Form 8840 is used by nonresident aliens to assert a closer connection to a foreign country than to the United States despite having spent a significant amount of time in the U.S. This form is relevant for individuals who need to determine their tax residency status under the substantial presence test. The substantial presence test calculates whether they have been in the U.S. enough days over three years to be considered a tax resident. Form 8840 allows eligible individuals to claim they are not U.S. tax residents due to closer connections to a foreign country where they have their tax home.

Form 8840 allows nonresident aliens to avoid being treated as U.S. residents for tax purposes, which can significantly impact their U.S. tax liabilities. By completing this form, individuals can demonstrate that their social, economic, and personal ties to another country are stronger than those to the U.S., thus exempting them from the need to report global income to the IRS.

Other IRS Forms for Individuals

If you are neither a U.S. citizen nor legal permanent resident, you might want to get familiar with some other IRS forms that might be of help to you.

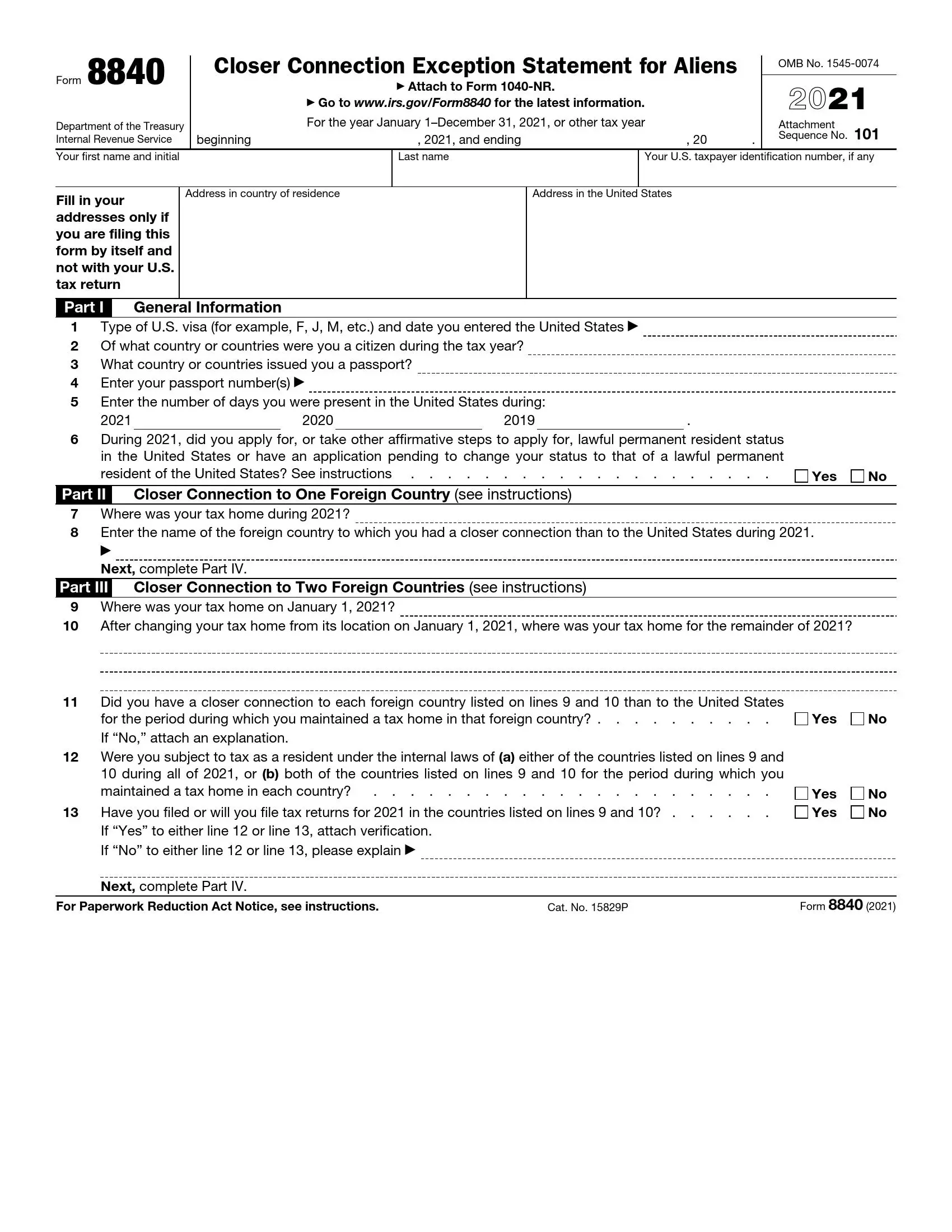

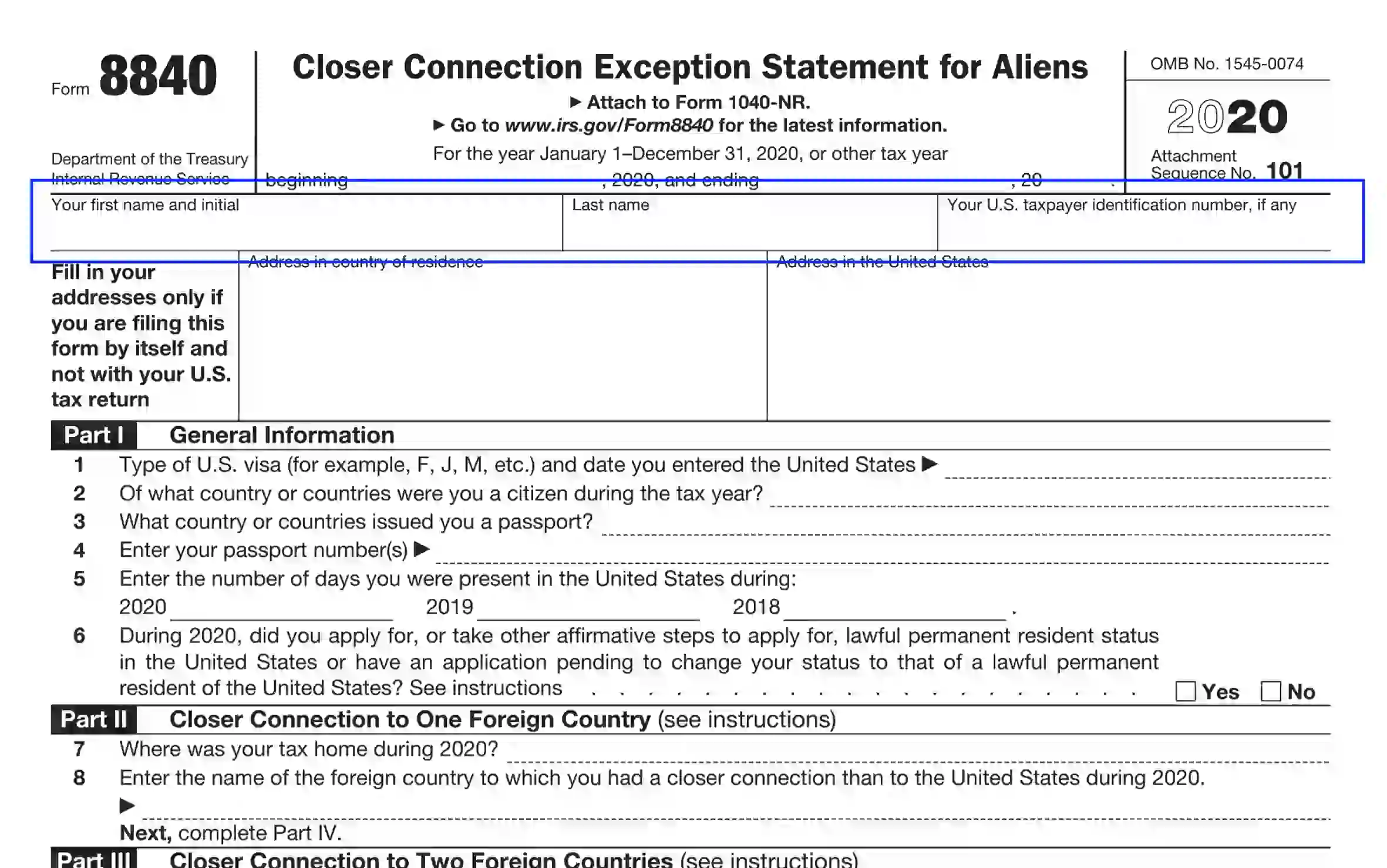

How to Fill Out Form 8840

Form 8840 consists of two pages and the IRS general directives regarding its purposes and inputting. Download a relevant updated PDF file. You are welcome to utilize our template-building software to generate the needed document and proceed to complete it immediately.

Follow our general guide to understand the essentials of the filling-out process.

Identify the Declarant

Before you proceed to submit the general info required by the form, you need to identify yourself by entering the first and last names (including the middle initial). Also, if you have a taxpayer ID number assigned by the U. S. IRS, specify the data in the right top corner. You don’t need to re-enter this info on the second page.

