Quitclaim Deed Form

A quit claim deed raises questions in many people who try to understand whether it is secure enough to use when transferring ownership to real estate. They might be comparing it to a warranty deed and wonder how these documents differ and what to choose.

We will tell you what a deed form is and how to choose the best option for yourself. We will also tell you where you can get a quitclaim deed form that can be utilized for your legal needs.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Quit Claim Deed?

A quitclaim deed is a written contract that helps transfer the title to real estate. Essentially, a person making a quitclaim deed “quits” their interest in a real property mentioned in the document.

The document can be used for multiple purposes. It is common to use a quitclaim deed to remove the defaults in title to real estate. It is also used to transfer title to property between members of a family.

The parties to a quitclaim deed are called the grantor (an individual who currently owns the real property) and the grantee (an individual who is about to become an owner of real property).

A quitclaim deed essentially provides a guarantee for a buyer if there is only one owner to real property, but it doesn’t have the same effect if there is more than one owner. In the latter case, a general warranty of deed or a special warranty deed is more effective as those two documents offer a higher level of security guaranteeing that a grantor is the sole owner of real estate.

How a Quitclaim Deed is Different from a Warranty Deed?

These two types of deeds are both common in sales of real property but they offer different levels of buyer protection.

A quitclaim deed requires less information than a warranty deed and is simpler to craft. A warranty deed involves mentioning finer details such as legal insurance, absence of the debts related to the property, full description of the property, etc.

A quitclaim deed also does not make any warranties about the quality of the property title. At the same time, a warranty deed, based on its name, provides certain warranties to the buyer, for example, the absence of any outstanding liens, mortgages, or other encumbrances against the property mentioned in the deed.

This way, those who want to get the most buyer protection should opt for warranty deeds while those who want to create a simple document with fewer details can choose quitclaim deeds. The latter is a perfect fit for a low-risk transaction where grantor and grantee are familiar with each other (for instance, family members) or no money exchange is involved.

What Are the Legal Requirements for a Quitclaim Deed?

Such a document needs to meet certain legal requirements in order to be legally binding. There are no federal requirements meaning that each state treats the document differently. There are three ways how to make a quitclaim deed binding a choice of which will depend on specific laws of the state:

- Sign it in front of a notary public (Alaska, Arizona, California, and most of the states)

- Either sign the document in front of at least two witnesses (sometimes one) or notarize it (Alabama, Kentucky, South Carolina, South Dakota, Tennessee, Virginia, West Virginia)

- Both notarize and witness the deed (Arkansas, Connecticut, Florida, Georgia, Louisiana)

After making the deed legally binding, the document is generally filed with one of the recognized offices in the county where the real estate is located, most commonly, the county recorder s office. But in some states, the form should be filed with the probate court (Alabama), circuit court (Arkansas, Maryland, Virginia), or superior court (Georgia).

To make sure your quit claim deed form is written properly, use our online document builder. It will help you get a legitimate document that can be filed with your county recorder s office straight away. However, before doing that, it is always wise to first review the form with an attorney.

In What Situations Might You Need a Quitclaim Deed?

Even though a quitclaim does not provide a 100% guarantee in case there is more than one owner of real estate, the document can be useful in the following situations:

Property transfers between family members

Some risks for a buyer connected with a quitclaim deed mean that it might be most beneficial for family members who want to transfer their right to the real estate between each other. It allows the grantee to trust the deed the grantor makes which is harder when two unfamiliar people sign a quitclaim deed.

It is common to use quitclaim deeds by siblings when they trade real estate with each other or by parents and children when the former sell property to the latter. A quitclaim deed in such situations does not mean a property sale in its general sense.

Property transfers between divorced couple

When a couple gets divorced and has decided that one party will buy an apartment or home from another, the party selling property might use a quitclaim deed to show that they don’t have interest in the real estate anymore. Sometimes, it might be required by the court in their decision.

Title error corrections

If a person makes a mistake in a quitclaim deed, for example, fails to clearly mention a titleholder or just a spelling error, it will cost them time and money to fix a defect. In such a case, an individual might use a quitclaim to include proper information in the title.

Another error that can be fixed is mentioning the wrong person in a title. For instance, a spouse can be added or removed from a title that is relevant after a marriage or divorce.

