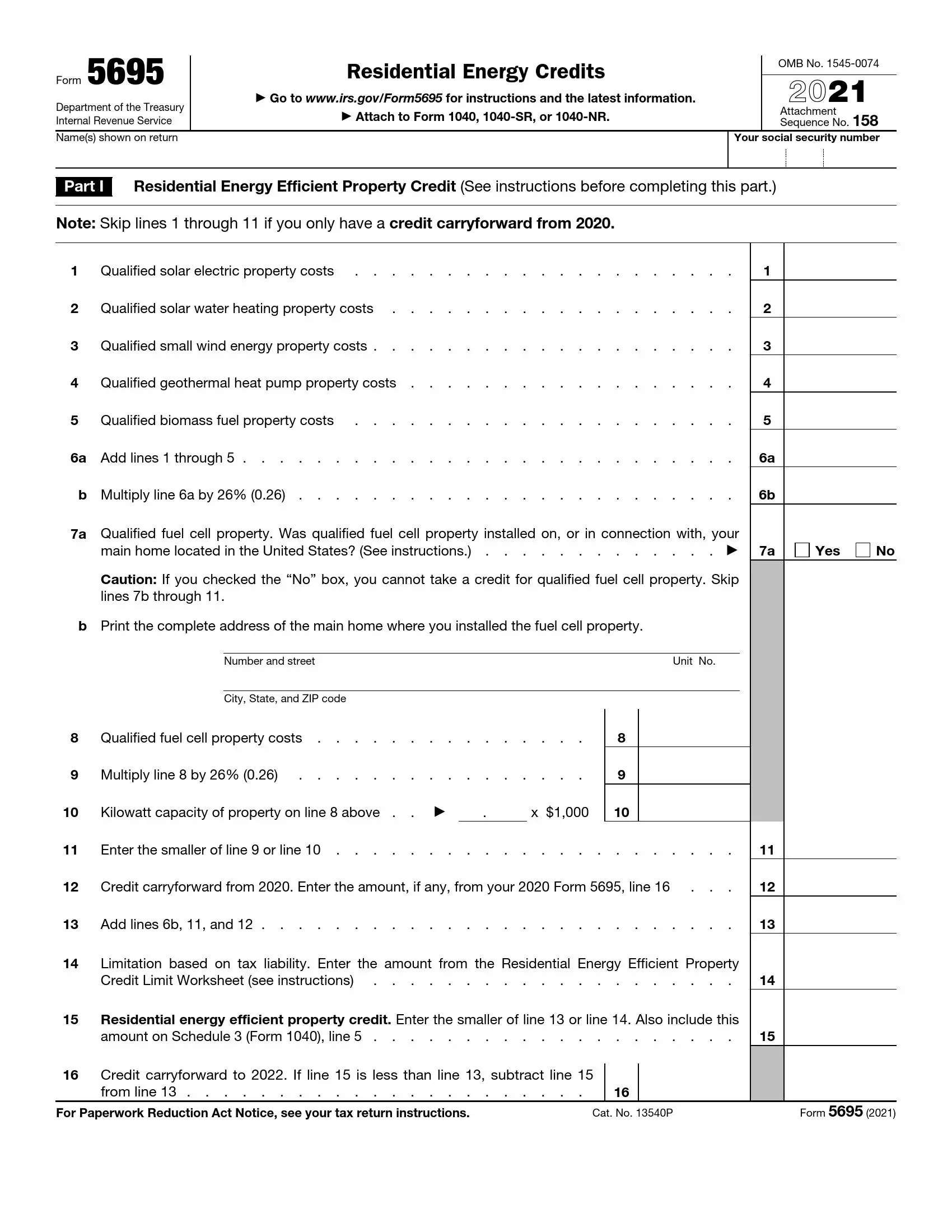

IRS Form 5695 is a United States Internal Revenue Service form used by taxpayers to claim residential energy credits. It is primarily utilized to calculate and declare the credits for energy-efficient home improvements and renewable energy installations. These improvements may include solar panels, solar water heating systems, small wind energy systems, and geothermal heat pumps, which are intended to promote environmentally friendly practices by offering financial incentives in the form of tax credits.

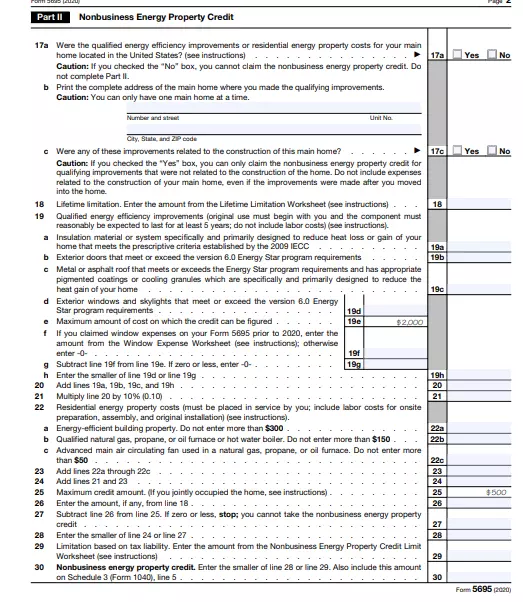

The form is divided into two parts: the Residential Energy Efficient Property Credit and the Nonbusiness Energy Property Credit. The first part relates to the costs associated with the installation of renewable energy systems in a home, including labor and any additional necessary equipment. The second part, which has been subject to phase-out rules and may not be available every tax year, pertains to energy-saving improvements such as insulation, energy-efficient exterior windows and doors, and certain types of roofs. Taxpayers who make these eligible improvements can potentially reduce their federal tax liability, supporting energy conservation and efficiency upgrades in residential settings.

How to Fill Out the Form

Any instruction is a valuable tool that ensures the correct completing of documents and explains some of the nuances. Therefore, carefully read the step-by-step guide to filling out a tax return, taking into account all the rules. Take your time, enter the exact amounts to avoid mistakes and miscalculations. In the end, remember that you are responsible for providing the data.

Include basic Information

Any tax documents request information about you. So please include your first and last name, as well as your social security number. The tax authorities verify this information and process it to identify you.

Specify data for a residential loan

The first part of the form is intended for a loan for energy-efficient residential real estate. You will need to enter the specific amounts you have spent buying or installing the above-mentioned energy-saving devices in your home. Enter these numbers in the appropriate lines. In the seventh line, specify the full address of your main house. Also, add a blank with the address of your spouse’s home.

You need to enter your credit limit based on your tax liability. As a rule, if you are unable to use the loan due to tax obligations, you can transfer the unused part of the loan to the following year.

Specify data for a non-commercial loan

The second section of this tax return is related to the credit for the non-commercial energy-efficient property. You independently determine what energy-efficient improvements you have made in your home and indicate their cost. You may receive such tax benefits and credit if your home is in the United States. Otherwise, the tax structures will reject your application. Also, you may not consider the cost of improving on the newly purchased home.

Carefully enter the number of your expenses for exterior doors, window inserts, or roofs that are certified with the energy star sign. To get credit, rely on the manufacturer’s certificate in writing that the product has a qualified energy property. It is a mandatory requirement for this form. Each line has a limit amount set, so keep this in mind.

Put a signature

After filling out this application, you must sign it. The signature confirms your consent to the processing of personal data and its accuracy. In case of any difficulties, it is better to use the support of a tax specialist. It will reduce your time and help you avoid mistakes.