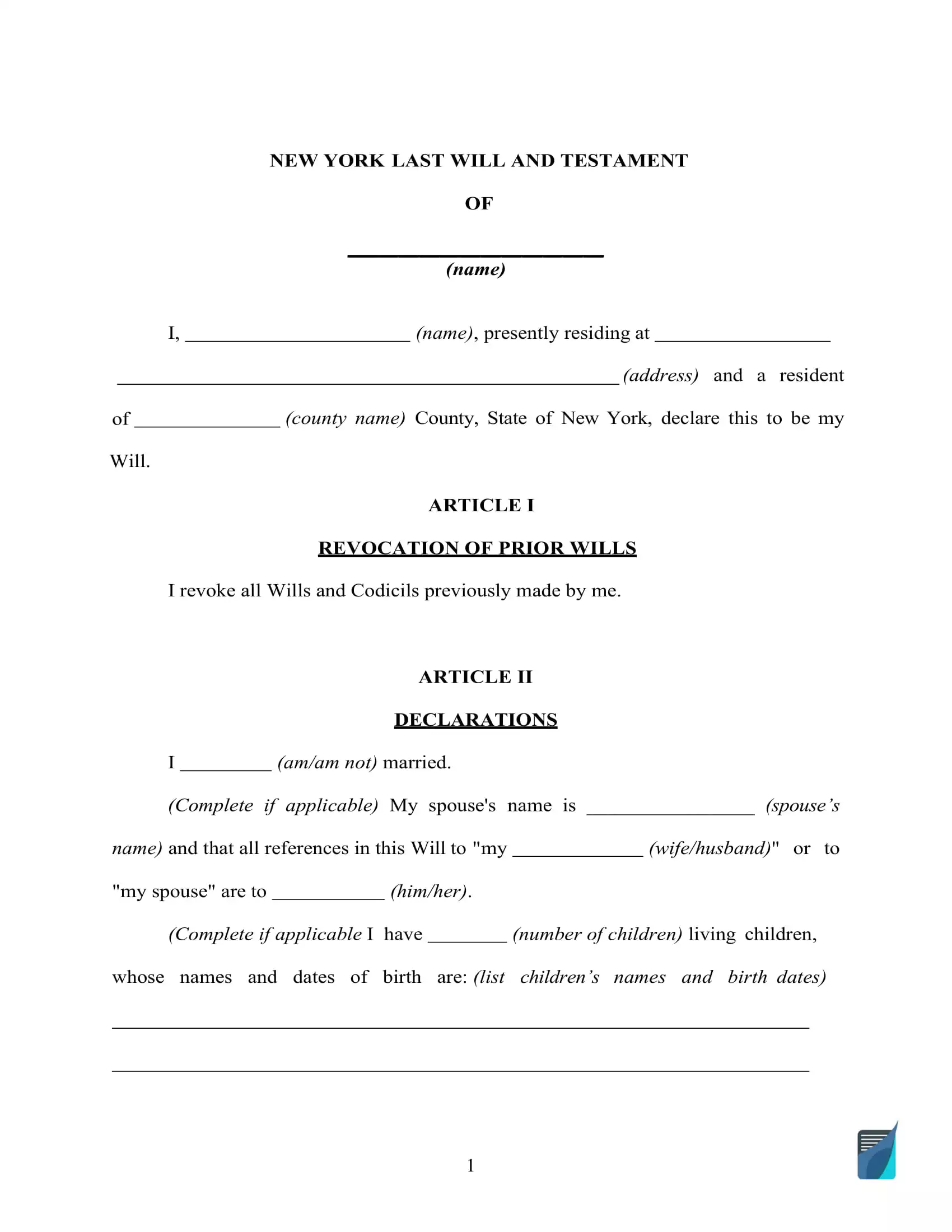

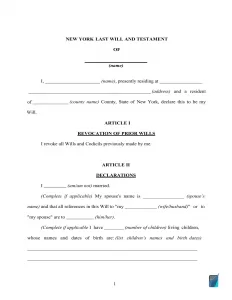

New York Last Will and Testament Form

A New York last will and testament is a powerful estate planning instrument that an individual (testator) can use to consolidate their last wishes related to their post-death estate distribution, burial arrangements, digital assets, and legal guardians.

