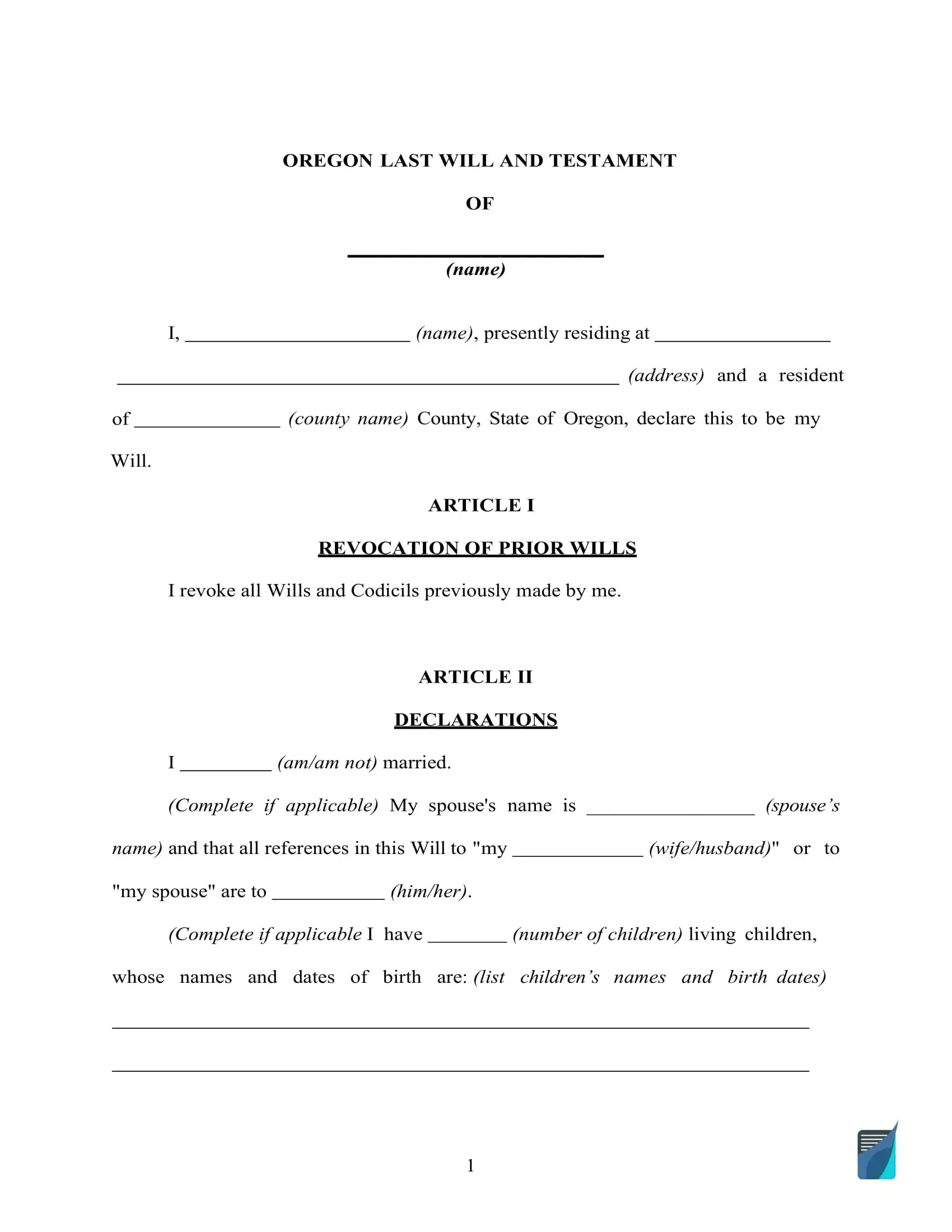

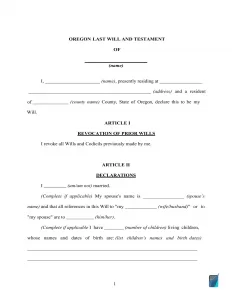

Free Oregon Last Will and Testament Form

A last will and testament is an important and legal instrument that reflects the last wishes of a testator with regard to their individual property and in what ways they’d want it to be distributed among chosen heirs. Making a will is a wise decision for any individual who wishes to prevent arguments and confusion.

