Washington Promissory Note Template

In Washington, when two parties (the debtor and the loaner) exchange money with each other, they need to complete specific legal papers to make their agreement valid. The Washington Promissory Note template is a legal document, without which Washington state law won’t recognize relations between the two parties as legal. But when both sides of the agreement sign it, it becomes legally enforceable for each of them.

In the free blank promissory note forms, both the loaner and the debtor register details of their agreement. They create terms and conditions that suit their interests.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Washington Usury Laws

Promissory relations between a loaner and a debtor are regulated by:

- The Washington Code, Title 19—Business Regulations—Miscellaneous, Chapter 19.52—Interest—Usury, Paragraph 19.52.020—Highest rate permissible—Setup charges prescribe the main rules of completing the promissory process.

- Chapter 1.16 of the Washington Code also has the power to manage these relations.

- The Board of Governors of the Federal Reserve System states the maximum rate of interest of promissory relations in Washington.

According to these official legal documents, the main condition that makes any Washington promissory relations legitimate is its established interest rate.

The maximum interest rate possible in Washington for regulating promissory relations is 12% or 4% point above the average bill rate for 26-week treasury bills. It means the interest rate in Washington is considered legitimate while it doesn’t exceed the Washington state’s established rate of interest.

Washington Promissory Note Form Details

| Document Name | Washington Promissory Note Form |

| Other Name | WA Promissory Note |

| Max. Rate | 12% or 4% points above average bill rate for 26-week treasury bills |

| Relevant Laws | Washington Revised Code, Section 19.52.020 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

In case you want to lend or borrow money, think about signing a promissory note. It is a simple legally binding document commonly drafted by businesses and individuals in all states. Listed below are the state promissory note templates our visitors read about the most.

Filling Out the Washington Promissory Note

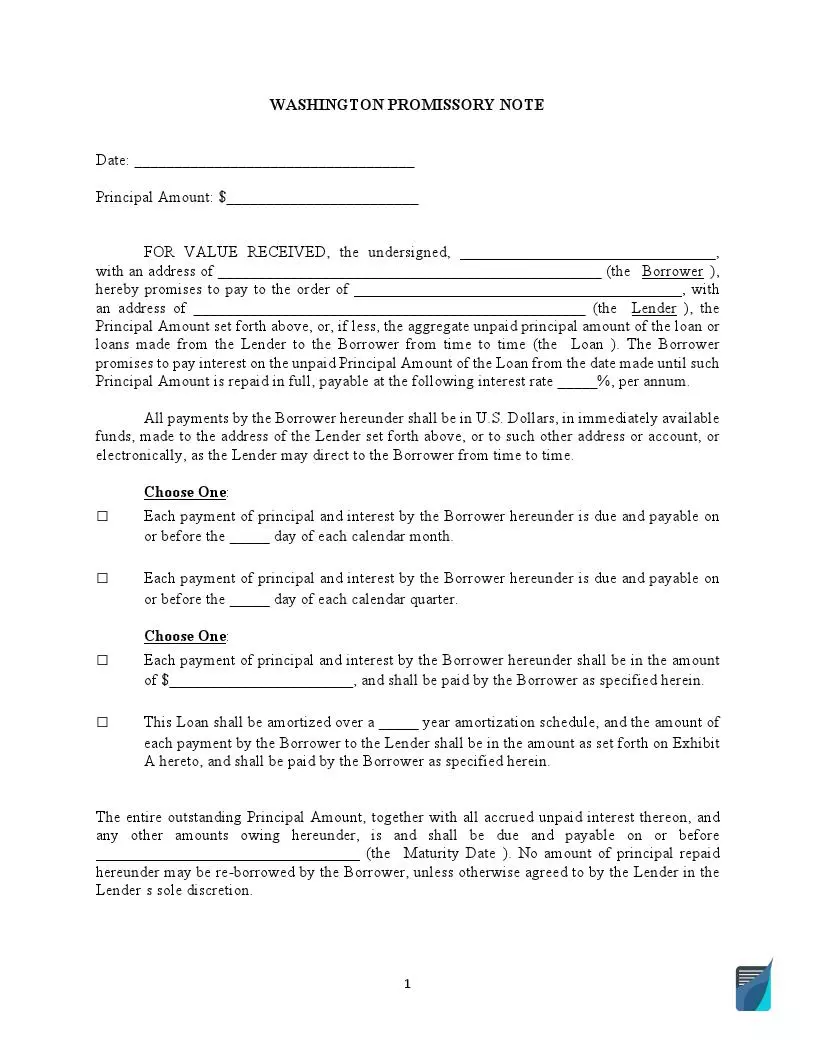

Give out Basic Information

Write down the names of both the loaner and the debtor, their addresses, the interest rate, the amount borrowed, and the date.

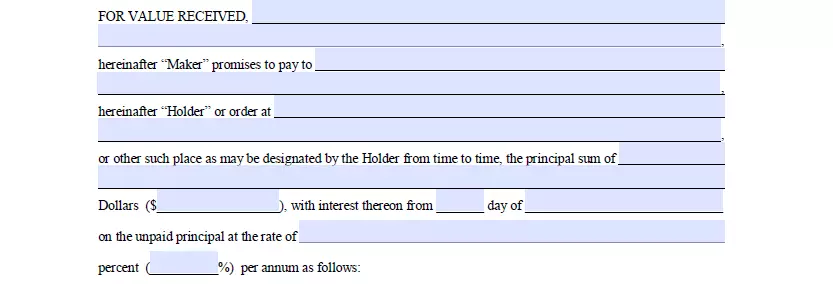

Choose the Payment Method

Choose the method of payment among the following options:

- Interest-only payments. The debtor pays only the interest rate weekly or monthly until they pay the full amount of money.

- No installments. The debtor makes a single payment to the loaner.

- Installments (write the amount of payment sum numerically). The debtor pays weekly or monthly.

State the date when the debtor has to pay the full amount borrowed.

Establish Delay Penalties and Conditions of the Acceleration

Enter conditions on which the debtor pays late fees to the loaner and mention circumstances in which the loaner can release the promissory note if the debtor pays before the due date.

Complete the Signature Area

The last section of the promissory note demands the loaner’s, debtor’s, and witnesses’ names and signatures, and the current date.

Interested in more Washington templates? We offer free forms and straightforward personalization experience to anybody who hopes for less hassle when coping with documentation.

Other Promissory Note Forms by State