Nevada Last Will and Testament Form

A Nevada last will and testament is a document that contains the final wishes of its creator (testator) and establishes exactly how his or her property will be used after their death. Make sure to go through all requirements before making a will. Even if you don’t possess a lot of assets, a last will might help your family situation and prove to be essential to all your family members.

If you need a fillable and printable Nevada will template, you’ll find one below in two common formats (PDF and Word), in addition to will preparation guidelines and answers to some of the frequently asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Nevada Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Chapter 133 – Wills | |

| Definitions | Chapter 132 – General provisions | |

| Signing requirement | Two witnesses | 133.040 Valid wills: Requirements of writing, subscription, witnesses and attestation |

| Age of testator | 18 or older | 133.020 Sound mind; age |

| Age of witnesses | 18 or older | 133.040 Valid wills: Requirements of writing, subscription, witnesses and attestation |

| Self-proving wills | Allowed | 133.050 Attesting witnesses may sign self-proving declarations or affidavits to be attached to or associated with will |

| Electronic wills | Recognized if meeting certain conditions | 133.085 Electronic will |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | 133.090 Holographic will |

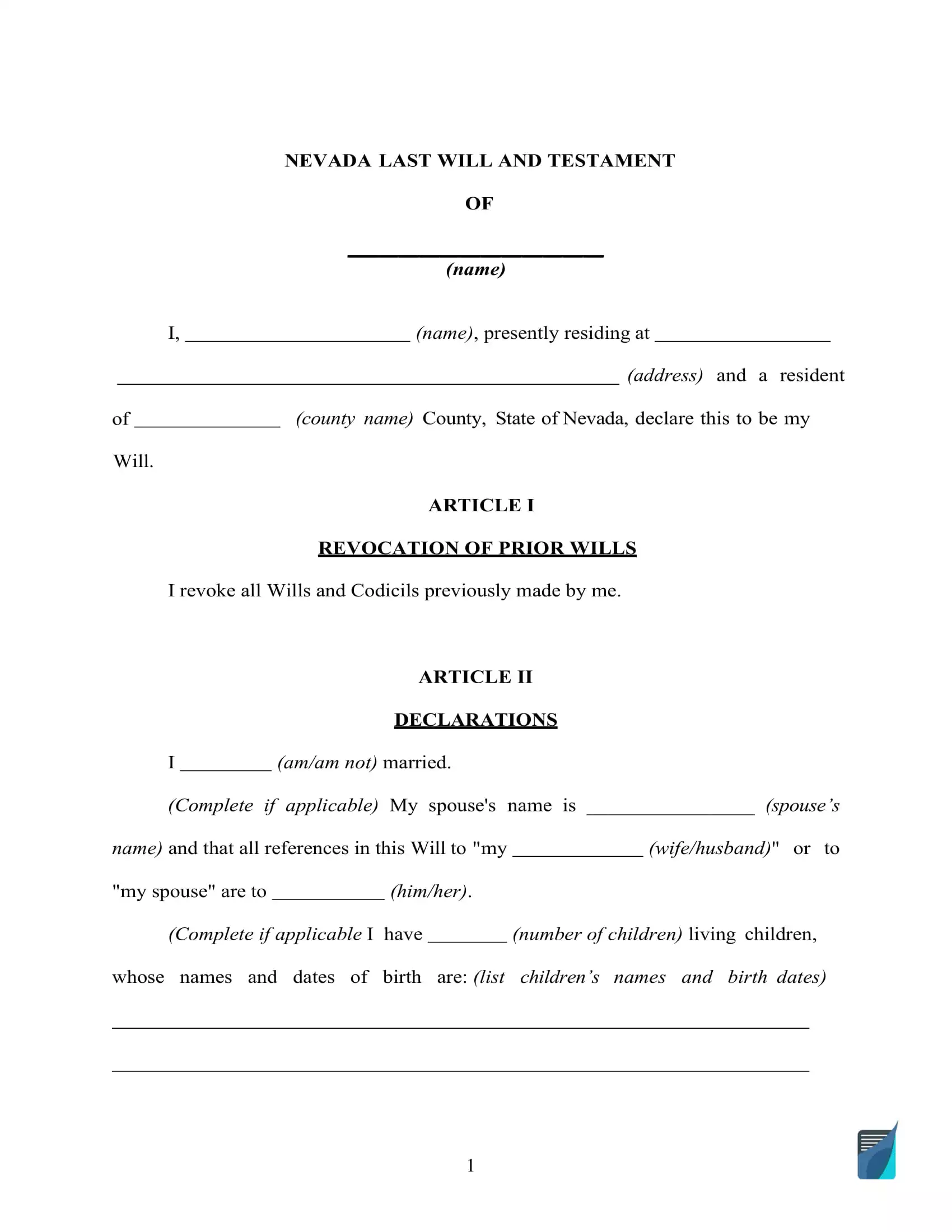