In order to use a quitclaim deed to bring any fixes to a title, the deed should be notarized.

Transferring property into a living trust

When an individual dies, their relatives might spend a lot of time and money during the litigation process. But if one of the beneficiaries uses a quitclaim deed, they will already have their title mentioned in the document. This will allow to shorten the probate process or even eliminate the need to start it.

How to Transfer Ownership with a Quitclaim Deed?

In order to transfer a person’s interest through a quitclaim deed, some steps should be taken.

Negotiate the price

A quitclaim deed should have a valuable consideration (or a purchase price). This is why it should be negotiated with the grantor before filing a quitclaim deed with the county recorder s office. A real estate agent is usually not needed, but turning to an attorney to make sure the transaction is filed legally is always a wise choice.

Obtain needed information

The request should be filed with the necessary information. Usually, it includes the name of a person creating the document (grantor), the name of a person who will receive the deed after its filing (grantee), the contact information of the parties, and the purchase price agreed between the grantor and the grantee. Another valuable piece of information that should be included is a legal description of real property.

Once at the recorder’s office, the grantor should obtain a special book called “Deed Book and Page Numbers” for the property they are searching for. All the deeds that are recorded at such offices should be assigned a book and a page number. The record office then uses it to locate the deed when it needs to be retrieved.

Authorize the document

Once the form is created, the grantor should validate it according to the signing requirements of the state where the property is located. It might be either notarization or signing in front of two witnesses or both options. In order to properly authorize a quitclaim deed form, both the grantor and grantee should be present at the moment of authorization.

Record the deed at the recording office

As the last stage, the grantor should bring the ready form to the respective recording office and pay a filing fee.

