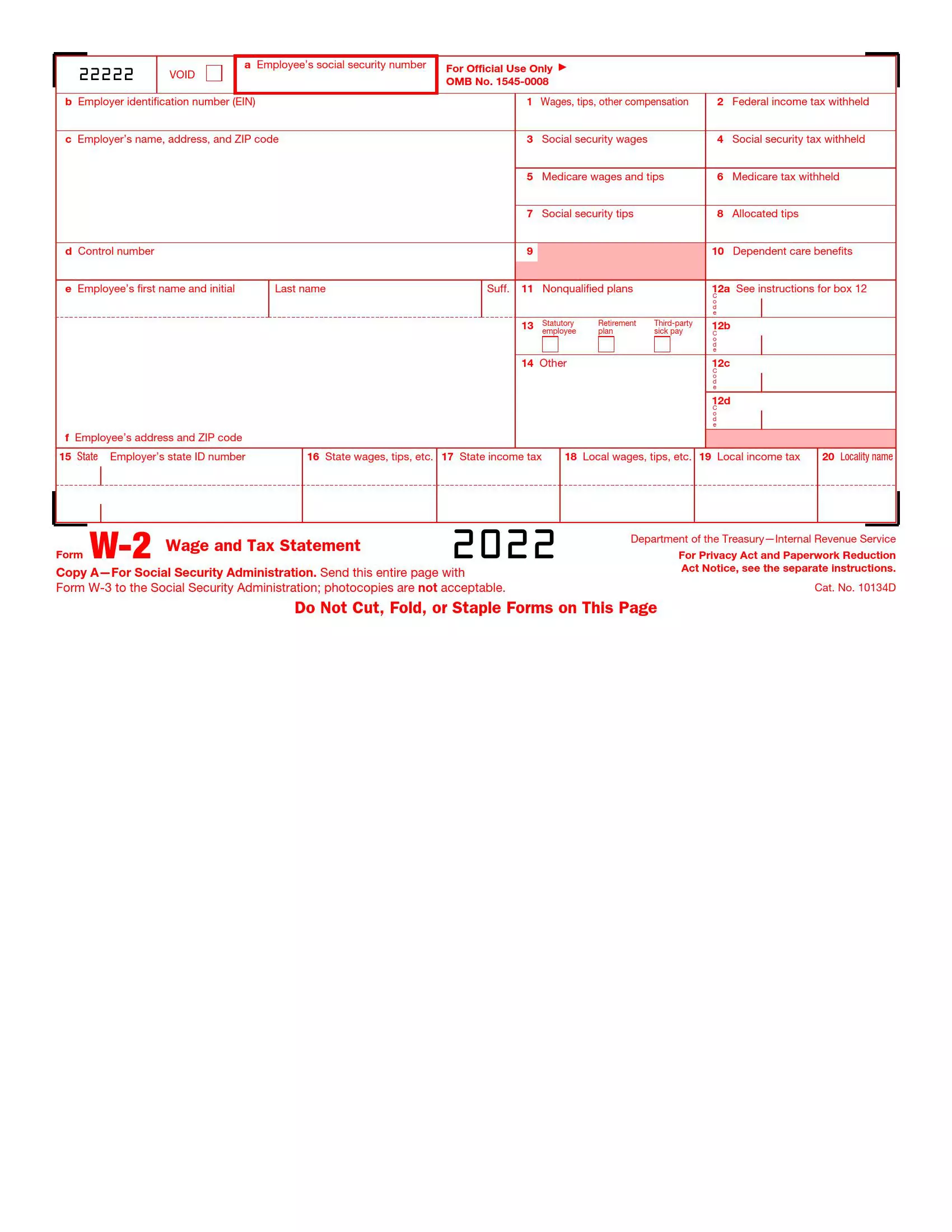

IRS Form W-2, or “Wage and Tax Statement,” is a crucial tax document in the United States that employers must provide to every employee who earns a salary, wage, or other compensation. This form reports the amount of taxes withheld from the employee’s paycheck for the federal government and documents the employee’s annual income. It includes information such as the total earnings, Social Security earnings, Medicare earnings, federal income tax withheld, state income tax withheld, and any other deductions, such as retirement plan contributions.

