Lease to Own Agreement

With the current economy at a downward spiral, property purchase has become a tough process for both owners and potential home buyers. While the situation calls for an adjustment for many industries, the real estate market has provided a solution that benefits both parties. This comes in the form of a rent-to-own agreement, which allows the property owner or landlord to gain money. In turn, it also gives the buyer or tenant an opportunity to build his or her finances so that he or she can buy the property in the future. Of course, there are pros and cons to this type of lease agreement. This guide will show you legally sound insights into how an “option to purchase” provision can work for you.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Rent-to-Own Contract?

A rent-to-own agreement is a typical residential rent contract with an additional clause or paragraph that gives the tenant the right to buy the property at the end of the contract’s lease term. In a sense, the tenant “reserves” the property for a period of time until he or she can prepare the necessary documents or improve his or her financial capacity to make the purchase.

Here are some useful definitions regarding this type of contract:

- Credit score – The numerical expression of a tenant’s ability to complete payment of the entire property’s purchase price.

- Exercise Period – The duration in which a tenant has the full right to exercise his or her right to buy the home.

- Option Consideration (or “Option Money”) – The amount that a tenant pays to “reserve” his or her option to buy the property. This usually becomes part of the down payment.

- Purchase Price — The total amount of the property when bought at full price.

A rent-to-own agreement is also called a “lease-to-own contract” or a “residential lease with an option to buy.”

Types of Rent-to-Own Agreements

There is a very fine line that separates the different types of rent-to-own agreements. These differences are discussed below:

Lease-option Agreement

In a lease option, the buyer or tenant signs into a contract stating that he or she may have the option to buy the home after a few years. However, he or she is not legally obligated to push through with the purchase and acknowledges that the extra rental payments will be forfeited. In this type of agreement, the purchase price is usually discussed toward the end of the lease term.

Lease-purchase Agreement

A lease-purchase agreement has almost the same setup, but the buyer is often obliged to continue with the purchase once the rental agreement expires. At the beginning of the contract, he or she signs two agreements—one, a lease agreement, and two, a typical residential agreement. In this type of contract, the landlord and the tenant agree on a fixed price for the purchase price.

Option to Purchase Agreement

An option to purchase agreement is normally short-term and gives the buyer enough time to gather funds. This type of agreement grants him or her the exclusive right to buy the property after a few months. If they do not want to proceed with the purchase, they may simply sell the right to another party or simply let it expire. In the same way, the fee will not be returned by the landlord.

Why Use a Rent-to-Own Agreement?

Though rent-to-own agreements have their unique advantages, they also come with tons of complications. It’s therefore necessary to balance out its pros and cons before signing into such a contract.

Landlord’s Perspective

Pros

- Landlords will not have much difficulty looking for people who want to buy the home.

- The monthly rental is significantly higher than regular rental fees (the excess of which is slowly used to pay off the tenant’s down payment or the total purchase price).

- If the contract does not have specific provisions for the option fee, the landlord may use it at present to increase cash flow while subtracting the same amount from the down payment.

- Landlords are also typically allowed to keep the option fee if the tenant backs out from buying the home.

- The tenant will typically take good care of the property he or she is looking forward to purchasing.

Cons

- The landlord may not be allowed to change the purchase price no matter how the property increases in value over time. However, this is easily solved by our template’s provision to refer to the market value assessment.

- The buyer may not be able to improve his or her credit standing after a few months or years, so you will need to start from scratch.

Tenant’s Perspective

Pros

- The tenant may reserve the home while taking the time to improve his or her “creditworthiness” by paying off existing loans or effectively balancing his or her cash flow, as evidenced by his or her bank statement.

- The tenant is not legally obligated to buy the property.

- The tenant can negotiate and secure a fixed price for the property no matter how the property’s value fluctuates over time.

Cons

- A rent-to-own agreement may have a higher monthly rental, which slowly accumulates to cover the cost of down payment or equity.

- Should the tenant fail to achieve an acceptable credit score, the tenant will lose years’ worth of extra monthly payments as well as the option purchase amount.

- Tenants typically pay for all other expenses such as insurance and upkeep.

