Gift Deed Form

A gift deed is a legal document used to pass movable and immovable property from one owner to another free of charge. Its form, types of gift deeds, and risks related to the document are described below.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Gift Deed?

With a gift deed, an asset owner gives it away to an appointed person or organization free of charge as a gift.

Real estate, vehicles, personal objects, financial assets, and cash can be transferred to a new owner under a gift deed.

The document is often used to transfer property and valuables within a family or between friends. Charity organizations receive donations under gift deeds too.

How to Use a Gift Deed?

Different legal documents and procedures are available to a person who wants to give some of his possessions away. If he/she decides to use a gift deed form to do it, he/she fills the paper where the asset is clearly stated and recorded in the Registration Office.

A gift deed helps give property away during the owner’s life, contrary to a last will, which states the intentions to distribute possessions after the owner’s death.

What are the risks of using a gift deed?

The risk for a person who gives their property away is that they lose all their rights to the property and can’t legally use it anymore.

Suppose an aunt wants to give her house away to her niece, but she wants to keep living there. If she transfers the property away with a gift deed, the niece becomes the only owner of the house, and she can sell it or rent it out to another person. The nice might choose to let her aunt use the house, but she is not legally obliged to do it.

A difficulty in terms of taxation is another risk when giving some property away with a gift deed. There is a limit on the total cost of gifts an owner can give away per year. The cost of a house will be well above the limit. It doesn’t mean the owner will have to pay the tax since there is a generous lifetime gift limit, which can be exceeded only by the super-wealthy. Nevertheless, a person who exceeds the yearly limit must report to the state to deduct the exceeding amount from the lifetime limit. Failing to do it properly might lead to penalties.

The person who receives the gift will not have to pay an income tax as long as the gift’s cost is within the lifetime limit. But he or she will have to pay taxes on the income the property gives.

No limits apply to gifts transferred between spouses or donations to charities.

Suppose the niece receives the house under a gift deed from her aunt and wants to sell it immediately. She will have to pay an income tax when the house is sold. A tax computation method is not the same as if she receives it after her aunt’s death under her last will. In some cases, the amount of tax the niece will have to pay will be higher.

Some states apply additional taxes on free-of-charge property transfers.

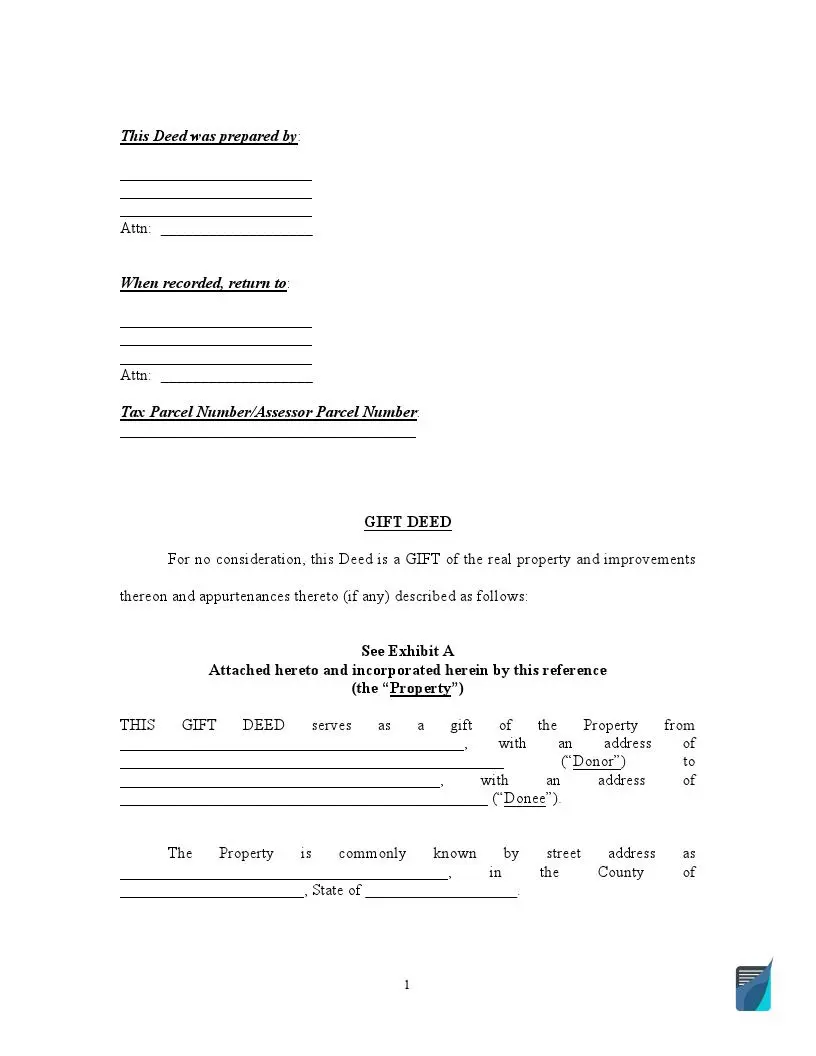

What Should Be Included in a Gift Deed?

The forms of legal deeds vary from state to state, but the correct form for each one can be easily found online.

The typical fields of a gift deed are:

- the name of a person who gives the property away (this person is called a donor in a gift deed);

- the person who is appointed to receive the gift, called a donee.

- description of the asset (if it is a real property object, the donor has to specify the parcel number correctly);

- the agent who is responsible for giving the gift to the donee;

- the signatures of the witnesses (in the states where it is required to witness a gift deed);

- the signature of a notary public who countersigns the deed to verify it.

A consideration, even a symbolic one, is not included in a gift deed. The document has to be registered to be legitimized.

Frequently Asked Questions

What types of property can I use a gift deed for?

Houses, cars, pieces of art, shares, and money can be given away with a gift deed. The value of a gift is restricted by taxes, but the limits are pretty generous.

What is a revocable gift deed?

A gift deed can be revocable or irrevocable. A donor cannot cancel the irrevocable one. Usually, a revocable deed states a promise to transfer property as a gift in the future and can be annulated by the owner of the asset before the due date or event.

For example, an aunt can arrange to give a house to her niece as a gift when she gets married. If the aunt does it with a revocable deed, she can change her mind before the wedding day.

Do I have to use a gift deed for cash?

If you are giving away a significant amount of cash as a gift, it is better for a donee to receive the money under a gift deed. Has the document been issued, the donee can prove the sum is given without any limitations or expectations of compensation.