How to Write a Will in Nevada

1. Think about possible formats. One thing to decide upon beforehand is whether you want to write the entire thing by hand (holographic will) or go for a fillable will template available in PDF and DOC. You can also use our will-making software for more options along the way.

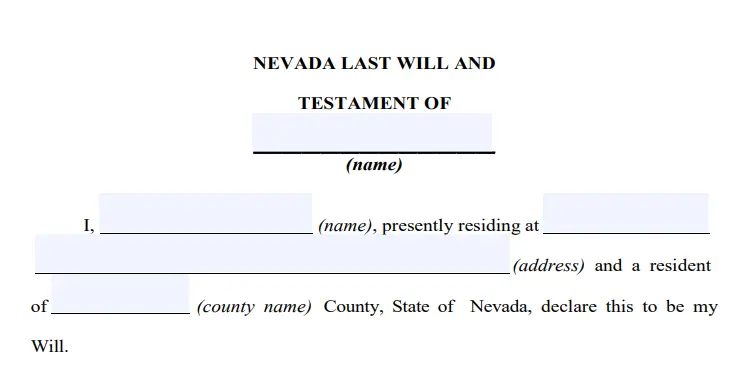

2. Indicate your information. Fill out your full name and address (the city, county, and state of residence) to ascertain the testator of the last will and testament. Go through the information you entered to double-check if all details are correct.

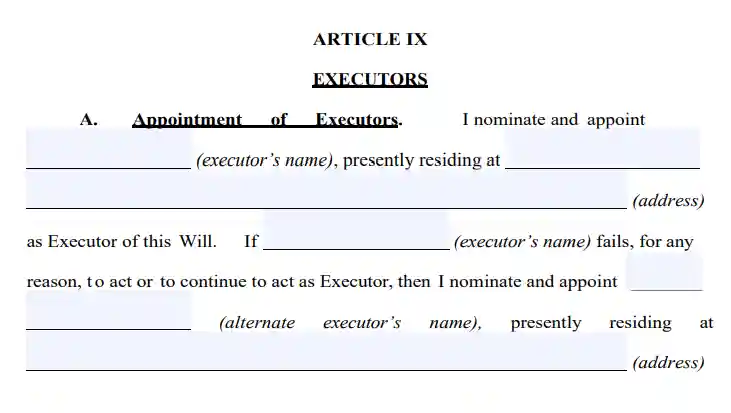

3. Determine the executor. Now is the time to decide on the executor of your last will and testament, the personal representative who will be in charge of ensuring that everything you write in this document comes true. Fill out the executor’s full legal name, as well as their residence information (city, county, and state).

Be sure you choose a person who resides in the same state as you do because they will have to deal with a lot of matters in the state, which can take weeks.

It may happen that the primary representative will be unable to carry out your last will as a result of a disease, passing, disinclination, or some other factors. In this case, the court will probably choose its own estate administrator to handle the duties. In order to avoid that, it’s possible to decide on a second executor under this section.

