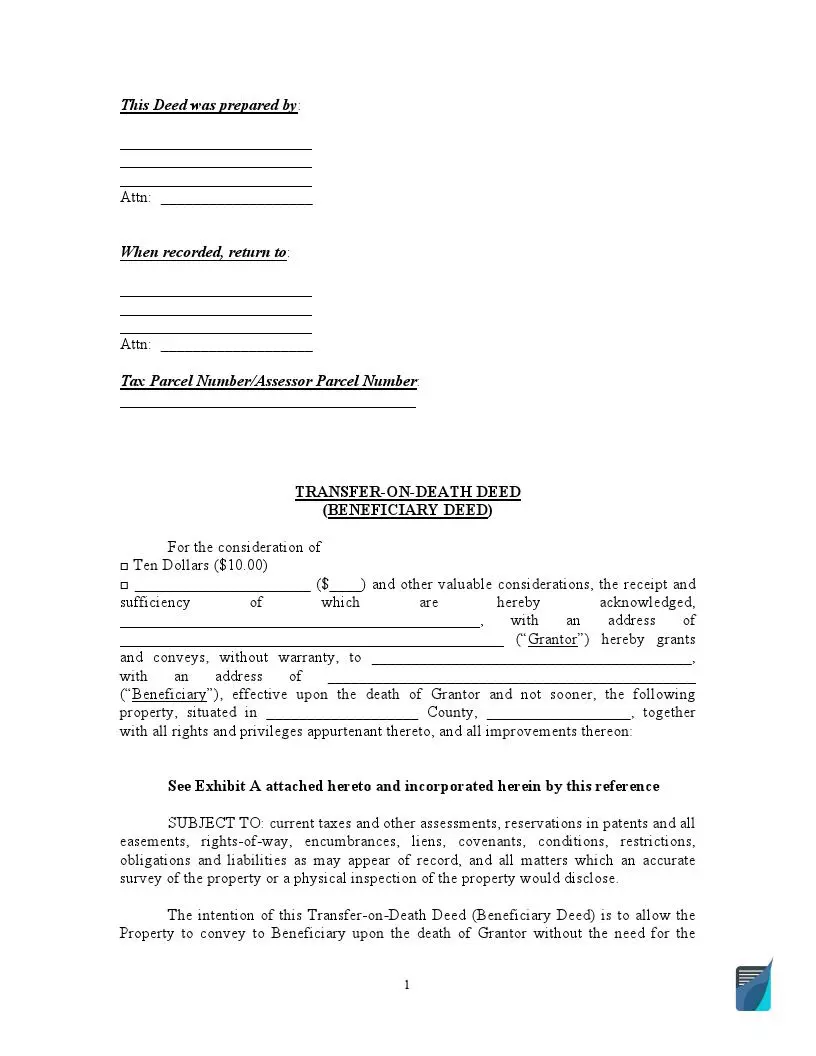

Transfer-on-death Deed

Planning on how to distribute your assets after your death can be tricky since laws in different states allow for various legal instruments working towards this goal. And you need to choose the most suitable among deed forms, based on your situation and needs of would-be beneficiaries. A transfer-on-death deed, often abbreviated as TOD, is one of such instruments, recognized in about half of the US states.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Transfer-on-death Deed?

It is a legal document that serves to convey ownership rights over a property after a person who owns the asset dies. In some states, it is called a beneficiary deed or has another name while retaining the essence and all associated benefits and requirements.

It works similarly to other deeds used in real estate transactions to change the title but comes into effect only upon the grantor’s death. It means that no beneficiary can take ownership of the property specified in a transfer-on-death deed before the current owner passes away. It also covers the possibility for the transferor to sell or mortgage, the asset indicated in the deed. Moreover, the owner can revoke the document and change beneficiaries as he or she wishes. Thus, the grantor is pretty much protected from the risk to lose their property or any other property-related limitations during their lifetime while the beneficiaries can enjoy probate-free title conveyance. The title is transferred automatically as soon as a duly executed document certifying the transferor’s death is issued and recorded.

However, certain restrictions make TODs inapplicable at all times, and some states do not recognize this legal instrument at all. They are Alabama, Connecticut, Delaware, Florida, Georgia, Idaho, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, and Vermont. In some of the states, similar estate planning tools are provided, basically known as enhanced life estate deeds.

