H.R.3200 – America’s Affordable Health Choices Act of 2009

- Bills

- Senators

- Representatives

- Votes

- Issues

- Committees

- Groups

- Start a New Group

- Advanced Options

OpenCongress will be retiring on March 1st. But don’t worry: We’re doing so for a number of good reasons. From then on, we’ll be redirecting users to the excellent GovTrack, where you can continue to monitor Congress.

America’s Affordable Health Choices Act of 2009

Browse Non-Congressional Legal Forms and PDF Forms

At OpenCongress, we are committed to providing free and accessible information to enhance community and individual understanding and empowerment. Use the links below to find fillable legal documents tailored to your needs, or view our complete selection of legal templates and fillable PDF forms.

Small Estate Affidavit

Another useful document for estate planning and distribution is a small estate affidavit. Explore the small estate affidavit forms available for you below.

Popular State Small Estate Affidavit Forms

A small estate affidavit enables a legal heir to assert inheritance rights, streamlining the probate process for estates below a specific value, which varies by state from $5,000 to $100,000. Often, you may need to attach the deceased’s (decedent’s) death certificate. Familiarizing yourself with local regulations is essential to prepare a small estate affidavit correctly. Below are some of the most sought-after small estate affidavit forms. If you reside in one of these states, review their specific requirements.

When preparing a California Small Estate Affidavit, residents of California need to adhere to specific guidelines. You must attach a death certificate to the affidavit and only file the document 40 days after the death of the individual. You must also sign the affidavit in the presence of an attorney. The total value of the estate can be up to approximately $170,000. Additionally, there are other forms that you will need to complete as part of this process.

In Illinois, you can use an Illinois Small Estate Affidavit to assert inheritance rights to personal property, provided the total value does not exceed $100,000. This affidavit does not cover real property. When filling out the form, you must also itemize the decedent’s debts and any unpaid bills.

In Texas, if someone passes away without a will, their heirs can use a Texas Small Estate Affidavit to settle the estate. This affidavit can be filed 30 days after the individual’s death and is applicable if the estate’s total value does not exceed $75,000. Additionally, the affidavit must receive approval from the probate court in the county where the person died.

Small Estate Affidavit Forms by State

Each small estate affidavit form requires information about the legal heir, their relationship to the deceased, details about the deceased, a description of their property and assets, instructions for division among heirs, and any debts and funeral expenses. However, state laws may affect how you prepare the form, including waiting periods before filing, signing requirements, and any additional documents that must be attached. We have compiled a list of the necessary small estate affidavit forms for each state below.