Employers must send out Form W-2 to their employees by January 31st of the year following the tax year being reported to ensure employees have sufficient time to file their federal and state income taxes. Employees use the information on Form W-2 to complete their IRS Form 1040 and state tax returns. This form is essential for verifying income and taxes paid throughout the year, which helps the IRS and taxpayers ensure that all income is reported correctly and the correct amount of tax is paid.

Other IRS Forms for Self-employed

Apart from Form W-2, employers need to file a number of other legal forms, depending on some factors. Learn what other IRS forms might be mandatory for your specific type of business.

Useful Tips on Filling Out the Form W-2

The tax form W-2 is the most common form used by US residents. Of course, this variety of empty boxes may seem a bit frustrating and complex at the first glimpse. But do not worry; we are here to help you figure it all out. Just follow our guidelines, and you will be able to fill out the tax form W-2 without making any mistakes.

There are boxes named A, B, C, and so on, and boxes with numbers. We will follow a specific order when filling out the form, so please stick to that order.

1. Enter the employee’s SSN

The employer has to fill in the Social Security Number of the subject employee in Box A for starters.

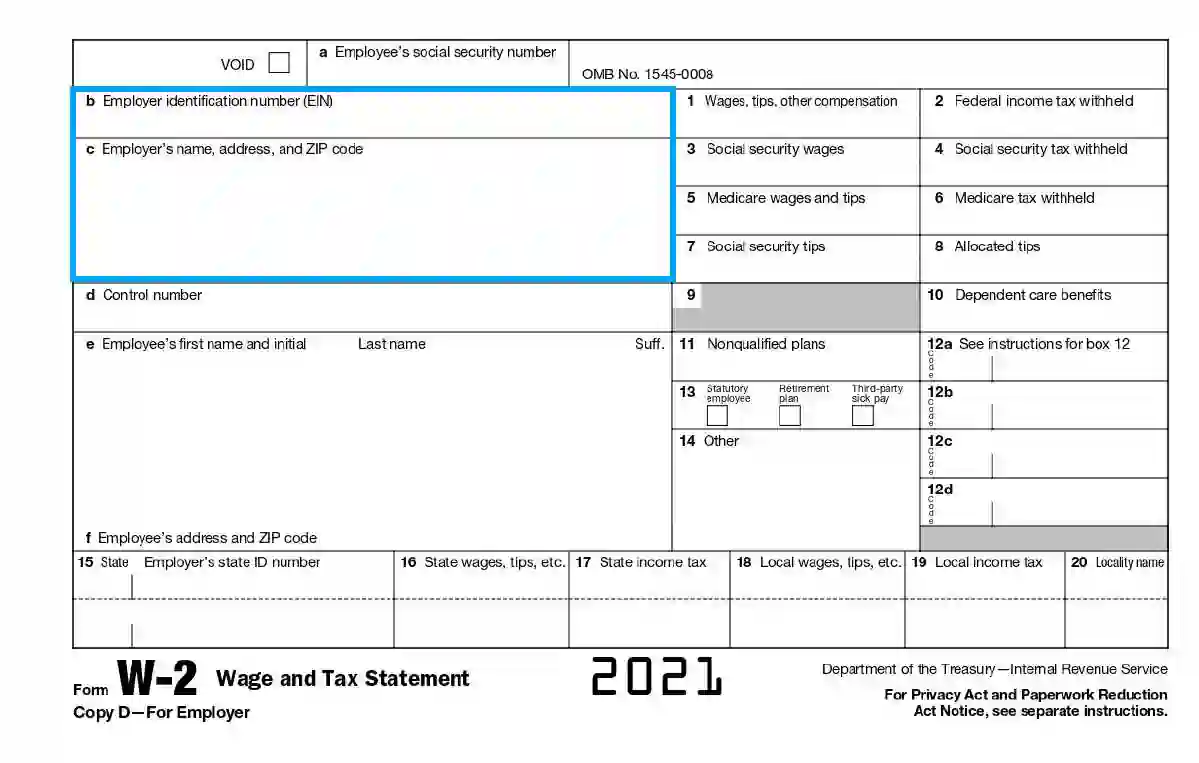

2. Insert the employer’s information

In Boxes B and C, insert the Employer Identification Number (EIN). Then, indicate the company’s full name and legal address, including the state and zip code.

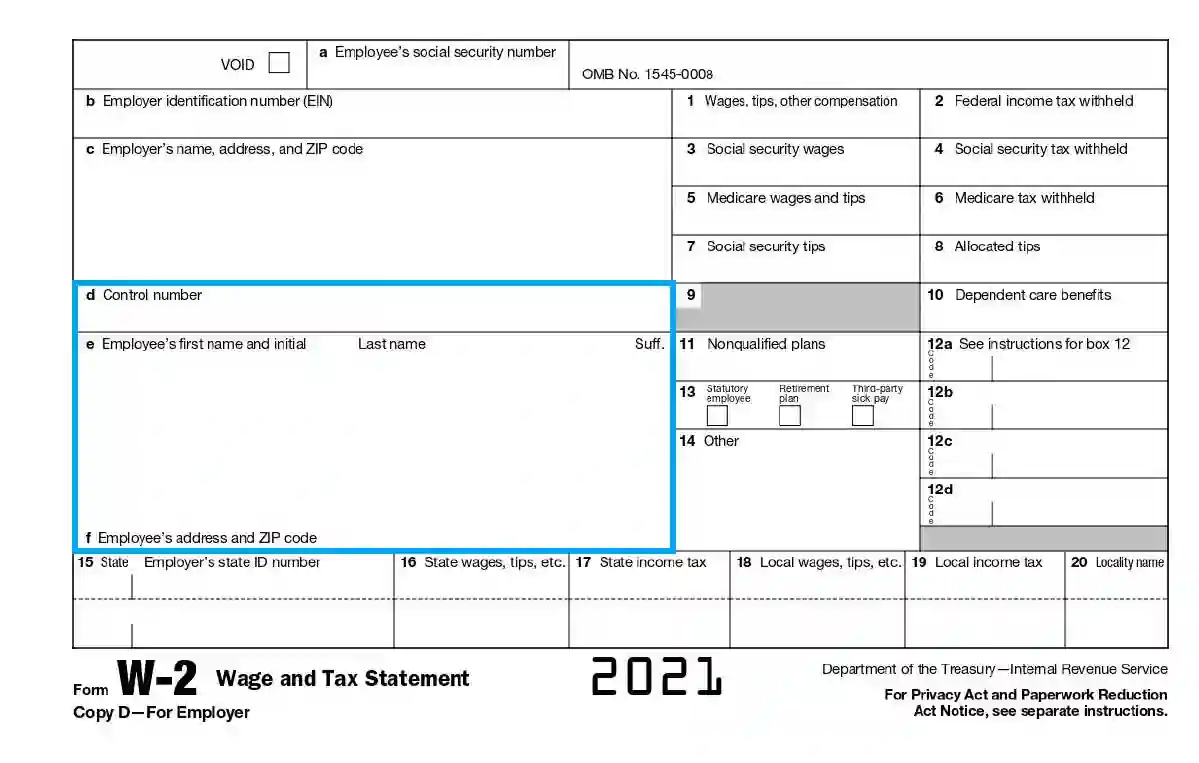

3. Enter the employee’s personal data

Insert the employee’s personal control number assigned to him or her by the company’s payroll processing system in Box D.

Then, fill in the employee’s full legal name (make sure it matches the employee’s ID card) and their physical address, including the state and zip code in Boxes E and F.