Pre-Signing Phase

Once you have talked about the details of the lease agreement (e.g. rent payment, responsibilities, etc.), it is crucial to consider the following:

For the landlord:

- Ensure that your tenant will have the capacity to pay for the extra monthly rent and purchase option fee.

- While the tenant’s average financial standing will suffice, it is important to get a projection on how the tenant plans to pay the rent and improve his or her credit or financial score. Does he or she own a growing business? What will be his or her plan at the end of the lease?

- Request a copy of his or her bank statements to check how they balance their income and their expenses.

- A full background check on the tenant must also be made. You may consult your state’s existing offenders’ database.

For the tenant:

- Make sure you have seen a legitimate copy of the deed. Regardless of whether or not you are a buyer or a tenant, you must make sure that you are talking with the real owner of the property. As an alternative, you may also check the home ownership registry.

- Inspect the property thoroughly for any damages and especially unacceptable living conditions that may be hazardous to your health and safety (e.g. mold, termites, etc.). You wouldn’t want to be stuck with a beaten-down home at the end of the lease term.

- Calculate the financial provisions inside the purchase agreement. A lease option calculation is tricky, so it is important to check whether or not you are getting your money’s worth. You may also ask a real estate agent to evaluate the property so you can effectively negotiate the purchase price and option money.

Lease to Own Agreement Form Details

| Document Name | Lease to Own Agreement Form |

| Other Names | Rent to Own Contract, Lease with Option to Buy |

| Avg. Time to Fill Out | 18 minutes |

| # of Fillable Fields | 109 |

| Available Formats | Adobe PDF |

Filling Out the Agreement

You don’t need to start from scratch with our free rent-to-own agreement below.

Step 1 – Download your preferred file.

Pick the file that is compatible with your computer:

- Lease-Purchase or Rent to Own Template – Open Office Format (.odt)

- Lease-Purchase or Rent to Own Template – Microsoft Office Format (.docx)

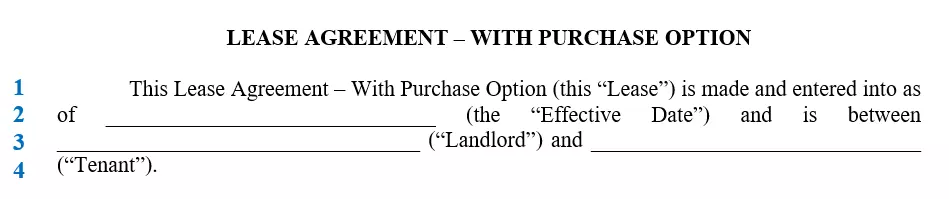

Step 2 – Add information to your opening paragraph.

For each blank, type the following sequentially:

- 2nd Line: Month, date, and year of the contract’s commencement (e.g. “October 3, 2020”)

- 3rd Line: Full name of the Landlord or Lessor, then Full name of the Tenant or Lessee

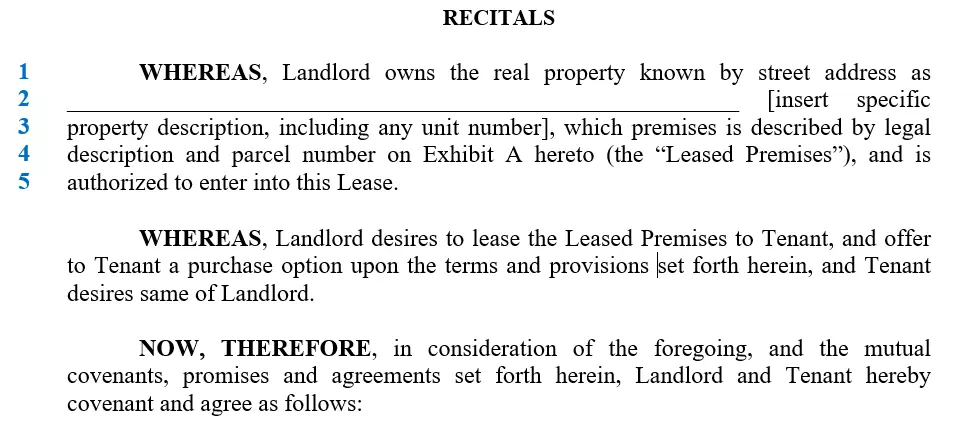

Step 3 – Add the address of the property being rented.

