LLC Purchase Agreement

The LLC Purchase Agreement is a vital legal document used when a Limited Liability Company (LLC) member intends to transfer their ownership interest, either in whole or in part, to another individual or entity. This agreement protects the interests of all parties involved and outlines the terms and conditions governing the transaction.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is an LLC Membership Purchase Agreement?

An LLC Membership Purchase Agreement, often referred to as a stock purchase agreement in the corporate context, is an essential legal tool that comes into play when a member of the LLC is set to exit the company, irrespective of whether the departure is voluntary or forced. This instrument allows the exiting member to manage the disposition of their ownership interest effectively.

This fillable purchase agreement template provides a clear framework for the LLC, detailing the rationale behind the sale and the destination of the ownership interest. Unlike shares in conventional corporations, which can be freely sold or gifted, LLC interests require a formal transfer process.

Although commonly termed as a ‘purchase agreement’, this document fundamentally enables the exchange of LLC membership interests for a specified fee, facilitating a smooth membership transition to a new entity or individual.

Note that it is not the same as the LLC Membership Interest Assignment. While both documents involve the transfer of LLC membership interest, the key difference is the level of detail and the legal implications. An LLC Membership Interest Assignment is a simpler document primarily used to record the transfer. An LLC Membership Purchase Agreement, however, is a formal contract that outlines the full terms and conditions of the sale, providing greater legal protection to both parties involved in the transaction.

When Is an LLC Membership Interest Purchase Required?

An LLC Membership Interest Purchase Agreement is crucial whenever a monetary transaction is involved in transferring an LLC’s ownership interest. In short, any situation where a member is abandoning their stake in return for a financial consideration requires the creation and execution of this purchase agreement.

LLC membership purchase agreements play an instrumental role in ensuring that the transaction complies with state laws. It’s essential to note that each state has its own unique regulations governing purchase agreements, and there are no overarching federal laws. Therefore, an LLC Membership Purchase Agreement can offer a valuable tool in navigating these diverse legal landscapes, ensuring each transaction is conducted in accordance with the relevant jurisdiction’s laws.

How to Use an LLC Membership Purchase Agreement

Our template can be used whenever there’s a need to transfer an LLC membership interest, which could be triggered by various circumstances such as:

- An owner deciding to sell the business

- The existing members voting for a new member to join the company

- A member becoming incapacitated, undergoing a divorce, or passing away

- A member choosing to exit the company

Step 1. Review the Operating Agreement

At the formation of an LLC, an operating agreement is usually established to provide a roadmap for the company’s operations. This agreement becomes a crucial point of reference during any transfer of interest because it outlines the best practices and procedures for such transactions.

In this step, engaging a legal professional to review the operating agreement is typically beneficial. Sometimes, the agreement might need to be amended to accommodate a new member or transfer interest, ensuring that the updated practices are properly recorded.

Step 2. Check State Laws

The majority of states mandate that all members of the LLC be notified of any impending transfer of interest. This requirement is aimed at ensuring transparency and that everyone in the company is aware of the proposed changes.

Note that some states prohibit the transfer process entirely. In such instances, the LLC would need to be dissolved, and each member would receive their due share. The members could then establish a new LLC if they so desire. In certain scenarios, a buyout or sales agreement might be proposed to facilitate this process.

At times, disagreements among the remaining members regarding the transfer provisions may necessitate intervention by a judge or civil court to establish the interest prices, particularly in cases where no initial operating agreement exists.

Given the absence of federal laws governing this process, it is vital to familiarize yourself with your state’s laws when crafting a purchase agreement. Consult a legal professional if you have any questions or concerns.

Step 3. Negotiate the Terms

During any transfer or transaction, the buyer and seller typically engage in negotiations. Remember that the sale and membership interest prices can have repercussions for all LLC members, so their involvement in the negotiation process is often desired.

In certain cases, a buy-sell agreement is negotiated to provide clarity on the protocols to follow if the interest owner exits the business. The operating agreement might also contain a buy-sell provision that needs to be referenced.

Negotiations are typically smoother and more equitable when facilitated by a legal professional, ensuring all parties receive what they are entitled to.

Step 4. Draft the Agreement

Once the details about the sale and procedures have been agreed upon, you can proceed to draft the LLC membership purchase agreement. While each agreement may vary slightly, they should all clearly outline the interest percentage, sale price, date of transfer, and terms of transfer.

