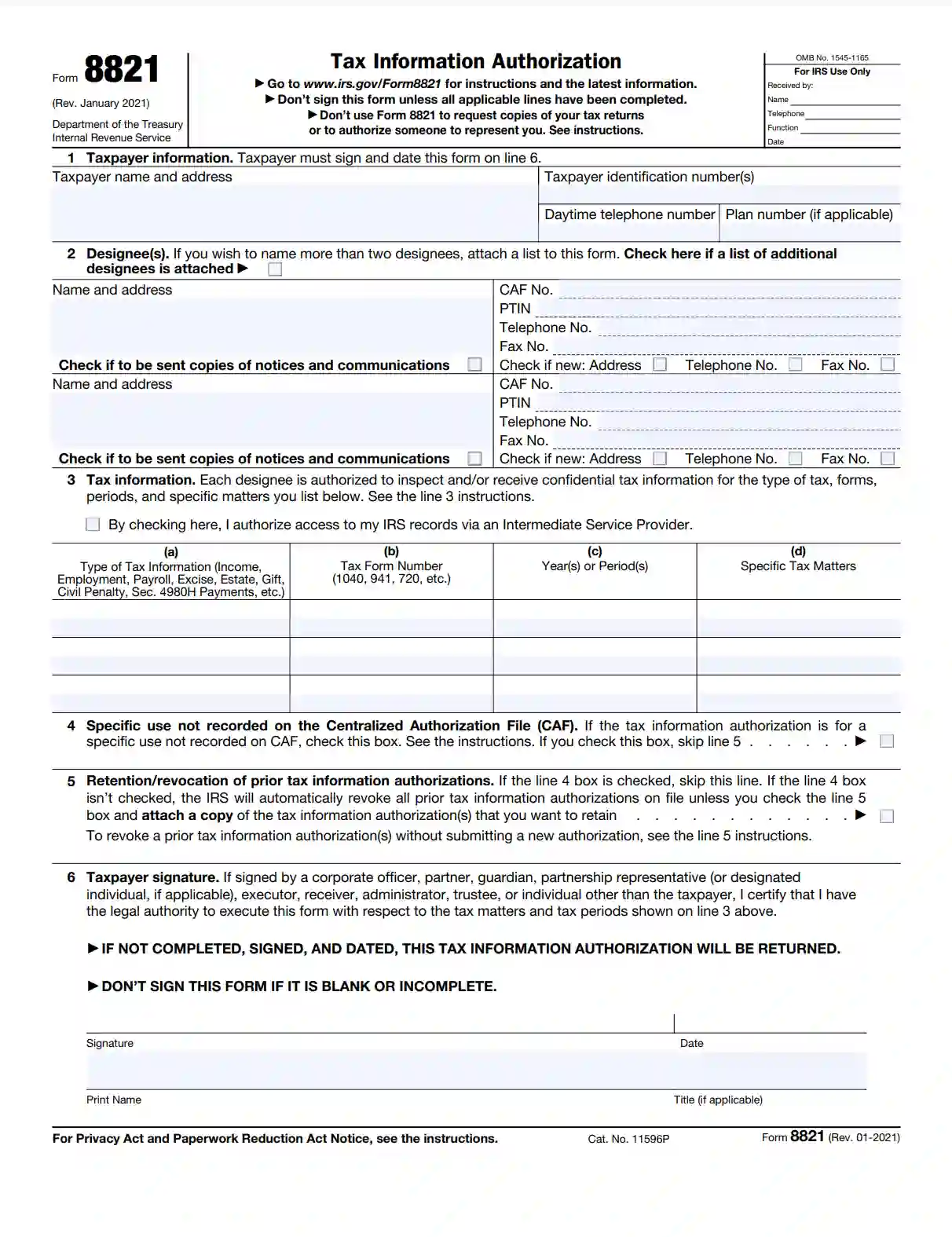

IRS Form 8821 is a document that allows individuals or entities to grant authorization to any individual, corporation, firm, organization, or partnership to inspect and receive confidential information in any IRS office for the type of tax and the years or periods you list. This form does not authorize the appointee to advocate for the taxpayer, execute waivers, consents, or closing agreements, or otherwise represent the taxpayer before the IRS.

