Free General Power of Attorney Forms

General powers of attorney are incredibly powerful and important tools in your legal arsenal. They allow you to give other people the power to act for you in certain circumstances including making financial decisions and managing your real estate.

However, they aren’t ideal for every situation. There are some cases when you may want to go with a different kind of power of attorney form. This article will cover the General Power of Attorney, what it’s good for, and when you might need something else. We’ll also go over the steps you’ll need to follow to fill out a general power of attorney form.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a General Power of Attorney Form?

There are some situations where it’s helpful and even necessary to have someone else who is empowered to take care of some financial, legal, and even medical matters on your behalf. A general power of attorney can be used to specify who has the right to act on your behalf, as well as which circumstances they have control over.

Here are some examples of powers you (the principal) can grant someone else (your agent or attorney-in-fact), via a power of attorney (POA).

Managing Real Estate

You can give someone else the right to manage your real estate including making changes to the property or even buying and selling real estate on your behalf. This often comes with access to accounts and documents relating to any and all real estate included in the POA.

When it comes to matters of real estate, you’re much more likely to need to have your general POA form witnessed and signed by a notary public.

Property Management

You can also grant the right to manage other properties on your behalf. This property can include or exclude real estate, and both rights can be included in the same POA.

Retirement Plans and Estate Planning

You can also give your agent authority to help with your retirement and estate planning documents as well as to execute anything included in those plans. That includes making decisions that impact your retirement accounts and planning investments to help with your financial security in retirement.

Financial Power of Attorney

A financial power of attorney is slightly more general and may include things like the right to make investment choices, manage your financial accounts, and pay routine bills. A financial power of attorney can also sign checks on your behalf and make other important financial decisions for you.

A financial power of attorney template also allows you to designate specific financial resources that your agent has access to, or to create a customized set of privileges and restrictions. This can include managing your:

- Life insurance

- Bank accounts

- Tax returns

- Lending and Borrowing

- And more

It’s important to make sure you designate only the powers you want your attorney-in-fact to have. However, you can always go back and change your agent authority by revoking your current financial power of attorney forms and creating new ones.

Handling Business Transactions

If you are in business for yourself, it is also possible to designate someone who can make business decisions on your behalf, usually if you cannot be reached in time to make the decision. Depending on your situation, this kind of power of attorney may not be necessary.

For instance, if you have employees who are empowered to make certain business decisions, they do not also have to have power of attorney.

Multiple Designated Power of Attorney

While this is not a specific power that you can grant, it’s also important to know that you can have multiple people designated as your agents by a general power of attorney document(s). This is important in the case that you want someone to make certain financial decisions on your behalf but would rather have someone else acting as a medical power of attorney.

Designating multiple agents also gives you the option of matching their rights and duties as agents to their unique temperament and talents.

When to Use a General Power of Attorney

There are several types of power of attorney as well as a wide variety of circumstances in which you would use one. We can’t go into all the details since the circumstances are nearly infinite, but here are a few important examples.

Limited Power of Attorney

You can designate someone to act as your agent for a limited time frame with pre-determined beginning and end points. This can be helpful situations where you need temporary assistance but likely won’t need to give anyone long-term POA rights.

For instance, you may want to give someone POA over your financial concerns if you have an upcoming surgery and are likely to be on pain medication for several months during your recovery.

Springing Power of Attorney

Similarly, you may want to have someone pre-designated as your power of attorney should a specific situation occur, but not otherwise.

For instance, if your spouse is your current agent, you may also want to have a springing power of attorney designed to kick in should you and your spouse ever get divorced. That way, you always have someone who can act as your agent and don’t have to worry about the paperwork during your divorce.

Other Circumstances

While there are many reasons to designate a POA, here are a few of the most common ones:

- Military service members may designate an agent to handle their affairs while they are deployed.

- If you frequently travel, you may want someone who can handle your affairs while you’re away.

- You need someone who can act on business opportunities when you cannot be reached.

- You have a long-term health crisis and need to focus on your health.

These are only a few of the most common circumstances. Don’t worry if your specific situation isn’t listed, you can still likely use a general POA to cover your needs.

