Virginia Promissory Note Template

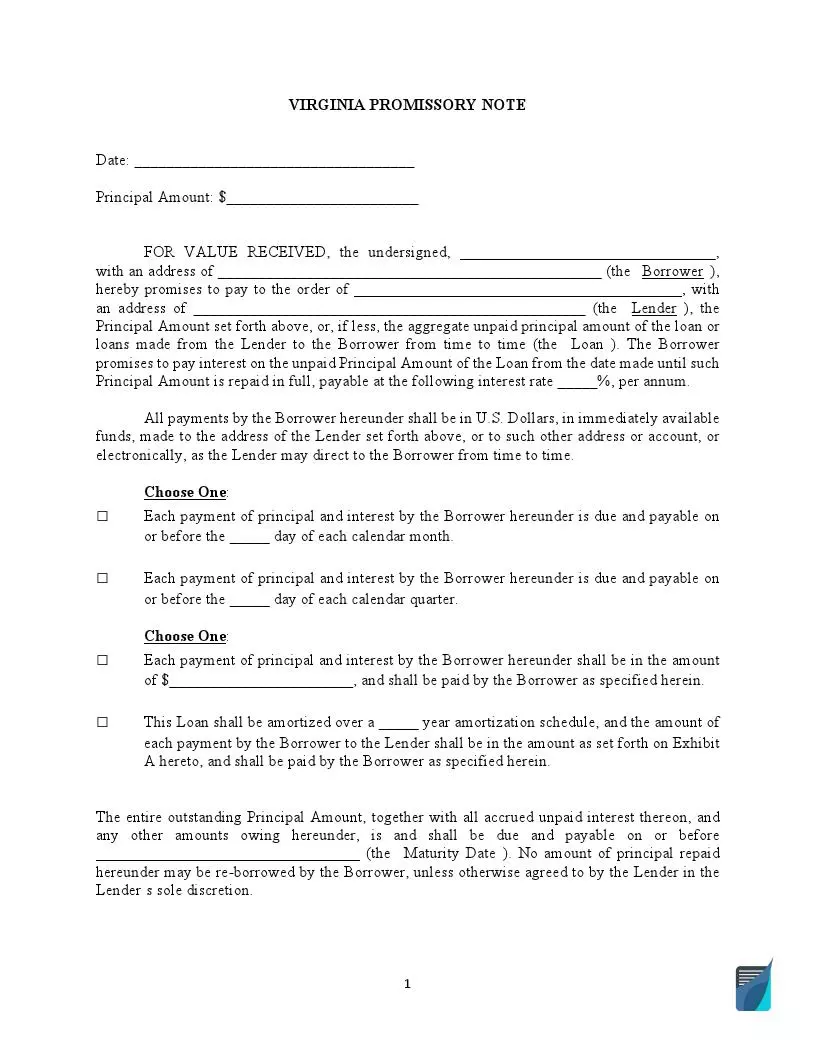

The Virginia promissory note template is a legal document completed and signed by people when borrowing money. With the promissory note template, the debtor assures the creditor that they will return the money on a specific date. If a debtor cannot or refuses to repay the money, the creditor can go to court and present the note to force the debtor to refund.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

You need to take certain things into account when completing the note. In particular, you should add the following items to the document:

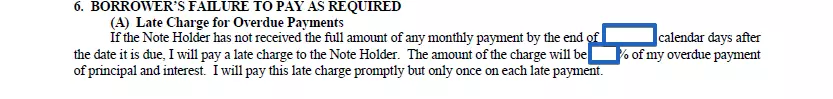

- Borrower’s and lender’s names accompanied by their signatures. In some states, only the borrowers’ signatures are required in promissory notes.

- The amount received by the debtor. You should indicate the exact amount given to the borrower in US dollars. The interest rate both parties agree on is written separately.

- Schedule of payments. The schedule has to terminate with the due date.

Promissory notes can be either secured or unsecured. With a secured note, creditors protect themselves because debtors write the items to act as collateral in case they cannot repay the money.

Unsecured notes do not propose any of such items. This type fits when you lend money to someone you trustfully.

Virginia Usury Laws

Each American state has its own legislation and regulates usury differently. In Virginia, the subject is reflected in Title 6.2 of the Code of Virginia.

The legal rate of interest in Virginia is set at 6% per year, as prescribed in Section 6.2-301. Other cases and limitations are given in Section 6.2-303.

Virginia Promissory Note Form Details

| Document Name | Virginia Promissory Note Form |

| Other Name | VA Promissory Note |

| Max. Rate | 6% – legal rate of interest; 12% – if a contract exists |

| Relevant Laws | Virginia Code, Sections 6.2-301 and 6.2-303 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes called loan agreement) is considered a useful lending document used regularly by many individuals and businesses in all states as a funds resource and an option to banks. Find out more about the most common US states searched by our website users when it comes to promissory note templates.

Filling Out the Virginia Promissory Note

To avoid wasting time when creating the note, our step-by-step guide will assist you.

- Download the Promissory Note Template

Any completion of such forms starts with getting suitable templates. You can use our form-building software to quicken the process. You should create two copies of the note: one for the lender and the other for the borrower.

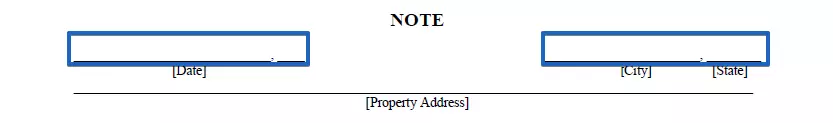

- Enter the Date and the City

You have to write the date when the document is signed on the left-hand side and the city on the right.

- Write the Given Amount

In the first line of the note’s text, you will see blank space for the borrowed amount, also called “principal amount.” Insert the sum in US dollars.

![]()

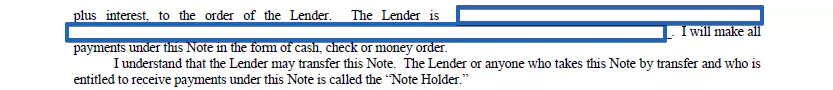

- Write the Lender’s Name

Then, you have to name the lender. Write their full name in the relevant line.

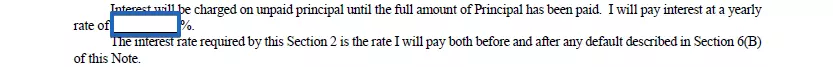

- Reveal the Interest Rate

Parties of such deals should agree on the interest rate per year. After the discussion is finished, write the rate in Section 2, called “Interest,” in the template.

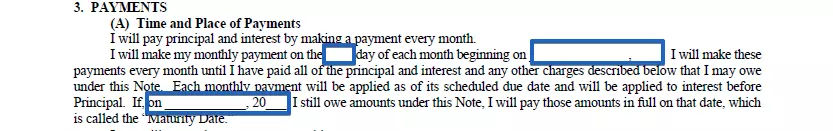

- Define a Timetable

In promissory notes, creditors and debtors normally include a detailed schedule of payments. Such schedules reveal how much the debtor should pay and when (for example, on a certain day of every month). Also, defining the due date is a must. In such agreements, this date is called the “maturity date.”

- Indicate the Penalty

If the debtor fails to refund as stated in the schedule, the creditor may apply penalties. They should be described in Section 6 of the form.

- Review the Statements

You have to read all the statements included in the promissory note, understand, and acknowledge them.

- Append Signatures to the Document

Only the borrower should sign the form. In Virginia, Notarization is not required.

Some other printable Virginia templates readily available for download and that can be customized in our hassle-free document builder.

Other Promissory Note Forms by State