Payment (Installment) Agreement Template

A payment agreement template is a useful document when it comes to financial relations between a debtor and lender. It helps the parties set out details of their agreement which provides legal protection for both of them.

If you want to get concentrated information about the basics of the payment contract, read our brief article.

What Is a Payment Agreement?

A payment agreement is a document that contains a plan on repaying an outstanding balance a debtor has over a specified timeframe. Commonly, a payment contract is created when a debtor does not have the ability to pay their debt in a single installment. The creditor takes into account the debtor’s situation and agrees to get installments at a schedule that is comfortable for both sides. This type of loan agreement template should specify the payment method – typically, via credit card or bank account straight payment.

Why Is It Important to Set Up a Payment Plan?

It is rare that a person doesn’t need to borrow money throughout their life. It might be needed for tuition, setting up a business, building a home, organizing a wedding, and many more situations. In the cases when a person gets money from another individual or entity, they become a debtor, and conditions of repayment will differ on a case-by-case basis.

Many people would think that they can rely on oral agreements when discussing the details of repayment. But life might be unpredictable, and conditions the parties negotiated at first might be not met by one of the sides at a certain point. For instance, a debtor might fail to make payments due to a lack of finances, and a creditor will not get proper legal protection without an agreement.

Here comes a payment contract that helps in this type of financial transaction. It sets the protection for the creditor in the first place and lets them not worry about not getting their money back. With the agreement in place, the debtor will be held accountable for non-payment of debt. The protection will be given to a debtor too in case the creditor breaches their obligations. As a result, if any dispute arises, the payment agreement will act as a point of reference.

A debtor and a creditor should negotiate the way in which the installments will be made. Arrangements can have the form of emails, messages, or oral conversations, but they don’t provide sufficient protection for both debtor and creditor. This is why it is prudent for both sides to create and sign a contract that would contain the legal consent of both parties and give them more protection.

What Should Be Included in Payment Agreements

In a payment agreement template, there should be certain clauses that will let parties feel safe about their financial transaction:

- Individuals/entities entering the contract

- Amount of debt

- Payment plan (including down payment, interest rate if any, payment schedule, etc.)

- Late fees (if any)

- Methods of managing cases of default

- Dispute resolution

- Amendment process

- Place for signing

How to Use a Payment Plan

To set up a repayment plan in the payment agreement, the parties, that is, the debtor and the creditor, should agree on its terms and outline it in the document. The payment agreement should include the important details for a debtor who has an outstanding balance.

Here are several steps on how to use a payment plan.

1. Agreeing on the terms

The very first thing for parties is to agree on the terms of repayment of debt. Ideally, it should benefit both sides. The debtor and the creditor should consider two types of payment plans before entering into a payment agreement:

- payment plan for goods or services: it is created when a customer wants to buy a product or service (gadget, car, etc.) in installments usually over a term from 6 to 18 months; there is typically an interest rate involved.

- payment plan for outstanding balance: it is created when a debtor owes money to a creditor; it is common to set an interest rate accumulating on the balance; a creditor might ask a debtor about their income returns for the last several years.

2. Preparing a payment plan

Now it’s time to prepare a repayment plan the parties agreed to. It should specify the type of payment plan, the balance owed, terms of repayment, etc. Putting both signatures will indicate the consent of both parties to the terms described in the agreement and make it legally binding.

Please mind that if a repayment plan concerns the sum that exceeds $10,000, it would be prudent to get the payment agreement notarized. The notary acknowledgment should always be attached to the payment agreement.

3. Beginning the repayment

To begin the repayment, the creditor should get the debtor’s payment details. In order to do that legally, a Credit Card/ACH Authorization Form should be used, depending on the payment method the debtor chose. It is common to make the debtor set up automatic payments for each installment period. These payments either charge the necessary sum from the debtor’s credit card or bank account.

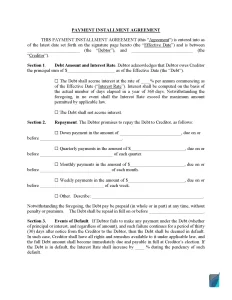

Filling Out the Payment Agreement Template

A payment agreement form should include the following information:

Step 1 — Parties

The payment agreement should start with an indication of who it was entered into by. It should mention the names and addresses of the debtor and creditor. Another thing to include at the beginning of the payment agreement is the effective date.

Step 2 — Agreement

Further, payment agreements should explicitly specify the amount of money the creditor lends to the borrower.

Step 3 — Repayment Plan

In this section of the payment agreement template, write the details of the repayment plan.

Step 4 — Default

The next paragraph in the payment agreement is intended to specify what will happen in case the debtor fails to provide payments under the repayment plan.

For instance, a payment agreement might state that in such a case, the creditor has the right to declare the remaining amount of the debt and the current interest immediately due and payable.

Step 5 — Governing law

This section of the payment agreement is meant to tell which state laws will govern its construction and effectiveness.

Step 6 — Severability

This section is needed if you want to specify in your payment agreement that if any of its provisions is void, it will not affect the remaining provisions of the payment agreement.

Step 7 — Dispute Resolution

Another piece of information every payment agreement template should have is the way of solving disputes between the parties. For instance, it might proclaim that the creditor and debtor might use arbitration, mediation, or negotiation to solve possible disputes. The paragraph should also mention laws of what state are applied.

Step 8 — Amendments

Another thing to put in the structured payment agreement template is the amendments section. Here, it should be explicitly stated that the parties can amend the payment agreement only in writing and with the signatures of both parties.

Step 9 — Signatures

Lastly, the parties should show their consent to the provisions in the payment contract by signing it. They should also mention their names and date.

Our free payment agreement template is at your disposal – use it to create your individual payment agreement. Contract form that you can find on our website has all the prerequisites that should be included in a legally binding document. Please mind that if the debt is sufficient, it is always recommended to consult an attorney or law firm before creating a payment agreement online.