Louisiana Last Will and Testament Form

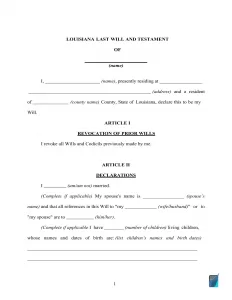

A Louisiana last will and testament is a legally binding document that expresses the testator’s (creator of the will) last wishes in the form prescribed by the state law. It ascertains the legal distribution of the testator’s estate after their demise and names the beneficiaries, executors, and guardians of the estate.

Making a last will is often a wise option for anybody who wants to steer clear of arguments and misunderstandings. Even if you don’t have a lot of assets, this document can help your family and prove to be fundamental to your household upon your death.

On this page, you can get a free Louisiana last will template that you can fill and print out. You can also opt for the builder we provide and make a more personalized will. Before getting started with either option, please check the will laws and requirements in the table below.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Louisiana Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Section 2 – Forms of Testaments, Section 3 – Of the Competence of Witnesses and of Certain Designations in Testaments | |

| Signing requirement | Two witnesses AND a notary public | SECTION 2 – FORMS OF TESTAMENTS |

| Age of testator | No statute | |

| Age of witnesses | 16 and older | SECTION 3 – OF THE COMPETENCE OF WITNESSES AND OF CERTAIN DESIGNATIONS IN TESTAMENTS |

| Self-proving wills | Not allowed | |

| Handwritten wills | Recognized under certain circumstances | SECTION 2 – FORMS OF TESTAMENTS |

| Oral wills | Not recognized | |

| Olographic wills | Recognized under certain circumstances | |

| Registering a will | Possible with the the secretary of state office | §2446. Will information registration |

How to Write a Last Will in Louisiana

1. Think about your possible choices. One thing to bear in mind, first of all, is if you want to write the whole document by hand or try a fillable last will and testament template that you can download on this page. Another option is to use our last will builder. It will guide you through every step and provide you with a more personalized document. Just click “Create My Document” to get started.

