IRS Form 5498-SA is a tax document used to report contributions to an individual’s Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. The trustee or custodian of the health savings account sends this form to both the IRS and the account holder.

The main purpose of Form 5498-SA is to inform the IRS of the total contributions made to the account during the year, which can affect the account holder’s deductions and tax liability. It also reports the account’s fair market value as of the end of the year. This information is crucial for taxpayers to complete their tax returns accurately, particularly for claiming deductions related to contributions made to their health savings accounts.

How to Read This Form

So, you will receive a completed form, and you do not need to add anything to it. Nevertheless, we will tell you what information is reflected in this paper.

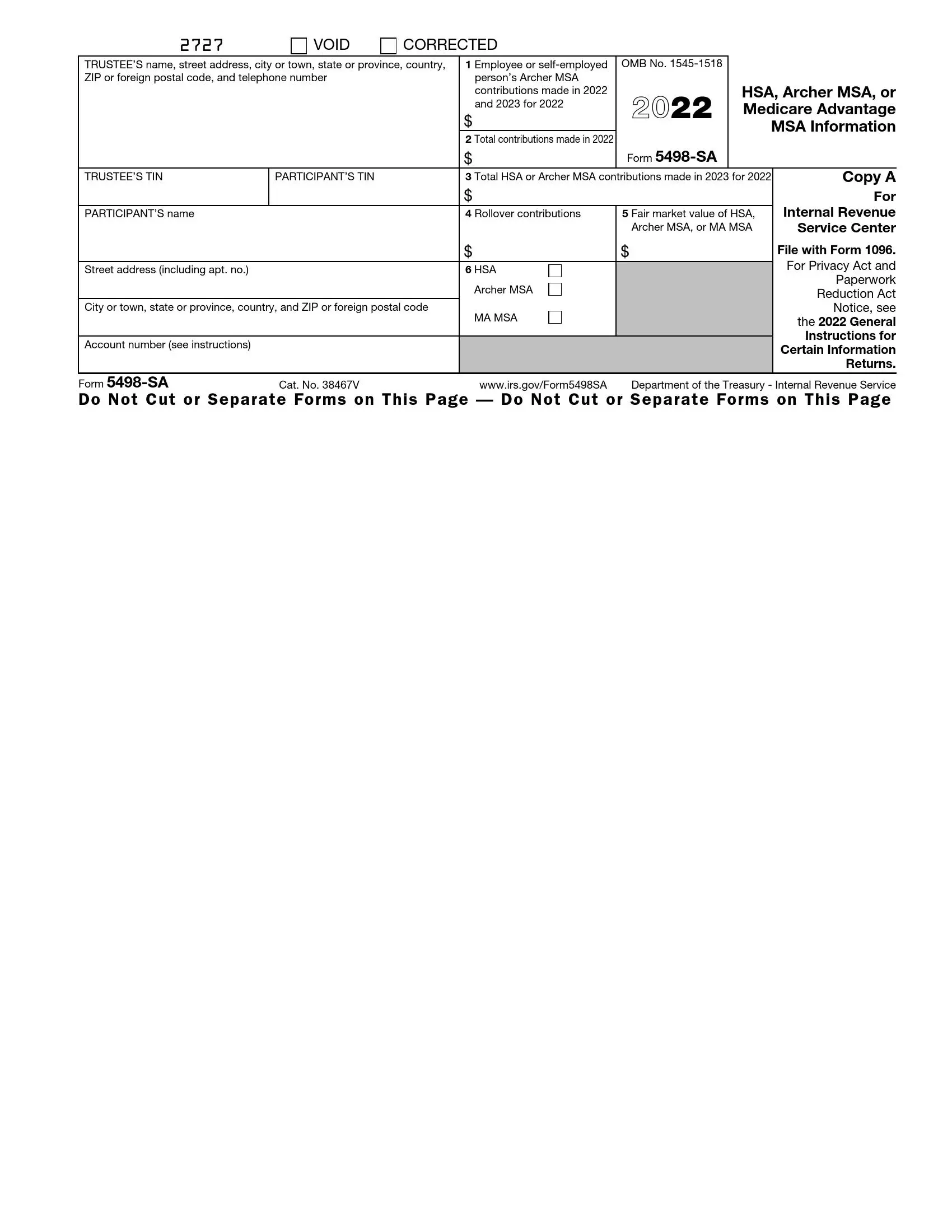

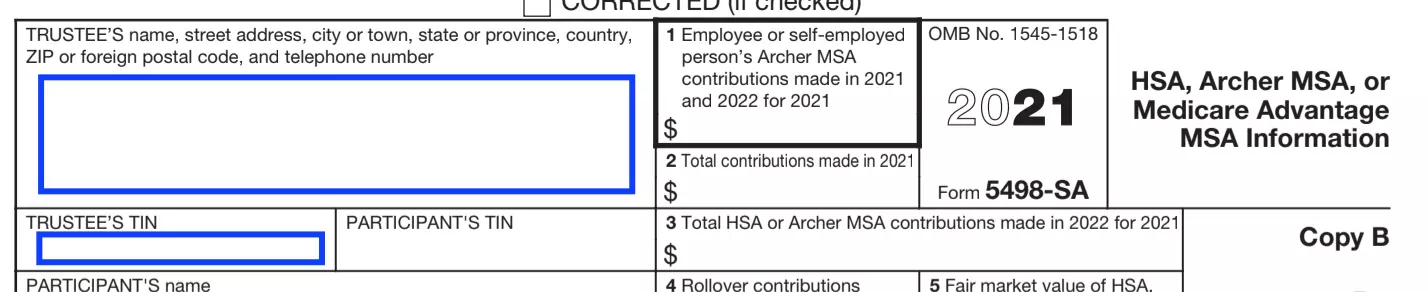

The form consists of three copies, each of which is sent to its addressee:

- Copy A is provided to the IRS Center

- Copy B is sent to you

- Copy C remains with the Trustee for internal reporting

- Let’s consider Copy B more attentively

Trustee Data

In the upper left corner, you will find information about the Trustee who generated this document:

- Full name

- Address

- Telephone number

