Iowa Promissory Note Template

A person lending money to someone in Iowa may complete the Iowa promissory note template. This legal form serves as proof of borrowing money and guarantees the repayment. Besides, you can set the refund period and conditions with such notes.

Each blank promissory note template signed in the United States should contain:

- The creditor’s and debtor’s personal info

- The borrowed amount in US dollars with the agreed interest rate

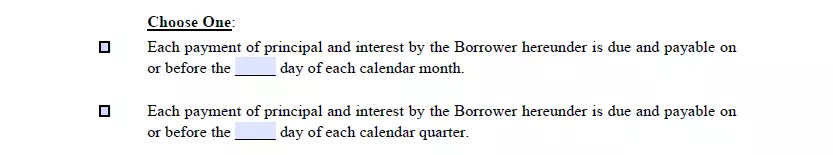

- The due date and payment schedule

- The borrower’s signature (or both parties’ signatures)

The borrower can suddenly stop repaying or disappear. If any of this happens, the creditor can submit the promissory note to the court, and a trial will start.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

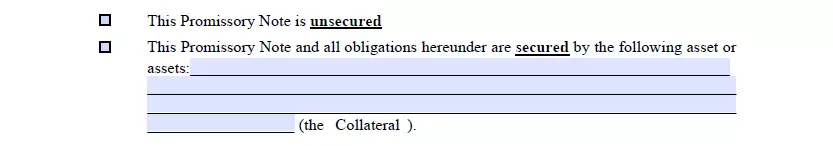

Promissory notes in the US can be secured or unsecured. If you borrow cash and sign a secured note, you will add the tangible things that can substitute the money (if you face trouble and cannot repay with money).

If you do not provide such items, the note is considered unsecured. Unsecured promissory notes are usually signed if parties know and trust each other.

Please note that you have to state all the details listed above regardless of the promissory note type you choose.

Iowa Usury Laws

Chapter 535 (or “Money and Interest”) of the Iowa Code regulates money, interest rate, usury, and all related questions.

Section 535.2 sets the interest rate at the level of 5%. However, there are exceptions. You may learn about them in Subsection 2 and 3 of Section 535.2 of the Iowa Code.

Remember that American states have different norms regarding usury, so Iowa’s provisions will change if you sign the note in another state.

Iowa Promissory Note Form Details

| Document Name | Iowa Promissory Note Form |

| Other Name | IA Promissory Note |

| Max. Rate | 5% (if otherwise agreed upon in writing, maximum is set by Iowa Superintendent of Banking) |

| Relevant Laws | Iowa Code, Section 535.2 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes referred to as just note) is a simple money instrument used by many companies and individuals throughout all states as a funds source and an alternative to banks. Find out more about the most common states searched by our visitors in terms of promissory note templates.

Filling Out the Iowa Promissory Note

If you suffer any time you need to complete a legal document, follow our recommendations. In particular, we have created guidelines to complete the Iowa promissory note template. You can check it below.

- Download the Correct Template

You cannot succeed in the completion without having the correct template. Our form-building software will help you download proper files quickly. Prepare two copies of the note, one for the borrower and the other for the creditor.

