There are many reasons you might want a power of attorney form, but if you want your agent to represent your interests with the Internal Revenue Service (IRS,) you’ll need a specialized POA. An IRS POA can be created with Form 2848, but the form also goes through a confirmation process.

Filling out this POA form and going through the approval process is necessary to authorize an individual to represent you can be a little bit of a hassle since you have to deal with the bureaucracy of the internal revenue service.

Since the IRS POA form is a little different than other POAs (you can read about all the types on the POA general page), we’ll go over everything you need to do to get an individual to represent you with the IRS, including who you can designate and the most common reasons why the internal revenue service might reject your form.

2848 forms are often a more powerful way to authorize someone to help you with your federal tax return and other IRS tax forms than a standard POA, though we’ll also discuss when a general form can work.

When to Use IRS Power of Attorney

The IRS POA is important anytime you want someone to represent you in front of the IRS. You may want one if your federal tax return is ever audited, or if you need to set up an installment agreement with the IRS on old taxes. These representatives can also help advise you on other tax matters.

Your representatives can also look at your confidential tax information including your taxpayer identification number, tax return instructions, and tax form number as needed to assist with your taxes.

This kind of power of attorney lets the IRS deal with your agent as if they were dealing directly with you, but it doesn’t let them do everything with your taxes. You are also still liable for your tax return, including if you need to make any payments and for any incorrect information filed on your behalf.

IRS Power of Attorney Form Details

| Document Name | IRS Power of Attorney Form |

| Other Names | Form 2848, Tax Power of Attorney |

| Relevant Link | Form 2848 instructions by Internal Revenue Service |

| Can be Used for State Taxes in | California, Delaware, Montana, Nevada (Business only) |

| Avg. Time to Fill Out | 15 minutes |

| # of Fillable Fields | 93 |

| Available Formats | Adobe PDF |

Who Can Represent Me?

Form 2848 is not a blanket authorization like other POA forms. You cannot authorize an individual to represent you unless they have other certifications that allow them to work with the IRS. Your business friend or colleague, for instance, cannot represent you.

Generally, there are a few groups of people who are allowed to access confidential tax information and can be authorized with form 2848:

- Attorneys

- Certified Public Accountants (CPAs)

- Enrolled Agents

Anyone you authorize will also need to provide some proof that they can legally work with tax information and act as a representative with the IRS. You’ll need to give your agents time to provide that information on the form, but you are not responsible for getting it yourself since they need to include their license information.

Common Rejection Reasons

Form 2848 isn’t very difficult to fill out, but it is one form where even one mistake might lead to the document being rejected.

There are lots of common reasons why the IRS might not accept your power of attorney request, including incorrectly filled attorney and declaration sections, incomplete information, or overly generalized information.

Here are some of the most common reasons the IRS denies this form:

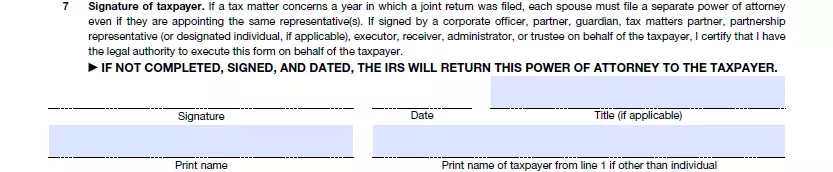

- Incomplete names and signature sections

- Overly general powers authorized

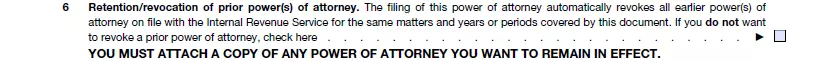

- Box 6 has been checked

- Missing designation or state jurisdiction

- Missing Bar license, certification, or enrollment

Avoiding these common problems can help make sure you get the representation you need right away.

Related IRS Forms

Form 2848 isn’t the only form you can use to get similar results. There are times when a general power of attorney might be all you need, but here are some of the other related forms you might want to use instead of or in addition to the IRS POA.

General POA

General power of attorney forms are often used for other financial matters, but they can also be used for tax professionals to give them access to your federal tax return and other tax information. This kind of POA is more generic and can be used for a wide range of different responsibilities, although it usually is considered the weaker of the two. Form 2848 is a better option if your representative needs a lot of power and access to federal tax matters.