You can also consult with a lawyer if you aren’t sure whether a POA is what you need or you aren’t sure what type of power of attorney is most appropriate.

General Power of Attorney Form Details

| Document Name | General Power of Attorney Form |

| Other Names | Financial Power of Attorney, Power of Attorney for Finances |

| Ends when | When the principal becomes incapacitated |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 43 |

| Available Formats | Adobe PDF; Microsoft Word |

Steps to Getting a General POA

1. Choose Your Agent

The first step is to pick your agent. You should carefully consider your options, including talking with anyone you’re considering. Make sure that they understand why you are considering giving them power of attorney and exactly what management powers, banking powers, or medical powers you would like to give them.

Your agent(s) must consent before you can give them power of attorney.

2. Decide Between Custom POA and a Template

Before you give someone POA, you may want to seek legal advice. More specifically, you need to decide whether you want to use a template or want to get a lawyer to create a custom document tailored to your specific circumstances.

Both types of legal documents are valid as long as you file them appropriately in your state. That may include seeing a notary public as well as filing copies of the forms with various governmental agencies.

3. Fill Out Your POA

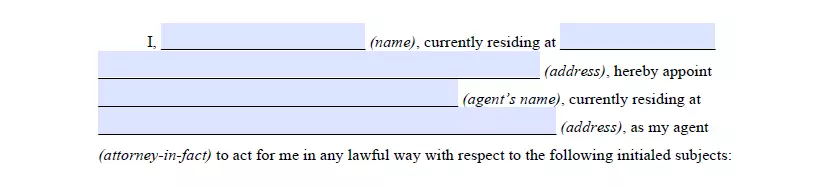

Your general power of attorney forms will require your personal information, your agent’s personal information, and the details regarding the rights and privileges granted by the general power of attorney document. You may need to provide supplemental information, such as account details, property information, or insurance information, depending on the nature of your POA.

4. File Your POA

The last step in most cases is to file your POA. This can involve getting it notarized, filed with the appropriate agencies, and keeping a copy for yourself, your agent, and any lawyers involved with your affairs.

5. Renew as Needed

Some states may require you to periodically renew your POA forms. Usually, if this is required, it’s only needed every few years. However, an expired POA is not considered valid, so it’s important to stay on top of renewal requirements in your state.

How to Fill Out a General Power of Attorney

For clarity’s sake, we’re going to assume that you have already decided between a template and working with a lawyer to fill out your power of attorney.

We’re also going to assume that you are using a template for the simple reason that your lawyer will help you fill out your POA after creating a customized form.

1. Choose the Relevant Form

The first thing you need to do is to make sure you have the right kind of POA form. While some templates are truly general, most templates are geared toward a particular purpose. You don’t want to use a financial POA template when trying to create a medical power of attorney, for instance.

Our POA is geared toward financial powers and is only suitable for allowing someone to act as your financial attorney-in-fact.

You should also consider whether you need specific categories or considerations in your POA. If you’re giving someone property rights over specific motor vehicles, for instance, you’ll want a section where you can specify which property your agent has the right to control.

2. Fill Out Personal Information

At the start of your POA template is a section for you to fill out personal information for yourself and your attorney-in-fact. That includes your legal name and address by default. You can choose to add additional information if you like, but it’s not necessary.

You should always make sure that both addresses are as up to date as possible, and will need to update the form any time either you or your attorney-in-fact change addresses.

