Free Rhode Island Last Will and Testament Form

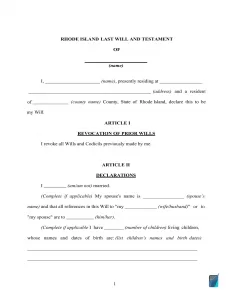

A Rhode Island last will and testament is a legally binding document that expresses the testator’s final wishes in the form prescribed by law. It establishes the lawful distribution of the will’s creator’s assets subsequent to their death.

On this page, you can get a free RI last will form that you can fill and print out. Other than that, down below, you can find lots of information related to the will preparation process and common questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Rhode Island Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | Section 33-5-1 – Definitions | |

| Statutes | Chapter 33-5 – Execution and Revocation of Wills | |

| Signing requirement | Two witnesses | § 33-5-5. Execution of will – Acknowledgment and attestation |

| Age of testator | 18 or older | § 33-5-2. Testamentary capacity – Property subject to will |

| Age of witnesses | 18 or older | § 33-5-5. Execution of will – Acknowledgment and attestation |

| Self-proving wills | Allowed | § 33-7-26. Proof of purported will or codicil |

| Handwritten wills | Might be recognized in specific cases | § 33-5-6. Persons in military service – Sailors |

| Oral wills | Might be recognized in specific cases | |

| Holographic wills | Might be recognized in specific cases | |

How to Write a Rhode Island Last Will and Testament

1. Consider your possible choices. Make a decision whether or not you need to seek the services of lawyers or write your last will on your own (either by handwriting it or working with a free last will and testament template).

2. Specify your information. Fill out your full name and address (the city, county, and state of residence) to ascertain the testator of the last will and testament. Go through the remaining portion of the passage, including the details you have entered along with the “Expenses and Taxes” subsection.

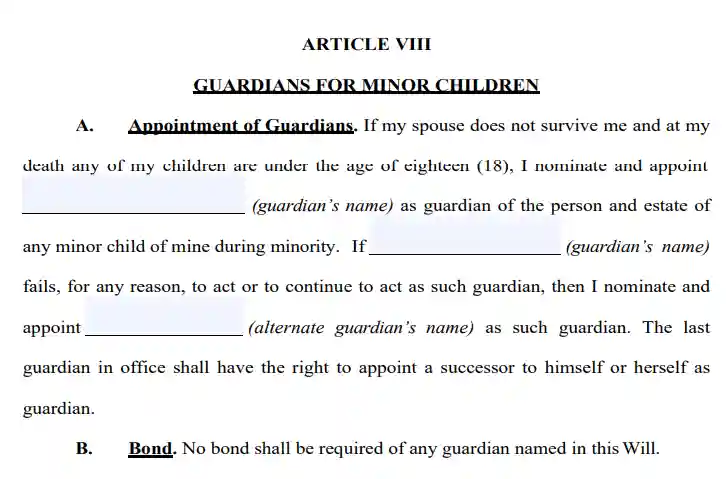

3. Determine the executor. The next step is to decide on the executor of your last will and testament, the person responsible for ensuring all you write in this document gets done. To achieve that, you need to enter the executor’s full name, followed by their residential specifics (city, county, and state). Ensure that you appoint somebody who lives in the same state as you do. Otherwise, there will be much more paperwork and unnecessary hassle in the procedure resulting from different special rules every state has relating to out-of-state executors. As a precaution, it’s possible to appoint an alternative executor of your last will and testament. That way, you’ll be able to make sure that even if the first chosen executor can’t perform their duties, there’s a second dependable person you can rely on.

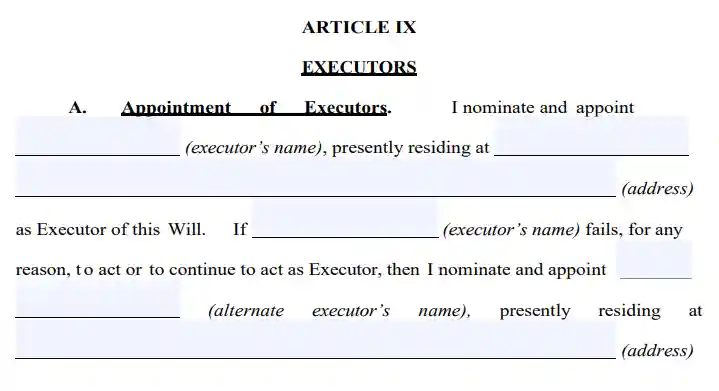

4. Determine the guardian (optional). In case you’ve got minor or dependent children and don’t want the court to choose a guardian for the kids when you’re no longer here, it is possible to choose somebody you know as a guardian for your children.