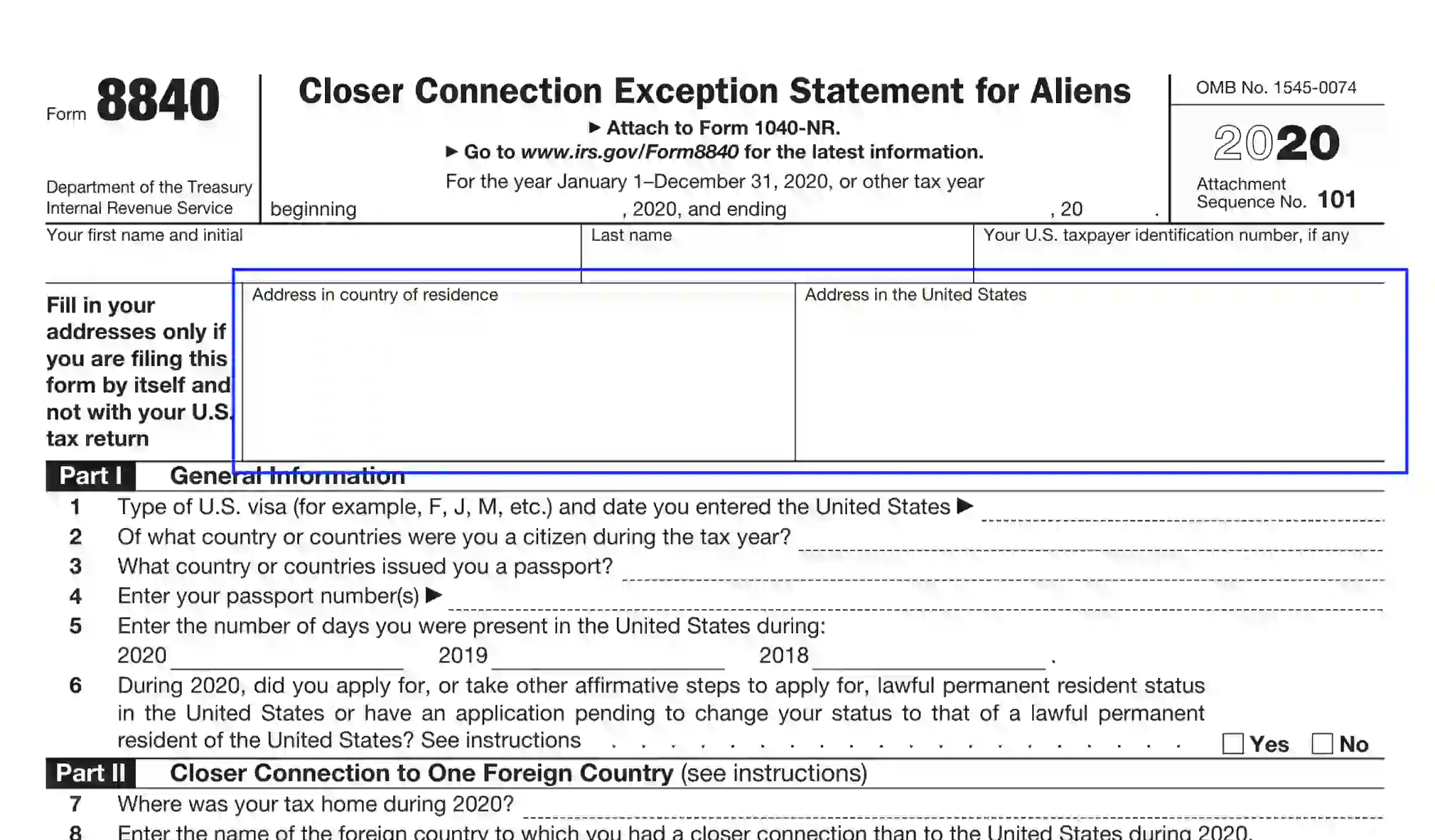

Enter Your Address (If Applicable)

The declarant should enter their address only if they complete and file Form 8840 by itself, not as part of the tax return paper set. Use the left box to specify your foreign residency. In the right box, you are encouraged to enter your U. S. living address. For both aspects, please, include the unit (or apartment) number, street, city, region or state, country, and postal data.

