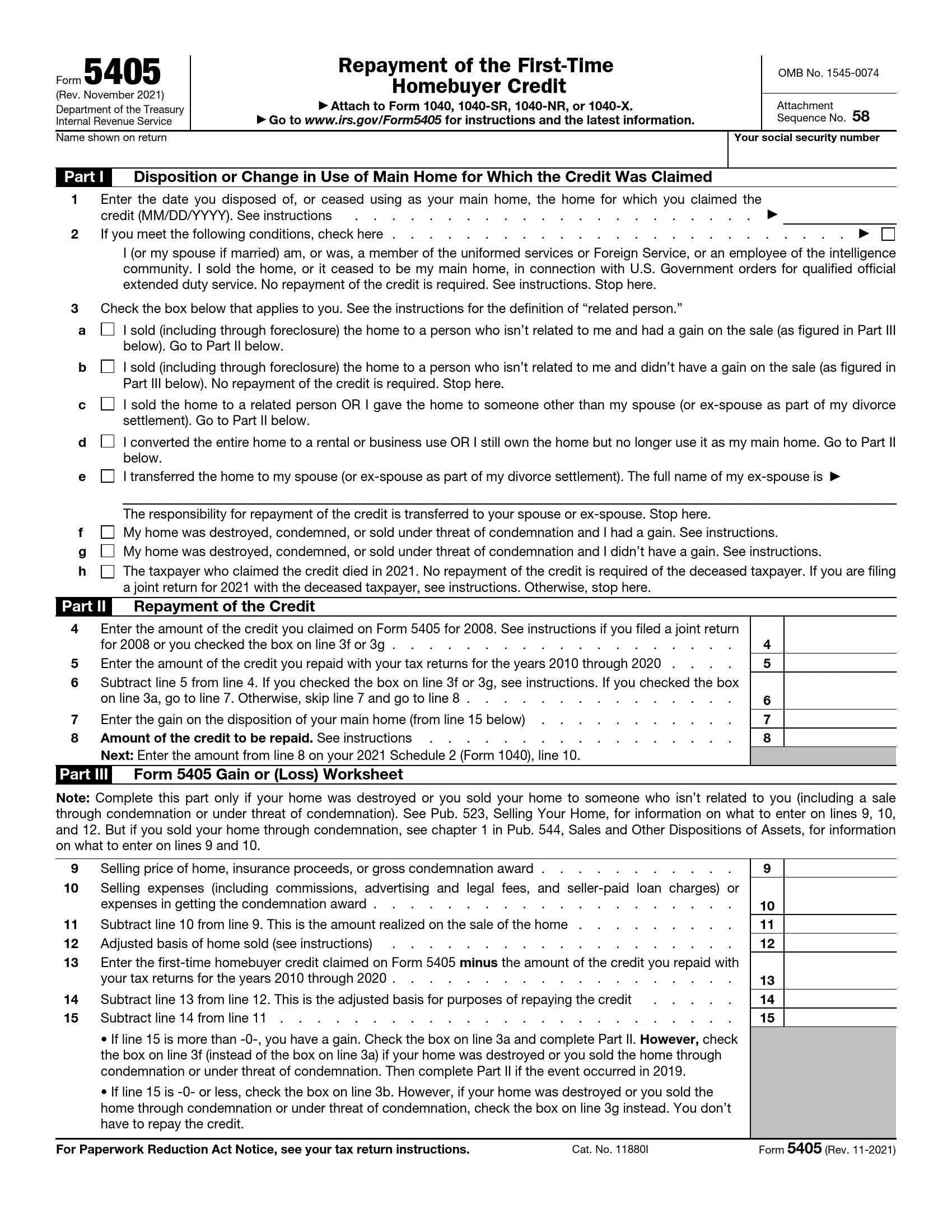

IRS Form 5405 is a tax form used in the United States to claim the First-Time Homebuyer Credit. This credit was available to individuals who purchased a qualifying home for the first time between April 9, 2008, and May 1, 2010. The form allows eligible taxpayers to claim a credit of up to $8,000 ($4,000 for married individuals filing separately) or 10% of the home’s purchase price, whichever is less.

When completing Form 5405, taxpayers must provide information about the home they purchased, including the purchase date, the purchase price, and the property’s address. They also need to calculate the amount of the credit they are eligible to claim based on the information provided. Additionally, taxpayers who claimed the credit in previous years may need to repay all or a portion of the credit if they no longer meet the eligibility requirements, such as selling the home or ceasing to use it as their primary residence within a certain timeframe.

How to Fill Out the Template

You have just one sheet to fill out, and you probably will not face any difficulties because the Service provides all guidelines regarding the calculations you have to make. But sometimes, people may have a lack of data or knowledge to create such forms, and it is absolutely normal.

We insist that you ask for professional assistance if you are unsure about some data. It is much better than getting fines and penalties from the Service in the future. It does not matter if you hire an expert or try filing the template by yourself. In any case, one should prepare all relevant documents (contracts with lenders, receipts, bank papers, previous tax returns, and so on) because you or the form preparer will surely need them.

It is necessary to check whether your template is current and accurate prior to the form completion. If you do not have any, you can switch to the Service’s site and seek it there; but we have a better solution. Use our smart form-building software to generate any template you are looking for, IRS Form 5405 included.

When the template is received, see the steps you need to accomplish to finish working on the form.

1. Enter Your Name and SSN

Under the heading, as it is usually required in the Service’s forms, write your full name on the left and your social security number (or SSN) on the right.

2. Explain the Changes to Your Main Home Usage

You have to explain what happened: why you have disposed of the home or stopped living there (or using it as a primary domicile). You do not have to invent anything because all possible options that the Service accepts are enumerated here.

Firstly, enter the date when things changed (when you either disposed of your home or stopped living there permanently).

Read the statements provided in line 2. If you recognize your situation in these statements, check the box and stop completing the form. You do not need to reimburse the credit: read the Service instructions to get more details.

In the third question, you will see points describing various cases that happen with people’s homes. You have to select the one applicable to you.

Among these points are selling to different categories of buyers, transforming the home to an office or any other business space, transferring the home to your ex-spouse (if this is the case, add their name, too). The other two points state that the house was destroyed or the taxpayer who has asked for the credit passed away.

In case of the taxpayer’s death, you need to continue working on the form only if you send a joint tax return with them. Read the Service’s guide to understand further procedures. Otherwise, there is no need to complete the template.

3. Define the Repayment Terms

You need to work with various numbers in the second part. In every line, you have to insert certain sums. Write the sum you asked for, then define how much you have already reimbursed, do the math as written in the template, and check the Service’s instructions to determine how much you have to pay after all.

4. Complete Part III (If Applicable)

You should complete this block only if your home were either ruined or sold to somebody who is not related to you (the Service defines relationships between parties in its guide).

Again, you will have to add several numbers here, starting with the home’s selling price and selling costs. Count the numbers as provided near each line and insert the results. Read additional instructions below and define if you need to repay or not.

Typically, taxpayers attach their 5405 form to their tax returns. However, the Service updates the rules for some forms every year, so it is better to check the deadlines and current submission methods on the official site.