Even if you don’t have a lot of assets, a last will can help your family situation and turn out to be fundamental to the ones you love after your death.

If you are searching for a fillable and printable Oregon last will and testament form, you will find one on this page, in addition to the recommendations on will creation and answers to frequently asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Oregon Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Chapter 112 – Intestate Succession and Wills | |

| Signing requirement | Two witnesses | 112.235 Execution of a will |

| Age of testator | 18 or a lawfully married minor or an emancipated minor | 112.225 Who may make a will |

| Age of witnesses | 18 or older | 112.235 Execution of a will |

| Self-proving wills | Allowed | 113.055 Testimony of attesting witnesses to will |

| Handwritten wills | Might be recognized if witnessed according to the state law | 112.235 Execution of a will |

| Oral wills | Not recognized | |

| Holographic wills | Not recognized | |

| Depositing a will | Possible with an Oregon county court A fee is $8 | Probate FAQs |

How to Prepare an Oregon Last Will

- Think about your options. Before starting, you need to determine if you would like to use the services of a lawyer or do the entire thing on your own. If you intend to write the will on your own, select the type you will use: a handwritten will or maybe a free last will and testament form.

- Specify your information. Establish the testator and their details: full legal name and address (city, county, and state). Review the information you wrote along with the remainder of the passage, which includes “Expenses and Taxes.”

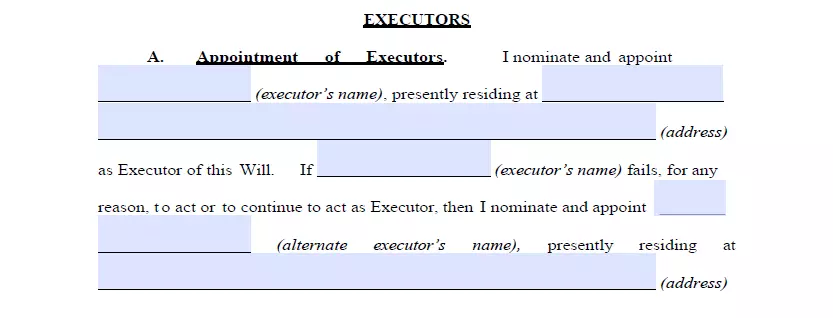

- Establish the executor (or executrix). This is the time to select the executor of your last will, the person liable for ensuring all you write in this document comes true. To do this, you have to specify the executor’s full legal name, together with their residential information (city, county, and state). Make sure you appoint someone who lives in the same state as you do. Otherwise, there’ll be more red tape and unnecessary hassle in the procedure resulting from various special policies every state has in terms of out-of-state executors. While not mandatory, it’s a good idea to appoint an alternative person to perform the duty of your executor in case the first one is unwilling or incapable of executing your last will and testament.

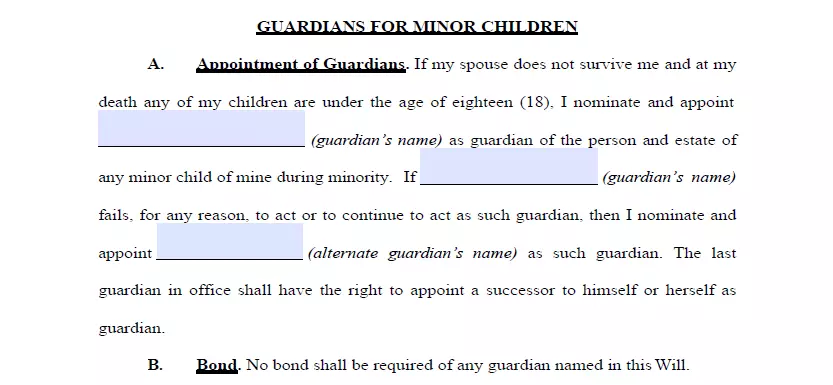

- Appoint the guardian (optional). You can specify a trusted person as a guardian in the event that you’ve got underage or dependent children that must be taken care of. In case there are no instructions regarding who should take care of your kids, the guardian will be appointed by the court.

