North Carolina Promissory Note Template

To guarantee the refund of the borrowed money, borrowers can sign various legal documents that the lender can submit in court if they fail to pay the debt in the agreed terms. The North Carolina promissory note template is an instrument to prove that money was lent and bind the borrower to repay.

In promissory notes, parties have to disclose specific figures and conditions they agreed on, including:

- The precise amount lent by the borrower

- The interest rate agreed upon by both parties

- The payment timeline and the deadline (when the borrower completes paying the debt

Every state regulates usury and legal forms tied to the topic differently. However, the document’s structure and mandatory details remain the same. The promise to pay template may include additional information based on the used template and the general regulations to such agreements.

There are two types of promissory notes in North Carolina and other states. You may choose between:

- Secured Notes. Such an agreement presumes that the borrower and the lender are not relatives or friends, or the lent amount is huge. However, you may complete this template for any other reason. In this document, the borrower states what they will transfer to the lender if they fail to repay—the cost of the provided items should coincide with the lent amount for compensation.

- Unsecured Notes. The principal difference is the absence of items that may be used as a refund instead of money. If you trust the person you are lending the money, or if the debt is small, but you still want to guarantee the payment, opt for the unsecured promissory note. Except for the substitutional items, the details you insert in such notes are still the same.

North Carolina Usury Laws

Chapters 23 and 24 of the North Carolina General Statutes are all about the relations between debtors and creditors, loans, and interest rates.

The standard interest rate in North Carolina is 8% per year by law, as written in Section 24-1.

North Carolina Promissory Note Form Details

| Document Name | North Carolina Promissory Note Form |

| Other Name | NC Promissory Note |

| Max. Rate | 8% – legal rate of interest (but consumers and creditors can contract for a higher rate) |

| Relevant Laws | North Carolina General Statutes, Section 24-1 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

Organizations and people frequently want promissory notes to take loans from other people and companies and stay away from lending institutions. Here are some of the most requested local promissory note forms searched by our users.

Filling Out the North Carolina Promissory Note

If you are wondering how to complete the North Carolina promissory note template, our guidelines will help you step by step.

- Get the Proper Template of the Note

You should be careful when choosing promissory note templates as not all of them are valid. Use our form-building software to download the right file quickly. Remember to make a couple of copies because usually, both parties have to sign and keep a copy of the promissory note.

- Write the Date

On the right-hand side below the heading, write the current date.

- Name the Lender

You should write the full name of the person lending the money in the suitable line of the form’s first part.

![]()

- Disclose the Lent Amount

After naming the lender, disclose the lent sum in US dollars. Write it in words first, then place the numbers in brackets nearby.

- Indicate the Place (or Manner)

You may choose a place where the borrower should bring the money or a convenient manner of submitting the money to the lender.

- Declare the Maturity Date

The term “maturity date” is the date when the borrower has to complete the payment. Insert this date in Section 2 (or “Term”) of the template.

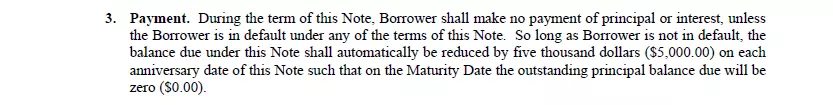

- Describe the Timeline

Usually, lenders want borrowers to refund in installments. This section should contain the payment schedule that both parties set.

- Read the Text Thoroughly

After creating the timeline and entering the details, read the statements listed in the form carefully. The information is useful for both lenders and borrowers in North Carolina.

- Sign the Promissory Note

In North Carolina, only the borrower has to sign the note. Notarization is not required. However, you may ask a notary to sign if need be.

Here are some other North Carolina forms downloaded by FormsPal users. Try out our powerful tool to personalize any of these forms to your preferences.