Nevada Promissory Note Template

A Nevada promissory note template is an official contract that is drafted between people to clarify the terms of lending money. The person who borrows the funds is referred to as the borrower or issuer. The individual who affords the required sum is recognized as the lender or payee. The signatories determine the contract’s conditions depending on the kind of document: loan sum, dates and amount of regular payments, the interest rates, and penalties for a late refund (if applicable).

There are two types of free promissory note document in Nevada. The alternatives have their benefits and flaws, so one should select the preferable variant.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Unsecured Promissory Note

Unsecured promissory agreements are typical between people who find each other dependable and can afford to lend (to borrow) a generous amount of money without setting guarantee assets. Usually, family members and friends use this type of contract.

Unsecured promissory notes do not demand specific attachments and outline the essential points of the contract:

- the borrower’s name and signature

- the amount of loan and its date

- late payment penalties

- interest rate

The parties can notarize the document for additional safety. If the issuer fails on reimbursement or defaults, the lender should turn to the court to regain compensation.

Secured Promissory Note

Unlike the unsecured type of agreement, a secured promissory note registers guarantees. If the borrower fails to return the funds within the designated period in full, the payee has a legal right to claim compensation immediately.

Secured promissory notes differ in structure compared to the unsecured contracts and usually contain the following sections:

- the parties’ legal names and signatures

- loan amount and date

- Interest rates and late payment charges

- method and schedule of payments

- maturity date

- collateral, list of assets provided as security

Nevada laws do not demand a compulsory notarial acknowledgment of secured promissory agreements. However, you are empowered to obtain notarization to grant the paper more authority. Appoint a notary representative and append both parties’ signatures in their witness. The notary will verify the signatories’ identities and affix the state seal and their signature.

Popular Local Promissory Note Forms

If you want to lend or borrow money, think about creating a promissory note form. It is a useful binding document largely used by companies and individuals in many states. The following are the state-level promissory note forms our users read about most often.

Nevada Usury Laws

The interest rate is balanced by § 99.040 and § 99.050 of the Nevada Revised Statutes. The laws state that the interest rate should not exceed the highest rate at the state’s largest bank if there are no specific written settlements in the agreement. The rates are modified every January and July.

The signatories may set their agreed interest rate that will not change throughout the designated period. The parties have to specify the percentage in writing and include these data in the contract.

Nevada Promissory Note Form Details

| Document Name | Nevada Promissory Note Form |

| Other Name | NV Promissory Note |

| Max. Rate | Without agreement – current prime rate of the largest Nevada bank; No usury limit |

| Relevant Laws | Nevada Revised Statutes, Section 99.040 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

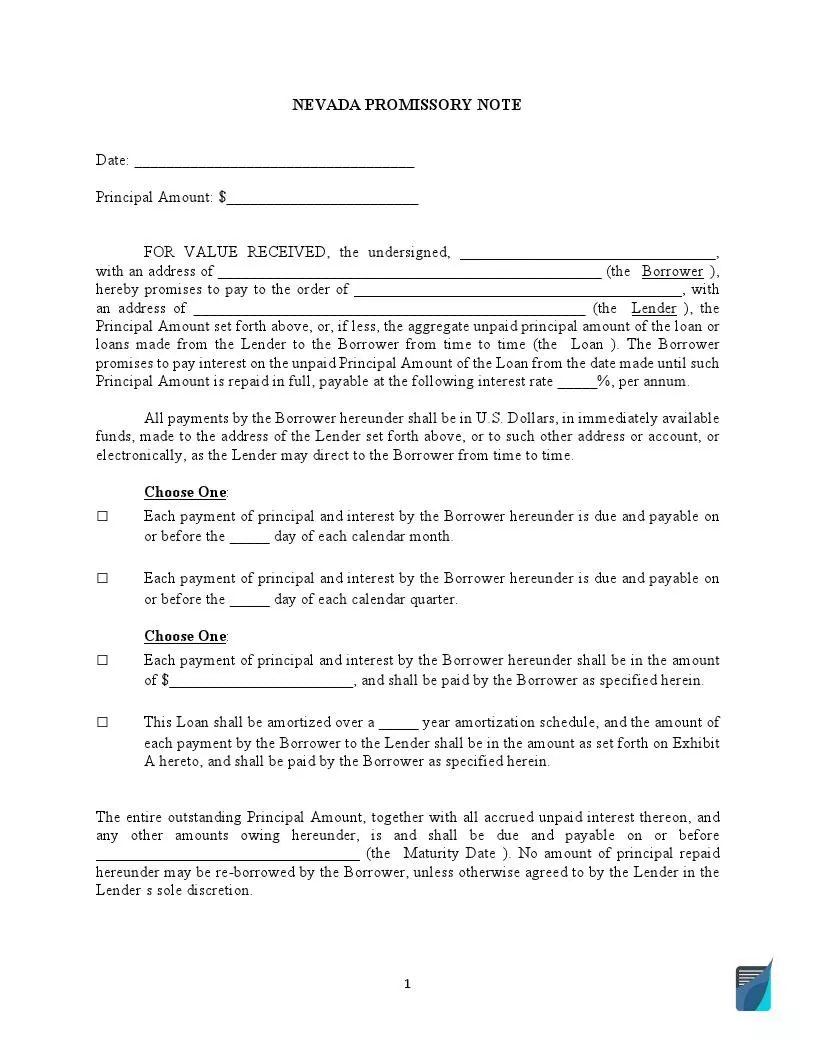

Filling Out the Nevada Promissory Note

Once you have orally discussed the details, create a respected contract. Use our advanced software to ensure an effortless process. Below are guidelines clarifying what information you should include in the form.

- Insert the Date and the Principal Amount

The issuer should enter the calendar date on which the Nevada promissory note template is created. Then specify the amount of the loan in US dollars.

- Define the Issuer and the Payee

Write down the borrower’s legal name and address. The next step is to introduce the lender’s name and address.

- Determine the Interest Rate

Insert the amount of interest percentage per annum.

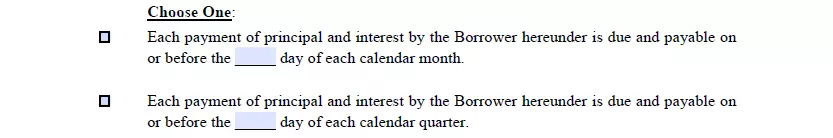

- Define the Payment Schedule

The following three sections outline the dates and amounts of regular payments. You should also include the maturity date.

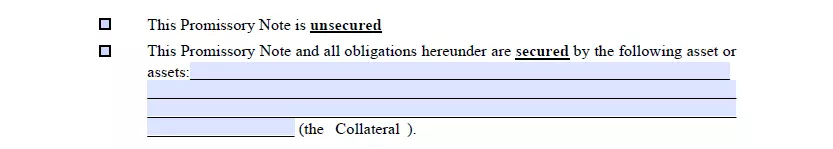

- Select the Type of Document

Specify if the promissory note is secured or unsecured and check the appropriate box. Note that a secured promissory contract should include the collateral section. Enter the property and assets that guarantee the performance of duties.

- Append Signatures

Before signing the note, insert the jurisdiction state (Nevada) and place the parties’ printed names. Once both signatories have read the paperwork, they can sign it. Under Nevada laws, the promissory note doesn’t require a mandatory notarization.

If applicable, the signatories outline the amortization schedule in Exhibit A section. The paper should be attached to the promissory note.

We provide a wide range of major Nevada documents to anybody seeking ease when dealing with various papers.