To finalize the agreement, it needs to be signed by the involved parties and notarized to ensure its legality and enforceability.

What Information Should Be Included in the Agreement?

Comprehensive and legally sound LLC membership purchase agreements should include several key components:

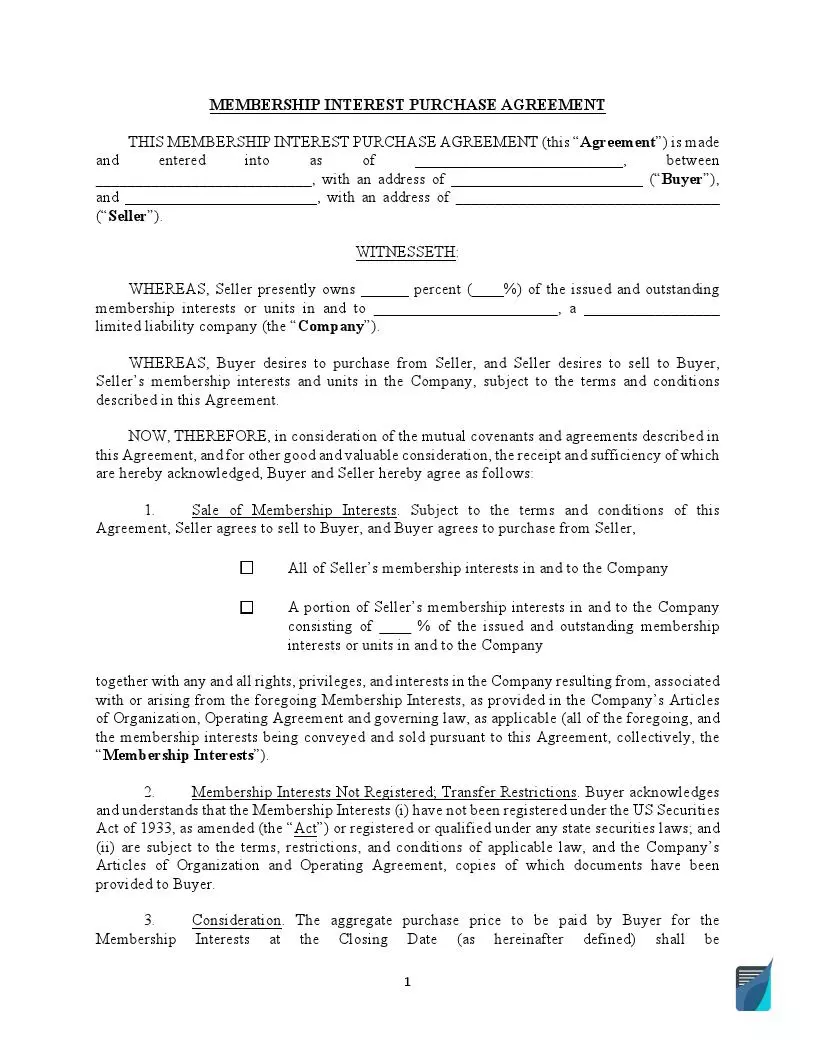

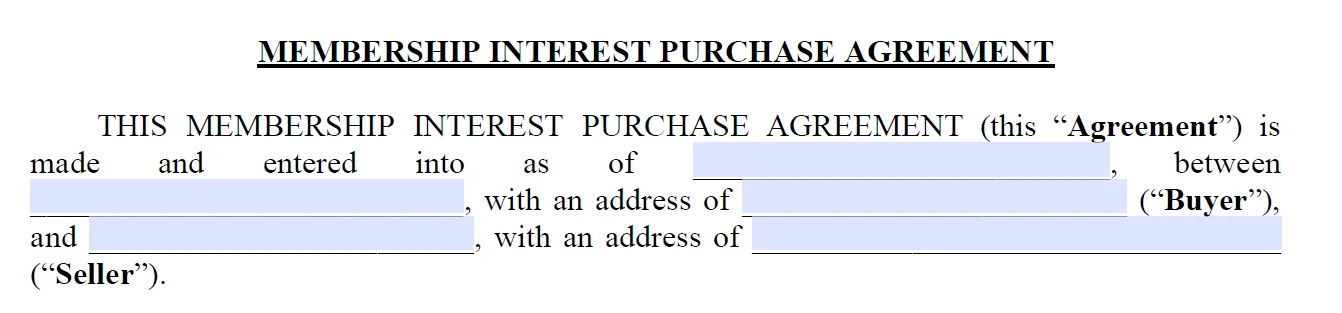

Identification of Seller, Buyer, and Company

The initial section of the agreement typically lists the seller, i.e., the person transferring their interest. Equally important is the inclusion of information about the buyer and the company involved. Detailed and accurate identification of these parties is essential to the agreement’s validity.