Form 8821

Tax professionals you’re working with may ask for you to fill out form 8821 if they don’t need full representative powers because it helps keep them in the loop on any IRS notifications you receive while they are working with you.

Essentially, it’s a step down from the full form 2848 and gives them access to more information without as many responsibilities.

Form 56

Form 56 informs the IRS of the creation or termination of a fiduciary relationship. Usually, this is used for trustees and the executors of estates. The fiduciary should fill out this form at the beginning of the fiduciary relationship, as well as at the end so that the IRS always knows what that individual has been authorized to do.

How to Fill Out IRS Form 2848

If you’ve ever filed your own taxes, then form 2848 should look fairly familiar. It’s like most IRS tax forms in formatting and needs just as much attention to detail and technical correctness. Make sure you pay attention to every section of the form as you fill it out and double-check the information when you’re done.

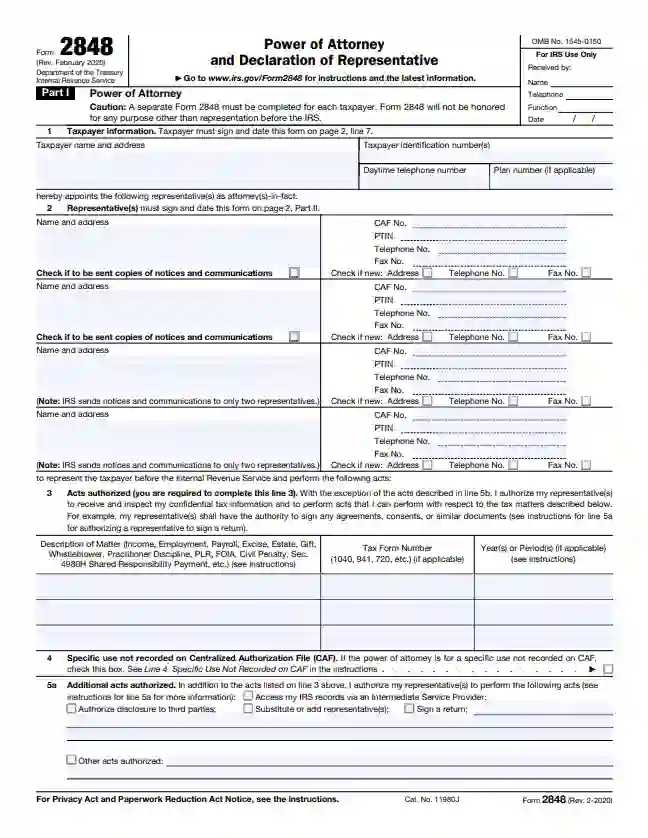

Step 1: Fill Out Taxpayer Information

As the taxpayer, the first thing you’ll need to fill out is your own personal information. You’ll need to include your taxpayer identification number, name, current address, and the best phone number to reach you during the day. You may also need to include a plan number, but not everyone will need that information.

Be careful to make sure you’re putting all of that information in the relevant boxes in section 1. There is also a small box in the top right that is also asking for a name and some other identifying information, but that section is for Internal Revenue Service use only.

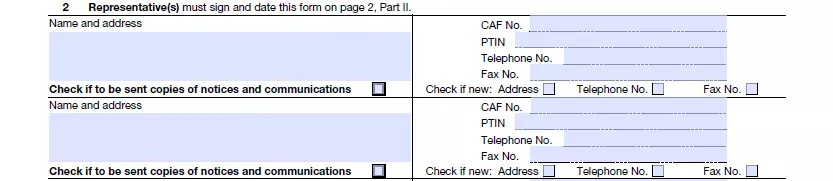

Step 2: Fill out Representation Information

The latest version for form 2848 has 4 slots to fill out in section 2. You don’t need to use every line. This section is designed to give you space so that you can designate more than one person as your agent, but that might not be necessary.

It’s important to consider who you’re going to list as your agent as well as the order you list it in. Even if you fill out the form for 4 representatives, the IRS will only send copies of notices and communications with you to two of your chosen representatives.

This section can be filled out by you or your agents, though it might be easier for your representatives to fill it out for themselves. That’s because section 2 needs their centralized authorization file identification number, which was created the first time they filed taxes on behalf of a third party.