- Florida Small Estate Affidavit Form

- Small Estate Affidavit Georgia

- Michigan Small Estate Affidavit

- Small Estates Affidavit NY

- North Carolina Small Estate Affidavit

- Ohio Small Estate Affidavit

- Small Estate Affidavit Pennsylvania

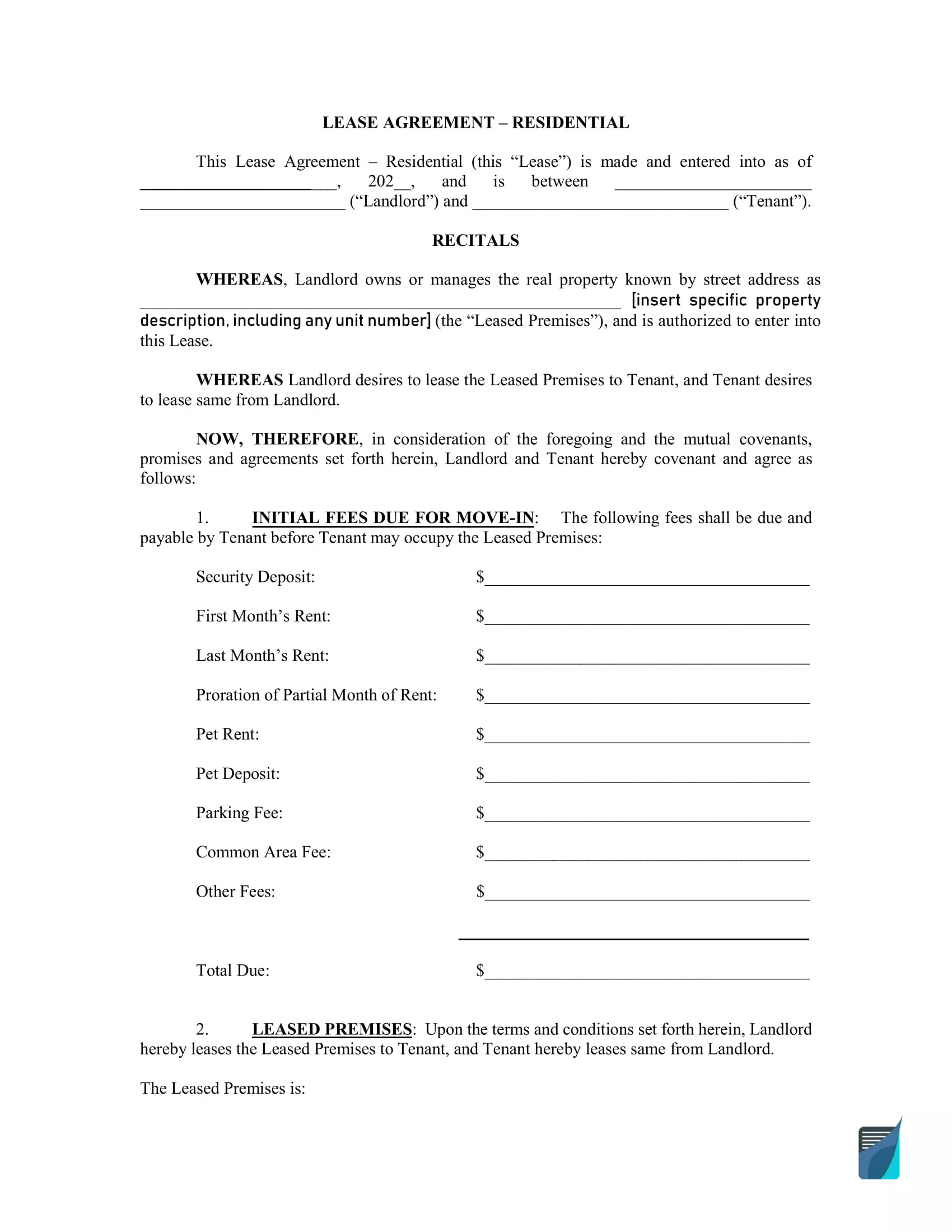

Lease Agreement Templates

An unprofessional rental agreement can lead to numerous problems, such as difficulties in evicting tenants, significant repair expenses, or other damage that could have been prevented. A proper lease agreement and real estate contract are designed to define the rights and responsibilities of all parties involved clearly. We have compiled a comprehensive list of rental agreement forms and templates below for your convenience.

The Most Widely Used Lease Agreement Templates

A lease agreement is fundamental to fostering successful relationships between landlords and tenants. It typically details all terms and policies of the tenancy comprehensively. Landlords and tenants should thoroughly review their lease agreement to ensure mutual understanding. Depending on the property being rented, there are several lease agreements, including one-page rental agreements, sublease agreements, rent-to-own agreements, room rental agreements, commercial leases, and roommate agreements. We will examine these in more detail in the sections below.

Before finalizing a lease agreement, landlords use the Rent Lease Application Form to gather more information about prospective tenants. This form often accompanies a request for the tenant’s consent to conduct a credit or background check, enabling landlords to make more informed tenant selections. Tenants, in turn, can use the rental application form to present themselves positively and stand out as favorable candidates.

When a landlord identifies an ideal tenant, they can proceed with a Simple Rental Agreement. This one-page document is specifically for residential properties and contains essential information about the tenancy, including the lease duration, rent amount, security deposit, and notice requirements. Despite its brevity, it effectively manages landlord-tenant relationships by clearly outlining all necessary details for the tenant to meet their contractual responsibilities.