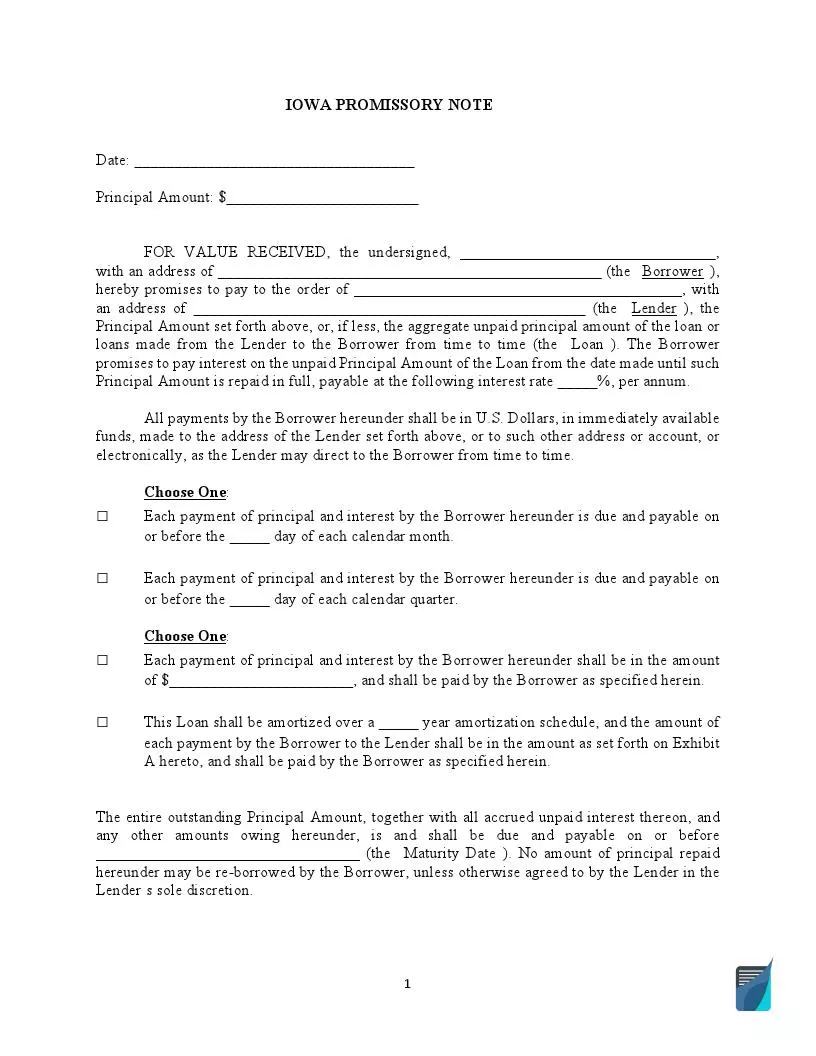

- Date the Promissory Note and Specify the Amount

You will see two blank lines below the heading. In the first line, add the date when the form is signed. In the second line, write the lent sum in US dollars.

- Specify the Parties

Write the names and full addresses (including state and county) of the creditor and the borrower.

- Specify the Rate of Interest

The interest rate you agree on should conform to the state law. Clarify the rate in the document.

- Describe the Schedule

Then, choose the statements that help you to create a payment schedule. Fill these statements out with the amounts and dates.

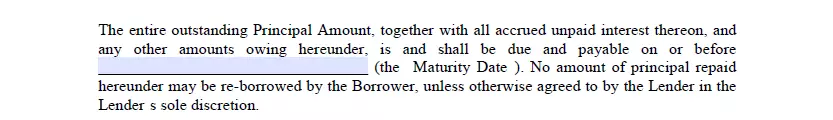

- Reveal the Maturity Date

Write the maturity date—the last day of payments by the borrower.

- Indicate the Note Type

Remember that the promissory note is either secured or unsecured. Choose the type of yours. For a secured note, add the “Collateral” (things the borrower gives away instead of cash if they cannot repay).

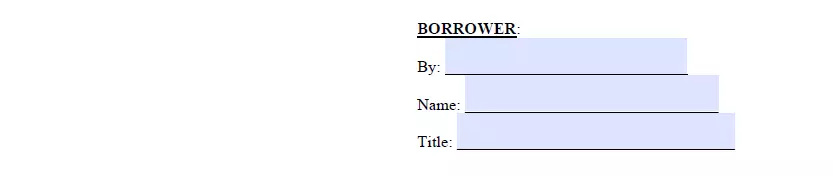

- Sign the Promissory Note

Once you have inserted all data, the lender and the borrower must sign the note.

Other important Iowa templates readily available for download on our site and that can be customized in our hassle-free document maker.