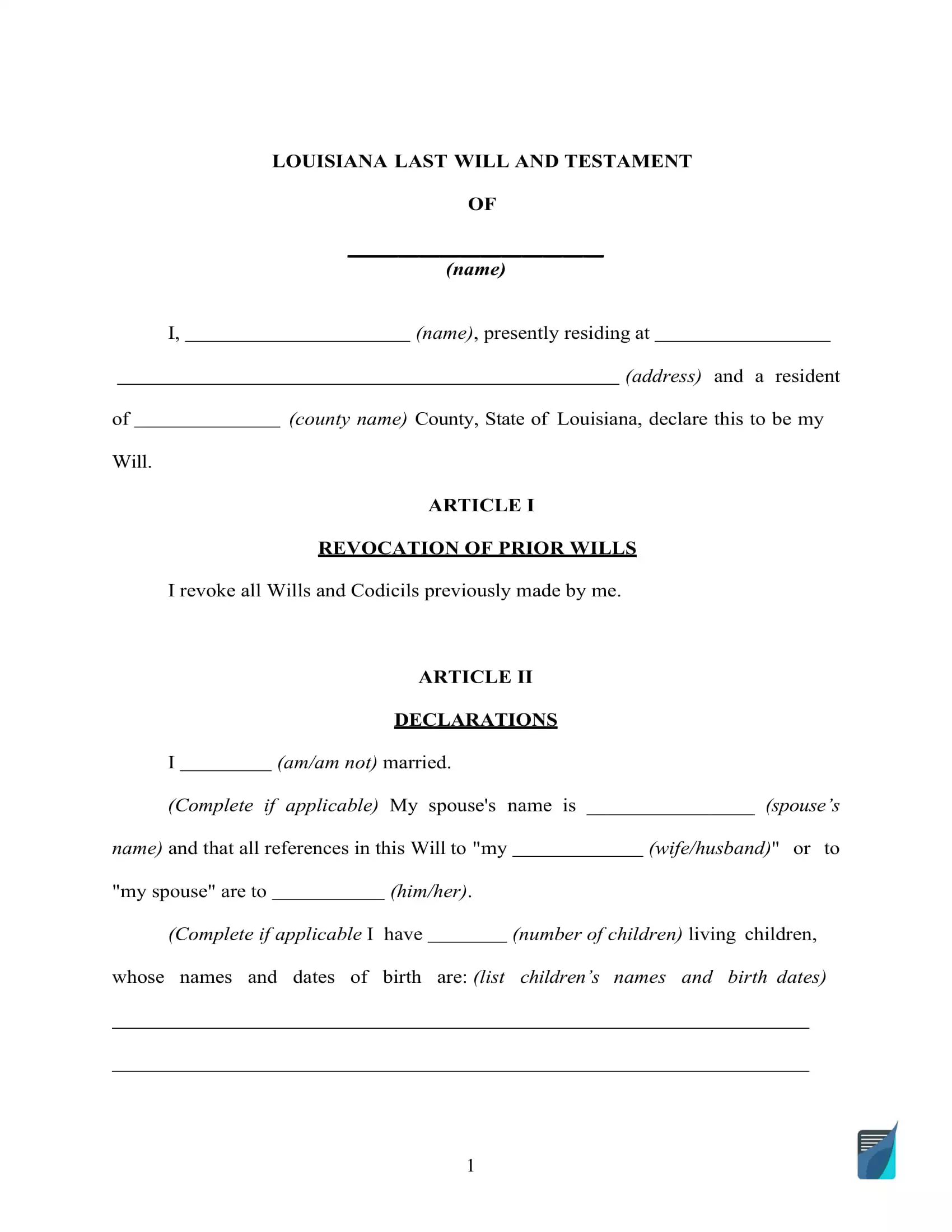

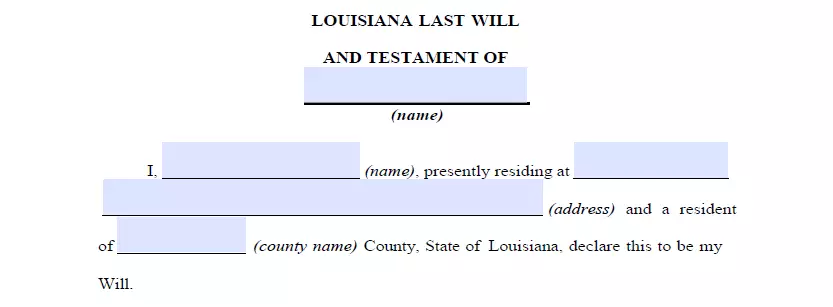

2. Indicate your details. The initial step of drafting any will is establishing the testator by filling out their full name, together with the residential information (city, county, and state). Make sure to double-check if every detail is correct.

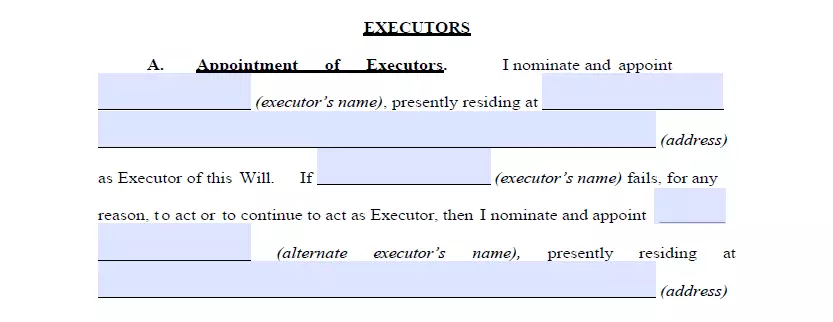

3. Appoint the executor. The next step is to choose the executor of your last will. This person will be responsible for ensuring that all you lay out in this document is made a reality. You will need to indicate the executor’s full legal name, together with their residence specifics (city, county, and state).

Make sure you choose a person who resides in the same state as you do. Otherwise, there’ll be more paperwork and unavoidable hassle involved in the procedure because of different special rules every state has when it comes to nonresident executors (see Section 3097 (4)).

It could also happen that the main representative will not be able to execute your last will and testament because of a health problem, death, unwillingness, or other reasons. In such a case, the court will choose its own agent to carry out the duties. In order to prevent that, it is possible to select a second executor by providing the same details you did for the main one.

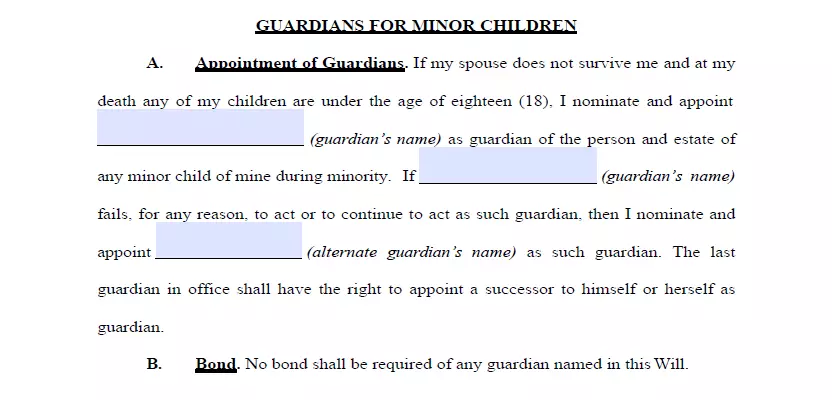

4. Indicate the guardian (optional). Should you have underage or dependent children and do not want the court to decide on a guardian for them when you’re no longer on this Earth, it is possible to appoint somebody you know as a legal guardian to take care of your children until they reach adulthood.