- 2nd Line: Insert the complete address of the property. Make sure to include the following if applicable: floor, building or house number, street, area, city, county, state, zip code.

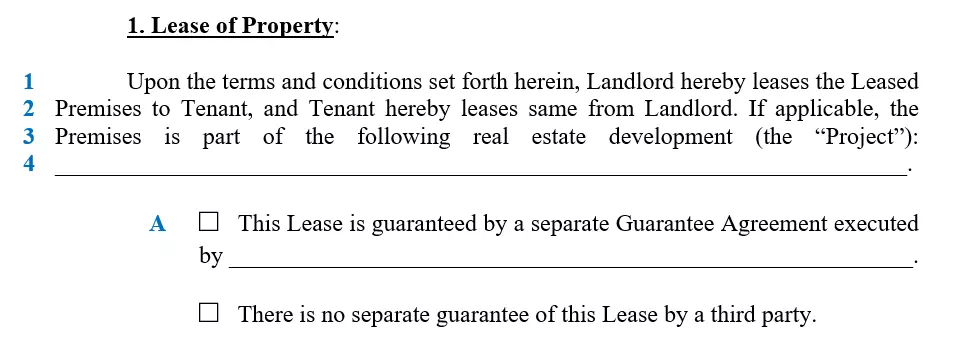

Step 4 – Indicate details of the third party (if applicable)

In most cases, the premises or rental property may have been developed by an independent construction company. If this is applicable to your agreement you may:

- 4th Line: indicate the company name of the developer on the fourth line.

- On decision point A, you may either choose to execute a separate Guarantee Agreement, commonly signed by the developer. Otherwise, you may check the second box.

However, if this clause is not applicable to you, and if the rental property was constructed under the supervision of the owner, you may put “N/A” on the fourth line.

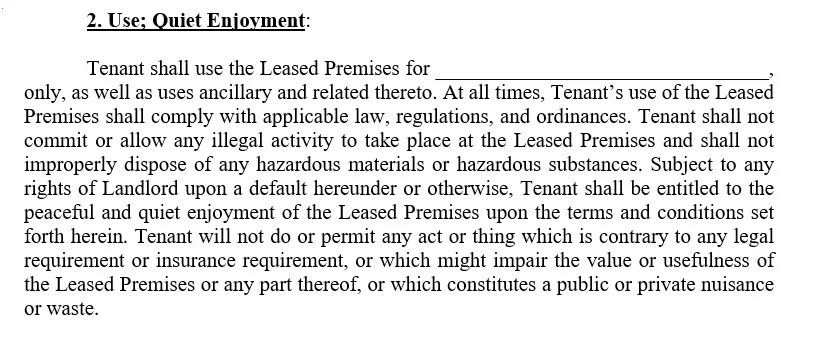

Step 5 – Indicate the purpose for use.

On the first line of section 2, indicate the allowable coverage of usage.

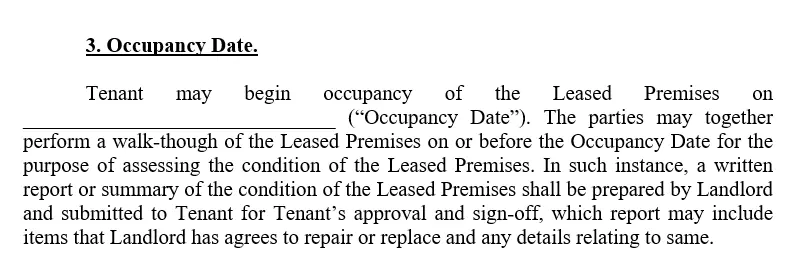

Step 6 – Add the date when the lease begins.

On the second line of section 3, type the date when the rent will begin as agreed upon.