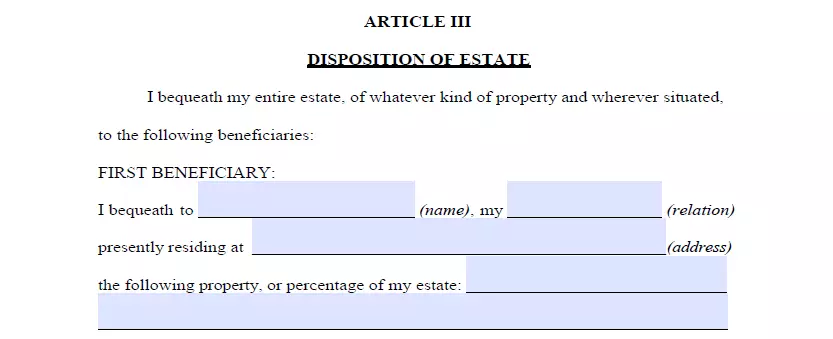

- Indicate your beneficiaries. Now specify individuals to whom you’d like to leave your property and assets, that is, your beneficiaries. Enter their full names, places of residence, and your relationship to them (spouse, child, friend).

- Allocate possessions. List your property and describe exactly how you would like to distribute it among your beneficiaries in case you’ve got something in mind other than splitting the assets equally. Cash, stocks, real estate, business ownership, money for arrearage, as well as any physical things of commercial worth that count among your possessions can be mentioned in your last will. But, joint and living will assets, as well as your life insurance, cannot be put into your last will and testament.

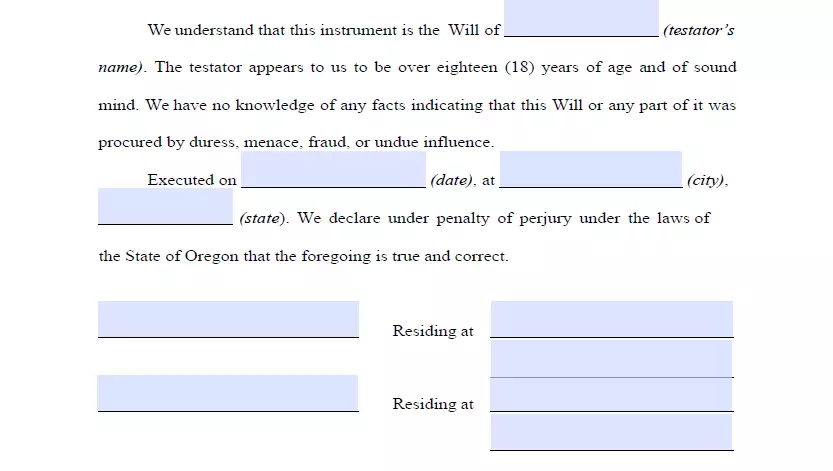

- Proceed with the witnesses signing the document. In accordance with the Oregon Revised Statutes, for any will to be legitimate, it has to be signed by two witnesses. They must be over 18 years of age and have no interest in your property; thus, they can’t be beneficiaries. Consider picking witnesses younger than you to ensure that they can be present if the will is contested in court or if some other problem arises. Now, you (and your two witnesses) have to sign the will after filling out your full legal addresses and names. Do not forget to review each section carefully prior to finalizing the matter.

Get a Free Oregon Last Will Template

Frequently Asked Questions

What is the difference between 'Power of Attorney' and 'Executor'?

The main distinction between the two documents is that as soon as you die, the representative you designate via power of attorney loses their legal authority to deal with any matters in your place.

There are two primary ones among the power of attorney varieties:

- General power of attorney – allows you to name a proxy (agent) who’ll be able to take care of your monetary and legal matters in your stead. However, this document becomes annulled if the principal passes away or becomes incapacitated.

- Durable power of attorney – grants the identical authority to the proxy as the prior type but continues to be effective even when the individual on behalf of whom the agent acts becomes disabled.

An executor is a person you establish in the will to deal with your affairs once you depart this life. It is possible to appoint one individual to act as an attorney-in-fact and a will executor.

Is last will notarization required by Oregon law?