The primary purpose of Form 8821, also known as Tax Information Authorization, is to appoint a third party to receive and inspect confidential tax information, which can be useful in assisting with tax preparation, audits, and other financial responsibilities.

Other IRS Forms for Individuals

Various tax situations might call for using different IRS forms. You can learn more about other forms individuals commonly use.

Completing Form 8821

You may choose to use our form-building software to obtain a personalized template ready for submission. Make sure to fill out all fields that are applicable, or your application might not be accepted and processed.

Please pay attention: the box in the top right corner should not be completed by the filer.

Input Essential Appointer’s Info

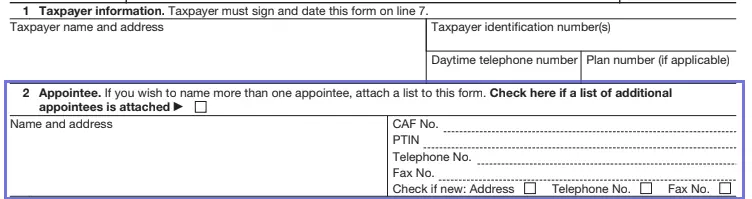

Depending on whether the applicant is an individual, a company, a trust, an entity, or other, the data required will differ. You are supposed to name yourself or the corporation you work for and indicate your mailing address first. Then, provide an appropriate type of ID that the agency will use for your identification as a taxpayer. Finally, insert the contact telephone number and, if applicable, the plan number, too.

Designate Appointees

You are allowed to choose more than one designee — check the box herein if you wish to do so (and do not forget to list your appointees in an attachment). The left field of this section is completed with your designee’s full name and address. The right field will contain some more personal and professional data.

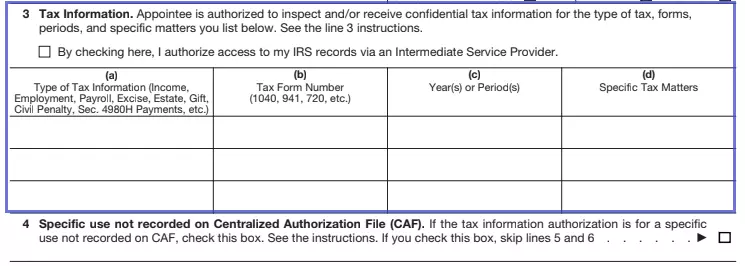

Provide Tax Info

In this part, specify the type of tax info you wish your appointee to access and tax form numbers. Establish a particular period during which this authorization remains effective. Be exceptionally careful about that — provide only specific years (for instance, 2019-2022). You may include the ended periods as well as future ones. However, there exist some details to look into — make sure to visit the IRS official web page for a more detailed set of instructions concerning the period part.

In case you do not intend to limit the designee’s authority to get tax information. Otherwise, indicate specific tax matters you wish them to inspect and receive info about.

Indicate Whether You Are Applying For a Specific Use

You have to check this box if your authorization is not supposed to be recorded on the CAF system. Specific uses are listed on the IRS official website.

Instruct the Agency to Send Your Papers to the Appointee

If you want them to be sent. If not, check another box.

Retain or Revoke Previous Authorizations

If you have not checked line 4, this means you intend to terminate the authority of previously appointed designees. Wish to retain them? Then, choose the box herein and attach a photocopy of the authorization you do not want to revoke.

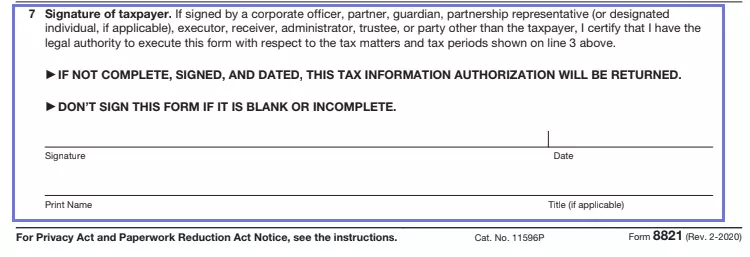

Sign the Document

Recheck that everything has been inserted correctly, enter your name in print, sign, and date this form. If you are entitled to represent an entity, you will also need to provide info about your job position.

According to the IRS, you will spend approximately one hour on preparations and filling this paper out. They also claim that they are open to suggestions if you think yourself able to understand how to modify Form 8821 so that it is simpler to work with.