Free Unsecured Promissory Note Template

A promissory note is a written promise to pay back. It is a legally binding document in which one party promises to pay back another party a specific amount of money at a later date. The person providing the loan is called the “Lender” and the person to whom the loan is given is called the “Borrower.” It acts as evidence for the existence of a debt between two parties. There are two types of promissory note templates: “Secured Promissory Note” or “Unsecured Promissory Note.”

An unsecured promissory note is one in which the loan is not backed up by any assets or property. There is no security provided to the lender against an unpaid loan. Unlike in a secured note, the lender here mainly looks at the borrower’s credibility while lending money without any security. In recent times, the practice of using unsecured notes for raising capital for business or for borrowing money has increased.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

When to Use

An unsecured promissory note is commonly used in these situations:

- When the parties know each other, unsecured promissory notes can be used.

- When the borrower is credible, the lender can opt for unsecured notes.

- When the term is short, unsecured promissory notes can be used.

- When the borrower is willing to pay a higher rate of interest for lack of collateral and the lender wants to make a great return on his money, they can use an unsecured promissory note.

Benefits and Drawbacks

Borrower’s perspective

For a borrower, an unsecured promissory note offers the following advantages:

- Ability to borrow money on a promissory note when you don’t have an adequate credit rating to obtain a commercial loan from a bank or other financial institution.

- It can be used to give some kind of assurance to friends or family who give you a personal loan.

- You can avoid creating a pledge on your property as collateral, and there will not be any interference with your enjoyment of such property.

An unsecured promissory note has the following disadvantages for a borrower:

- Unsecured promissory notes bear a higher interest rate as compared to a secured promissory note. This is because the risk to the lender is higher in an unsecured note.

- If the loan is taken in place of a commercial loan due to lack of a good credit rating, then the borrower is likely to pay a higher interest rate than applicable in a commercial loan.

- Failure to make a payment due to lack of funds will make you end up in court and legal claims will be filed against you.

Lender’s Perspective

From the perspective of a lender, an unsecured note offers the following advantages:

- The promissory note will let you charge a higher interest rate than the market rate for a secured loan. Your returns will be higher than what you can get with your money in a bank account.

- As the borrower does not have collateral to make the note secured, you are in a better bargaining position in the agreement. The borrower will have limited options to borrow money from as only a few people provide a loan without any security. You can have a better say in negotiating the terms of the agreement.

An unsecured note can have the following disadvantages for a lender:

- The risk is greater than other secured investments.

- If the borrower files for bankruptcy, secured creditors will be prioritized over you.

- If you wish to sell the note, you may have trouble finding a buyer as not many people prefer to buy unsecured promissory notes.

- If there is a default of payment, you will be required to take legal action and if the borrower does not have enough assets against which the judgment can be obtained, your Legal action will have no effect. Your loan may turn into a monetary loss.

Filling Out an Unsecured Promissory Note

You can use FormsPal’s free and easy-to-use unsecured promissory note template by following these simple steps:

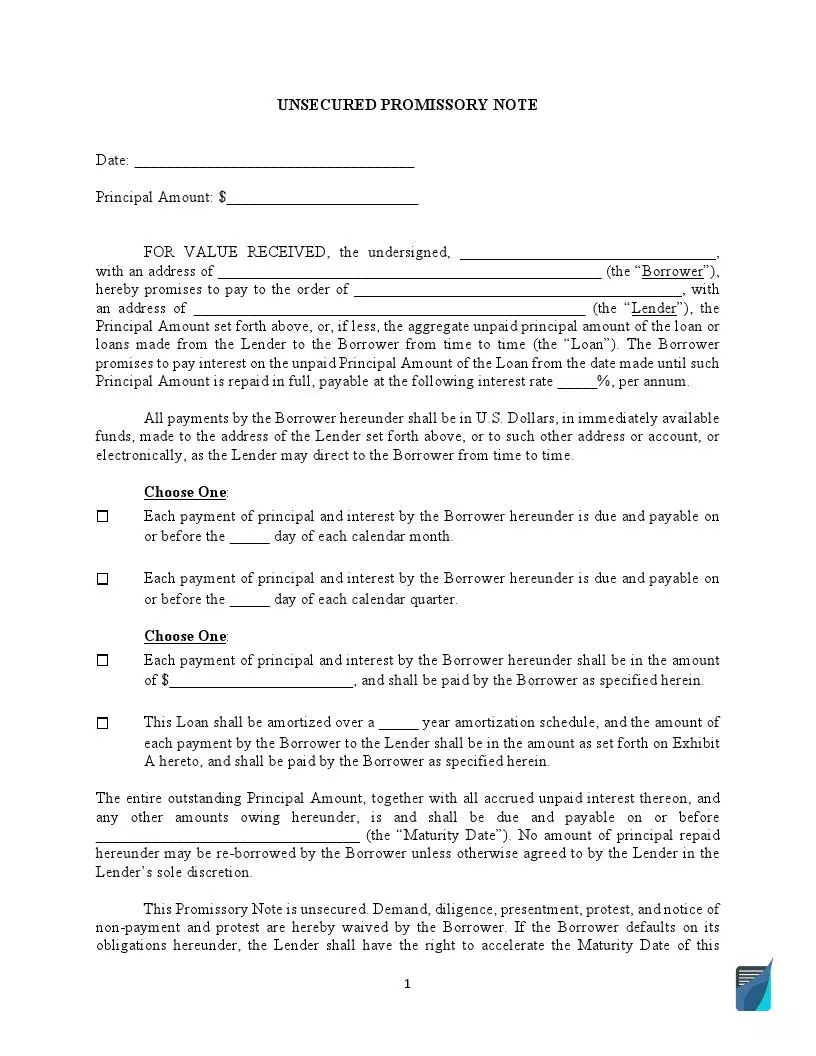

Enter major details

- Enter the date of the loan transaction on the left side at the top. Write the full date (e.g., November 20, 2020).

- Enter the principal amount of the loan in both words and numbers. For example $10,000 (Ten Thousand U.S. Dollars).

- Enter the full names and addresses of both parties including city, state, and zip code.

- Mention the interest rate applicable. It should be in accordance with the maximum state limits.

Select monthly or quarterly payment type

- If the installments are to be paid monthly, then select the first option and enter the date of the month on which installments will be paid. For example, “27th day of each month.”

- If the installments are to be paid quarterly, then select the second option and enter the date of the quarter on which installment payments will be made. Each year has four quarters and each quarter has 90-92 days.

Select payment structure

- If the payment is to be made in installments of fixed amounts, then select the first option. Calculate and enter the total installment amount after adding the interest and principal amount.

- If the loan is amortized to be paid over a number of years, then select the second option and enter the number of years. Attach the amortization schedule to the promissory note. The amortization schedule can be calculated using a free amortization calculator.

Indicate maturity date and governing law

- Enter the maturity date of the loan. All payments due must be made by this date by the borrower.

- Then, enter the state name whose code will be the governing law in case there are disputes between the parties.

Sign

All of the parties in the unsecured promissory note should sign the note clearly. A signed copy should be given to each party. The following repayment options can be used in unsecured promissory notes: Yes, unsecured promissory notes can be enforced under the law. Even if it does not have collateral security, it is still an agreement in which the borrower promised to pay back your money. It is still a legally-binding document. When a default is made by the borrower, the following actions can be taken by the lender: The noteholder can also sell his note for cash, but instead of getting the full value of the note, the noteholder will receive a discounted value. The discount will mainly depend on the borrower’s credit rating, loan amount, and rates of interest. Usually, a note buyer discounts the note 10 to 35 percent of its face value. The difference between a security and a promissory note is crucial. When a promissory note is termed security, securities law compliance can come into the picture. However, the determination of whether or not a promissory note is security is to be done after considering different factors: Therefore, the question of whether or not an unsecured promissory note is security will depend upon the purpose of acquiring or issuing the note. Unsecured notes that are issued for a term exceeding nine months to a number of different people who want to use them to make money or have some return on their investment will be considered as a security offering. Once it is clear that the promissory note is a security, it needs to follow and adhere to securities law compliances.Frequently Asked Questions

What are the Repayment Options?

Can an Unsecured Promissory Note be Enforced?

Is an Unsecured Promissory Note a Security?

After reading and understanding the above information, you can create your own Unsecured Promissory Note by using FormsPal’s free and easy-to-use unsecured promissory note template. You can also try our simple step-by-step builder for a highly personalized experience.