4. Provide the employee’s income and taxes information

Proceed to the right side of the page and keep on feeling the fields as indicated below.

Fill in all the salary, tips (if applicable), and other remuneration amounts, including annual bonuses received by the employee in the current financial period, into Box 1. Insert the taxes withheld amount in Box 2. Then, list all the social payments received by the employee in Box 3. Finally, in Box 4, define the amount of money withheld in taxes.

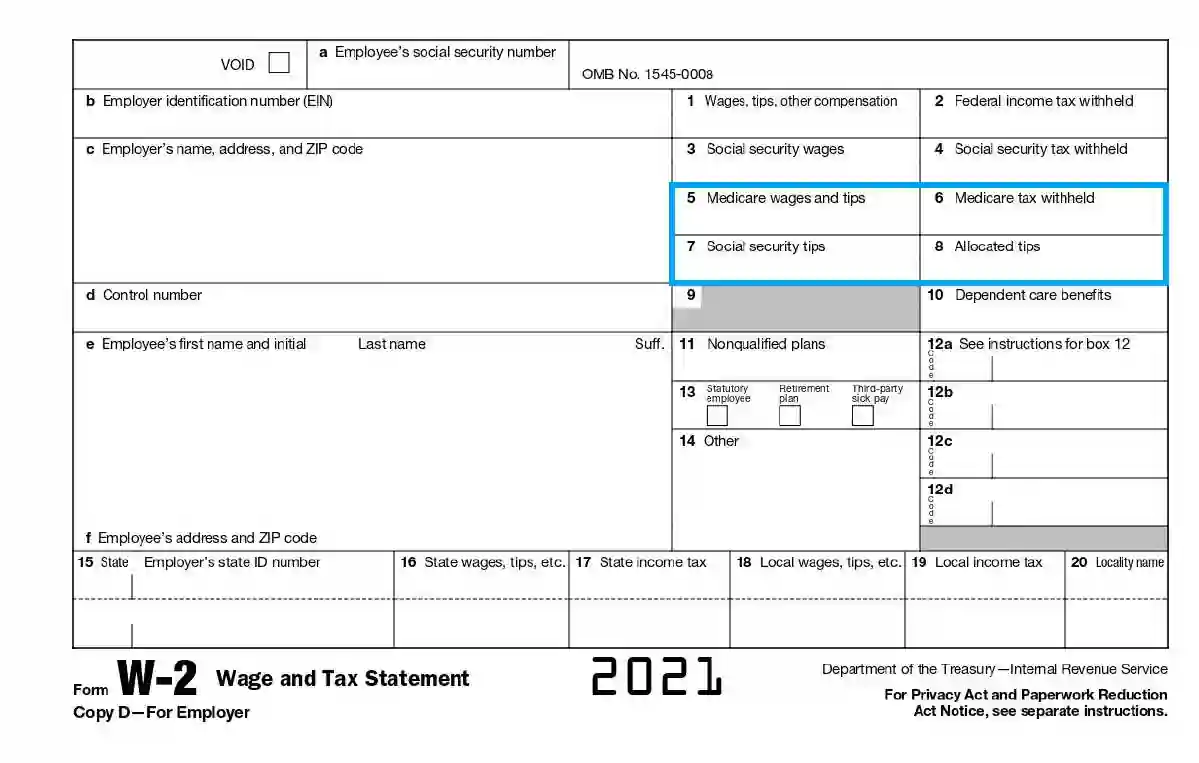

5. Determine the social services tax withheld amounts

In Boxes 5 and 6, indicate the Medicare tax and tax withheld amount, respectively. Enter tip income reported by the employee to the employer in Box 7, and then enter the employer’s tip income to the employee in Box 8.