They will also need to provide their preparer tax identification number, which helps the IRS identify both who prepared your taxes, and that they are legally able to do so.

Lastly, your representative(s) will also need to provide a telephone number and fax number to receive communication from the IRS.

Step 3: Fill Out the Powers Authorization Line

In section 3, you have the ability to customize what your agents can access. You can specify the forms you want them to look at, including for form 1040 tax form, and you can also specify the type of taxes you want your representative to deal with.

So if you want a representative to manage your estate taxes but don’t need assistance for income tax, you can make those customizations.

It’s important to make sure the powers you authorize in this section are very specific. One of the most common problems with these forms is that section 3 isn’t detailed enough and gets rejected by the IRS. Your tax representative can usually tell you what powers they need to handle your federal tax return and other tax information.

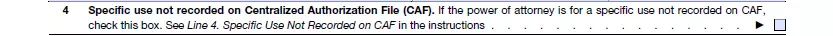

Step 4: Fill Out Any Use Not Recorded on the Centralized Authorization File

Most people won’t need this line, but if you want your agent to be able to do anything outside the normal scope of a tax representative, you can indicate that here.

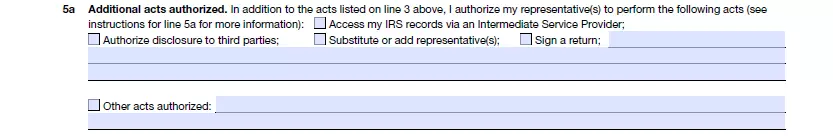

Step 5: Fill Out Additional Authorization

This is where you specify which additional authorizations you’d like to include if you checked the box in section 4. That includes the right to access tax information directly, authorize disclosure to third parties, or substitute or add other representatives as needed.

Usually, your agent will only add another representative if they need additional tax professionals to help with your case.

Step 6: Revocation of the Power of Attorney

This section allows you to remove the powers you’ve authorized in the rest of the form. Don’t check this section until you are ready to remove authorization from your tax representative. Checking this box is another common reason for the form to be rejected.

Step 7: Taxpayer Signature

Lastly, you’ll need to sign and date the whole form to indicate that you agree with everything in the form and want it to come into effect.

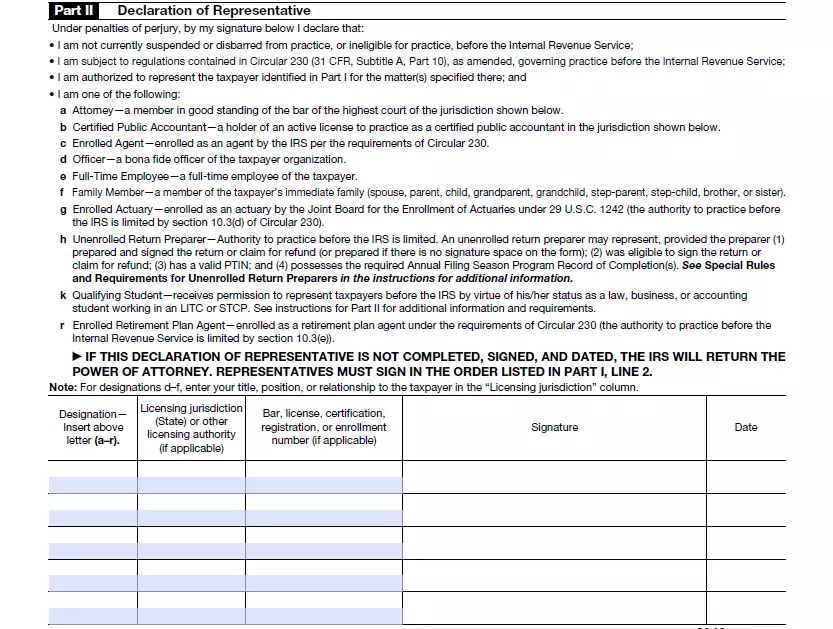

Step 8: Part II, Declaration of Representative

This last section is another section primarily for the tax professionals you’re authorizing. They’ll include their tax professional identification and qualifications in this section as well as signing and dating.

This section is important because it indicates what level of professional certification you’re authorizing and what they can do.

The declaration of representative is one last opportunity to make sure you have the right tax professionals and that they can work with the documents you have indicated.