Percentage of Interest Being Transferred

The agreement should clearly stipulate the percentage of ownership interest being transferred and identify the company from which this interest originates. This ensures clarity about the extent of the transaction.

Purchase Price and Payment Method

The agreed-upon price for the ownership interest being transferred is a crucial part of the agreement. How the buyer intends to make the payment, whether in a lump sum, installments, or other agreed terms, should also be specified.

Representations and Warranties

This section assures the seller that all information provided within the agreement is accurate and complete to the best of their knowledge. It’s a safeguard against potential disputes arising from misinformation or misrepresentation.

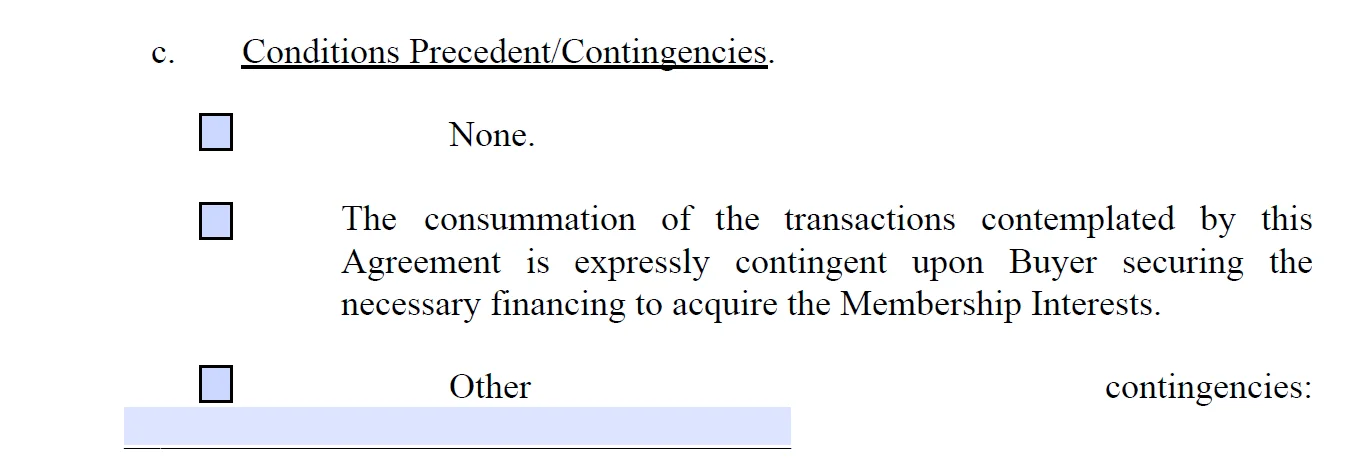

Contingencies

Contingencies refer to specific conditions or events that could alter or nullify the agreement. These could include the buyer securing financing, satisfactory results from a due diligence investigation, or obtaining requisite approvals.

Closing Date

The agreement should clearly indicate the closing date — the day when the ownership interest will officially change hands. This date is significant as it sets the timeline for the completion of all contractual obligations by both parties.

Filling Out the LLC Purchase Agreement Template

Follow these steps to fill out the LLC Share Purchase Agreement template effectively:

Step 1. Identify the Parties

In the first section, provide the seller and buyer’s names and addresses. Also, include the date on which the agreement is being executed.

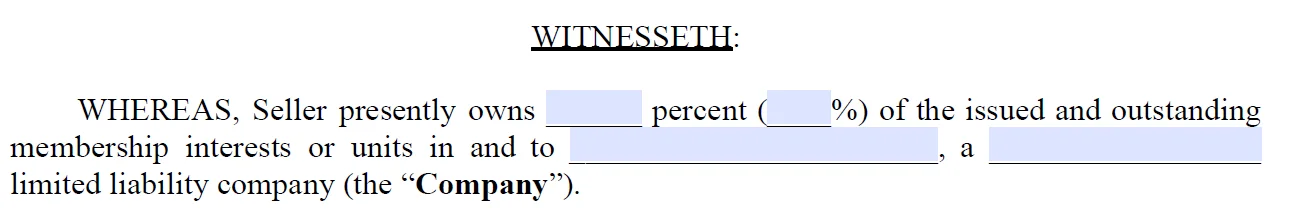

Step 2. Specify the Interest Amount

Clearly indicate the percentage of a membership interest that the seller owns in the company and identify the company in question.