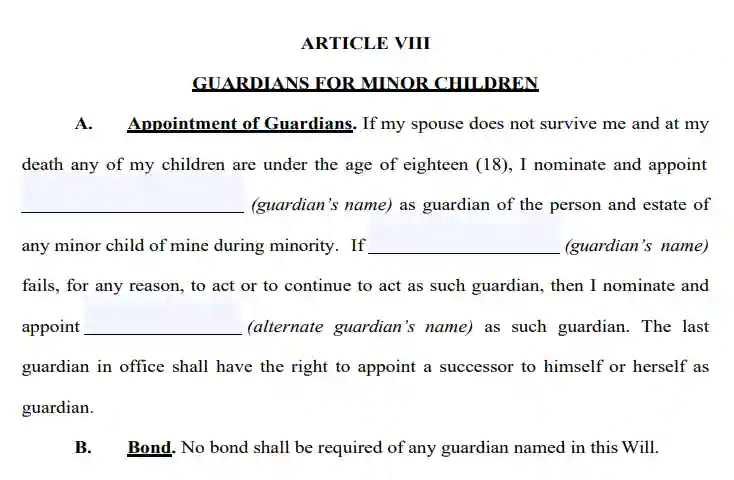

4. Appoint the guardian. You are able to appoint a trusted person as a guardian if you’ve got underage or dependent children that must be looked after. In case there are no instructions concerning what person should look after your children, the guardian will be chosen by the court. Although this is optional, consider how important it is based on your circustances.

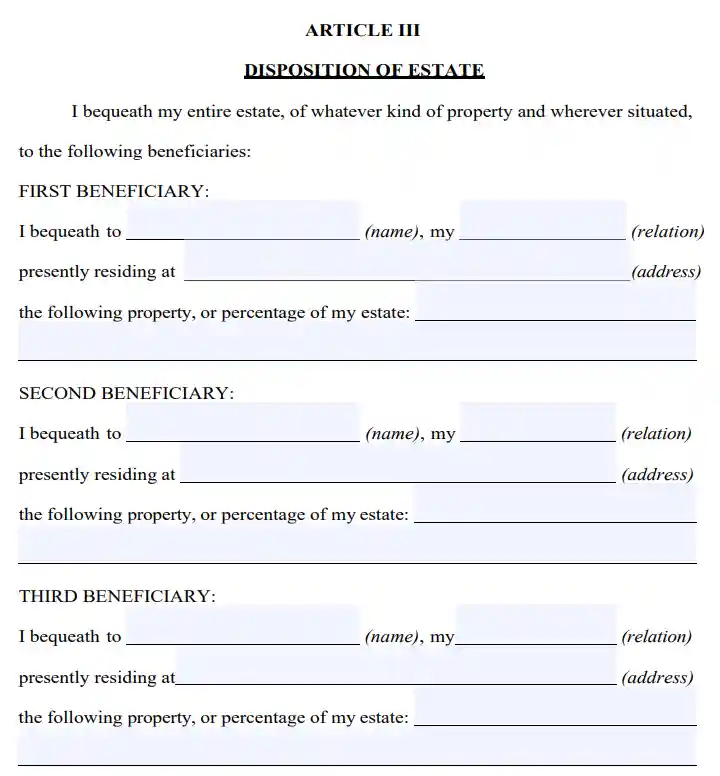

5. Indicate your beneficiaries. This is where you indicate people who are going to inherit your assets. For every beneficiary, fill out the next details: full legal name, address, and the way they are related to you.

6. Assign your possessions accordingly. It is possible to specify which of your respective beneficiaries gets this or that piece of property. Otherwise, the assets are going to be allocated equally amongst the inheritors. These assets cannot include shared and living trust property, as well as your life insurance.

