Missouri Promissory Note Template

If someone has turned to you for financial assistance, do not disregard tailoring a guarantee document. A Missouri promissory note template will be of great help when you lend money to a family member, a friend, or a workmate.

The form is recognized as a Promissory Note and Loan and Security Agreement in Missouri. Promise-to-pay contracts are advantageous both for the lender and borrower, as these forms establish protecting terms for the parties. The lenders receive legal security to get refunded. The document promises the borrowers not to change the interest rate and charges within the operating period.

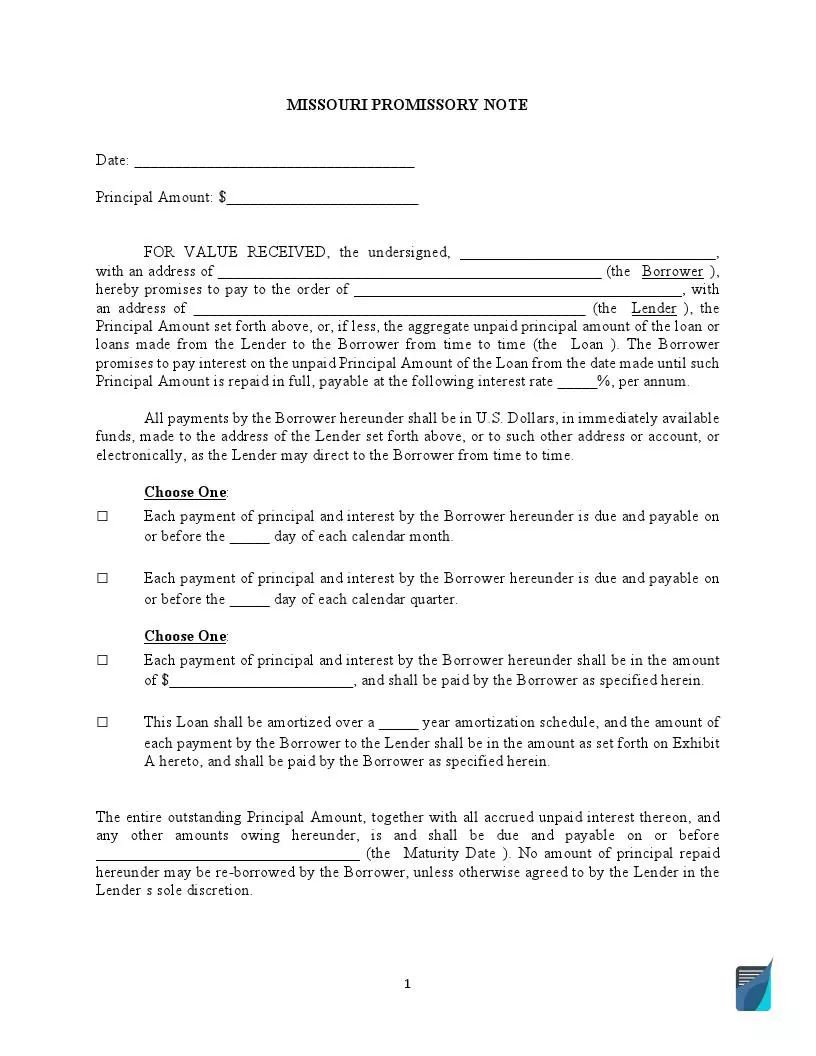

Besides specific regulations and conditions, every simple promissory note template should contain the following information:

- signatories names and addresses

- the amount of loan

- interest rate (if applicable)

- the date and the method of reimbursement

If you need to add any extra data, specifying the security part of the contract, use supplements, and attach the papers to the agreement.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

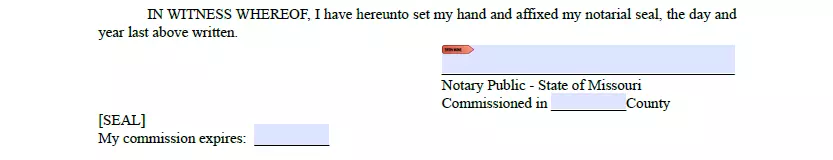

Under the statutes, the signatories should authorize the Missouri promissory note template in the presence of a licensed notary and obtain their acknowledgment afterward.

Unsecured Promissory Note. An unsecured promissory contract doesn’t contain any physical guarantee that the borrower will pay the loan in time. Should the borrower violate the agreement, the lender will have to take legal action. As a rule, unsecured promissory notes are drafted by relatives, dependable friends, and colleagues.

