Free Secured Promissory Note Template

A promissory note is a legal document of record to show the existence of a loan between a borrower and a lender. It is a contract to ensure that the borrowed money is paid back as per the terms of the note. The lender is the party providing the loan and the borrower is the person taking the loan. There are two types of promissory note templates: a secured promissory note or an unsecured promissory note.

When a loan is provided or taken, the borrower and lender usually prefer to use a secured promissory note as their loan agreement. This type of note provides the lender with some sense of security in case of an event of default. The borrower, on the other hand, with the help of a secured promissory note, can convince the lender that their money is in safe hands. A secured note also helps the borrower in negotiating for a lower interest rate as compared to an unsecured promissory note.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Secured Promissory Note?

When the borrower provides a “collateral security” in the loan agreement, which the lender can utilize if the borrower defaults, the note is called a secured promissory note. The word “secured” signifies that the money given is backed up with an asset or property of value as an extra assurance towards repayment. It gives the lender the right to forfeit the collateral if the loan is not paid back as per the repayment schedule.

However, it is critical to note that a secured promissory note is a legally binding document that can have a profound impact on the asset or property of the borrower. It must be carefully drafted and signed. A secured note is only binding on the borrower, which means that only the borrower is bound by its consequences of nonpayment in terms of forfeiture of the collateral.

If the borrower files for bankruptcy, then the lender is counted as a secured creditor and will receive priority of payment against unsecured creditors. When the borrower fails to pay back the loan as per the loan agreement, the lender does not get any automatic rights to the collateral asset or property. He or she needs to file a lawsuit to obtain legal rights to the collateral.

Security Agreement

When personal property such as a car or jewelry is used to secure the loan, then a security agreement is entered into. In a secured promissory note, such an agreement is a part of its terms. If there is a default by the borrower, the lender can file a court case based on the agreement.

Mortgage

When real property such as a house is used to secure the loan, then a “mortgage” is created on the house between the lender and the borrower. Some states also refer to it as a “deed of trust.” If there is a default by the borrower, the lender can file a foreclosure of the mortgage in court.

When to Use?

Since promissory notes are typically used for personal loans where there is an informal relationship between the parties, there should be a good reason to ask for collateral from the borrower. The most common situations when a secured promissory note is used are:

When the Buyer Does Not Have Full Funds to Purchase

When a buyer does not have full funds to purchase an item, the seller may allow the payment of the purchase price as a loan amount to be paid on a later date. However, the seller will require the buyer to provide a security in exchange. For example, Olivia wants to buy jewelry worth $10,000 for her wedding day from John’s shop, but she does not have the full amount to be paid at that moment. John loans her the purchase amount through a secured promissory note, where Olivia provides the collateral security of her car and agrees to pay back John after four months along with an interest.

When The Borrower Lacks Credibility

Even if it seems that the borrower will have enough funds to pay back the loan money as per the contract, they might not have good credibility in the market due to various reasons such as previous defaults. In such a case, to secure the payment amount, it is wise to ask for collateral to guarantee the payment.

When the Borrower is Short on Liquidity

Sometimes, a borrower might want to take a loan for personal, investment, or business purposes, but might not have enough income or salary to assure payment. However, he or she might have valuable assets inherited from parents that can be used as collateral. If the borrower defaults, the lender can regain the payments from such valuable assets.

For example, A and B are friends. A wants to borrow $100,000 from B to start a new business. This is a risky loan as A’s business may or may not make money to repay to B the borrowed money. However, A inherited her parents’ home in Dallas which has a good market value. B agrees to provide the loan to A on the condition that they secure the loan in the agreement with their inherited home.

When The Loan Amount is Too High

When the principal amount is a hefty sum of money, it is preferable to use to secured promissory note to cover the risk of huge monetary losses. In case the borrower fails to make payments in accordance with the agreed terms, the lender has a back up against the nonpayment.

From a lender’s perspective, it is preferable to always use a secured promissory note.

What Should be the Value of Collateral Asset or Property?

It only makes sense to have a secured promissory note, if the lender can recoup the losses from default through the security provided. Therefore, the value of the collateral asset or property should be equivalent to or more than the principal loan value. The current market value of the collateral should be considered. For example, if a car is used to secure the loan, then the current market value of that used car, if sold, should be considered.

What Information Should be Included?

