Florida Promissory Note Template

The Florida promissory note template is used when individuals enter a loan agreement, with one party, typically called the “borrower” in documents, promising to repay a sum of money to the other.

The parties outline the terms, such as the amount of money lent and the consequences of not repaying the debt. A simple promissory note allows you to have an enforceable legal agreement to ensure that the money will be returned within a promised time frame in full. The lent amount is usually called the “principal” amount. The date when the payment is due is called the “maturity” date.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Having a promissory note template is beneficial for both parties, but especially for the lender. It is a binding agreement that will make the requirement to pay the money back to you unavoidable for the borrower.

The following information, among other details of the agreement, should be included in a promissory note in Florida:

- Confirmation of the promise to pay

- Details about the interest and the payments

- Consequences of failing to pay

- Possibilities of prepayment

- Borrower’s waivers

- Giving of notices

- Responsibilities of the parties.

The Florida promissory note template can be used by individuals and organizations and in a variety of loan-related situations. Certain regulations apply to the creation of such forms in Florida under the Florida Statutes. A promissory note does not normally need to be notarized.

Florida Usury Laws

According to the information included in Chapter 687 of the Florida Statutes, it is unlawful to charge any interest of more than 18% a year. If the loan is over $500,000, the rules change though. In such cases, the limit becomes higher (25%).

If you have decided what the conditions of your loan agreement will be, you can now proceed to fill out your Florida promissory note template. Use our form-building software to achieve the best results. Follow the steps outlined in the next section.

Florida Promissory Note Form Details

| Document Name | Florida Promissory Note Form |

| Other Name | FL Promissory Note |

| Max. Rate | 18% – general usury limit; 25% – if loan is over $500,000 |

| Relevant Laws | Florida Statutes, Section 687.03 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (often referred to as loan agreement) is a basic financial form used by many businesses and individuals in all states as a funding resource and an alternative to banks. Learn more about the most common states requested by our users with regards to promissory note templates.

Filling Out the Florida Promissory Note

1. Insert the Date of the Signing of the Promissory Note

The first thing you will need to include is the date of the agreement.

2. Specify the Loan Amount

Fill out this box very carefully and make sure that both parties have agreed to the exact amount that you are specifying in the form.

3. Confirm the Promise to Pay

Here, the borrower agrees to pay the principal amount to the lender (the person or organization) holding the note.

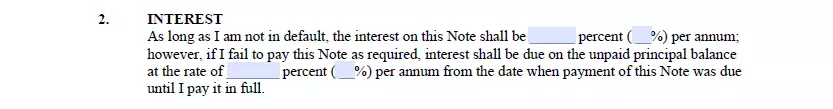

4. Specify the Interest Rate

The form includes the annual interest per year. The interest rate can change from how it is specified in the template if the borrower is late with the payment.

5. State the Maturity Date

This is the date by which the payment should be made in full.

6. Discuss the Prepayment Option

There is usually an option to do a “full prepayment,” meaning that the borrower can pay the money before the maturity date.

7. Specify the Consequences of Not Repaying the Loan as Required

This is a crucial part of the promissory note. Here, the borrower agrees to what the consequences will be if they do not repay the loan as stated earlier in the form.

8. Indicate if the Note Is Protected by Other Documents

It can be a mortgage, for example.

9. Include Borrower’s Waivers

The borrower can waive some of their rights if needed and agreed upon by the parties.

10. State How the Notices Should Be Given

Here, the borrower specifies how they want to receive notices.

11. Specify the Responsibilities of Persons Signing the Promissory Note

It can be that more than one person will be obligated to pay by the form if they sign it.

12. Check That You Have Completed All Blank Spaces

Do not sign the form if there are any blank spaces left.

13. Sign the Note

The borrower must sign the note for it to become valid.

Use our document maker to personalize any form offered on FormsPal to your needs. Here’s a group of some other printable Florida forms we provide.

Other Promissory Note Forms by State