Creating a will is often a recommended option for everyone who wants to steer clear of disputes and confusion that might arise among their relatives. Even if you haven’t got a lot of assets, this document may turn out to be fundamental to your loved ones after your passing.

In case you are in search of a fillable and printable will template for NY, you will find one below in PDF and DOCX formats, along with the guidelines on will writing and state requirements.

New York Will Requirements and Laws

| Requirements | State laws | |

| Statutes | Estates, Powers & Trusts; Article 3 – Substantive Law of Wills | |

| NY Will Definition | EPT § 1-2.19 Will | |

| Signing requirement | Two witnesses | § 3-2.1 Execution and attestation of wills; formal requirements |

| Age of testator | 18 or older | § 3-1.1 Who may make wills of, and exercise testamentary powers of |

| Age of witnesses | 18 or older | § 3-2.1 Execution and attestation of wills; formal requirements |

| Self-proving wills | Allowed | Section 1406. Proof of will by affidavit of attesting witness out of court 1 |

| Handwritten wills | Recognized if meeting certain conditions | § 3-2.1 Execution and attestation of wills; formal requirements |

| Oral wills | Recognized if meeting certain conditions | § 3-2.2 Nuncupative and holographic wills |

| Holographic wills | Recognized if meeting certain conditions | |

How to Write a Will in New York

1. Think about your options. Before getting started, you’ll want to determine if you’d like to use the assistance of an attorney or make a will on your own. The first option is recommended if you have a lot of assets and you don’t want to miss anything important. And in the event that you would like to make the will yourself, consider if a fillable template is all that you need or you’d like to try our step-by-step document builder.

2. Indicate your information (if you are the testator). Add your full name and address (the city, county, and state of residence) to establish the testator of the will. Review the details you entered and the remainder of the passage to exclude any typos or mistakes.

3. Specify the executor of your will. Appoint the executor (personal representative) of your estate and indicate their particulars: full name and place of residence, which should preferably be in the same state the testator lives in to avoid any unnecessary hassle.

Note: There are certain restrictions regarding who can be your executor, they are listed here – New York Consolidated Laws § 707.

Although not mandatory, it might be wise to choose an additional person who will be able to perform the duty of your executor in the event the first one is unwilling or incapable of carrying out your last will and testament.

4. Appoint the guardian (optional). In the event you’ve got underage or dependent children and don’t wish the court to pick a guardian for the kids when you’re no longer on this Earth, it is possible to appoint someone you know as a guardian for your children.

The requirements that potential guardians must fulfill might be different depending on the state. Typically, a legal guardian can be anybody over 18, who is not jailed, and who is of sound mind. Before selecting someone, it would be wise to consider their financial situation, location, readiness to take the duties, willingness to take care of your child if they are or might be physically impaired, and religious beliefs.

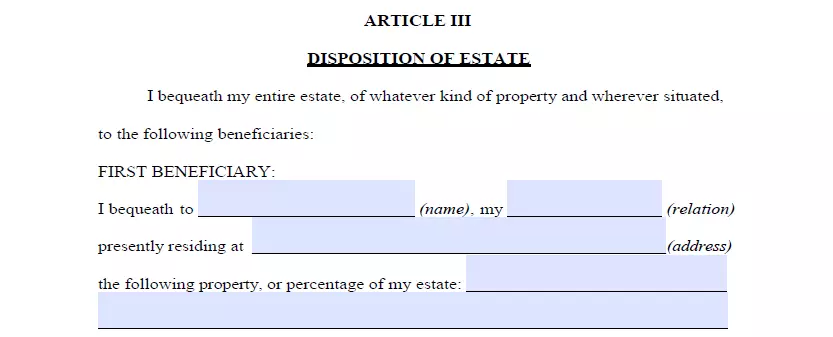

5. Indicate your beneficiaries. Now specify those people to whom you bequeath your property, that is, your beneficiaries. For each inheritor, enter the next particulars: full name, address, and the way they are related to you.