6. Provide information on verification and Dependent Care benefits

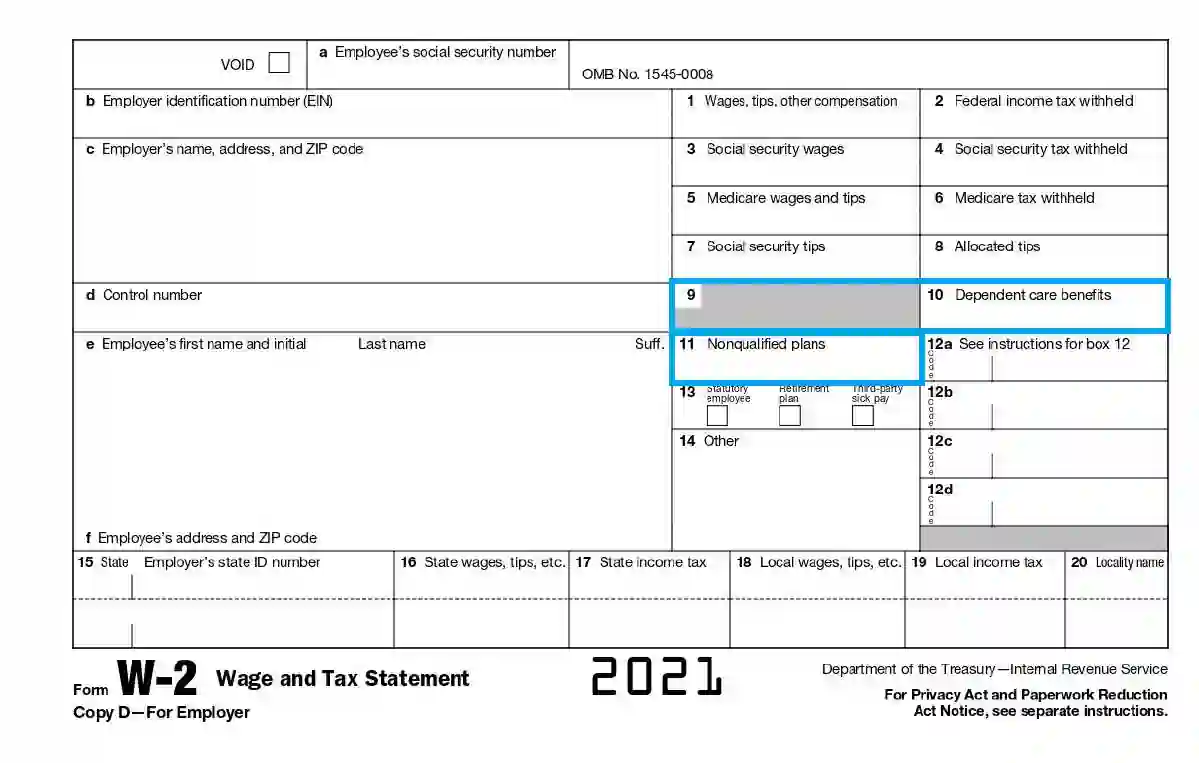

If you are still part of the verification code program, enter your verification code into Box 9. Most people that do not have the code leave this part of their W-2s empty.

If you are taking care of a sick family member, indicate any earnings you get for Dependent Care or any related expenses, you need to reimburse yourself in Box 10. Box 11 is designed for those involved in non-qualified payment plans and programs. Most businesses do not have such plans, thus leaving the section empty. Box 11 may also be used to report any non-governmental pension plan.

