Maryland Promissory Note Template

The Maryland promissory note is a document you use when borrowing or lending money in this state. The basic promissory note also is widely utilized in other American states. It is a repayment guarantee from the borrower to the lender.

If you lend someone money, you expect to get the money back at some point. With a promissory note, you may state the exact day when you should receive the funds, and the borrower promises to refund. When you sign this note, it becomes legal proof, and you can take it to court if the borrower disappears or refuses to pay for some reason.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Each promissory note completed in the United States (and in Maryland) should disclose specific info to be effective. If you create such a paper, remember to indicate:

- Creditor’s and debtor’s names and contact information

- The sum to repay with an interest rate you have discussed

- The payment schedule with a termination date.

Sometimes the lent amount is huge, and the lender needs an additional guarantee of repayment. For such a case, a secured promissory note comes in handy. In the paper, the debtor offers something instead of cash if they cannot cover the debt. Suggested items should be commensurate with the lent amount.

Another type of promissory note is called “unsecured.” This means that nothing is offered to substitute the money. Typically, parties sign these notes when the creditor is sure of the debtor’s ability to refund.

Maryland Usury Laws

You should know that the laws regarding usury are not unified, and each American state proposes its own provisions tied to the theme.

Regulations covering usury in Maryland are included in Article 12 (also referred to as “Commercial Law”) of the Maryland Statutes.

Section 12-102 of the Maryland Statutes says that the legal rate of interest in the state is 6%. In other cases, it may increase to 8%, as written in Section 12-103.

Maryland Promissory Note Form Details

| Document Name | Maryland Promissory Note Form |

| Other Name | MD Promissory Note |

| Max. Rate | 6% – legal interest rate; 8% – if a written contract |

| Relevant Laws | Maryland Annotated Code, Commercial Law, Sections 12–102 and 12–103 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes called loan agreement) is a handy money instrument used by many individuals and companies through all states as a funds source and a substitute for banking institutions. Discover more about the most popular US states requested by our users when it comes to promissory notes.