Make sure the person you lend funds meets your expectation of reliance and credibility. Unsecured promissory contracts are short-dated bills and exclude penalties. However, as a lender, you can determine dates of repayment and interest rates.

Secured Promissory Note. A secured promissory agreement tailors extra safety and ensures that if the borrower defaults or refuses to reimburse the loan, the lender will get the legal right to assign the secured assets noted in the contract.

This type of agreement is beneficial to both parties. Property assets protect the lender’s funds, while the borrower usually pays smaller interest charges. Secured promissory notes contain collateral that ensures the equal value of the borrowed funds.

As most promissory contracts are unsecured, people get confused, creating a successful agreement of the secured promise.

What should you remember creating a promissory note?

- Discuss the conditions before appending signatures.

- Determine the date and method of restitution.

- Consider any penalties for late payments.

- Determine the interest rate regarding Missouri Statutes.

- Speed up the process

If the borrower fails to repay the loan, the lender can speed up the process due to security options and property assets set as a guarantee.

Missouri Usury Laws

The interest rates are regulated by § 408.030 of the Missouri Revisor of Statutes. The signatories can determine an interest rate not exceeding 10% per annum unless the “market rate” passes these criteria. If these rules are violated, and the borrower is forced to pay at a rate greater than 10%, the borrower or their legal delegate can seek compensation twice the rate.

To learn and understand all details and regulations, consider Chapter 408 of the Missouri Revisor Statutes.

Missouri Promissory Note Form Details

| Document Name | Missouri Promissory Note Form |

| Other Name | MO Promissory Note |

| Max. Rate | 10% |

| Relevant Laws | Missouri Revised Statutes, Section 408.030 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

If you need to lend or borrow money, think about signing a promissory note. It is a useful legally binding document widely used by companies and individuals in all US states. The following are the state-level promissory note templates our visitors read about most often.

Filling Out the Missouri Promissory Note

A promissory note is a DIY-generated document, but some states offer official templates. Make use of our latest form-building software to tailor a relevant Missouri form. Below are the guidelines on how to fill out the promissory note.

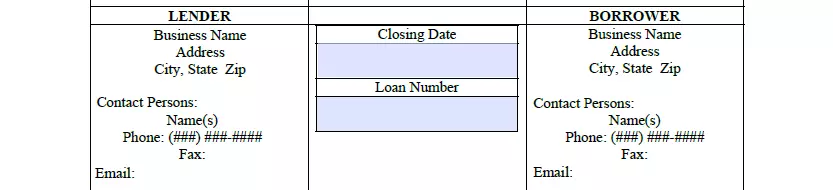

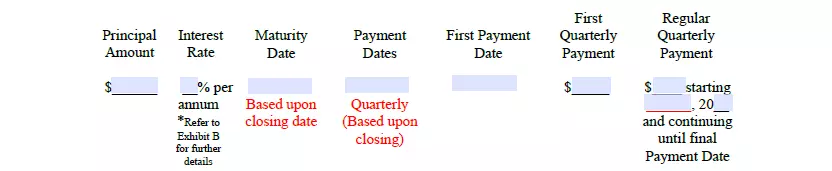

- Introduce the Borrower and Lender

Write both parties’ (persons’ or entities’) legal names, business addresses, and contact data (including phone numbers and email addresses).

- Determine the Loan Amount and Payment Details

Follow the directions and enter the amount of the money borrowed, the interest rate (in percents per annum), maturity date, and regular reimbursement dates.

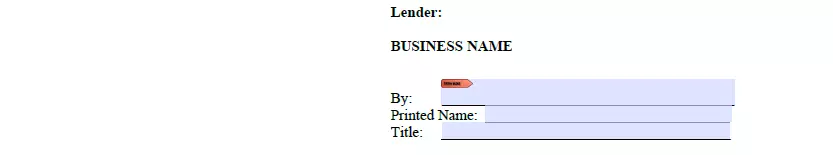

- Collect the Signatures

After reading the respected terms of the agreement, both parties should give their consent and verify the afore-mentioned information by appending signatures and dates in the presence of a licensed notary.

- Notarize the Contract

After the signatories have completed the necessary actions, the notary state representative should verify the parties’ identities and validate the Missouri Promissory Note. Let the notary affix the state seal and their signature.

Try our maker to personalize any form offered on FormsPal to your needs. Here’s a list of other fillable Missouri forms we offer.