7. Describe contributions

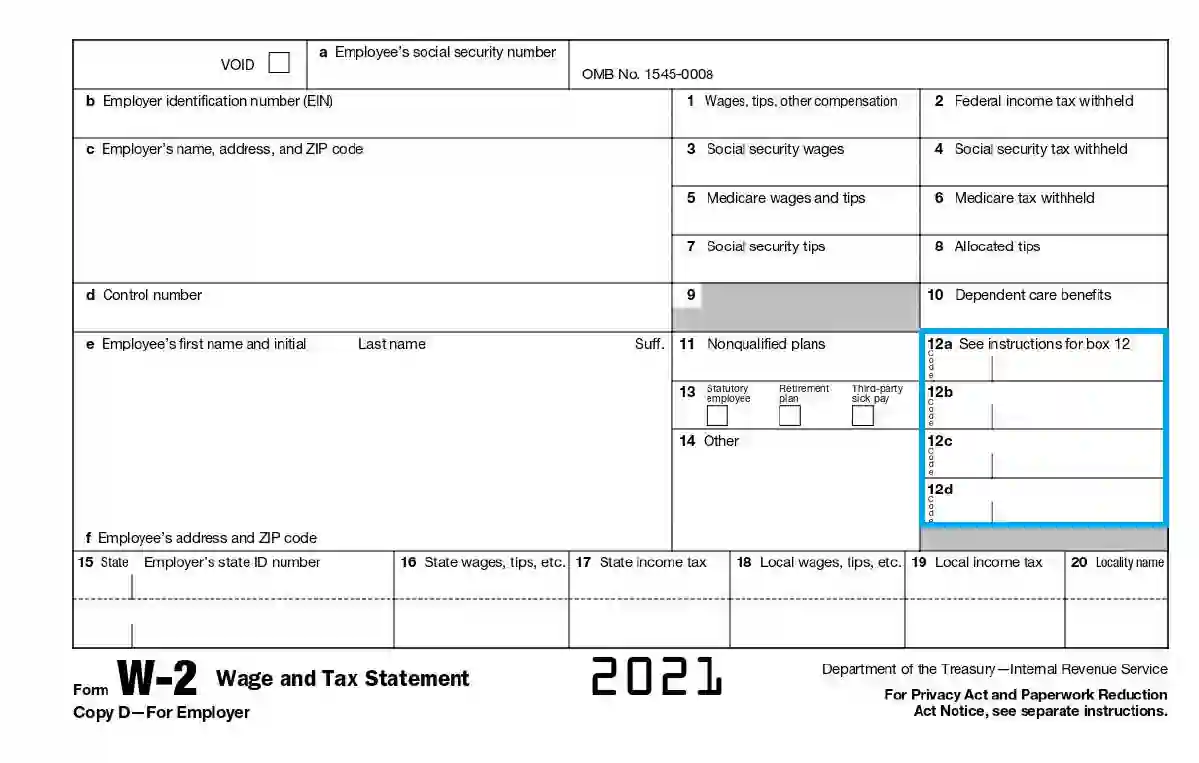

In Box 12, provide for any deferred compensation information. Usually, there are instructions for filling out the W-2 form along with the document. There is an explanation for each code in this box. You may also need extra information to complete the deferral tax returns.

Please note that if you turn at least 50 years old in 2021, you can be entitled to a $6,500 additional deferral compensation.

8. Indicate any other relevant benefits information

For Box 13, all you need to do is check the corresponding box suitable for specific tax situations. You may list any additional tax return-related information in Box 14. You may indicate your government tax deductions here (if you gave any).