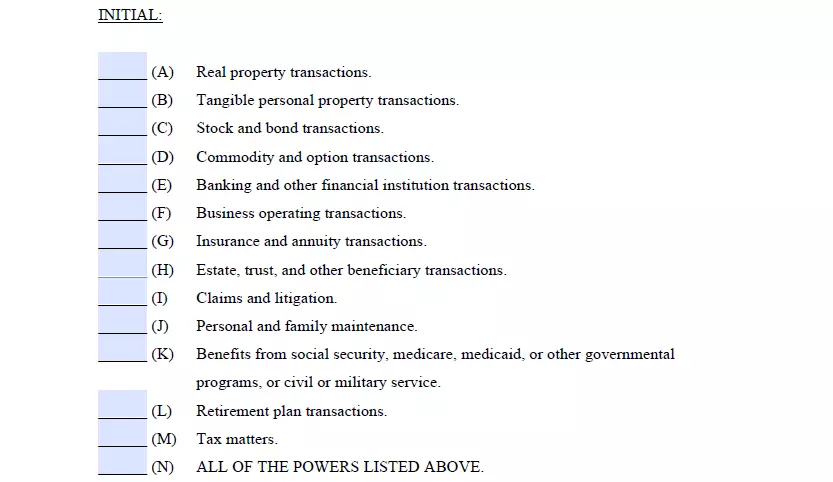

3. Select Financial Powers

Since this form is geared toward allowing someone else to handle your financial affairs, you will also need to select the specific powers you are granting your attorney-in-fact.

There are several powers to choose from. Simply initial next to the powers you would like to grant with your general power of attorney template. You can also add any powers that aren’t mentioned on the template in the next section.

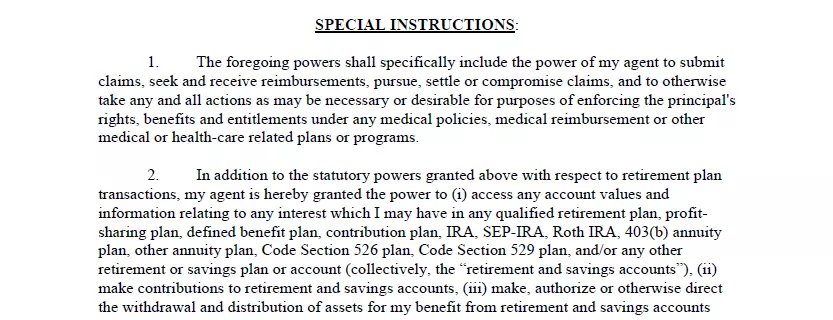

4. Give Special Instructions

Just because you are using a template doesn’t mean that you can’t make some modifications to the terms outlined by the form. Many templates can be edited to eliminate certain clauses, or to add additional stipulations depending on your circumstances.

Our template allows you to add additional powers, if needed, in the special instructions. It also includes three special instructions that are common, but may not always be relevant or necessary. You can add additional instructions, or remove any of the special instructions already included in the template to create a more customized document.

Avoid blank space in this area since additional rights and powers can be added in the blank space and will be considered valid unless you can prove that the additions were not part of the original document.

Unless you have a strong grasp of legal language and are very familiar with POA laws, it’s best to consult with a lawyer about any alterations you make. They may recommend changes or supply you with the legal language you need to accomplish your goals.

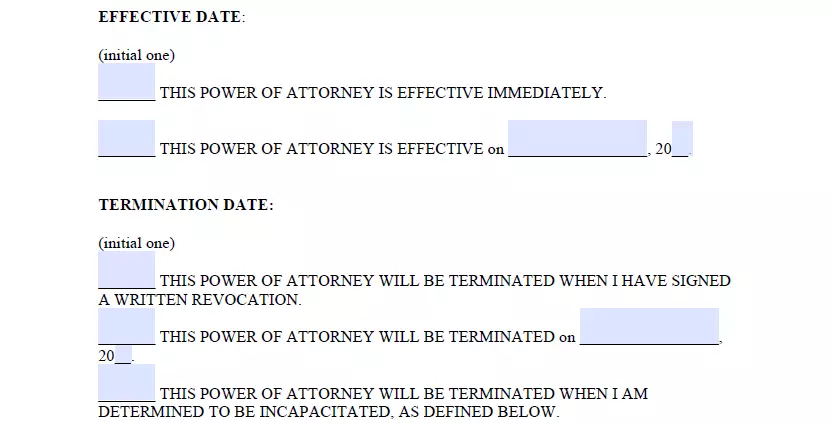

5. Enter Effective and Termination Dates

You will also have to indicate an effective date on the template. You can optionally indicate a termination date as well so that your attorney-in-fact’s rights automatically expire at a specific time.

Since this is a general power of attorney form, you will also need to initial that the powers will expire automatically if you are ever considered incapacitated, in need of a conservator or guardianship. Like any POA, you have to be considered of sound mind to execute this document, and it will expire if that status ever changes.