Complete the General Info Section

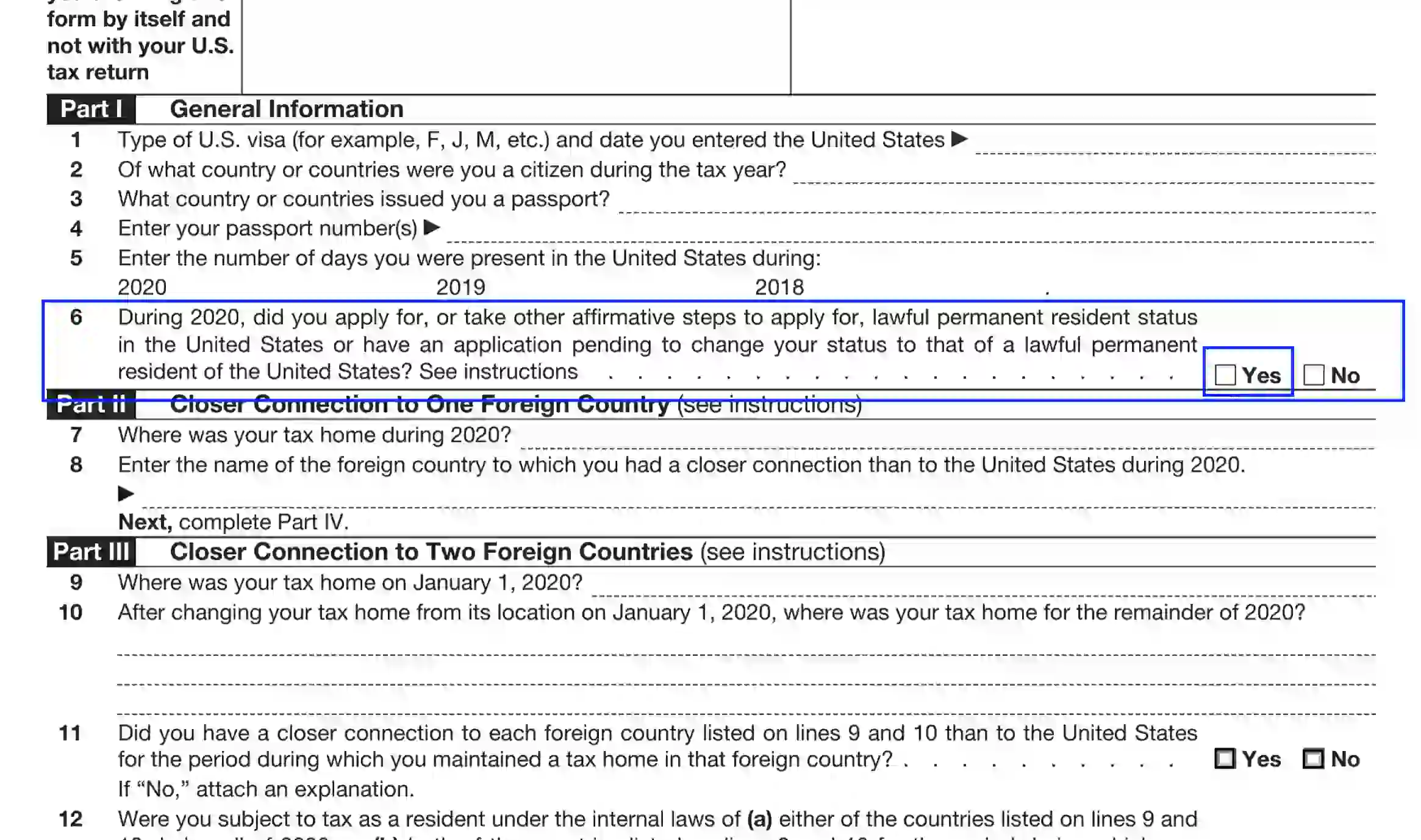

Part I is dedicated to collect basic data about the declarant’s visa, citizenship, passport issues, US presence, and resident status applications. You also need to submit your passport number and specify the periods during which you resided in the US. Fill out all corresponding lines by entering the required data.

Revise Unit 6

Whether the declarant answers Unit 6 positively, they are not allowed to file Form 8840 and get the closer connection privileges. Check out IRS Publication 519 to learn more about applying for the nonresident rank.