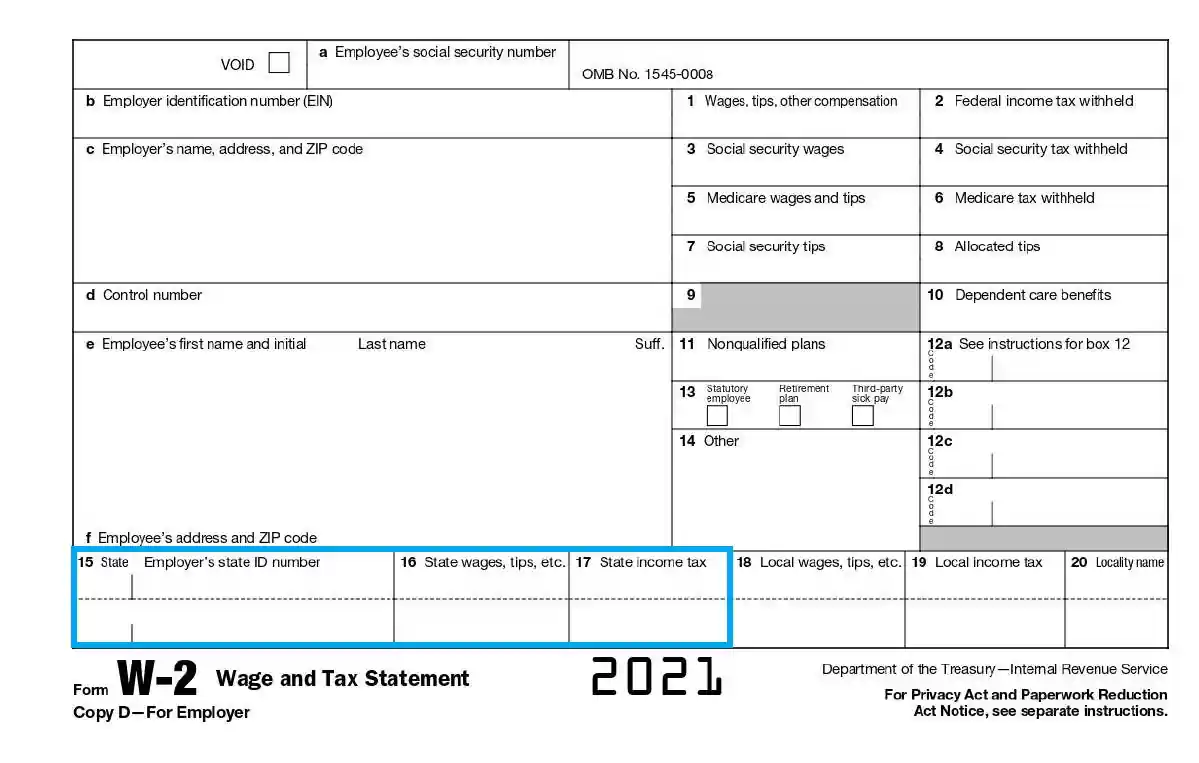

9. Indicate the state average salary and tax information

Indicate the employer’s state tax identification number in Box 15. You can leave the records of two different states if you need to. In Box 16, enter the total taxable salary amount that the employee has earned during the financial period. Enter the total of tax withheld in Box 17.