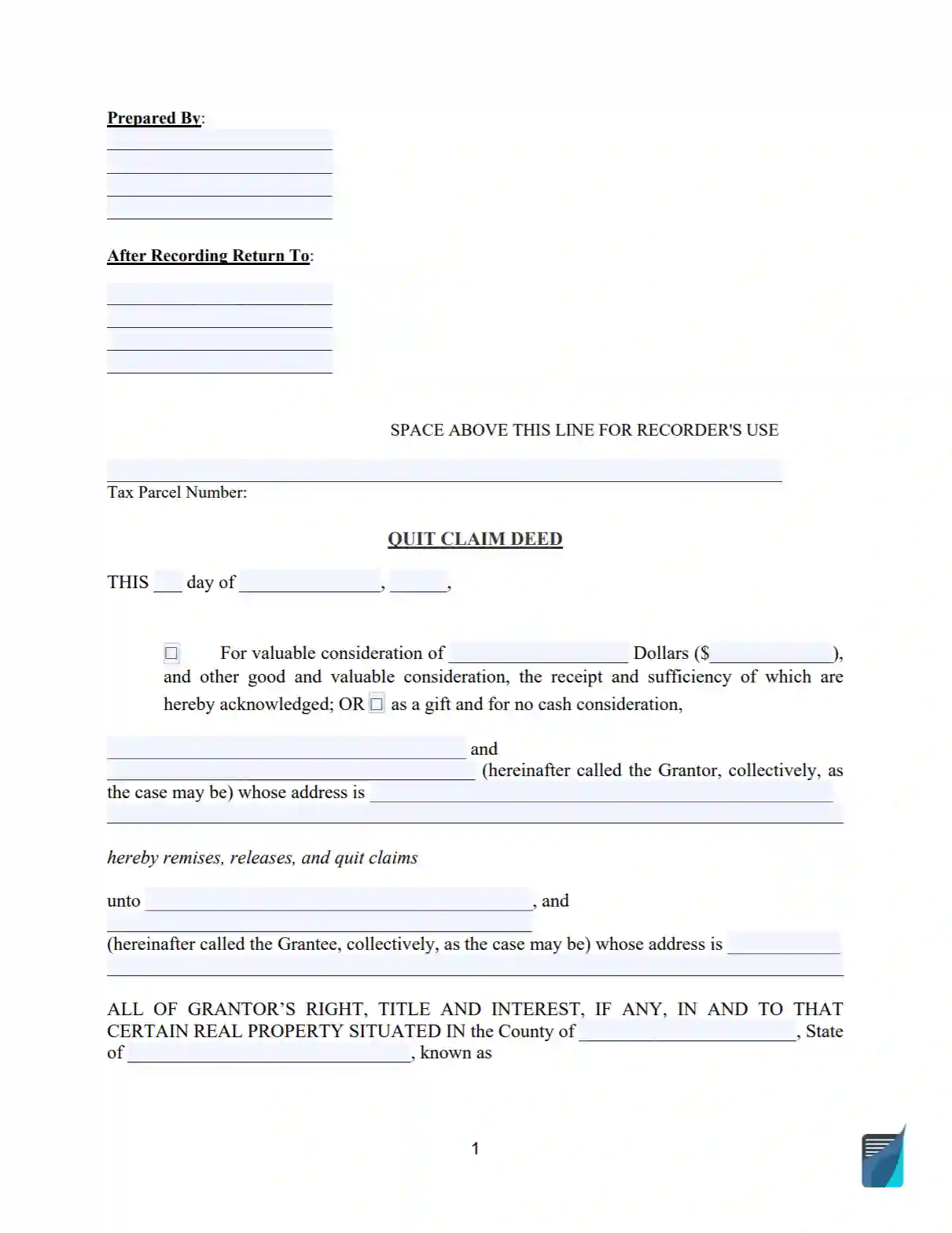

How to Fill out a Quitclaim Deed?

Step 1

In the upper part of a quitclaim deed form, the name of the grantee or grantees (new owner or owners) should be written. In addition to the names, their addresses, zip codes, and states should be mentioned.

Step 2

In the main body of the deed, the first thing to mention is the name of the document, for instance, “[name of the state] quitclaim deed”.

Then, the assessor’s parcel number (also called APN) should be written. It can be generally found on the current deed.

Further, there should be a special box where any exemptions from paying transfer tax should be included.

After that, the purchase price should be included. In case the property was gifted by the grantor (for example, from parents to children) a price should be set at a minimum of $1. The following information should be the name of the grantor or grantors (previous owner or owners), their marital status, and address for mail.

The last thing that needs to be mentioned in the main body of the document is the state and county of the real estate ownership to which is being transferred.

Step 3

Here should be legal information about the property called the Map and Lot numbers. They should be detailed by the assessors’ office of the county or city where the property of the grantor is located. For instance, “Lot 14 of Blackacre Addition to the City of Sacramento, as delineated on the map of said addition, recorded December 1, 1973, in Book 103, Page 201980”.

Step 4

On the last page with signatures, the name and address of the grantor and grantee should be included. If parties choose to witness the document in front of two witnesses, their names should be printed out in the form in advance. If the document is about to be notarized, a notary acknowledgment section is needed.

These are 4 easy steps to fill out a quitclaim deed form. However, it is even easier to get a ready free quitclaim deed form and just fill in the gaps with necessary information. Get a quitclaim deed template here on our website!

Frequently Asked Questions

How does a quitclaim deed differ from a title?

It is important to understand that a quitclaim deed and an ownership title are different legal documents. If the distinction is clear, it will help avoid unpredictable ownership issues.

A title is aimed at proving legal ownership of a property, while the purpose of a deed is to designate the transfer of the title to a new property owner.

Why is a quitclaim deed considered less secure than a warranty deed?

The risk connected with quitclaim deeds is that the grantor does not guarantee the quality of the property title. It means that the grantee might receive a quitclaim deed made by a grantor with no legal interest in the property and consequently, get no rights regarding the property and no rights of warranty against the grantor.

If I am sure in the title of the owner, should I choose a quitclaim deed?

Using a quitclaim deed involves high risks only if the property title has some defects. However, if it is good or the grantee has reasons to think so, a quitclaim deed can convey title as effectively as a warranty deed.

What title defects can I fix with a quitclaim deed?

Technically, a quitclaim deed can be successfully used to cure any defect in the recorded history of a property title. Most commonly, it is used to change the wording if it does not comply with state requirements, add a signature of a spouse, misspellings of the name of the grantor, etc.

I am hesitant about the past grantor’s spouse having an interest in the title. Will a quitclaim deed help me?

Yes. If you have conducted title research and it has revealed that the spouse of the grantor might have an interest in the real estate due to improper execution of a past deed, a quitclaim deed will let them waive any interests they might have. They have to be asked to execute it by the present owner.