New Jersey Promissory Note Template

When you want to complete the money-lending process between the debtor and the creditor, under the New Jersey state law, you should complete the New Jersey Promissory Note it controls the implementation of the agreements within the promissory relations. Without it, the creditor and the debtor are at risk.

The New Jersey promissory note templates protect both the debtor and the creditor from possible future issues with recognition of the money transaction as valid. When both sides sign the note, they get some noticeable perks. First, the debtor receives the opportunity to pay the full amount in installments. At the same time, the creditor makes a profit by receiving additional money from the interest rate above the stated balance.

After both parties of the promissory relations sign it, the note comes into force.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New Jersey Usury Laws

The New Jersey Promissory Note is only valid if it conforms to the New Jersey state laws. Laws of the state that control the implementation of the promissory agreements are:

- The 2013 New Jersey Revised Statutes Title 31 — Interest and Usury Section 31:1-1 — Contract rate; rate on mortgages on dwellings and other loans; computation of interest of discount; determination of rates

- New Jersey Department of Banking and Insurance

According to these legal documents, demands of the state for concluding promissory relations are:

- The highest interest rate stated by the New Jersey state laws is 6% if you don’t have a written document.

- If you have a written legal document proving the promissory relation, the interest rate can be a maximum of 16%.

- The circumstances under which the interest rate can be charged must be written in the promissory note.

- The credit amount must be stated in the promissory note. All details of the promissory relations also must be in the promissory note.

- The promissory note can be considered valid after both the debtor and the creditor sign it.

New Jersey Promissory Note Form Details

Document Name New Jersey Promissory Note Form Other Name NJ Promissory Note Max. Rate 6% – without a written contract;

16% – if a written contract existsRelevant Laws New Jersey Statutes, Section 31:1-1 Avg. Time to Fill Out 10 minutes # of Fillable Fields 28 Available Formats Adobe PDF  Create a free high quality New Jersey Promissory Note online now!

Create a free high quality New Jersey Promissory Note online now!

Popular Local Promissory Note Forms

Whenever lending or borrowing money, consider signing a promissory note form. It is a useful legally binding document largely drafted by companies and individuals in many US states. Listed below are the local promissory note documents our users read about most often.

Filling Out the New Jersey Promissory Note

We created step-by-step instructions, and if you follow them, you will fill out the promissory note template on your own, as it doesn’t require some specific skills.

There are two types of the New Jersey Promissory Note—unsecured and secured ones. Here, we will focus on the secured note, as individuals tend to choose this note more often than the other. These two promissory notes have many things in common, but there’s one essential difference between them.

When you sign the unsecured promissory note, and when the debtor has difficulties paying the money back, you have to appeal to the court and ask for compensation. It takes a lot of time and effort, but it is real to get your money back.

On the other hand, when you choose to sign the secured promissory note, even when the debtor can’t return your money, you take the items the debtor stated as security. Therefore, your money will return to you anyway.

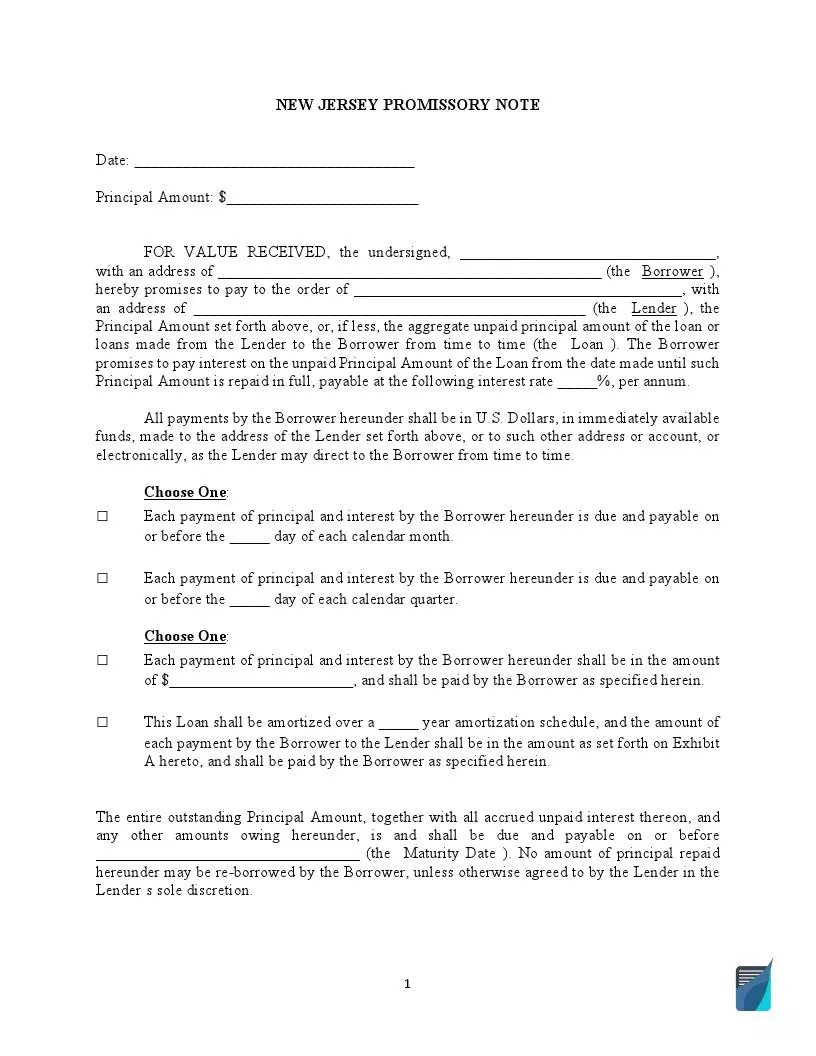

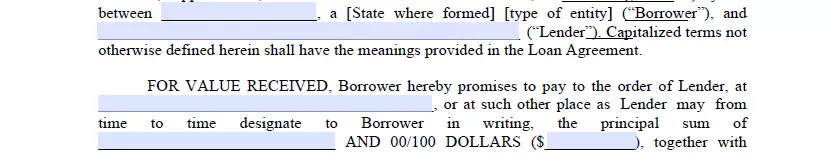

Enter Basic Information

Write down the promissory note signing date, the names of the debtor and the creditor, their addresses, the interest rate approved by both parties, and the full amount of the credit.

Select the Method of Payment

Between three options of payment, select the one that suits both parties.

- Installments. The debtor pays the whole amount weekly or monthly.

- No installments. The debtor pays the whole amount and the interest rate on the due date.

- Interest-Only Payments. The debtor makes numerous payments of the interest rate only.

State the Details

Include the due date of paying the whole amount, and then write down the gate when the interest is due.

Announce the Late Fees

Give details on the number of late fees and conditions that require the debtor to pay them.

Declare Acceleration Details

The debtor has a specific number of days to pay the whole amount, failure to which the debtor default is stated. After recognizing the default, the creditor can request the payment acceleration.

State the Security

Select the object that will serve as security. If the debtor fails to return money to the creditor, the latter can take the debtor’s security object in exchange for the money.

Sign the Promissory Note

Write down the promissory note signing date. Both the debtor and the creditor, and one witness need to sign the note.

We provide a variety of key New Jersey forms to anyone in quest of ease when filling out all sorts of papers.