10. Enter the local tax and wages information

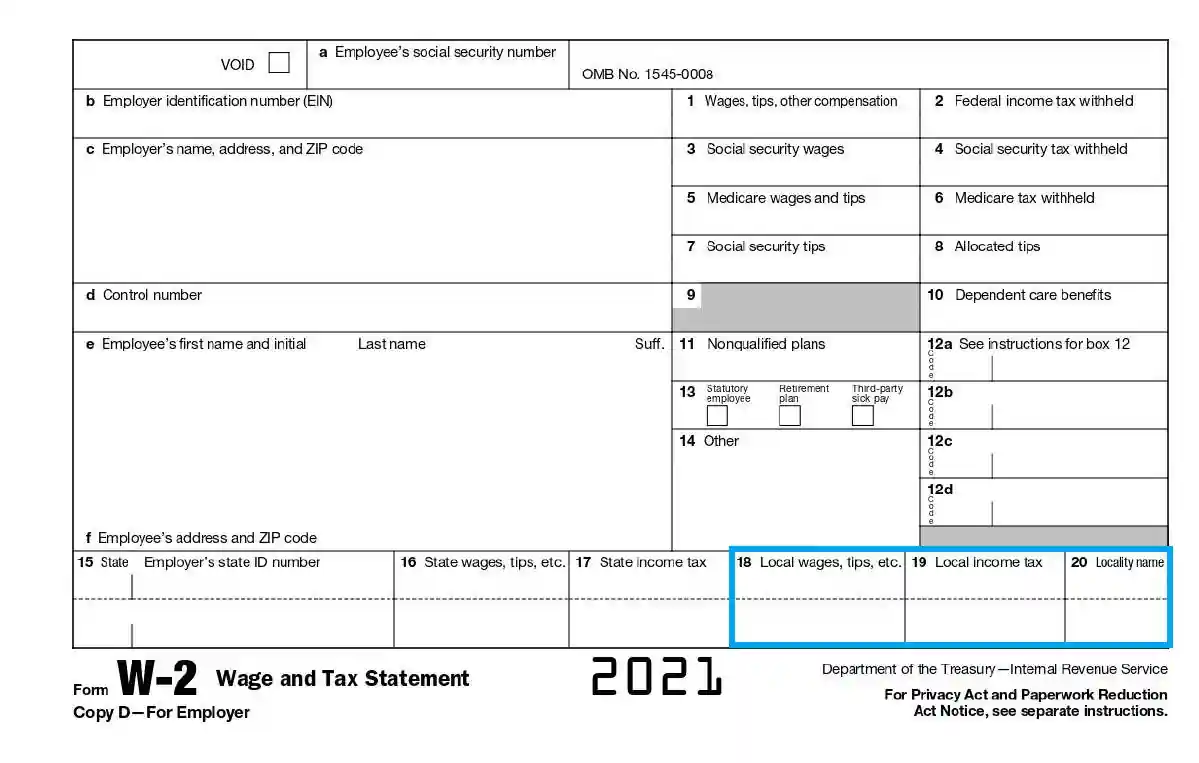

Box 18 is designed to record the employee’s wages subject to local, city, or any other types of taxes. In Boxes 19 and 20, you need to enter the local income taxes withheld and the locality or city to which the employer has to pay taxes.

The most commonly made mistakes

There is a series of mistakes people regularly make when filling out the Form W-2. As you remember, any error leads to the form becoming invalid and subject to a fee. From this point of view, we decided to draw some useful tips for filling out the W2.

Tip №1: if you fill out the form by hand, only write in black ink that is bright and well visible. Write in normal-sized letters (not too large, but not too small either).

Tip №2: if you decided to build the form and fill it out online, use an easy-to-read font.

Tip №3: make sure NOT to add a dollar sign in boxes, where it is necessary to enter dollar amounts.

Tip №4: Pay special attention to Box E. People tend to format an employee’s name incorrectly.

Additional things to remember

You have to prepare six copies of your W-2 tax return form. All of them go to different departments (according to the marking at the bottom of the page):

- Copy A goes to the relevant SSA office;

- Copy 1 is for the Local Tax Department;

- Copy B is designated for the employee’s Federal Tax Return;

- The employee keeps Copy C for his own records;

- Copy 2 is for the employee’s local income tax return;

- The employer gets to keep Copy D.

Please note that you have to retain your copy for at least 4 years. Keep a receipt every time you pay your taxes. You can later provide that receipt as payment proof in case an argument occurs. Make sure to get legal advice if you are not sure about certain taxpayers’ data.

Penalties and Remedies

Of course, there is a certain tax liability for failing to obey the local norms and regulations. It is crucially important to stick strictly to the filing deadline. If you happen to fail to send your tax return report in time, you will be subject to a fee. The penalty amount varies depending on the delay. Thus, there are the following penalties applied to unscrupulous taxpayers:

- The $30 penalty for 30 days and less delay (per one form);

- The $60 penalty for a delay of over 30 days, but the documents are submitted before August 1 (per one form). Please note that this penalty might be increased to $200–500, depending on the business or company size;

- The $100 penalty for a delay of over 30 days, but the papers were sent in after August 1 (per one form). Please note that this penalty might be increased to $500–1500, depending on the business or company size.

If you happen to fill in the form W-2 incorrectly, you will be subject to a penalty as well. You (or your employer) will have to pay $250 per one spoiled form. Three million dollars cap this annual penalty amount. If both the employer and the employee fail to fill out the Form W-2 correctly, both parties will have to pay a total $500 penalty. The price for failing to submit the necessary documents internationally increases up to $500 per form.