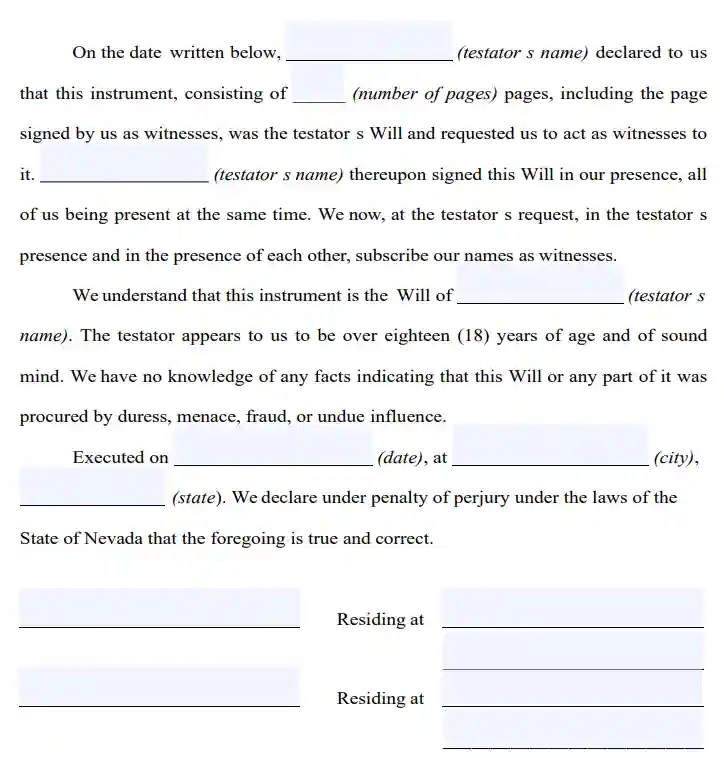

7. Finalize the document. Nevada Revised Statutes (133.040) specify that at the least two witnesses have to sign a last will and testament for it to be regarded as valid. Only a person who isn’t your beneficiary and is of 18 years or older can be chosen as a witness.

As a possible precaution against scenarios when your will is challenged or other problems, it’s wise to appoint a witness who’s younger than you. After a careful review of every section in your Nevada last will, all parties involved (you and the two witnesses) have to write their full names and full addresses and sign the document.

Make a Free Nevada Last Will and Testament With Ease

Frequently Asked Questions

Do I have to notarize my will in Nevada for it to be valid?

No, In Nevada, you don’t have to notarize your last will.

Is there any point in making a holographic last will?

A holographic last will is handwritten and doesn’t require witnesses. For it to be effective, the document has to be fully in the handwriting of the testator and dated and signed by them (133.090). This type of a will is usually created when there’s no other option and is replaced by a more detailed document made with the aid of a fillable will template or a law firm. It’s not advised to keep a holographic will as the last version because it could have ambiguous or conflicting statements, resulting in a great delay in the probate, its invalidation, or easier contestability.

Should I attach a self-proving affidavit to my will in Nevada?

It is not required, but you can certainly do it to make it less susceptible to fraud and contesting and to quicken the probate. You would still need two witnesses, plus a notary public acknowledgment.

Is it possible to disinherit your child or spouse?

In Nevada, there exists such a term as community or marital property. This requires that all of the properties and assets acquired or increased while in the marriage ought to be evenly devolved to the two marriage partners, and this will make it nearly impossible to disinherit your spouse.

The sole way to disinherit your marriage partner would be to enter into a prenuptial contract with him or her before the marriage (hence the name). Here, they can waive their community property rights.

Except for your marriage partner, you can disinherit any other members of your family.

Can a signed, typewritten will be revised in Nevada?

Yes, it can be done. A testator can alter or annul the will at any time until their death. The only case that can prevent you from doing it is when this action is prohibited under the contract you signed, which is rarely recommended to do.

If you need to change something minor (e.g., change someone’s name), use a codicil. But if changes required are numerous, just create a new will from scratch to avoid any confusion during probate.

What should I do if my will has been lost?

Nevada law says that a copy of a last will can be admitted if the original has been lost or destroyed after the testator’s death, which also must be proven. (See 136.230)

Here’s a case example where someone tried to prove that a will existed without the original – Howard Hughes Med. Inst. v. Gavin.

| Related documents | When to create one |

| Codicil | Your will requires one or a number of minor modifications. |

| Self-proving affidavit | You want the probate to be quicker when it’s necessary. |

| Living will | You want to make certain your end-of-life treatment is carried out in accordance with your wishes. |

| Living trust | You would like to consider an alternative to a last will. |

Last Will and Testament Forms for Other States