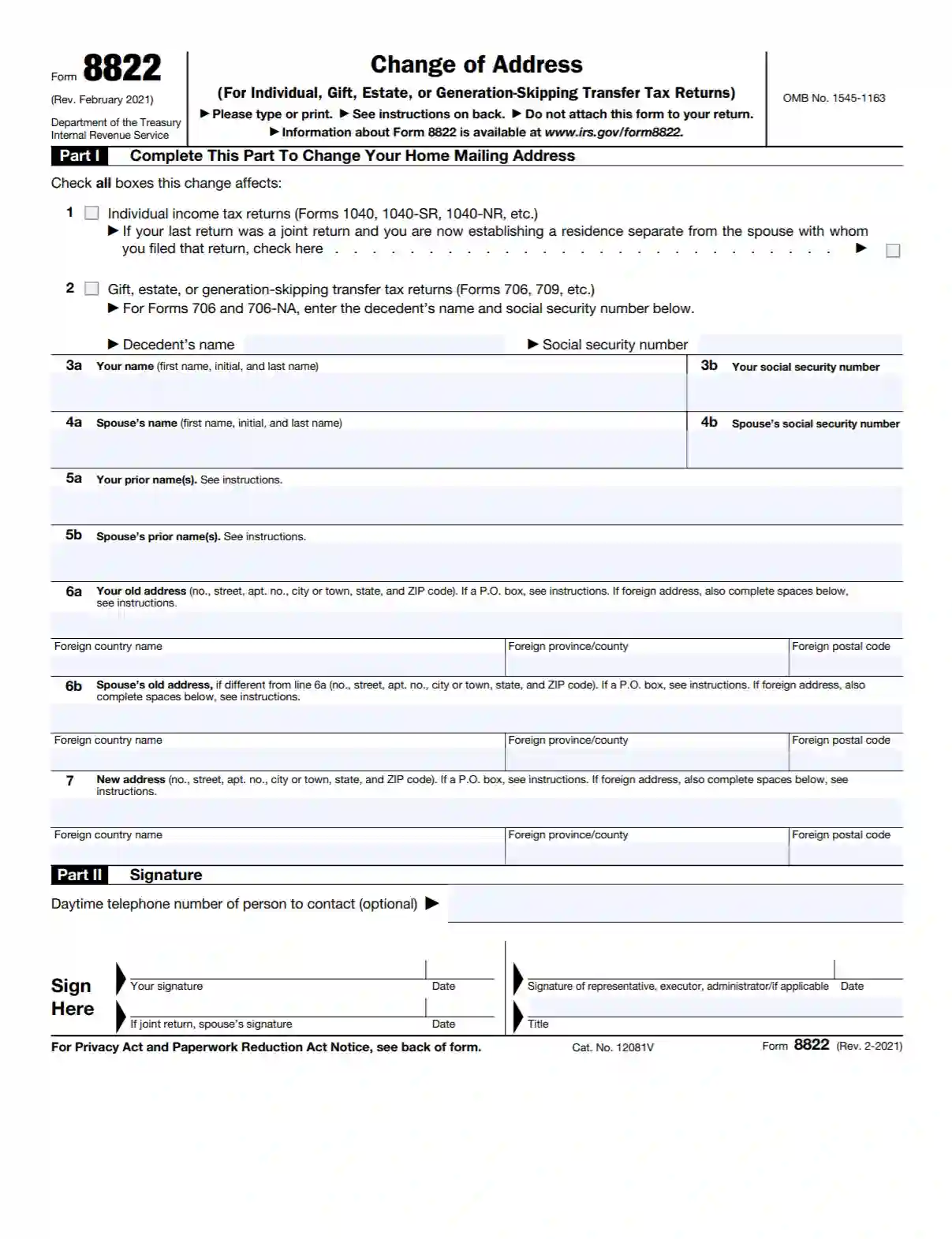

IRS Form 8822, titled “Change of Address,” is a document taxpayers use to notify the Internal Revenue Service (IRS) of an address change. Completing and submitting this form ensures that any correspondence or notices from the IRS reach the taxpayer at their new location. Maintaining accurate records with the IRS and avoiding potential delays or problems when filing tax returns is critical.

The primary purpose of Form 8822 is to update the taxpayer’s address records in the IRS database. This is important because the IRS uses the last known address to send notices, refunds, and other critical communications regarding tax filings. By updating their address using Form 8822, taxpayers can help ensure they receive all IRS communications promptly.

Other IRS Forms for Individuals

Change of address form is one of many forms individual taxpayers use to report important information to the IRS. Learn what other IRS forms might be required of you.