A will in Oregon is effective without notarization. However, you’ll need a notary if you wish to make your last will self-proving by adding an affidavit to the document. In the event that you make your will self-proving, the court will not have to speak to the witnesses to ascertain the validity of the document, which is going to facilitate the probate.

When weighing attested and holographic last wills, which one is preferable?

In order to make a holographic last will, you will have to do it by hand and have it witnessed according to the state law. Take into account that this type of last will is often made when there is no other choice and is normally replaced by a more thorough document created with the help of a fillable will template or law firm. It is not encouraged to have a holographic last will as your final version since it might have unclear or inconsistent statements, resulting in a great delay in the probate.

An attested last will is a typewritten document, usually based upon a fillable form obtainable online or prepared with the aid of a law firm. To be viewed as valid, it must be signed by the testator and two trusted witnesses older than 18 in the testator’s presence, which can also be exercised in the presence of a notary public. But, the latter isn’t needed in Oregon.

What's testamentary capacity?

The testator must meet testamentary capacity prerequisites in order to make and change their last will, including being of sound mind.

There are usually two requirements to meet: age and soundness of mind. In the majority of states, you have to be over 18 years old in order to create a last will. Being of sound mind indicates that you are conscious of your estate as well as the heirs of your assets and have a full understanding of the aftereffects of your doings.

Do I have to attach a self-proving affidavit to my last will and testament in Oregon?

According to Oregon law, you do not have to add a self-proving affidavit to your will. Nonetheless, it will serve you well to include this document. In the course of probate, it can serve as an alternative for the witness testimony in court and ease the procedure.

Can you leave out your children or spouse from a last will and testament?

In Oregon, there’s no such concept as community or marital property. That means all the possessions gained or improved during the marriage do not have to be evenly distributed between each of the spouses. Taking the above-mentioned fact into account, one might assume that it is somewhat easier to divorce with such a marriage system.

Oregon law permits you to cut your spouse off the will, yet he/she will have the right to get a definite minimum amount of your property.

Regarding other members of your family, you can legally disinherit anyone else. Your adult children or any other relatives can be legally disinherited totally in your will. For doing that, include specific paragraphs to your last will and testament.

Is someone allowed to modify my last will and testament?

Only the testator can change his or her will. There is one particular situation when another person is allowed to intervene. When you are physically incapable of signing your will, a third party is permitted to do it instead of you but only with you present.

In Oregon, is it possible to adjust a typewritten will after signing it?

Yes, it can be done.

A testator is allowed to change or repeal his or her will at any time. The sole situation that will prevent you from doing it is if such action is prohibited under the contract you signed.

It can be a good idea to review your last will when a serious event takes place in your life. Those include but are not limited to:

- A child has been adopted or born

- Divorce or marriage

- You bought or sold real estate or a large piece of property

- Your financial position has changed considerably

What should I do in case my last will and testament has been lost?

Oregon law says that a will can be accepted in case it is lost or damaged. However, just the initial version of the last will may be recognized by the probate court.

Oregon law can make a supposition that the will’s absence implies it has been annulled. This puts the responsibility on the advocate of the will to give evidence of the said will.

For holographic wills, the situation may become a lot more troublesome as sworn witnesses and testimony will be demanded. The reason behind not producing the last will and its elements has to be confirmed too.

In what way does a physically challenged person sign his or her last will?

In line with the Oregon Estate Code, it will be possible for a person to sign his or her last will providing it is your (as a testator) directive and in your presence. The testator can communicate their last wishes verbally, by giving a positive answer to an inquiry, or with a gesture.

It is possible to have a notary sign the name of a testator who is physically unable to do it in case the testator guides the notary public in the presence of a witness. It is worth noting that such witnesses can’t have an interest (equitable or legal) in any properties and assets being the subject or that might be influenced by this type of a document (the last will and testament).

| Related documents | When to make one |

| Codicil | You want to make a single or several slight adjustments to your will. |

| Self-proving affidavit | You want to facilitate the probate in the future. |

| Living will | You want to state your wishes regarding the end-of-life medical care and life-prolonging procedures. |

| Living trust | You need more confidentiality and protection once the time to distribute your possessions comes. |