Oregon Promissory Note Template

An Oregon promissory note is a written legal form that confirms the validity of a loan offered to the borrower by the lender. In other words, it is a guarantee of payment made official and provided by the borrower. Promissory notes define the amount of due money, conditions, and terms of the deal, and, in some cases, the interest.

Such a type of standard promissory note is represented by two main types: secured and unsecured. The first one is based upon the condition of transferring ownership of a property or an asset called “security” to the creditor in case the money is not paid back. The second type is less reliable, though built on mutual trust: it implies that no asset should be paid to the lender in case of non-payment, as no property was stated as a pledge in the agreement. The second type applies more to your friends and people you fully trust.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Oregon Usury Laws

The usury laws in Oregon are regulated by § 82.010(1), (3). We advise you to get acquainted with further details to increase your awareness before filling out the agreement.

Before the agreement is signed, both parties should come to terms with the basic repayment conditions, late fee terms, the borrowed sum, the pledge, and interest, if applicable. In Oregon, the legal interest rate is 9%. However, other conditions may apply to business and agricultural loans.

The amount of interest depends on the borrowed sum, but the maximum amount of interest chargeable on a credit of $50,000 or less is 12% per year. In case of a substantial loan sum, a house, a vehicle, or other valuable properties may serve as a security or pledge of the deal.

In a particular case, when the debtor is financially incapable of paying back the money, one should indicate in the agreement a person called co-signer to pay back the stated sum.

Once the agreement is in full legal force, the borrower becomes the debtor and is accountable for providing installment payments to the creditor in prompt and accurate terms specified in the agreement.

Oregon Promissory Note Form Details

| Document Name | Oregon Promissory Note Form |

| Other Name | OR Promissory Note |

| Max. Rate | 9% – legal interest rate (but other conditions apply to business and agricultural loans) |

| Relevant Laws | Oregon Revised Statutes, Section 82.010 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes referred to as loan note) is a basic monetary instrument used regularly by both companies and individuals across all states as a funding resource and an alternative to banking institutions. Discover more about the most common US states searched by our visitors with regards to promissory notes.

Filling Out the Oregon Promissory Note

Completing the form may not be a time-consuming procedure if you apply our in-built template and consequently follow the steps.

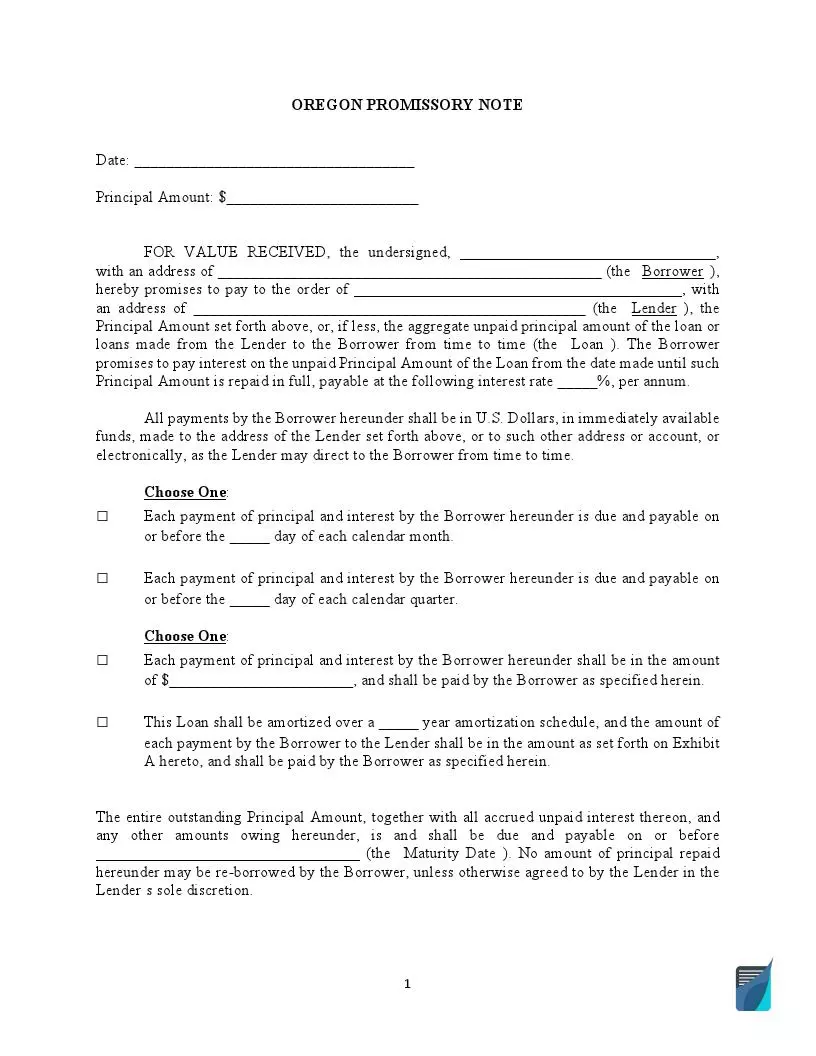

- Indicate the actual date when the agreement was signed.

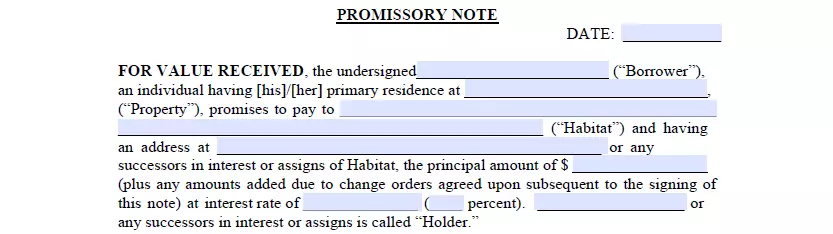

- Write down the names and addresses of both parties.

- State the loan amount.

- Define the Interest Rate.

Note that the amount of interest is generally counted per year.

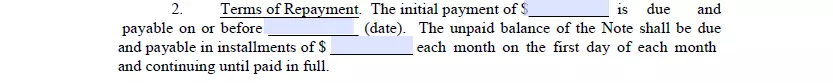

- Specify the ultimate due date, installment amount, and frequency of such payments.

The conditions may vary, though they usually consist of three main options. It can be a single payment—the total amount borrowed plus interest at a due date.

The second option implies regular installments (usually monthly or weekly) specified in the agreement.

The third one consists of only the interest rate paid by the debtor regularly.

- Indicate the terms of the late fee and the waiting period after the due date.

- Insert the time frame that the creditor will have to wait after the default has happened before acceleration is issued.

- Specify the security property in case of non-payment (for secure notes only).

The property’s value should generally be comparable with the amount borrowed. This asset is given to the creditor after the debtor finally fails to solve a potential default situation.

- Provide conditions and responsibilities of the signatories.

In some cases, the agreement may presuppose the third person, who is accountable for the payment and will ensure it, or acts as a witness if such person signs the contract.

- Do a control check once again before signing the document.

Make sure there are no blank spaces left.

- State the actual date followed by the printed and signed names of two parties and a witness if applicable.

- Make the borrower sign the note.

In this step, the borrower agrees to pay the principal amount to the lender, represented by a business entity, an organization, or a particular person. The signature is the final confirmation of the validity of the agreement.

Some other popular Oregon templates readily available for download here and that can be modified in our hassle-free document maker.