Specify the Closer Connection Info

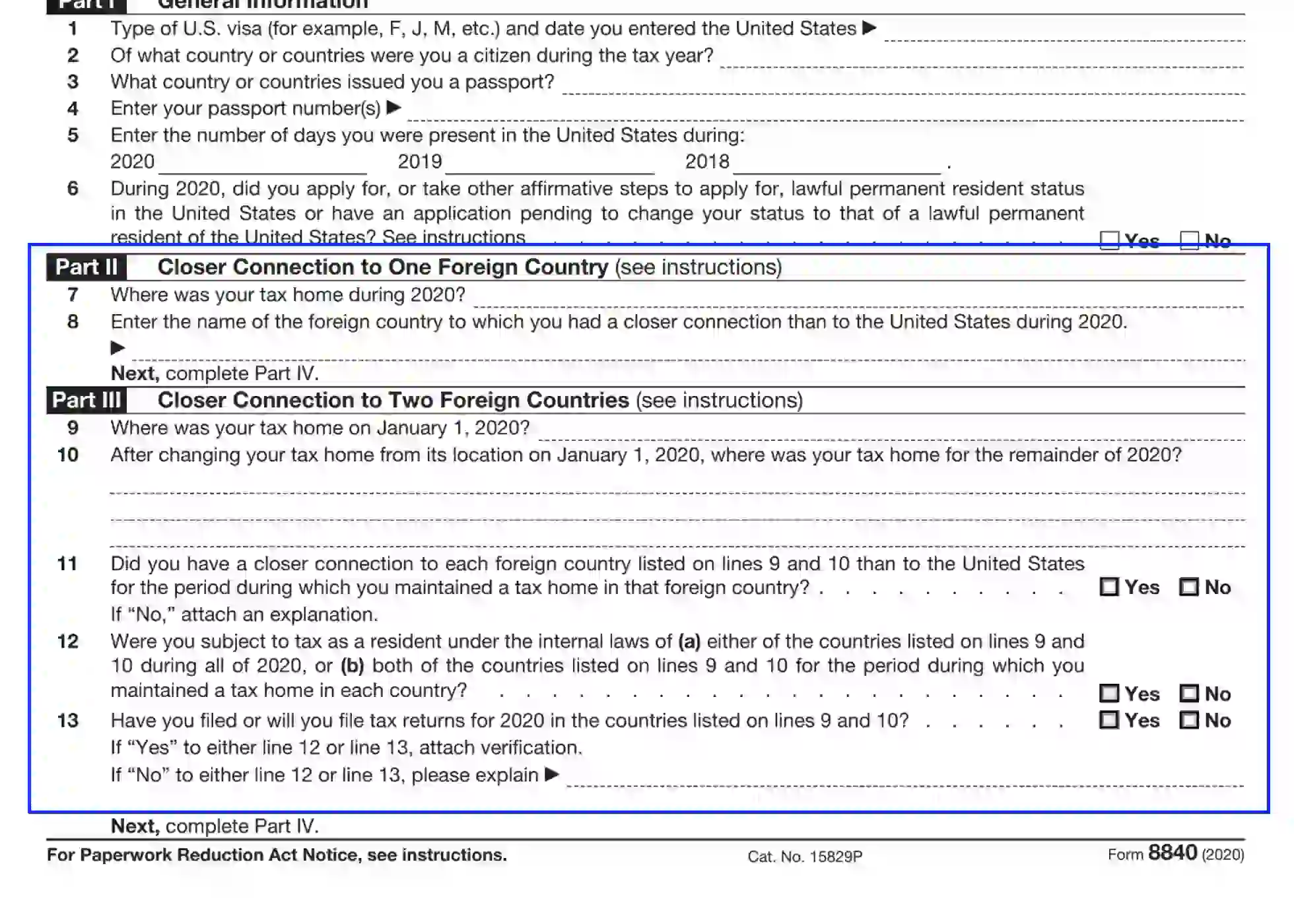

By offering to fill out Part II and III, the Service wishes to understand if the declarant has been subject to a foreign tax home during the reporting period at issue. If you have a closer connection to only one foreign country, ensure to complete Part II, clarifying the name of the country and tax home details.

If your closer connection relates to more than one foreign country, you are empowered to complete Part III, providing the valid data:

- Tax home specifications

- Tax home adjustments — submit the second location.

- Complete the poll, selecting between “Yes” and “No” alternatives.

Choose only one “Closer Connection” variant and fill out either Part II or Part III. However, if you have been subject to tax home in the US during any periods indicated in Part II or III, you cannot be qualified for the closer connection privilege.