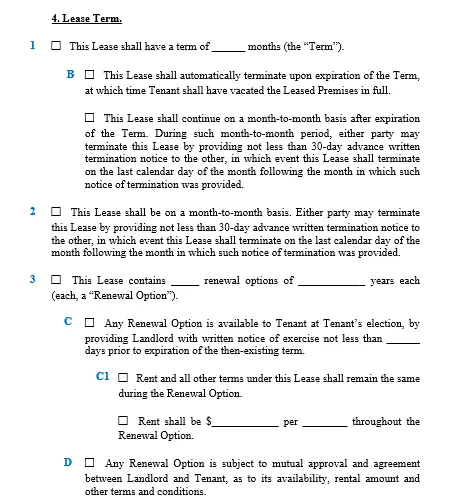

Step 7 – Finalize the terms of the rent.

- 1st Part: Put the number of months agreed upon

- Decision Point B: Select whether you’d like the rent to automatically end (first box) or automatically renew (second box)

- 2nd Part: Tick the box if month-to-month renewal is applicable. (Not recommended for a rent-to-own agreement)

- 3rd part: Write the number of options on the first blank. Then, on the second blank, write the number of years.

- Decision Point C: Tick the box if you want a fixed assurance on the renewal. Indicate the number of days on the line provided.

- Decision Point C1: If you checked Box C, then you may choose whether to keep the same rent amount (Box 1) or change it (Box C). Should you choose the latter, write the new amount on the first line, then the period (either monthly or yearly) on the second line.

- Decision Point D: Tick this box if you’d like to discuss this option at a future time.

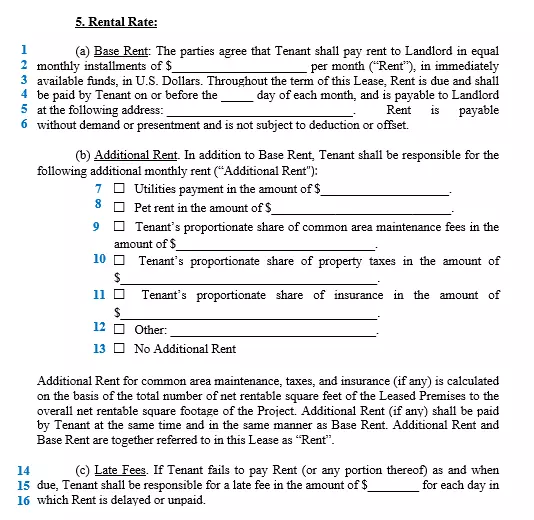

Step 8 – Discuss the rates.

In the fourth paragraph or SECTION 3, input the following:

- 2nd Line: Monthly rent amount in USD.

- 4th Line: The fixed date when rent payments are due monthly.

- 5th Line: Landlord’s address for settling rent payments (either in cash or through checks).

- Lines 7 to 12: You may tick any of the applicable boxes and provide the rent amount.

- Line 13: Tick this box if Lines 7 to 12 are not applicable.

- 15th line: indicate the amount of penalty.

In this part, you may also add the option fee to secure the rent-to-own agreement or any additional cost on top of rent payments. More details are discussed in the option to purchase section (Step 14).

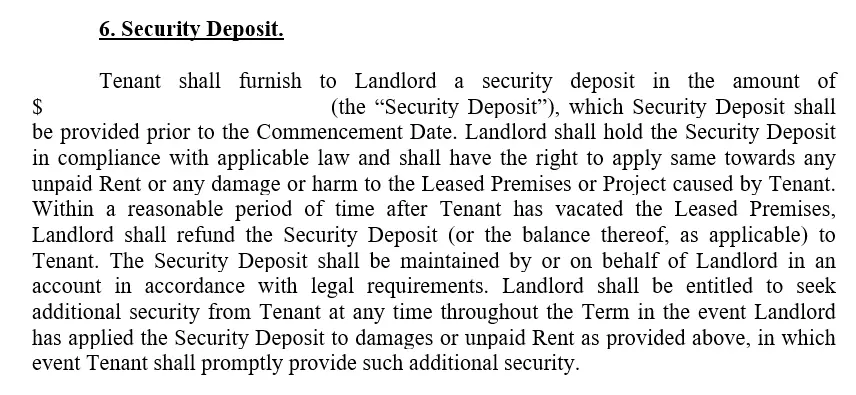

Step 9 – Indicate the amount of Security Deposit.

Write the amount of security deposit (up to 150% of the monthly rent) on the second line.

Step 10 – Read the following sections

- Section 7: Assignment and Sublease.