When renting a property in California, landlords must include several mandatory disclosures and the California Rental Agreement. These include disclosures for lead-based paint, bedbugs, flooding risks, pest control plans, mold, and the property’s smoking policy.

A tenant can sublet the landlord’s property using a Sublease Agreement Template. This agreement is made between the tenant, also known as the sublessor, and the subtenant but must receive the landlord’s approval. Essentially, it functions as a lease within the original lease, and the tenant must adhere to the terms of the original rental agreement. A sublease agreement is useful when the tenant is unable to continue residing in the property and finds someone else to occupy it until the original lease term ends.

If you’re interested in buying a residential property but aren’t financially ready, consider a Lease to Own Agreement. This document functions primarily as a lease but includes an option to purchase the property once the lease term concludes. It should detail the earnest money deposit, the agreed-upon purchase price, and the portion of the rent that will contribute towards the purchase, in addition to the standard terms and policies of a lease agreement.

A Room Rental Agreement Template enables a homeowner or the original tenant to rent or sublet a room. This is a useful option for landlords who wish to lease individual rooms within an apartment separately. The document includes all the standard terms and provisions in a typical lease agreement.

A Roommate Agreement Template differs from a room rental agreement in that it is established between tenants sharing the same rental space without involving the landlord. Tenants use this agreement to organize their financial responsibilities and establish household rules. As a legally binding document, tenants should treat a roommate agreement seriously.

A Commercial Lease Agreement template is essential to renting out a business property. Commercial property refers to premises not used for residential purposes, such as offices, restaurants, or warehouses. Rent for commercial properties is typically calculated on a cost-per-square-foot basis. Additionally, commercial leases generally have longer durations than residential leases.

When a landlord or tenant wishes to terminate a lease before its scheduled expiration, they should use a Termination of Lease Letter to inform the other party of their decision. While landlords are not required to renew leases, they must issue a notice to vacate to the tenant. Similarly, tenants must send an intent to vacate notice if they plan to leave. Typically, the lease agreement will specify the notice requirements that the landlord and tenant must follow if they decide to end the tenancy early. Here is a sample to provide you with a clearer understanding:

State Lease Agreement Templates by Type

A lease agreement is established between a landlord and tenant once the tenant’s rental application has been approved. Please refer to the list below if you are searching for a specific lease agreement or related application forms. For your convenience, the documents are categorized by both type and state.

- California Rental Application

- California Commercial Lease

- California Month to Month Rental Agreement

- California Rent Increase Form

- Room Lease Agreement California

- California Sublease Agreement Template

- Florida Rental Application

- Florida Commercial Lease Form

- Florida Month to Month Lease

- Rental Application NY

- Sublease Agreement New York

- NC Rental Application

- Texas Rental Application Form

- Texas Commercial Lease Form

Lease Agreement Templates by State

Lease agreements define the duties and responsibilities of both landlords and tenants. State laws mandate that these agreements be documented in writing and signed by both parties. Lease terms, such as the security deposit amount, can differ across states. Many states regulate the maximum amount a landlord can charge for a deposit, often based on the monthly rent. The lease agreement templates below are crafted with all critical state-specific regulations in mind.

- Florida Lease Agreement

- Rental Agreement Georgia

- Lease Agreement Illinois

- Chicago Apartment Lease Form

- Rental Agreement Michigan

- New York Residential Lease Agreement

- Lease Agreement NC

- Ohio Residential Lease Agreement

- Rental Agreement PA

- Lease Agreement Texas

Lease Agreement Types

Renting property necessitates a precise lease agreement tailored to the type of property involved. For instance, if you plan to rent your property regularly, consider drafting a week-to-week or month-to-month rental agreement. A parking rental agreement would be appropriate if you require a space to park your car. The lease templates provided below are designed to assist both landlords and tenants.