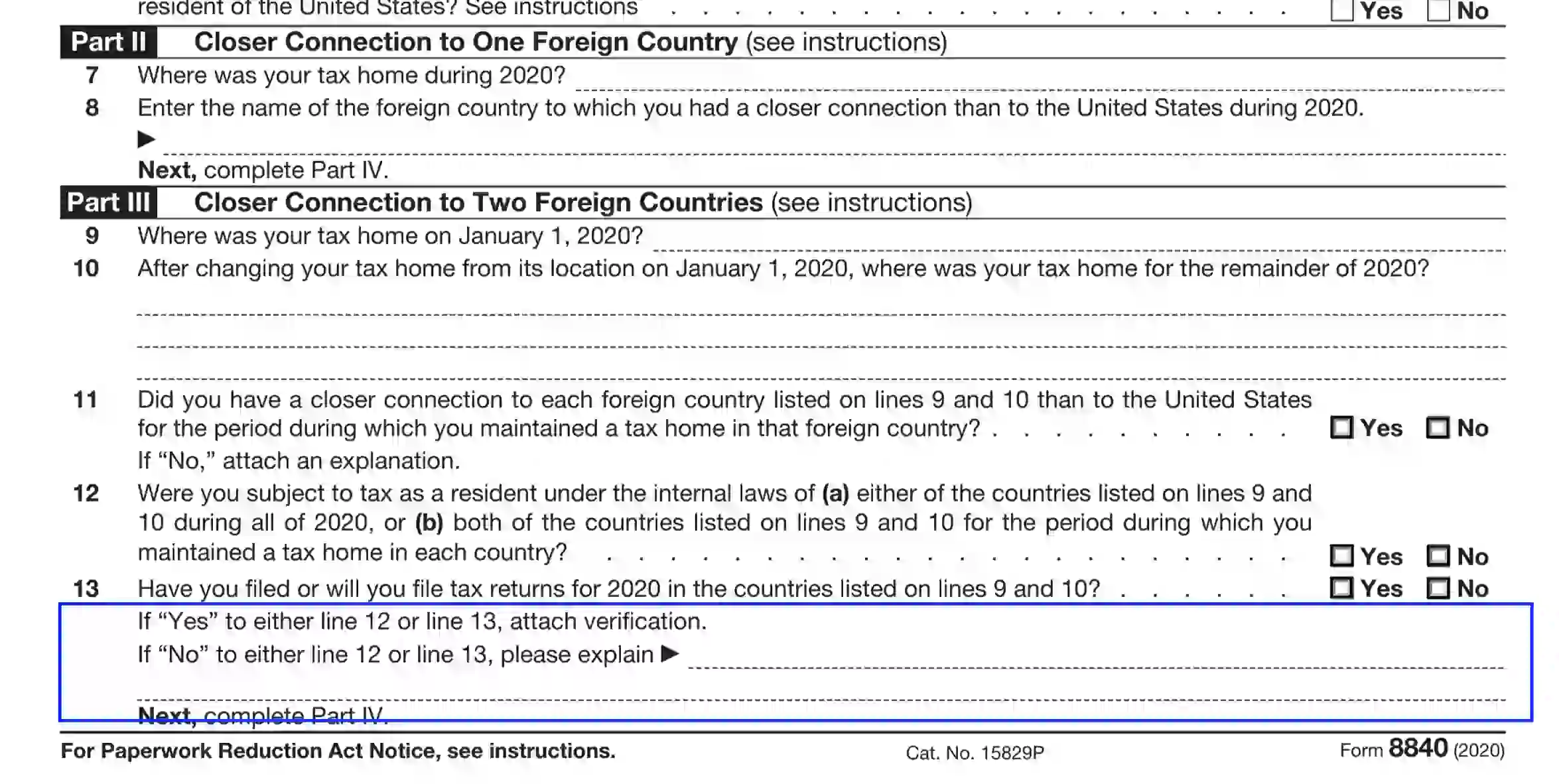

Whether you answer positively to Units 12 and 13, you are obliged to provide proof in attachments. If you check the negative statement, you need to explain your “No” answer on the blank line below Unit 13.