- TIN

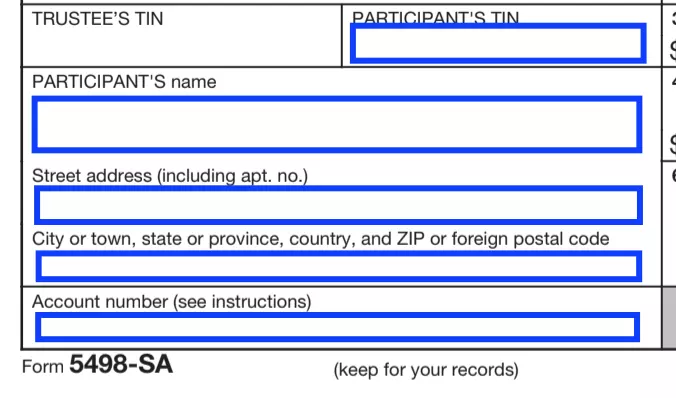

Your Data

Next, you will see your data:

- TIN

- Name

- Address

- Account number

Please check carefully that you have received the correct form, completed in your name. We also draw your attention to the fact that you will receive a separate form for each of your accounts (if you have several ones).

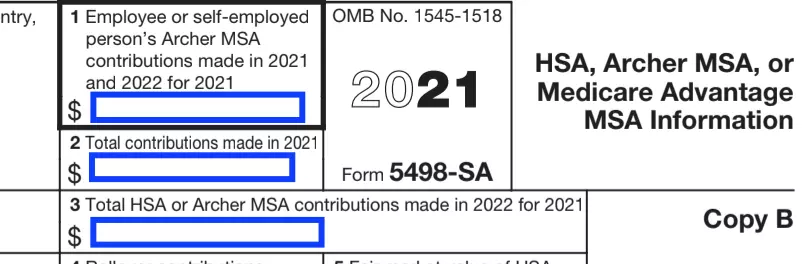

Boxes 1-3

These sections contain different amounts of contributions, namely:

- Archer MSA contributions made for 2021

- Total contributions in 2021

- Total HSA or Archer MSA contributions made in 2022 for 2021

You need the information in Box 2 and 3 just for review, but you can probably use the data from Box 1 when filling out Forms 1040 or 1040-SR.

Boxes 4 and 5

In Box 5, you will see the fair market value of your accounts in 2021.

Box 4 will give you information if there were any rollover contributions. It is important to note that these amounts are not included in the first 3 Boxes.

The Type of the Account

Since a separate form must be filled out for each account, in Box 6, there will be a checkmark next to the appropriate type.

Do not lose your Form. Although you do not need to attach it to the rest of your tax return documents, you should keep the document in a safe place. Some forms require you to indicate the information provided in it.