6. Allocate possessions. You can define which of the inheritors receives this or that piece of property. Otherwise, the assets will be divided equally amongst the listed beneficiaries. Assets can include money for outstanding arrears, real estate, stocks, company ownership, cash, and any tangible things of financial worth you possess. Anything that’s owned jointly or is in a living trust cannot be listed in your will.

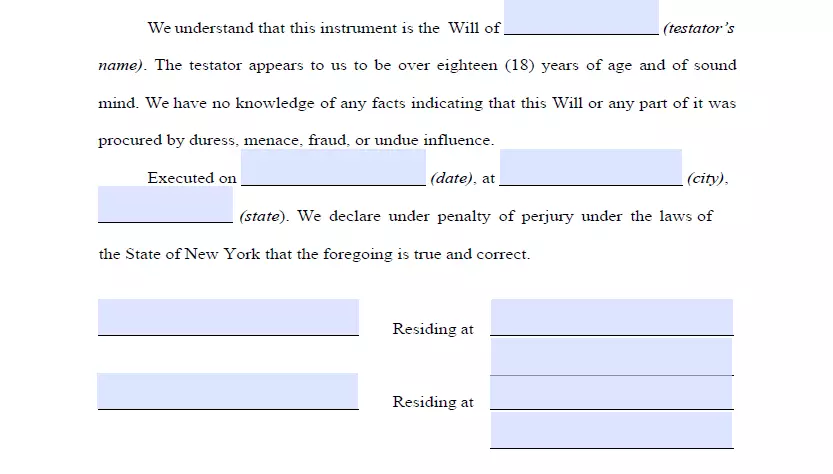

7. Ask witnesses to sign the document after you sign it yourself in their presence. According to the New York law (§ 3-2.1), one of the conditions that a will has to meet to be valid in this state is being signed by at least two witnesses. Only somebody who is of sound mind, isn’t your named beneficiary, and is of 18 years or more could be chosen as a witness.

At this point, all parties involved have to sign the will after filling in your full legal addresses (required) and names. After that, you can check every paragraph carefully to see if you haven’t forgotten to include something and ensure there are no mistakes.

Make a Last Will and Testament Valid in New York State

Frequently Asked Questions

Is will notarization required in New York?

No, it is not. A last will and testament in New York is effective without notarization.

Is a handwritten will legal in NY?

Yes, a handwritten (holographic) will can be valid in New York, but only if certain requirements are met regarding the person writing the will. Basically, only those serving in the military during war or an armed conflict. Additionally, such wills can expire after a set period of time. (For more details, see § 3-2.2 Nuncupative and holographic wills)

How can I find a will in New York State?

If you believe a person died and left a will and you are someone interested in this will (e.g., a beneficiary or a relative of the testator), to find their will, you can visit the court of the county where the will was presumably filed and request a copy of the document.

You can also try to acquire a copy of the decedent’s probate file by visiting the court clerk’s office and paying a fee.

If you are from a different area, you can phone the clerk for information, and if they can’t help you, you can hire an attorney to obtain the file for you.

Do I have to attach a self-proving affidavit to my last will in New York?

No, in New York, there isn’t such a requirement. However, including one could be rather useful given that it removes the demand for witnesses’ testimony at the time of probate, which speeds up the process substantially.

Is it possible to disinherit your spouse?

No, in New York, you cannot disinherit your spouse by excluding them from your will. If you do so, they will have the right to claim their elective share (§ 5-1.1-A) within six months from the date of issuance of letters testamentary.

What will happen a last will is lost after the testator's death?

According to New York probate law, if the original copy of the will is lost, the court will conclude that the testator intended to revoke the document. Proving otherwise can often be difficult, time-consuming, and costly but not impossible (See § 1407. Proof of lost or destroyed will).

| Related documents | When to create one |

| Codicil | You need to make one or several minor adjustments to your last will. |

| Self-proving affidavit | You would like to save time and legal fees for your will’s witnesses. |

| Living will | You want to state precisely what medical care you prefer if you cannot communicate that by yourself. |

| Living trust | You want to skip probate by putting your property in the possession of a trust. |

Last Will and Testament Forms for Other States