How to Fill Out Form 8822

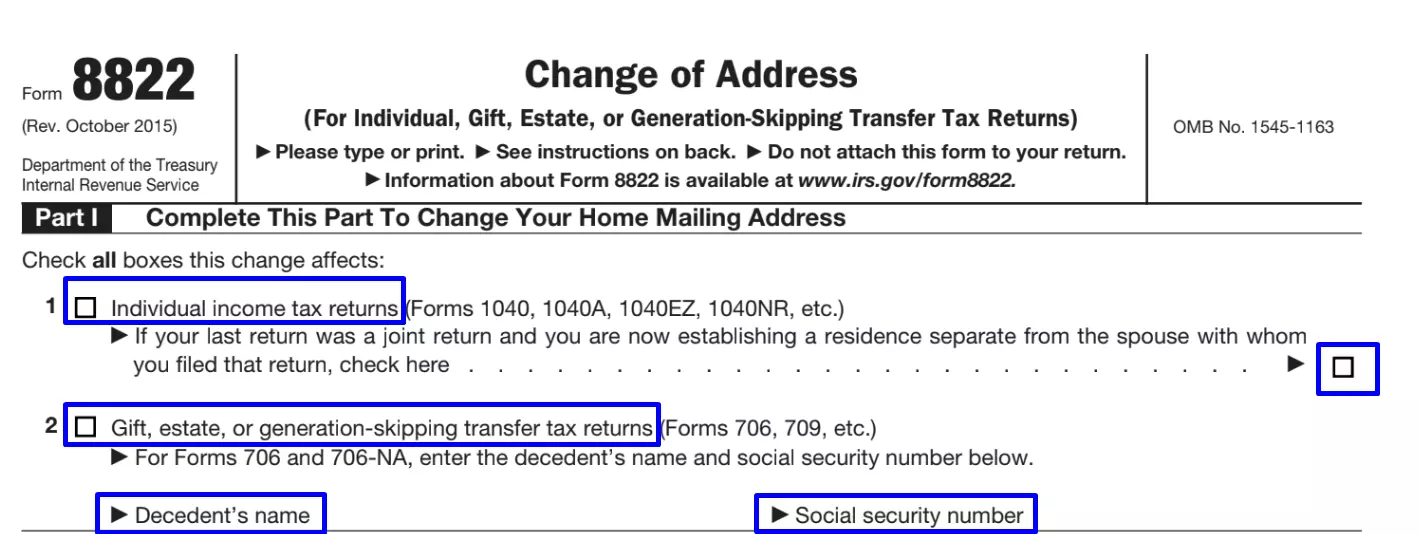

Fill out the tax return information.

At the beginning of the first part, you mainly need to check the box. Mark the item in line 1 if the change of address affects your personal income tax return. The Forms that regulate this are listed in this line and in the IRS instructions. If you began to live separately from the spouse with whom you previously had a common tax return, check the box on the right side.

Mark line 2 if the move involves a change in the status of items such as gifts or inherited real estate. Enter the deceased’s name and social security number where required.

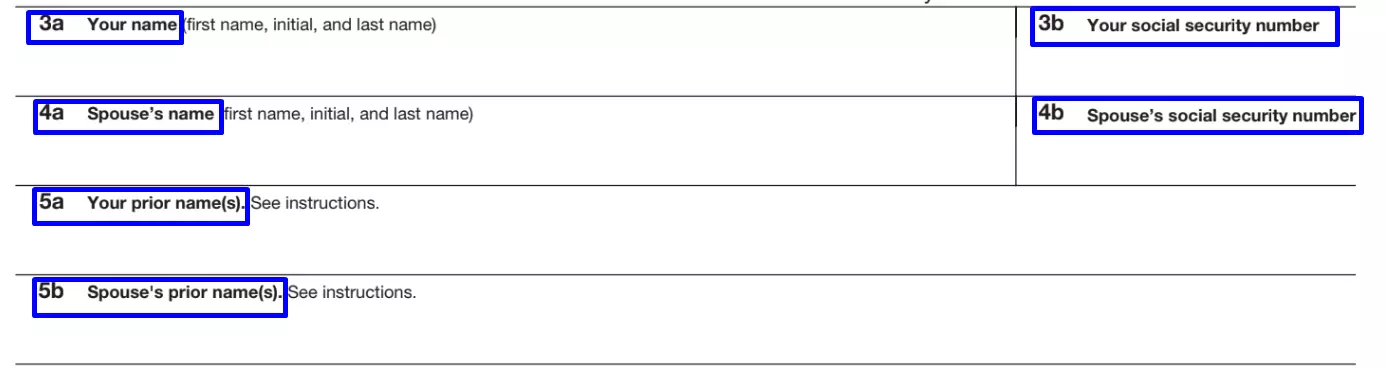

Enter personal data.

In lines 3a – 4b, input your name and your spouse’s full names, as well as the social security number of both persons. In lines 5a and 5b, specify the names if it was changed after marriage. For example, you changed your last name.