Benefits of a Transfer-on-death Deed

The main advantage that comes with a transfer-on-death deed is the possibility to avoid probate, which is usually associated with last wills. Probate is a legal process aimed at confirming a will through a court ruling, reviewing the deceased person’s assets, establishing heirs and beneficiaries, and implementing the provisions of the will. Actually, the proceeding is required not only with last wills but also in some other cases when the property in question falls under the “probate” category and is subject to corresponding state laws. Anyway, the process can turn out to be time-consuming and costly, although some states provide simplified alternatives, for example, California or Illinois.

A TOD is helpful in bypassing the probate proceedings, thus saving plenty of time, money, and effort. And unlike other ways of eliminating the trouble, such as a joint tenancy, life estate, or a quitclaim deed, the document does not assign a part of the property to someone else, or create another party’s interest in it, or give away the whole asset to a beneficiary. As such, it bears lower risks for the current owner to lose the real estate or face litigations and other problems related to the ownership rights, for example, when a beneficiary gets sued or files for bankruptcy. The owner can cancel the deed or sign a new one at any time, with no need to get other parties’ consent, while this is required for all the above-mentioned alternatives.

Besides, it is easier and faster to execute a TOD than to create a living trust, which can be another option to sidestep probate. The deed does not prevent the owner from getting nursing home care or tax benefits and does not require paying a tax gift either; instead, it allows excluding the asset from Medicaid estate recovery. Although local TOD requirements vary in some aspects, opting for this legal instrument might be a great way of estate planning.

Transfer-on-death Deed vs. Last Will

Filing a TOD does not eliminate the possibility of making a will, although you should ensure the documents’ consistency as to your estate distribution among heirs. But if you need to choose between the two, consider the following factors:

- By contrast to wills, TODs do not require probate, which allows beneficiaries to take ownership immediately after the grantor’s death.

- TODs do not incur legal fees.

- Unlike wills, the deeds are not recognized across all the states.

- TODs do not cover all kinds of an estate, while wills do.

- Wills serve better when you want your property to be sold, with the proceeds distributed among multiple heirs.

In case you decide to settle both documents, keep in mind that provisions of a last will do not revoke a TOD.

How to Prepare a Transfer-on-death Deed?

While it is quite easy to make the deed, you will still need to go through a couple of stages.

Defining beneficiaries

There can be one or several beneficiaries written into the deed, but the best choice is to have only 1 or 2 people on the list. Having fewer beneficiaries and choosing among people who are on good terms will save the heirs from disputes if they want to sell the property. Keep in mind that a TOD might not be a good option when minors are involved as beneficiaries and that the document can deprive adults of receiving some government benefits. Also, consider the possibility of a beneficiary’s death prior to taking the ownership.

Following legal requirements

As local requirements attached to TODs differ, check out the information on official web resources of your state/county or seek legal advice. Some states provide approved transfer-on-death forms, so an owner can use a fillable template just to be on the safer side.

Signing the document

Generally, the deed must be signed by the grantor and acknowledged by a notary public. Yet, some states, for instance, Illinois, require at least two witnesses to sign the document, with their signatures notarized as well.

Recording the deed

The document must be recorded at a public records office in the county where the asset is located prior to the grantor’s death. If the deed covers a property with its parts located in different counties, the document must be recorded in each of them.

What Should Be Included in a Transfer-on-death Deed?

Although grantors are recommended to refer to local statutes when preparing a TOD, its basic elements are usually as follows:

- the full names and mailing addresses of the grantor and grantees

- the legal description of the property

- a statement specifying that the title conveyance takes place upon the grantor’s death

- the transferor’s signature

- execution date

- information about witnesses and their signatures if required by the state

- notary statement

Frequently Asked Questions

Can I revoke the transfer-on-death deed?

Yes, a transferor can cancel or file a new TOD whenever they see fit without giving notice to beneficiaries. For cancellation, the property owner needs to fill out a revocation form, which is often available on the web pages of local authorities, for example, in the District of Columbia. The statement of revocation must be signed by the grantor and notarized before handing it over to a recorder of deeds. Filing a new TOD will also do the job, as the deed with the latest date is considered valid.

Is it the same as life estate?

No, although both of the instruments work to evade probate. However, a life estate is irrevocable without the beneficiary’s consent, meaning that the initial owner cannot change their mind and get the asset back. In addition, since the beneficiary holds an interest in the property, it might become subject to creditors’ claims.

Can this deed be contested?

Yes, any deed, as well as a last will, can be contested, for example, if there are reasons to suspect fraud or the grantor’s incompetence at the time of writing the TOD.