Ohio Promissory Note Template

When it comes to money transactions between the debtor and the creditor in the state of Ohio, certain papers should be completed. If you’re one part of these transaction relations, the Ohio Promissory Note template is the document you need to complete to make your agreement valid, following Ohio state laws.

Usually, individuals complete the blank promissory note to protect themselves from possible future issues regarding money transactions. Thus, it’s essential to state all the agreement details and write down under what terms and conditions you sign the papers. Try to give as many details as possible to ensure that if something goes wrong and the other party of the agreement doesn’t fulfill its obligations, the Ohio state laws will protect both you and your money.

The Ohio Promissory Note is considered valid after the agreement’s parties (both the creditor and the debtor) sign it.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Ohio Usury Laws

In Ohio, promissory relations between the creditor and the debtor are regulated by Ohio Revised Code—Title 13—Commercial Transactions and the Ohio Uniform Commercial Code—Chapter 1343 (Interest).

Following the Ohio Revised Code, these are the requirements for promissory relations:

- The highest amount of interest rate is 8%.

- Sometimes there can be an exception to the previous statement if the credit amount is more than $100,000.

- The template comes into force only after both parties of the promissory relations sign it.

- If an individual refinances or prepays less than $75,000 of the stated mortgage bond, the other party of the agreement should charge no penalty.

- The interest rate is charged until the debtor deposits the full amount of the money mentioned in the promissory note.

Ohio Promissory Note Form Details

Document Name Ohio Promissory Note Form Other Name OH Promissory Note Max. Rate 8% – if a written contract Relevant Laws Ohio Revised Code, Section 1343.01 Avg. Time to Fill Out 10 minutes # of Fillable Fields 28 Available Formats Adobe PDF  Create a free high quality Ohio Promissory Note online now!

Create a free high quality Ohio Promissory Note online now!

Popular Local Promissory Note Forms

Should you want to lend or borrow money, think about using a promissory note. It’s a simple legal document frequently used by companies and people in all states. Here are the state-level promissory note documents our visitors read about the most.

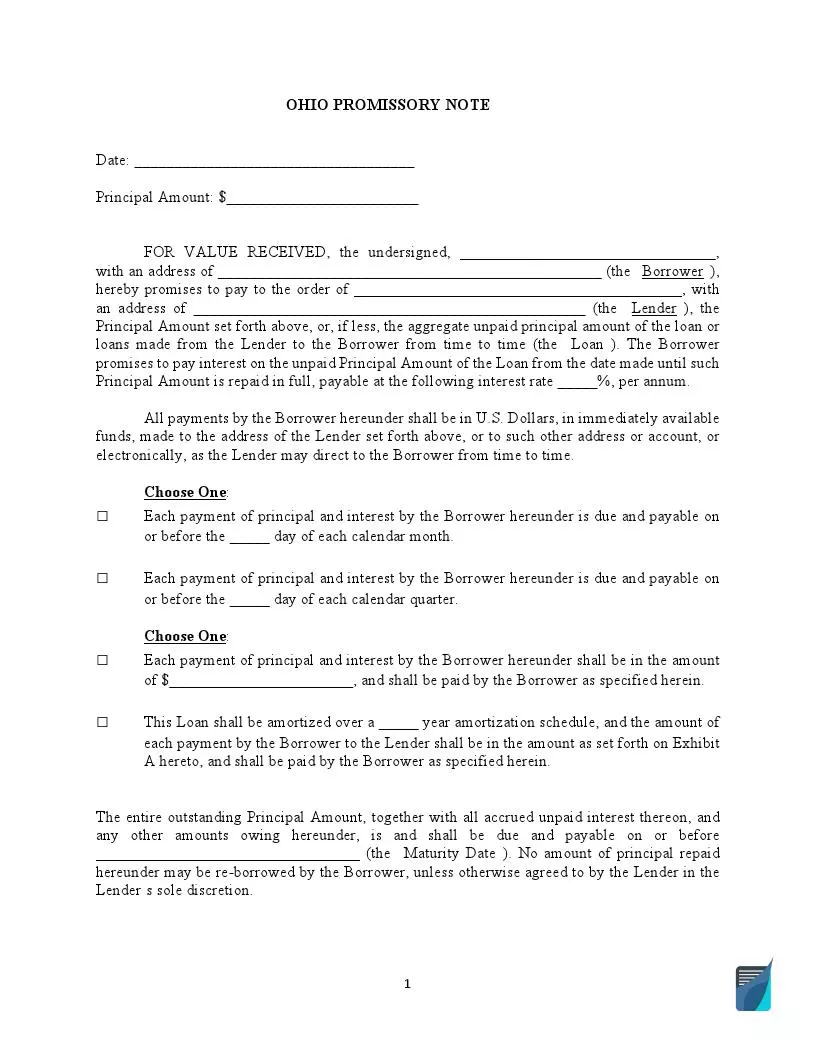

Filling Out the Ohio Promissory Note

Follow these step-by-step instructions to complete the Ohio Promissory Note by yourself. Although there exists an unsecured promissory note, we will take a closer look only at the secured form. There is one significant difference between an unsecured promissory note and a secured one: if you complete the unsecured one, and the debtor doesn’t return your money, the Ohio state laws will protect you and compensate if you appeal to the court, but the process can be tiring.

On the other hand, when you sign the secured promissory note (the one we’re analyzing now) and the debtor fails to pay you back, the creditor can take the item that the debtor puts as security.

Give Basic Information

Write down the current date, the full amount of the credit, interest rate, and creditor and debtor’s name and address.

Choose the Payment Method

Select the payment method among three options given in the note:

- Interest-only payments

- Installments

- No installments. Here, the debtor pays both the whole amount and the interest rate on the due date.

Write down the due date.

State the Interest Rate

Write down the interest rate and the conditions for charging it.

Declare Late Fees

Mention the requirements for charging the late fees. Register the dates on which the debtor has to pay them.

Give the Details on Acceleration

State the number of days after which the creditor can request the acceleration of the debtor payment after recognizing the debtor’s default.

Select the Security Item

Choose assets belonging to the debtor that will be chosen as security. This means that the creditor can take them if the debtor fails to pay the full amount of the borrowed money. Usually, houses and vehicles are considered as a security.

Sign the Papers

Write down the current date, after which the debtor, the creditor, and one witness should sign the papers and give them legal force.

Need some other Ohio templates? We offer free templates and simple personalization experience to anyone who hopes for less hassle when coping with forms.