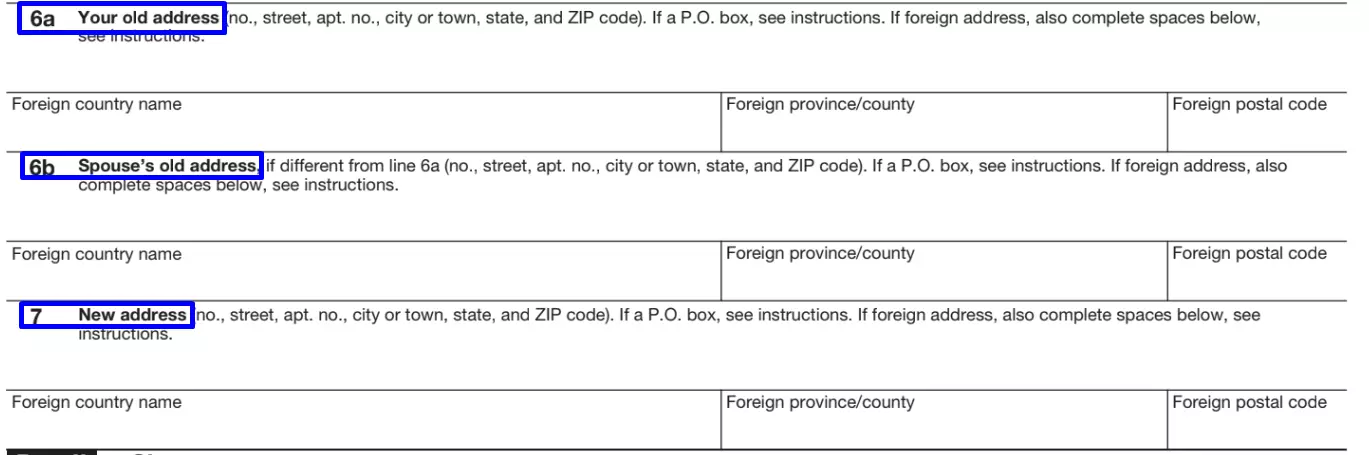

Provide address information.

Enter your previous address and fill in all the sections that are specified. Do the same for your spouse, that is, specify the same address if you had a common place of residence or a different one if you have just moved in together.

Please note that there are different lines for those who have had a residence in the US and for those who are moving to the US. If you are moving from another country, fill in the lines where “Foreign province/county” is indicated.

Finally, fill in the current address lines, both for yourself and your spouse. If you are moving abroad in the United States, also enter a foreign address.

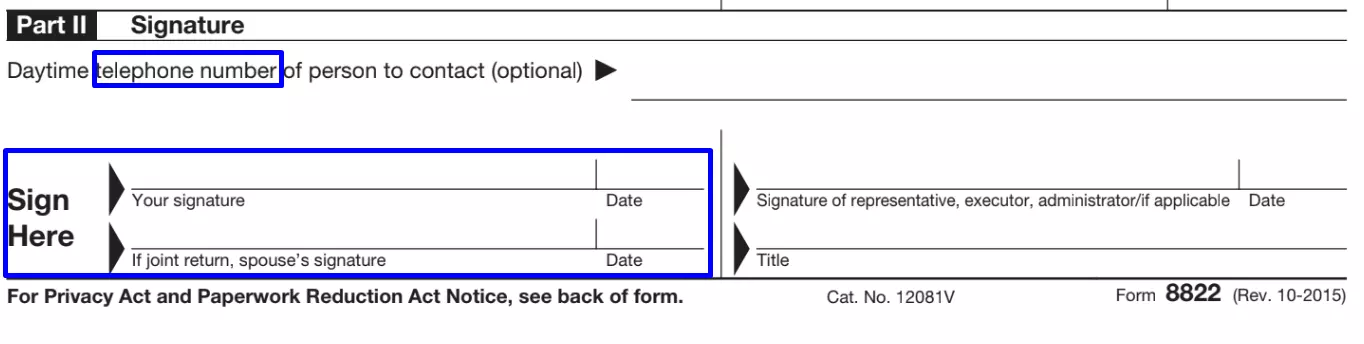

Put your signature.

Let’s go to the last part of the paper. Here you must sign the document. Have your spouse sign it if you have a joint tax return. Also, put the signature of the representative or other person in the right corner of the sheet, if necessary.

Input the date of filling out the Form.

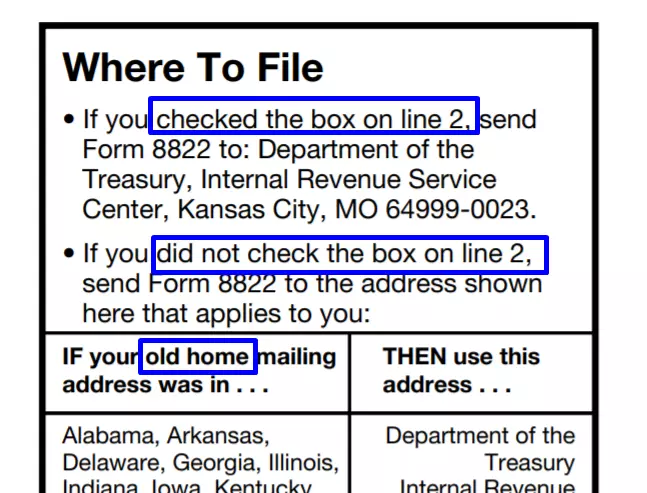

File the application.

The IRS instruction specifies the addresses of public services that accept Form 8822 from taxpayers. The address to submit the Form depends on the very first part of the document. If you ticked the second item (gifts, estate, etc.), you should send the documents to the Department of the Treasury.

If you did not check the second box, select the address of the IRS office, depending on the previous state of residence. A list of the corresponding addresses can be found in the table in the instructions.