse.

Count the SS Taxes

Follow the instructions on both lines to calculate the numbers.

Insert Medicare-related Data

First, enter the payment amount you have transferred to your farmworkers, which is Medicare-taxed. Compute the levy. Then, if your employees are obliged to pay some additional health insurance contribution, indicate that as well, and count the withholding.

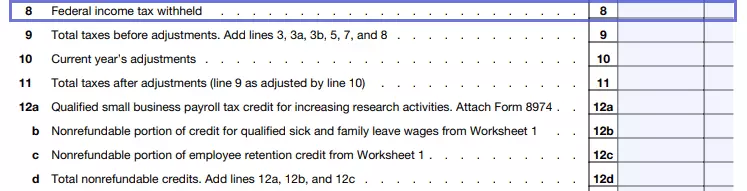

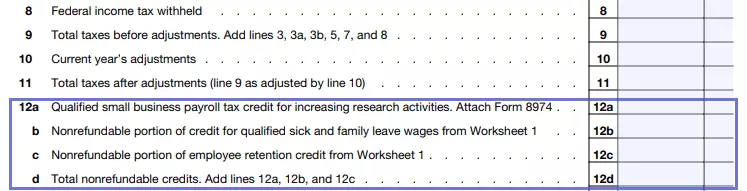

Input the Federal Income Tax Withheld

This is the amount of money you do not deliver to your employees at all, as it is the employer’s responsibility to provide a correct sum to the government.

Adjust the Totals

Consider the minor changes introduced by the IRS last year and enter the total taxes you have already submitted above.

Indicate the Credit For Research Processes Stimulation

Check whether you have to complete this section or not. If such is the case, use another form mentioned on line 12a to submit the correct numbers. Then, enter the nonrefundable portions and add them up to see the final amount. To learn more about this part of the document, study the complete set of instructions on the official IRS web page.

Recalculate the Totals

If your company is qualified to complete lines 12a-d and you have provided appropriate data there, you will need to recount the total taxes again herein.

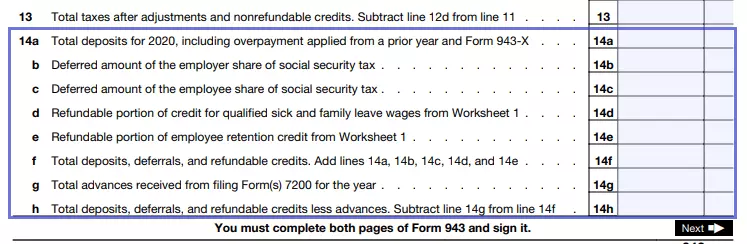

Enter Total Deposits

Complete these lines with deposits, deferrals, and refundable credits info.

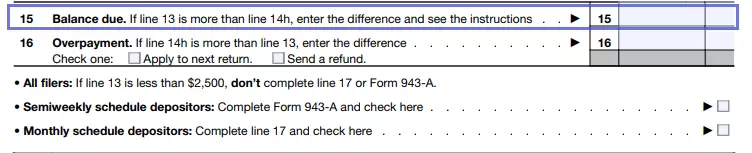

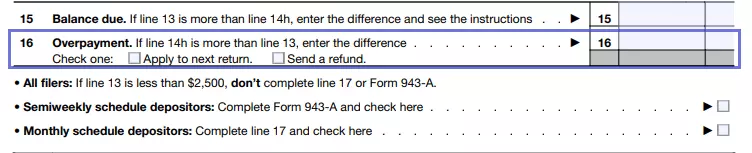

Indicate Tax Debt

You may not have one — and this will be excellent. However, it is not always possible to avoid calculation mistakes. Employers do not have to pay in case this sum is less than one dollar. If the sum is larger, consider managing your finances that way so you can pay the tax you owe. The agency allows work providers to split the payment in the following situations:

- You prove to be able to pay the debt within two calendar years;

- Your debt does not exceed 25,000 US dollars;

- You objectively are not capable of delivering the required amount ASAP.

Confirm to Have Overpaid

The opposite may take place as well — if, according to the data you present in this paper, you have transmitted an excessive amount of taxes, enter the exact number in US dollars. Express your wish — whether you prefer to receive the sum as a refund or leave it until filing the next return.

Check the Boxes

Before you proceed to the next part of this form, if appropriate.

Complete Monthly Summary of Federal Tax Liability

Input required info next to each month unless you are a semiweekly schedule depositor.

Insert the Credit Amounts for Sick and Family Leave Wages

The employees’ retention credit is provided in this section as well.

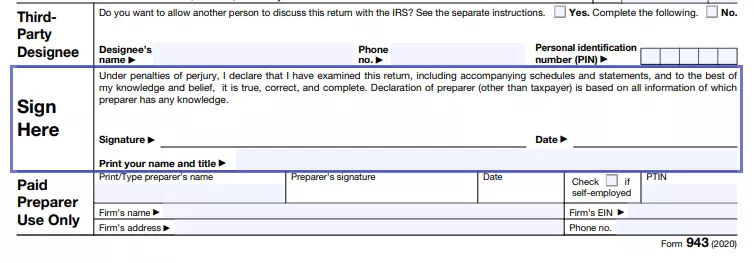

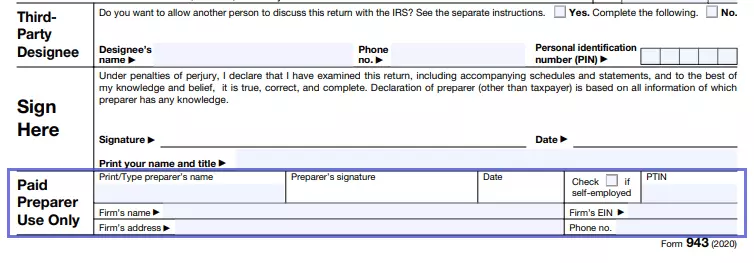

Designate a Representative

Processing tax forms is relatively difficult and time-consuming, even though it is done by professionals. The IRS staff might contact you to clarify some information you have input. If you, according to any reason, do not wish to communicate with the agency about the filed Form 943, you can always opt for appointing a designee. To do this, check the “yes” box here, provide this individual’s full name, daytime telephone number, and PIN. This number may contain any digits the appointee chooses to use for further identification.

No notices or communications will be delivered to your representative, though this person will be authorized to answer those notices you receive concerning this report. The appointee is allowed to refuse to perform this function. Otherwise, they will remain accountable until one year from the due date.

Sign the Form

In the USA, any filer who has willfully provided misleading information in this declaration will be considered guilty of a felony. By printing your name, signing, and dating the report, you confirm to have checked that the document, to the best of your knowledge, consists of true and correct data.

Depending on who or what the filer is from a legal point of view, the following individuals may append their signatures:

- Individual Entrepreneur;

- Someone Authorized to Represent a Corporation;

- A Member of Partnership (Or Chosen Representative);

- The LLC’s Owner;

- Fiduciary of a Trust (Estate).

Complete the Preparer’s Info

Due to the document’s complication, an individual may want to ask a legal professional to fill it out. In such a case, this paid preparer has to sign and date the paper, indicate their full name, PTIN, and define whether they are working for a company or represent themselves. If they are a member of a firm, provide its name, address, EIN, and telephone number.

If you are making a payment with Form 943, use Form 943-V to submit the data about this transaction.