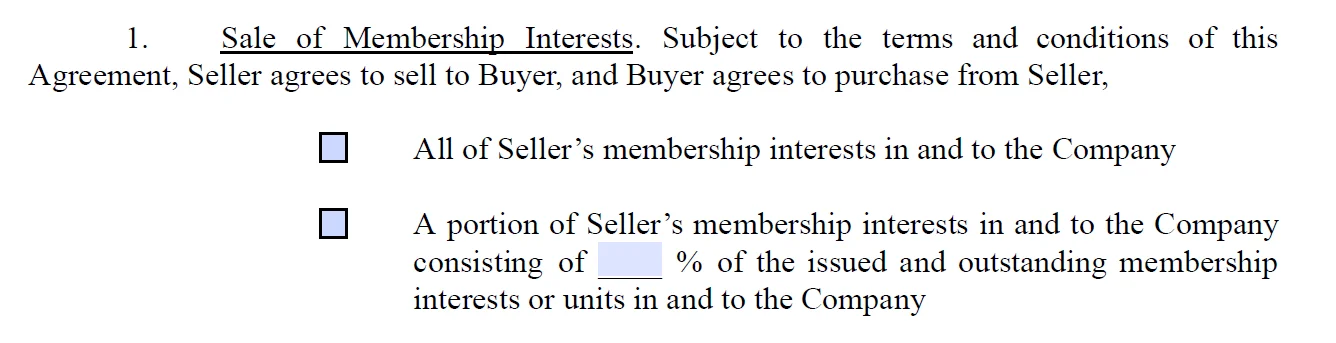

Step 3. Detail the Sale of Membership Interests

Specify whether the seller is transferring their entire ownership interest or only a portion of it. If the transfer involves a partial interest, mention the exact percentage being transferred.

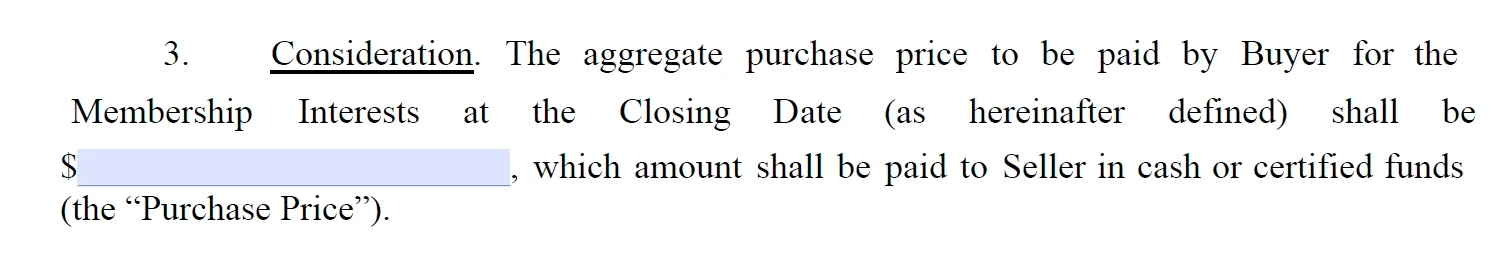

Step 4. State the Price

Clearly indicate the agreed-upon purchase price for the ownership interest being transferred.