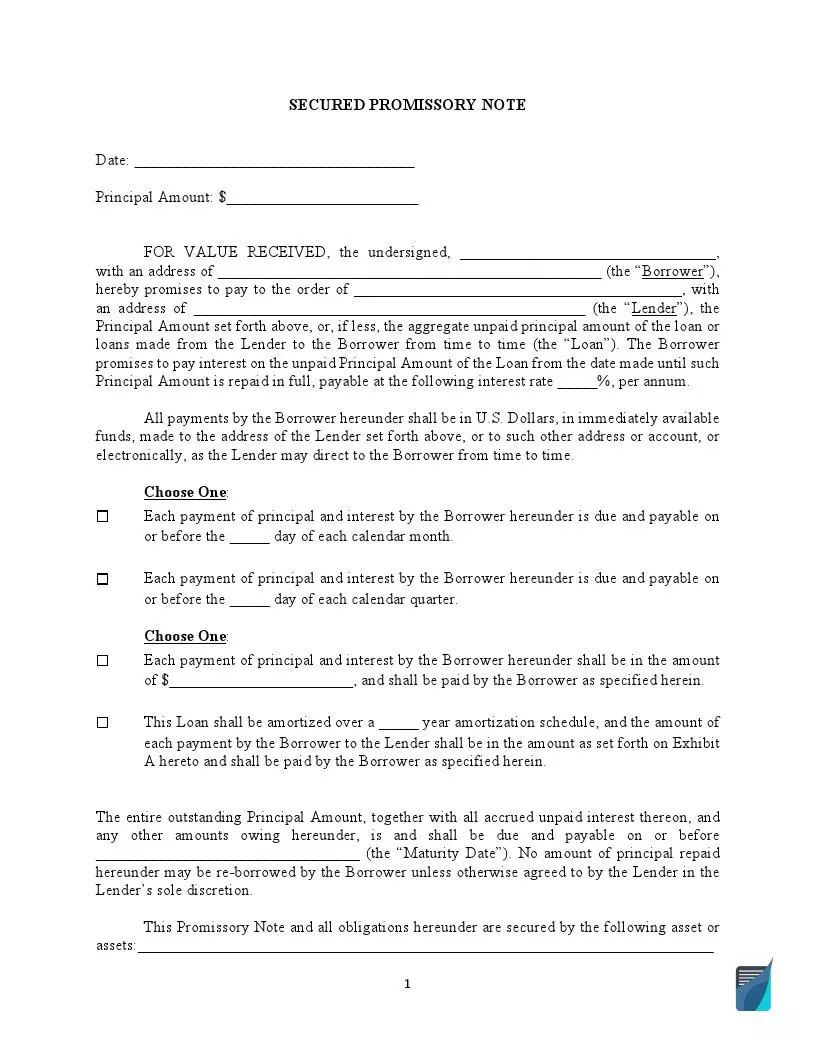

A secured promissory note should include the following details:

- Party Information: The secured promissory note should contain information about the borrower and the lender including their name and address.

- Loan Amount: The principal loan amount provided should be mentioned.

- Interest Rate: If interest is applicable, then specify the rate. Different states have different limits regarding the maximum rates that can be charged.

- Repayment Plan: Mention how and when the loan will be repaid. It can be either repaid in installment payments, lumpsum, or upon demand. Specify the due date and the maturity date.

- Collateral Details: All information related to it should be mentioned. If it is a house, mention the full address, or if it is a car, mention the name, model number, registration number.

- Governing Law: Mention the state name which will have the governing law jurisdiction.

- Date and Signature: Signatures of all the parties should be provided. The date of signing the agreement and the date from which the loan takes effect should be mentioned.

A secured promissory note should include all other important terms included in a promissory note. To see other important terms used in a promissory note, see FormsPal’s Free Promissory Note Template.

What Are The Repayment Options?

A secured promissory note can have one of the following repayment structures:

- Lumpsum Payment: When the loan is to be paid back in one single payment for both the interest and the principal, then it is called a lumpsum payment. The agreed due date of payment, also called the maturity date, should be mentioned. The exact lumpsum amount that is to be paid back should be mentioned.

- Installment Payments: The loan can also be paid back in installments over a set period of time and on specific dates, such as monthly, quarterly, or half-yearly. Mention the due date and the number of installments. Also, specify how much of the installment money is towards interest and how much is towards the principal. Parties can also choose to pay only interest in installments and the principal on the maturity date.

- Payable on Demand: When no specific date is mentioned in the promissory note and payment is to be made upon the demand of the lawyer, it is called “payable on demand.” Usually, there is a lock-in period in such notes, during which the lender cannot ask for payment.

- Amortization: In this option, payment is made in periodic installments containing both principal and loan money. An amortization schedule is prepared and attached to the note. While the amount of installment remains the same, the payments towards the interest keep on decreasing and payments towards the principal amount keep on increasing over time.

You can prepare an amortization schedule by using a free amortization calculator.

Filling Out The Secured Promissory Note

After reading and understanding the above information, you can easily fill FormsPal’s secured promissory note template by following these simple steps:

Enter key details

- On the left side of the document at the top, write the full date ( December 04, 2020).

- Mention the amount in both numbers and words. For example, $5,000 should be written as Five Thousand United States Dollars.

- Mention the full name and full address of the borrower and the lender. Include the city, state, and zip code.

Select between monthly or quarterly

- If the installment is to be made monthly, then select the first option and enter the date on which payments will be made each month. For example, you can write “25th day of each month.”

- If the installment payments are to be made quarterly, then select the first option and enter the date on which payments will be made each quarter. There are four quarters in each year and each quarter has 90-92 days. For example, you can write “85th day of each quarter.”

Select between fixed installment or amortization

- If the repayment is to be made in fixed amounts of principal and interest, then add them to calculate the total amount and select the first option.

- If the payments are to be made as per an amortization schedule, then select the second option and prepare a schedule and attach it to the agreement. Then enter the number of years over which the loan will be amortized.

Enter the maturity date and describe collateral

- Write the maturity date by which all payments under the loan agreement should be made.

- Enter all details related to the collateral. Identify the assets or property in detail, mention its location or identification number. For example, if it is a house, then write “contemporary two-story house located at 66 Avenue Street, San Francisco, CA 75205.”

Specify the governing law and sign the note

- Enter the state name whose law will govern the agreement in case of disputes.

- Enter the signatures of all the parties along with their full name.

FormsPal’s free secured promissory note template is easy to fill out and download. We also offer a convenient question-based document builder that you can you to customize the note for your needs.