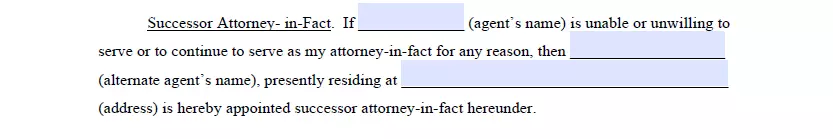

6. Indicate a Successor Agent

The last section you can fill out yourself gives you the option to choose a successor agent in case your primary attorney-in-fact chooses not to act or is unable to act on your behalf.

Like your primary attorney-in-fact, this person should be a family member, friend, or other trusted third party. This person can also be considered a support agent or co-agent. When you have support agents they are granted the same rights unless you use a different attorney template to designate each one.

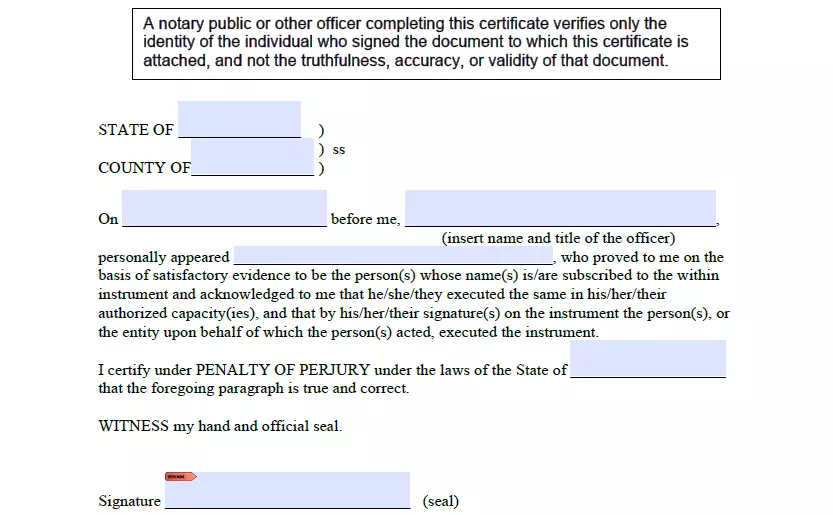

Notarize and File the Document

The exact filing requirements vary from state to state, and you may not always need to have your general POA form notarized. Even if it’s not a requirement, it’s a good idea to get your POA notarized because that will reduce the chances of your agent’s rights being contested in a legal battle.

Our template includes a page for your notary public, which should not be filled out except by a notary public. It includes a blank line for the notary public signature as well as a blank line for a witness signature.

At a minimum, you should make sure that you have a copy of each form, as does your agent. A third copy should be left with your lawyer or kept with your Last Will and Testament and other legal documents.

Ways to Terminate a Power of Attorney

Revoking a power of attorney can sometimes be just as important as creating one in the first place. Once created, a power of attorney is usually valid until and unless it is specifically revoked, but there are several ways that you can revoke power of attorney.

Limited Power of Attorney

One way to revoke POA privileges is simply to provide a time limit in the original document. You can specify both an effective date and an end date. In that case, POA would be automatically revoked at the end of the specified period.

Springing Power Of Attorney

Another way to revoke the power of attorney in the case of a springing POA is to specify circumstances under which the power of attorney would no longer be active.

That may be a set period of time after the POA is activated, or it might be more circumstantial. For instance, if the principal has MS, they might want a POA that springs into action if they have an MS flare, but not need their POA after they have recovered.

Fill Out a Revoke POA Form

Much like a POA can be set up by filing the appropriate forms, you can also end a POA using a specific form. You’ll need to state a reason for terminating the POA, which may be as simple as ‘no longer necessary’.

If your original POA form was notarized, your revocation should also be notarized.

Our template allows you to revoke your POA simply by filling out the revocation line in the original form. That should be a blank line unless/until you revoke the power of attorney form.

Divorce

Another common way that POA can be automatically revoked is in cases of divorce. If your spouse had a POA and you get divorced after the fact, their power of attorney will be revoked. You can re-instate POA if necessary, but the original form will not be considered valid after a divorce.