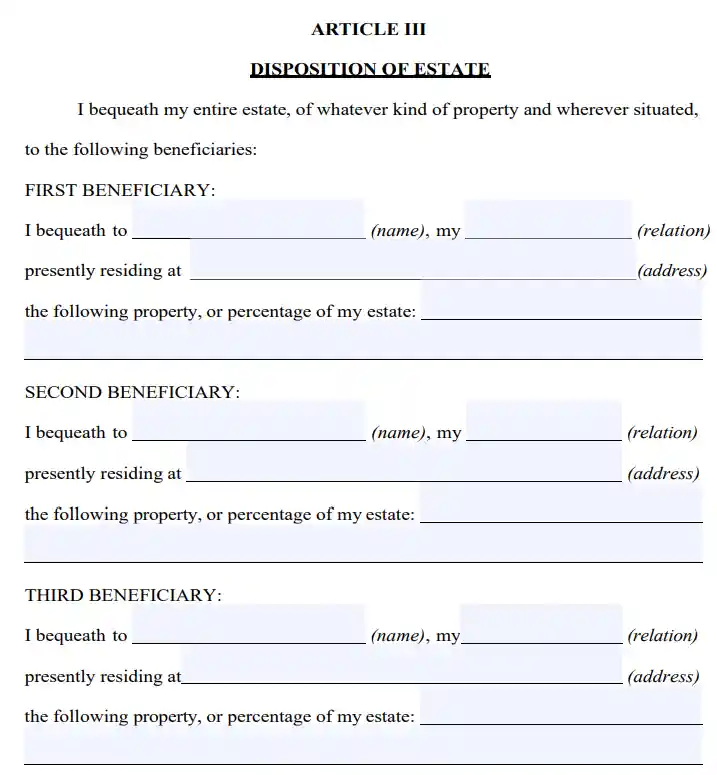

5. Establish your beneficiaries. This is where you indicate those who are going to inherit your property. Enter their full names, addresses, and your relationship to them (spouse, child,

6. Distribute assets. List your assets and explain precisely how you want to distribute them to your inheritors if you’ve got something under consideration aside from splitting the estate commensurately. Assets may include cash, stocks, real estate, company ownership, money for unresolved debts, as well as any tangible things of monetary worth that count among your possessions. Please notice that there are things that cannot be distributed in your last will and testament, such as life insurance and shared and living will assets.