- Garage Lease Agreement

- Photo Booth Contract

- Salon Booth Rental Agreement

- Commercial Sublease Form

- Venue Contract Template

- Wedding Venue Contract Template

- Condominium Lease Agreements

- Family Rental Agreement

- Hunting Lease Contract

- Month to Month Lease Agreement

- Parking Space Rental Agreement

- Roommate Agreement Dorm

- Short Term Lease Agreement

- Week to Week Rental Agreement

Termination Letter Templates

The list below can guide you if you need to end your tenancy earlier than planned. State laws permit early termination of leases if either the landlord or tenant provides advance notice. These notice periods differ by state, ranging from 20 to 60 days. Additionally, your specific lease agreement may outline its requirements and notification periods.

- Early Termination of Lease Letter

- California 30 Day Notice to Vacate

- 60 Day Notice to Vacate California

- Florida Lease Termination

- 30 Day Notice to Vacate Illinois

- 30 Day Notice of Termination NYC

- Ohio Notice to Vacate

- 30 Day Notice to Vacate Texas Template

Other Templates Related to Lease Agreements

The forms below are useful for landlords who need to renew a lease, inform a tenant of a rent increase, or give written consent for a sublease agreement. Each scenario requires specific documents and letters, which you can fill out and use.

Fillable Internal Revenue Service PDF Forms

You can also choose from our vast list of IRS PDF forms as a matter of convenience. The documents are customizable and can be created in minutes.

IRS Form 5498-SA

IRS Form 5558

IRS Form 5695

IRS Form 6251

IRS Form 6252

IRS Form 656-B

IRS Form 6744

IRS Form 6781

IRS Form 7004

IRS Form 706

IRS Form 709

IRS Form 720

IRS Form 7200

IRS Form 8233

IRS Form 8282

IRS Form 8283

IRS Form 8300

IRS Form 8332

IRS Form 8379

IRS Form 8396

All Bill Titles

Official: America’s Affordable Health Choices Act of 2009 as introduced.

Official: To provide affordable, quality health care for all Americans and reduce the growth in health care spending, and for other purposes. as introduced.

Popular: America’s Affordable Health Choices Act of 2009 as introduced.

Short: America’s Affordable Health Choices Act of 2009 as introduced.

Short: America’s Affordable Health Choices Act of 2009 as reported to house.

- Overview

- Actions & Votes

- News (2K) & Blogs (8K)

- Videos

Bill’s Views

Today: 62

Past Seven Days: 209

All-Time: 2,220,857

Official Bill Text

Comment on about 0 Pages

| Introduced | House Passes | Senate Passes | President Signs |

| 07/14/09 |

Sponsor

Representative

John Dingell

D-MI

Hide Co-Sponsors

Robert E. Andrews

Joe Baca

Dale E. Kildee

Carolyn B. Maloney

George Miller

Frank Pallone Jr.

Charles B. Rangel

Fortney Pete Stark

Henry A. Waxman

Committees

House Committee on Oversight and Government Reform

House Committee on Education and the Workforce

House Committee on Energy and Commerce

House Committee on Ways and Means

House Committee on the Budget

Hide Committees

Related Issue Areas

Government studies and investigations

Health

Administrative law and regulatory procedures

Administrative remedies

Advisory bodies

Border security and unlawful immigration

Child health

Consumer affairs

Dental care

Department of Health and Human Services

Disability and health-based discrimination

Drug, alcohol, tobacco use

Education of the disadvantaged

Education programs funding

Employee benefits and pensions

Employment discrimination and employee rights

Evidence and witnesses

Executive agency funding and structure

Government information and archives

Government trust funds

Health care costs and insurance

Health care coverage and access

Health care quality

Health facilities and institutions

Health information and medical records

Health personnel

Health programs administration and funding

Health technology, devices, supplies

Home and outpatient care

Income tax credits

Income tax rates

Infectious and parasitic diseases

Interest, dividends, interest rates

Long-term, rehabilitative, and terminal care

Marketing and advertising

Medicaid

Medical education

Medical research

Medicare

Mental health

Nursing

Poverty and welfare assistance

Prescription drugs

Rural conditions and development

Small business

Student aid and college costs

Tax administration and collection, taxpayers

Taxation of foreign income

Comprehensive health care

General health and health care finance matters

Fraud offenses and financial crimes

Data via Congressional Research Service

Hide Issues

OpenCongress Summary

This is the original health care bill that was marked up by three House Committees in the summer of 2009. The final version that was passed by the House is H.R. 3962.