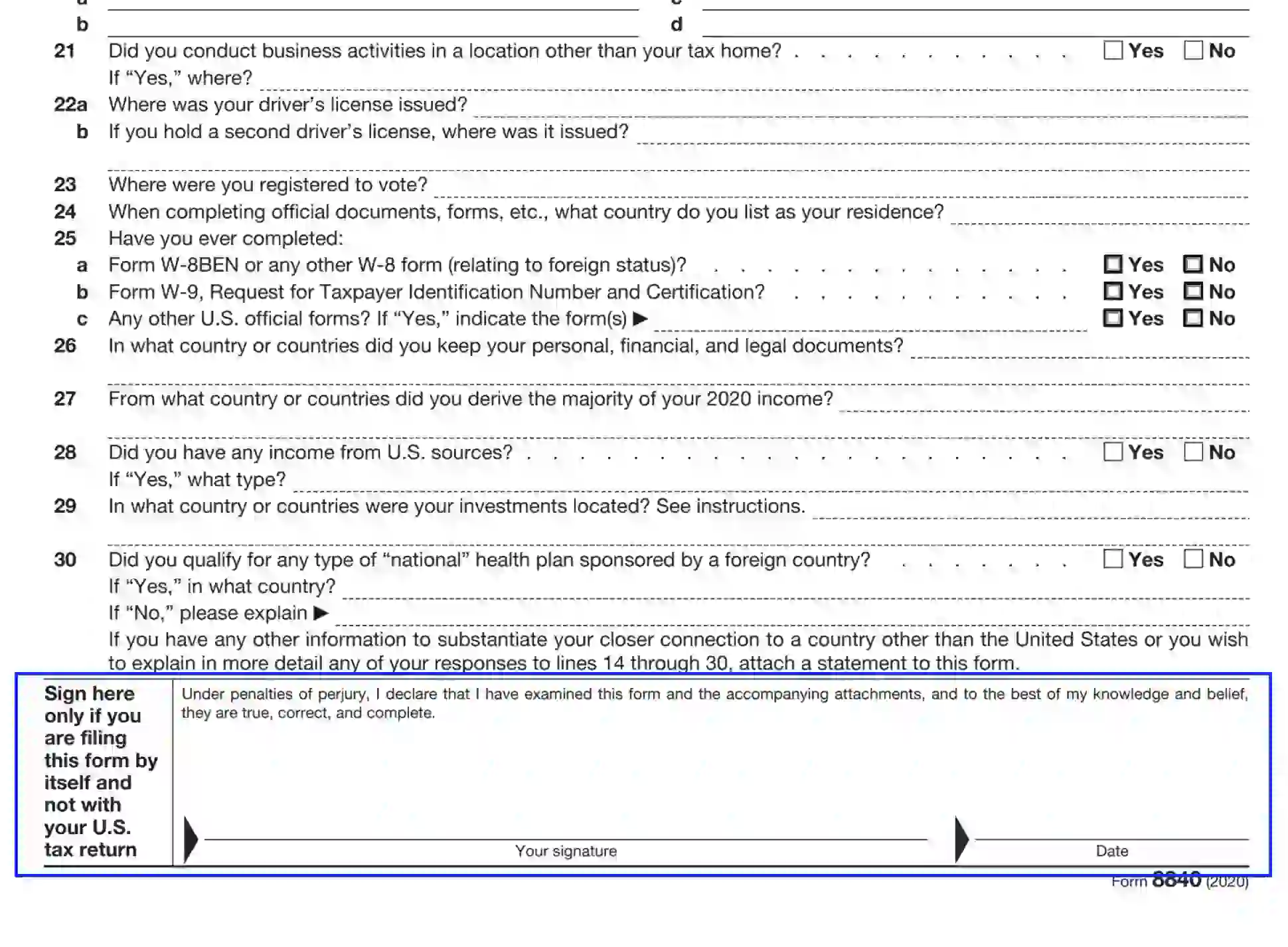

Clarify the Important Contacts with Foreign Territories

In Part IV of Form 8840, the declarants should provide any essential info regarding significant contacts, people, family members, locations they resided or worked at, voting specifications, business aspects, and other info. Relying on this background, the IRS will decide whether the declarant is eligible for a substantial presence test.

Follow the document’s questionnaire and submit the required data. Here are some tips to help you with indicating the correct information:

- The “Permanent home” concept covers any owned or rented dwelling or room you use at any time, which excludes short visits and overnight stays. Use this idea to provide info in Unit 14 of Part IV for the reporting year at issue.

- In Unit 29, you are supposed to indicate the origin of your investments (bonds or stocks that you own). Ensure to fill in the name of the territory (or country) where the stock corporation, for example, is situated, notwithstanding where you keep your paper holdings safe.

If any statement demands proof or explanation, you should either use attachments or clarify your answer on the blank lines below the statement.

Acknowledge Form 8840

Once again, check the data you submit in the form and the verification attachments. If everything is authentic and correct, append your signature and date the paper.

You shouldn’t authorize Form 8840 unless you file it separately, which means the paper is not part of your tax return bundle.