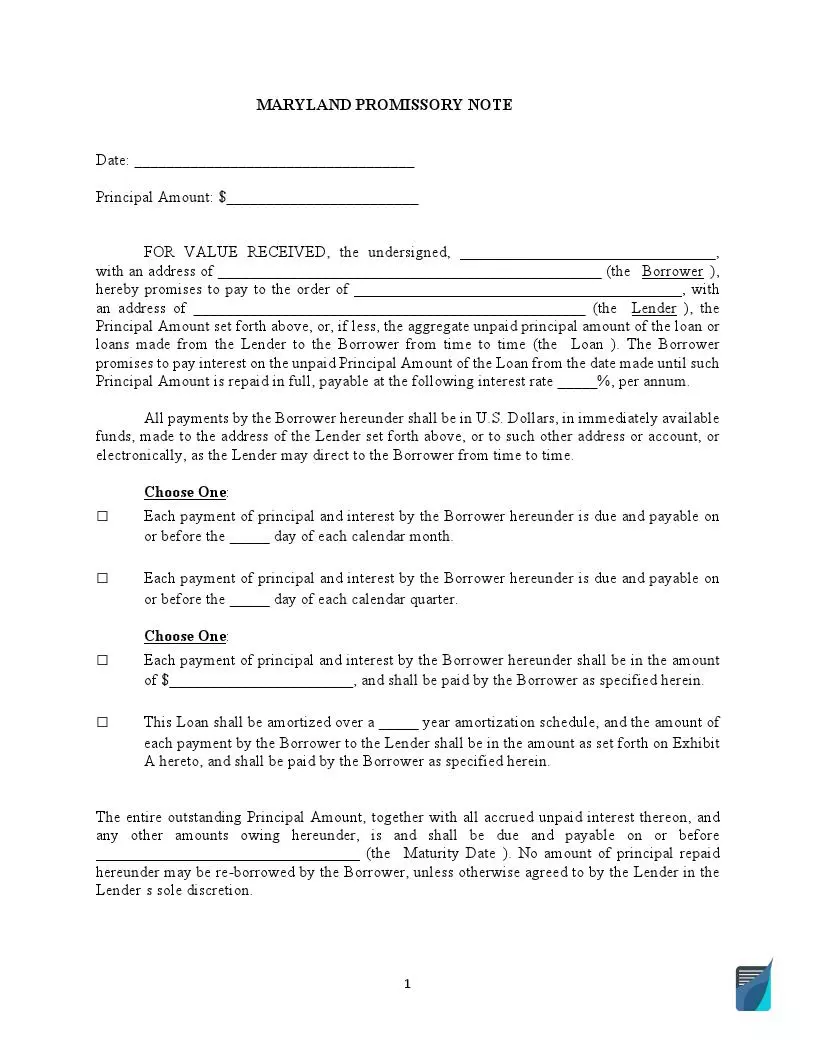

Filling Out the Maryland Promissory Note

It is typical to face difficulties when creating various legal forms. You can use our instructions to complete the Maryland promissory note template quickly and correctly. Keep reading to understand how to write the note step by step.

Get the Proper Template

Each time you decide to complete any legal form, begin with searching for the relevant template. Our form-building software creates the needed templates in seconds. Use it to download the file.

Promissory notes are kept by both the creditor and the debtor. So, you have to make at least two copies.

The Date the Promissory Note

You should begin by adding the current date in the relevant blank space.

Reveal How Much Has Been Borrowed

Below the date, write the exact sum that the debtor has obtained. It has to be stated in US dollars.

![]()

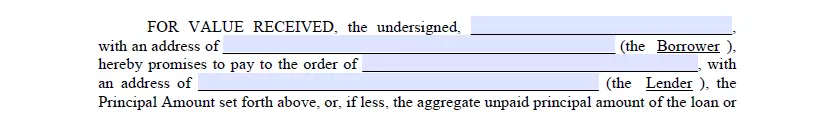

Name the Debtor

Write the debtor’s full name in the first line of the form. Then, indicate their full address.

Do the Same for the Lender

Then, add the lender’s name and full address.

Indicate the Interest Rate

Insert the interest rate you and the other party have decided to apply to the debt.

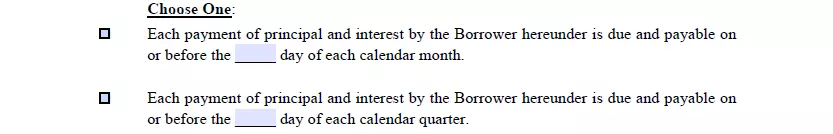

Create a Schedule

You have to discuss when the borrower will cover the parts of their debt. When the creditor and the borrower have accepted the conditions, choose the appropriate options and write the dates and the amounts to pay.

Specify the Termination Date

The lender often wants to get the money fully in a certain period. So, the agreement presumes that the exact date will be indicated. This date is also called the “maturity date.” Write it in the appropriate line.

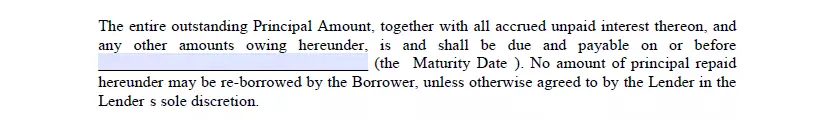

Choose the Promissory Note Type

We remind you that the promissory note can be either secured or unsecured. You should choose the type and add the items that can be given instead of cash. In the template, these items are referred to as the “Collateral.”

Sign the Note

To finish the process and make the document valid, the creditor and the debtor must sign it. Ask a notary to sign if you like.

We offer a wide range of key Maryland templates to anyone looking for simplicity when handling various papers.

Other Promissory Note Forms by State