- Section 8: Access by Landlord.

- Section 9: Lease Termination; Surrender.

- Section 10: Default:

- Section 11: Remedies:

- Section 12: SNDA; TEC.

- Section 13: Casualty and Condemnation.

- Section 16: Indemnification.

- Section 19: Additional Provisions:

Should you need to change any of the above sections, it is best to consult with a lawyer with a real estate background.

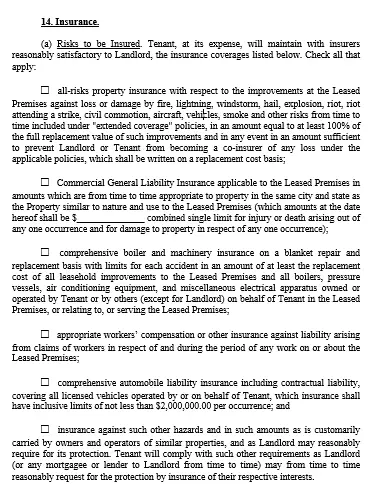

Step 11 – Determine your property’s insurance coverage.

You may tick your preferred insurance coverage depending on your agreement with the tenant. It is best to consult an insurance broker who will assess the proper coverage for the rental property.

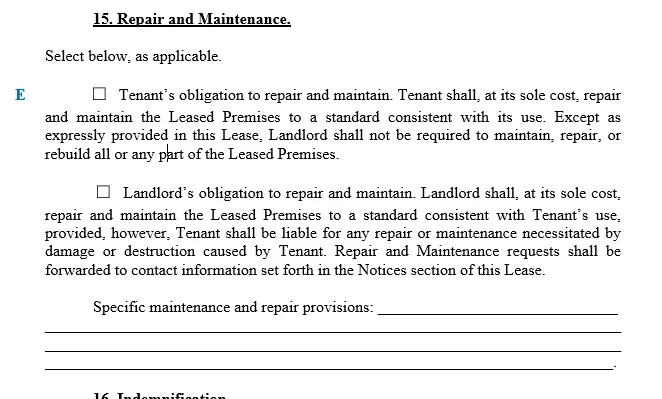

Step 12 – Assign responsibility for maintenance and repair.

- For Decision Point E: Select the person responsible for repair. It may be shouldered by the tenant (first box) or the landlord (second box). For rent-to-own agreements, the tenant normally shoulders all costs.

- At the bottom, you may also indicate which parts of the property needs to be repaired.

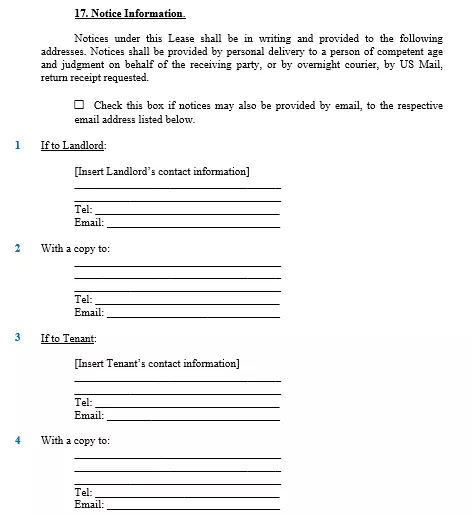

Step 13 – Indicate addresses for notices.

- 1st Part: Landlord’s complete name, residential or office address, telephone and mobile number, and e-mail address.

- 2nd Part: The landlord’s representative and his or her corresponding details.

- 3rd Part: Tenant’s complete name, residential or office address (usually the address of the property), telephone and mobile number, and e-mail address.

- 4th Part: The tenant’s representative or guarantor. Include his or her corresponding details.