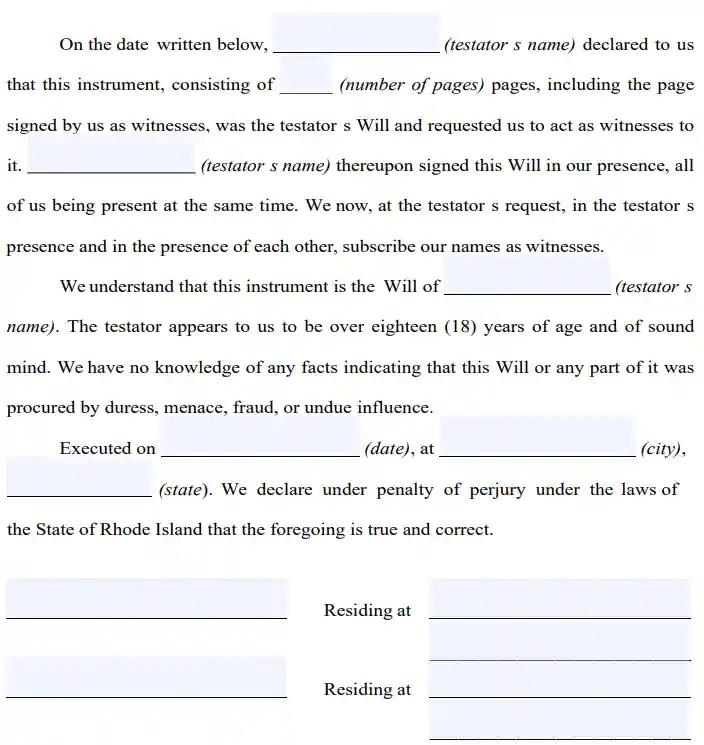

7. Ask witnesses to sign the document. In accordance with Rhode Island General Laws, for any will to be considered valid, it has to be signed by two witnesses. They should be over 18 years old and have no interest in your estate, so they can’t be inheritors. Think about selecting witnesses who are younger than you to ensure they can be present if the will is contested in the court or if any other problem arises. After a careful revision of every paragraph in your last will, all parties involved (you and your two witnesses) must fill out their full names and addresses and sign the will.

Create a Free Rhode Island Last Will Template

Frequently Asked Questions

Is a Rhode Island will form effective without notarization?

Rhode Island law says that a last will is valid without getting a notary public to certify it. But if you would like to add a self-proving affidavit to the will, you’ll need to notarize it. Making your will self-proving might be a great choice because it speeds up the probate and provides another level of security should the will’s legitimacy be doubted.

Do I have to add a self-proving affidavit to my last will in Rhode Island?

No, in Rhode Island, there isn’t such a requirement. Nevertheless, attaching one may be quite beneficial since it eliminates the need for witnesses’ testimony in the course of probate, which speeds up the procedure a lot.

Is child or spouse disinheritance allowed?

With regards to your spouse, it is significant to highlight that Rhode Island is not a community property state, meaning it is not required that all of the belongings that were gathered while in the marriage or that increased with the capital got during the mentioned marriage, belong to each of the spouses evenly. In Rhode Island, you have the right to disinherit your spouse, but the latter will be able to get some minimum amount of your property.

Besides your husband or wife, Rhode Island law enables you to disinherit any other family member. With the addition of corresponding disinheritance paragraphs to your last will and testament, you will be able to exclude your children (of 18 years and above) or other family members from receiving any belongings.

In Rhode Island, am I allowed to modify a typewritten last will after signing it?

Yes, this can be done.

A testator can alter or repeal his or her last will and testament at any time. The sole situation that will not allow you to do it is if such doing is prohibited under the contract you signed.

It will also be a wise decision to revise your last will and testament in such situations:

- Adoption or childbirth

- You have divorced or married

- You purchased or sold real estate or a considerable piece of property

- Fundamental changes in your financial situation

What if I have lost my last will?

In case the last will and testament has been lost or destroyed, as outlined by Rhode Island law, the court can accept it. However, the probate court will be unlikely to admit anything other than the initial version of the last will to probate.

Rhode Island law gives an assumption that the absence of the will means it’s repealed. This puts the obligation on the proponent of the last will and testament to give proof of the stated last will.

For holographic last wills, the situation can become more troublesome as sworn witnesses and testimony are demanded. Furthermore, you will also have to provide proof of the reason why the last will and testament and its contents cannot be produced in ways that will ensure it hasn’t been annulled.

How can a physically impaired person sign their last will and testament?

Rhode Island Estate Code permits some other individual to sign your last will and testament just per your directive and with you present. The person who wrote the will can express their last wishes in words, by way of answering positively to a query, or with body language.

A notary can sign the name of the testator if the testator isn’t able to do so due to a physical impairment. The notary public must be directed to do so with a witness present. It is important to mention that these witnesses are not allowed to have an interest (equitable or legal) in any of the properties and assets being the issue matter or that may be affected by this type of document (the will).

Other Documents Related to Wills in Rhode Island

| Related documents | When to make one |

| Codicil | Your will requires one or a couple of minor changes. |

| Self-proving affidavit | You need to expedite the probate later on. |

| Living will | You want to declare your wishes regarding the end-of-life health care and life-prolonging measures. |

| Living trust | You would like to deal with your end-of-life affairs without probate. |

Last Will and Testament Forms for Other States