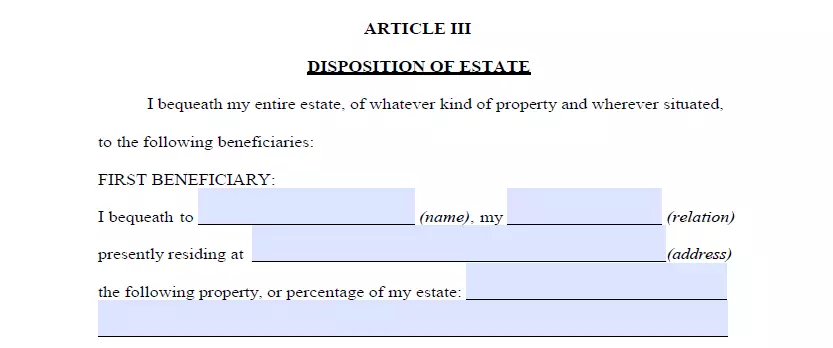

5. Establish your beneficiaries and their shares. At this stage, you specify people who will receive your estate. Fill out their full names, places of residence, and your relationship to them (spouse, child, friend). If you want to, you can also donate some of your assets to charitable organizations. To do that, you must indicate them as your beneficiaries and list the donated property.

When you have got an asset distribution in mind that is not even, you can describe it within this part. Assets might include money for arrearage, realty, shares, company control, cash, and any material items of commercial worth you own. Please be aware that there are things that can’t be distributed in your last will. Such assets include jointly acquired assets and life insurance.

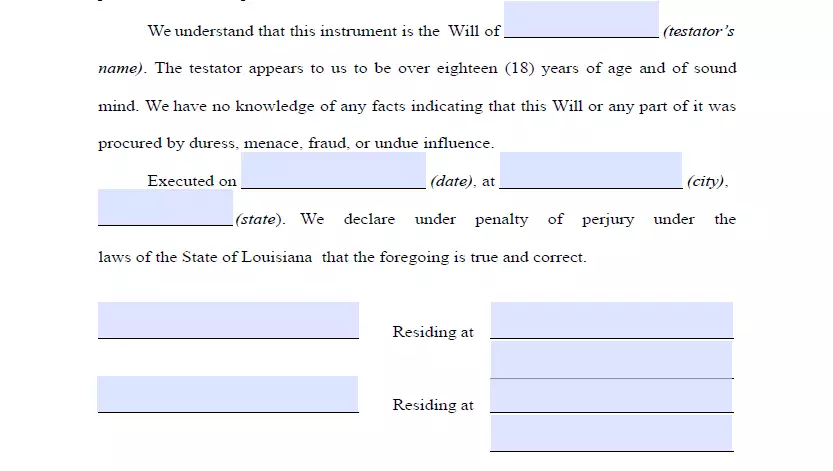

6. Ask witnesses to sign the document and notarize it. Louisiana rules stipulate that at least two witnesses must sign a last will so that it is deemed legally binding. They have to be over 16 years of age and have absolutely no interest in your last will, otherwise, they can’t be beneficiaries. Also, this is the only state where will notarization is mandatory (СС 1577).

Make a Free Last Will and Testament Valid in Louisiana

Frequently Asked Questions

Is will notarization required by the Louisiana statute?

Yes, a last will and testament document must be notarized in Louisiana and is not valid without a notary certification.

Is spouse disinheritance possible in this state?

If you wish to disinherit your marriage partner, it will most probably be unfeasible. Louisiana is a community property state (sometimes also called marital property). Half of all properties and assets (including arrears) of one spouse belong to another and remain such after divorce.

Well, before getting married to someone, you can also conclude a prenuptial agreement with your partner. It will allow you to redefine the way the community property will be allocated upon divorce or your demise. It is perhaps the sole plausible way to disinherit your spouse or limit her or his share. But, there’s also something called “marital portion,” which ensures the surviving spouse gets one-fourth of the testator’s estate if the testator died “rich.”

For any other members, it’s legal in Louisiana to disinherit them in your last will. Include disinheritance sections where you clearly state your intentions and attach a letter with some explanations to be sure there’s no misunderstanding.

What are the consequences of losing a will?

There is a legal presumption that the original last will was destroyed and that the testator meant to revoke it if there is no will to show it to the probate court. This presumption cannot be disproved with just a copy of the will. It must be proven in the court that:

- 1) There was a legally valid will written by the testator

- 2) The contents of the will were clearly determined

- 3) The original last will was not revoked and the testator did not have such an intention

To avoid such a case, it is possible to register a will (Will Registration Form).

How does a physically impaired person sign their will?

Louisiana Estate Code, namely Section 2:1578-1580.1, makes it possible for another person to sign your will just per your directive and in your presence.

| Related documents | Times when you might want to have one |

| Codicil | You want to slightly modify your last will without writing a new document from scratch. |

| Self-proving affidavit | You want to steer clear of possible complications in the probate court. |

| Living will | You would like to indicate precisely what health care you expect if you can’t communicate that yourself. |

| Living trust | You want to skip probate by placing your assets in a trust. |

Last Will and Testament Forms for Other States