The Senate’s health care bill can be read here: Patient Protection and Affordable Care Act

This bill it seeks to expand health care coverage to the approximately 40 million Americans who are currently uninsured by lowering the cost of health care and making the system more efficient. To that end, it includes a new government-run insurance plan (a.k.a. a public option) to compete with the private companies, a requirement that all Americans have health insurance, a prohibition on denying coverage because of pre-existing conditions and, to pay for it all, a surtax on households with an income above $350,000. A more detailed summary of the bill by the House Committee on Education and Labor can be read here (four-page .pdf).

OpenCongress bill summaries are written by OpenCongress editors and are entirely independent of Congress and the federal government. For the summary provided by Congress itself, via the Congressional Research Service, see the “Official Summary” below.

Official Summary

America’s Affordable Health Choices Act of 2009 – Sets forth provisions governing health insurance plans and issuers, including:

(1) exempting grandfathered health insurance coverage from requirements of this Act;

(2) prohibiting preexisting condition exclusions;

(3) providing for guaranteed coverage to all individuals and employers and automatic renewal of coverage;

(4) prohibiting premium variances, except for reasons of age, area, or family enrollment; and

(5) prohibiting rescission of health insurance coverage without clear and convincing evidence of fraud. Requires qualified health benefits plans to provide essential benefits. Prohibits an essential benefits package from imposing any annual or lifetime coverage limits. Lists required covered services, including hospitalization, prescription drugs, mental health services, preventive services, maternity care, and children’s dental, vision, and hearing services and equipment. Limits annual out-of-pocket expenses to $5,000 for an individual and $10,000 for a family. Establishes the Health Choices Administration as an independent agency to be headed by a Health Choices Commissioner. Establishes the Health Insurance Exchange within the Health Choices Administration in order to provide individuals and employers access to health insurance coverage choices, including a public health insurance option. Requires the Commissioner to:

(1) contract with entities to offer health benefit plans through the Exchange to eligible individuals; and

(2) establish a risk-pooling mechanism for Exchange-participating health plans. Provides for an affordability premium credit and an affordability cost-sharing credit for low-income individuals and families participating in the Exchange. Requires employers to offer health benefits coverage to employees and make specified contributions towards such coverage or make contributions to the Exchange for employees obtaining coverage through the Exchange. Exempts businesses with payrolls below $250,000 from such requirement. Amends the Internal Revenue Code to impose a tax on:

(1) an individual without coverage under a health benefits plan; and

(2) an employer that fails to satisfy health coverage participation requirements for an employee. Imposes a surtax on individual modified adjusted gross income exceeding $350,000. Amends title XVIII (Medicare) of the Social Security Act to revise provisions relating to payment, coverage, and access, including to:

(1) reduce payments to hospitals to account for excess readmissions;

(2) limit cost-sharing for Medicare Advantage beneficiaries;

(3) reduce the coverage gap under Medicare Part D (Voluntary Prescription Drug Benefit Program);

(4) provide for increased payment for primary health care services; and

(5) prohibit cost-sharing for covered preventive services. Requires the Secretary of Health and Human Services (HHS) to provide for the development of quality measures for the delivery of health care services in the United States. Establishes a Center for Comparative Effectiveness Research within the Agency for Healthcare Research and Quality, financed by a tax on accident and health insurance policies, to conduct and support health care services effectiveness research. Sets forth provisions to reduce health care fraud. Amends title XIX (Medicaid) of the Social Security Act to:

(1) expand Medicaid eligibility for low-income individuals and families;

(2) require coverage of additional preventive services; and

(3) increase payments for primary care services. Sets forth provisions relating to the health workforce, including:

(1) addressing health care workforce needs through loan repayment and training;

(2) establishing the Public Health Workforce Corps;

(3) addressing health care workforce diversity; and

(4) establishing the Advisory Committee on Health Workforce Evaluation and Assessment. Sets forth provisions to:

(1) provide for prevention and wellness activities;

(2) establish the Center for Quality Improvement;

(3) establish the position of the Assistant Secretary for Health Information;

(4) revise the 340B drug discount program (a program limiting the cost of covered outpatient drugs to certain federal grantees);

(5) establish a school-based health care program; and

(6) establish a national medical device registry.

Organizations Supporting H.R.3200

Communication Workers of America

Service Employees International Union

American Association of Retired Persons

American Federation of State, County and Municipal Employees

American Medical Association

American Counseling Association

…and 26 more. See all.

Organizations Opposing H.R.3200

National Stone, Sand, and Gravel Association

Printing Industries of America

Retail Industry Leaders Association

Society of American Florists

Independent Electrical Contractors

International Dairy Foods Association

…and 42 more. See all.

Latest Letters to Congress

H.R.3200 America’s Affordable Health Choices Act of 2009

MaryJane2nd October 02, 2013

I oppose H.R.3200 – America’s Affordable Health Choices Act of 2009, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

Mary Brewer

H.R.3200 America’s Affordable Health Choices Act of 2009

Kris1 July 09, 2012

I am writing as your constituent in the 8th Congressional district of Indiana. I am writing as your constituent in the 8th Congressional district of Indiana. I oppose H.R.3200 – America’s Affordable Health Choices Act of 2009, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

Kris Ploetz

H.R.3200 America’s Affordable Health Choices Act of 2009

sandraatkinson June 12, 2012

I am writing as your constituent in the 1st Congressional district of Florida. I oppose H.R.3200 – America’s Affordable Health Choices Act of 2009, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

sandra atkinson

Related Bills

- 1796: America’s Healthy Future Act of 2009

Introduced Oct 19, 2009

16 views

H.R. 5636: Community Mental Health and Addiction Safety Net Equity Act o…

Introduced Jun 29, 2010

11 views

Videos of H.R.3200

House proceeding 07-29-09 03 2:04:35 to 2:11:50

July 29, 2009

7 minutes

House proceeding 07-27-09 00 2:30:00 to 2:38:25

Diane Watson

(View All Videos)

July 27, 2009

8 minutes

See more videos (13 total)

Video footage of Congress made available by Metavid and by the YouTube Senate and House hubs (via GovTrack).

Interest group positions: Maplight-trans

Vote on This Bill

22% Users Support Bill

2320 in favor / 8052 opposed

Yes No

Send Your Rep a Letter

about this bill

Support

Oppose

Tracking

Track with MyOC

Share This Bill

Save to Notebook

Top-Rated Comments

“we should strive for healthcare for all americans but anything that has …”

andrea1318

“i have taken the time to read some of the comments and i’m truly amazed …”

la1401

OpenCongress

OpenCongress allows anyone to follow legislation in Congress, from bill introduction to floor vote. Learn more about issues you care about and connect with others who share similar views. OpenCongress was founded by the Participatory Politics Foundation in 2007 and operated as a joint project with the Sunlight Foundation until May 2013.

OpenCongress’ data was updated about 4 hours ago.

About OpenCongress

- User’s Guide

- Terms & Privacy

- Search

- Contact Us

- Resources

Sunlight Foundation

Founded in 2006, the Sunlight Foundation is a nonpartisan nonprofit that advocates for open government globally and uses technology to make government more accountable to all. Visit SunlightFoundation.com to learn more.

Like this project and want to discover others like it?

Join the Sunlight Foundation’s open government community to learn more.