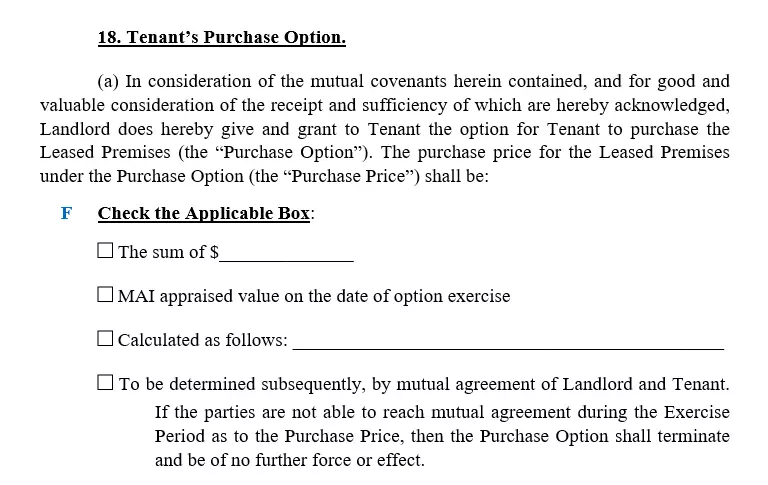

Step 14 – Select the provisions for an option to purchase.

- Decision point F: You may determine the purchase price of the property upon writing the lease option contract (first box), get it appraised at the end of the contract (second box), include a calculation that gives a fixed percentage of increase after a few years (third box), or decide through a future agreement (fourth box).

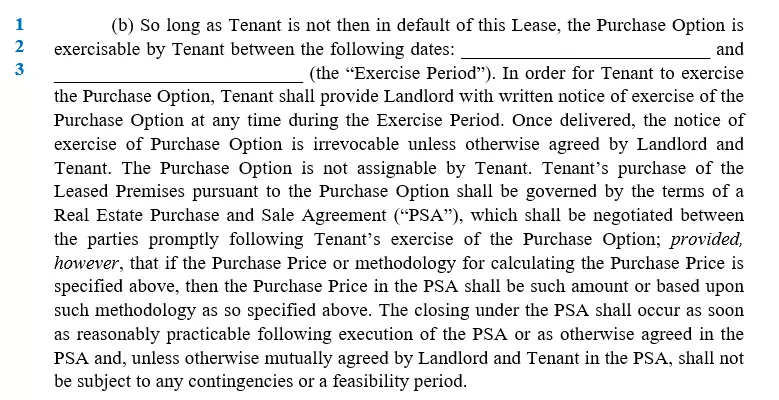

In part B under SECTION 18, the following must be indicated:

- Line 2: The date when the tenant has the sole right or option to purchase the home, usually a few months after the first lease agreement has ended.

- Line 3: The expiration date of the said right.

Finally, part C’s last line must contain either the word “TENANT” or “LANDLORD”, who will then be responsible for any costs incurred for the sale to happen.

Step 15 – Fill out the riders.

Just like any other residential contract, a rent-to-own agreement comes with riders for the benefit of both the landlord and the tenant. This will ensure that necessary disclosures are made such as:

- Lead Warning Statement, and

- Assessor’s Parcel Number of the Leased Premises

You will find these at the end of the rent-to-own agreement template.

Step 16 – Sign the option to purchase agreement.

On page 14, you will find the page where the landlord and the tenant can sign the rent-to-own agreement. For each corresponding part, write the following:

- Signature

- Title of the signatory (e.g. President)

- Full name

Both parties will also need to sign on every page of the printed document as well. Once done, the landlord may get the lease option contract notarized and duly documented.

Frequently Asked Questions

How do you find rent-to-own homes?

You may go online to check different platforms. Most online property rental or buy-and-sell websites now have filters for landlords who are open to rent-to-own arrangements. Alternatively, you may ask your potential landlord if he or she is open to such an agreement.

What about property taxes?

Depending on your agreement, either party may pay for property taxes. Our rent-to-own agreement template is editable so that you can easily revise depending on your landlord’s or tenant’s preference.

Will rent-to-own help my credit history?

Unlike a mortgage or a loan, a rent-to-own set-up will not help improve your credit history since you are directly purchasing the home. However, should bank financing come into play, you may indeed use this opportunity to increase your finances.

Navigating through a rent-to-own agreement is definitely tricky but very beneficial to both the landlord and the tenant. When in doubt, ask your real estate agent or landlord about the “option to purchase” rent set-up or check our detailed template. A lease option agreement will not only will it become leverage that will solve buy-and-sell woes, but it will also open up much-needed rent opportunities during the financial crisis.