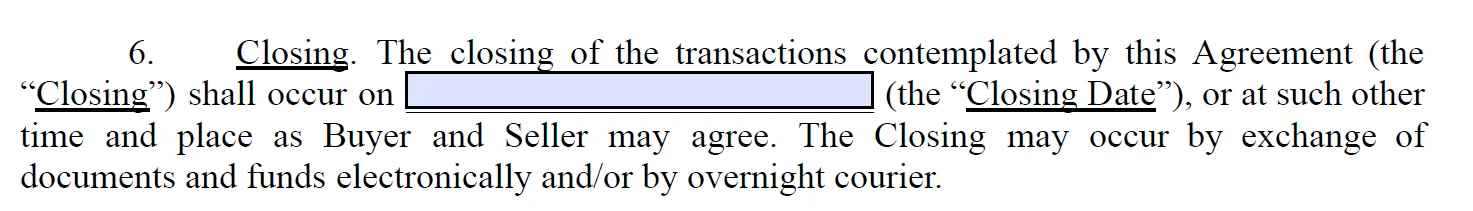

Step 5. Set the Closing Date

Provide the date on which the transaction will be officially completed and the ownership interest will change hands.

Step 6. Outline Contingencies

Select the appropriate option to indicate whether there are no contingencies in the agreement or list any specific conditions that need to be met before the transaction can proceed.

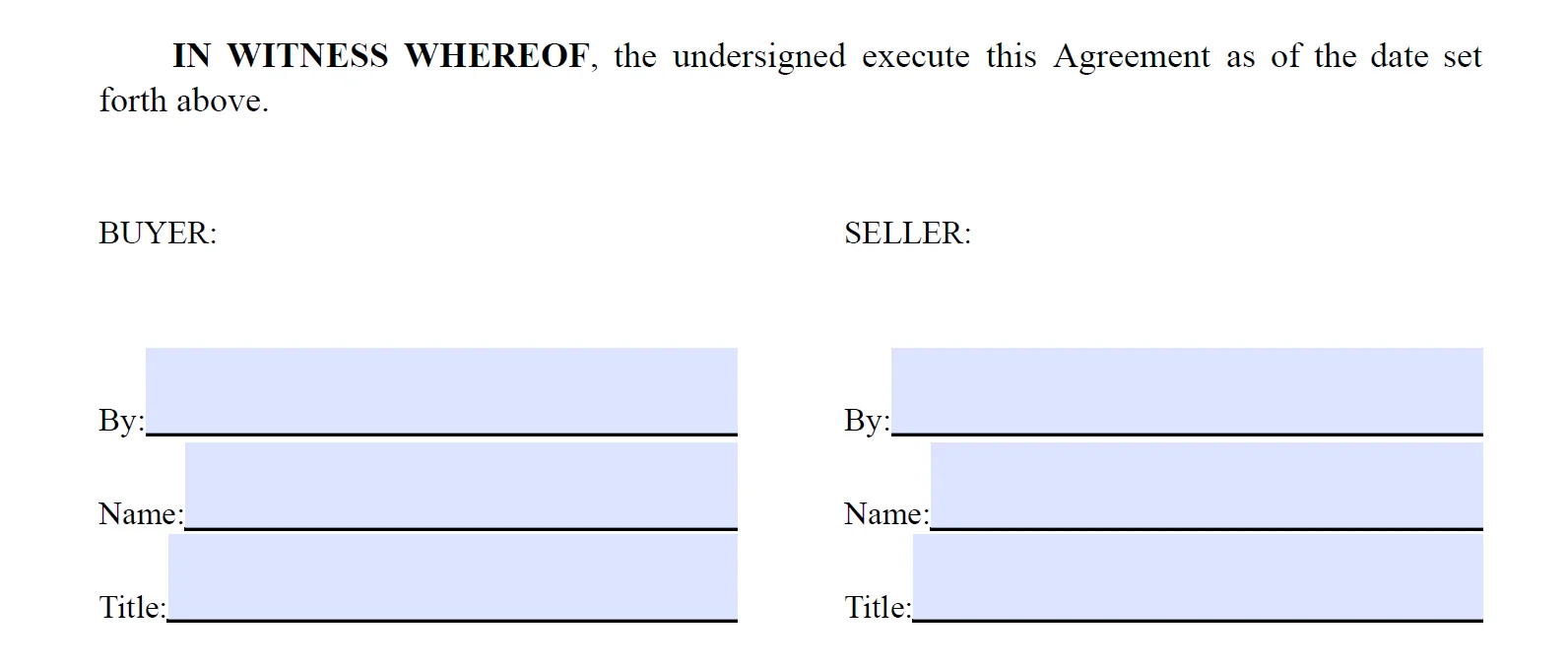

Step 7. Sign and Date

To finalize the agreement, both the buyer and the seller must sign, print their names, and date the document, confirming that they have read, understood, and agreed to its terms and conditions.