Louisiana Promissory Note Template

A promissory note registers an agreement between a person who borrows the funds and a person who lends the required amount. Following the state customs and laws, a Louisiana promissory note template is specifically tailored for the residents. It contains inherent responsibilities that the wealth will be returned to the lender within the determined interval.

Should you lend any amount of money to a friend, a colleague, or any person you consider dependable, a promissory note is a legal guarantee to protect your funds and get reimbursement.

In Louisiana, the note payable template should contain the following:

- the signatories’ data

- the amount borrowed

- the interest percentage

- late payment compensation terms

- amount of regular payments and the date of providing the refunds

Once the parties place their signatures, the promissory note becomes valid and ensures that both individuals found agreement.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

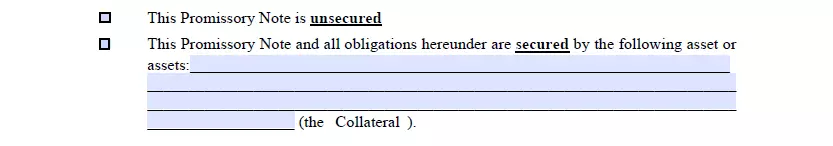

In Louisiana, you can opt for a secured and an unsecured standard.

- Louisiana Promissory Note (Secured). Secured Promissory Notes contain data about assets that guarantee reimbursement if the borrower fails to repay the amount. As a rule, the borrower engages real property, personal items (like jewelry), motor vehicles, or watercraft.

- Promissory Note (Unsecured). An Unsecured Promissory type provides no guarantees if the borrower fails to reimburse the funds. It is an unsafe decision on the lender’s part as the borrower doesn’t pledge any property as security against the credit. It is advisable to provide loans to family members or dependable friends.

Louisiana Usury Laws

Interest rates are regulated by §9:3500 of the Louisiana Revised Statutes and cannot surpass 12% per year. These terms should be included in the promissory note form in a written manner when borrowing from an individual. Credit transactions do not implement these conditions and are regulated by the state Consumer Credit Law.

Louisiana Promissory Note Form Details

| Document Name | Louisiana Promissory Note Form |

| Other Name | LA Promissory Note |

| Max. Rate | 12% – general usury rate |

| Relevant Laws | Louisiana Revised Statutes, Section 9:3500 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes called just note) is considered a great financial instrument used by many individuals and businesses in all states as a money source and a substitute for banking institutions. Discover more about the most popular US states requested by our website users with regards to promissory note forms.

Filling Out the Louisiana Promissory Note

Louisiana does not provide official promissory documentation. However, if you aim to guarantee that the borrower performs their obligations, the template will be needed. We empower you to use our advanced software and generate a required file. Follow this thoroughly-constructed guide.

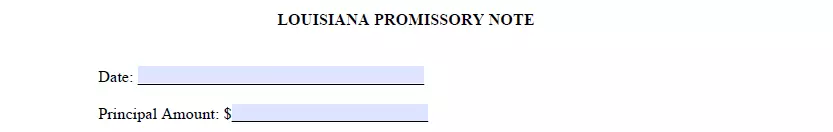

1. Insert the Date and the Principal Amount

Start filling out the Note by specifying the amount of money borrowed and the current calendar date.

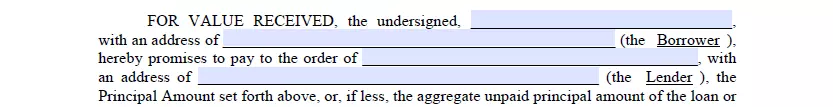

2. Introduce the Parties

Submit the parties’ names and physical addresses, recognized in the record as the Borrower and the Lender.

3. Determine Interest Rate

Specify the Interest percentage per year. Remember that under Louisiana statutes, the usury rate equals 12%and less.

4. Choose the Regular Payment Alternative

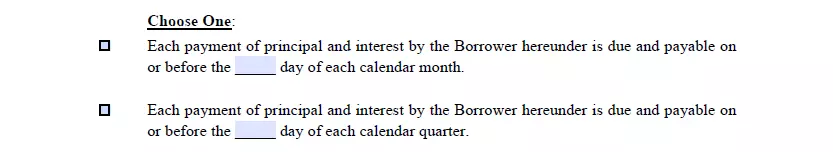

The parties are authorized to pick a preferable alternative defining the algorithm of how the Borrower will render reimbursement—monthly payments or refunds by quarters.

5. Determine the Value of Regular Payments

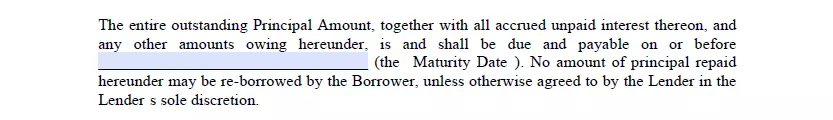

Pick one alternative specifying the amount of each payment. Below that, identify the “Maturity Date” and enter the information.

6. Define the Type of the Promissory Note

Here, you should indicate whether this Promissory Note is secured or unsecured. Check the preferable box. Should you choose the secured type of document, please, identify the assets (Collateral) that ensure the performance of obligations.

After reading the information on assets management, proceed to the next step.

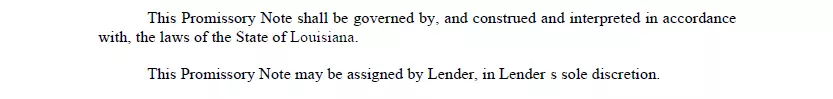

7. Specify the Jurisdiction

Enter “Louisiana” in the suggested field.

8. Collect the Parties’ Signatures

Once you have completed the document, the Borrower and the Lender should append their signatures and enter legal names.

9. Outline the Amortization Schedule

This section is offered as Exhibit A and is optional to complete. Fill out if appropriate under the circumstances.

Various other essential Louisiana templates available for download and that can be customized in our simple document maker.

Other Promissory Note Forms by State