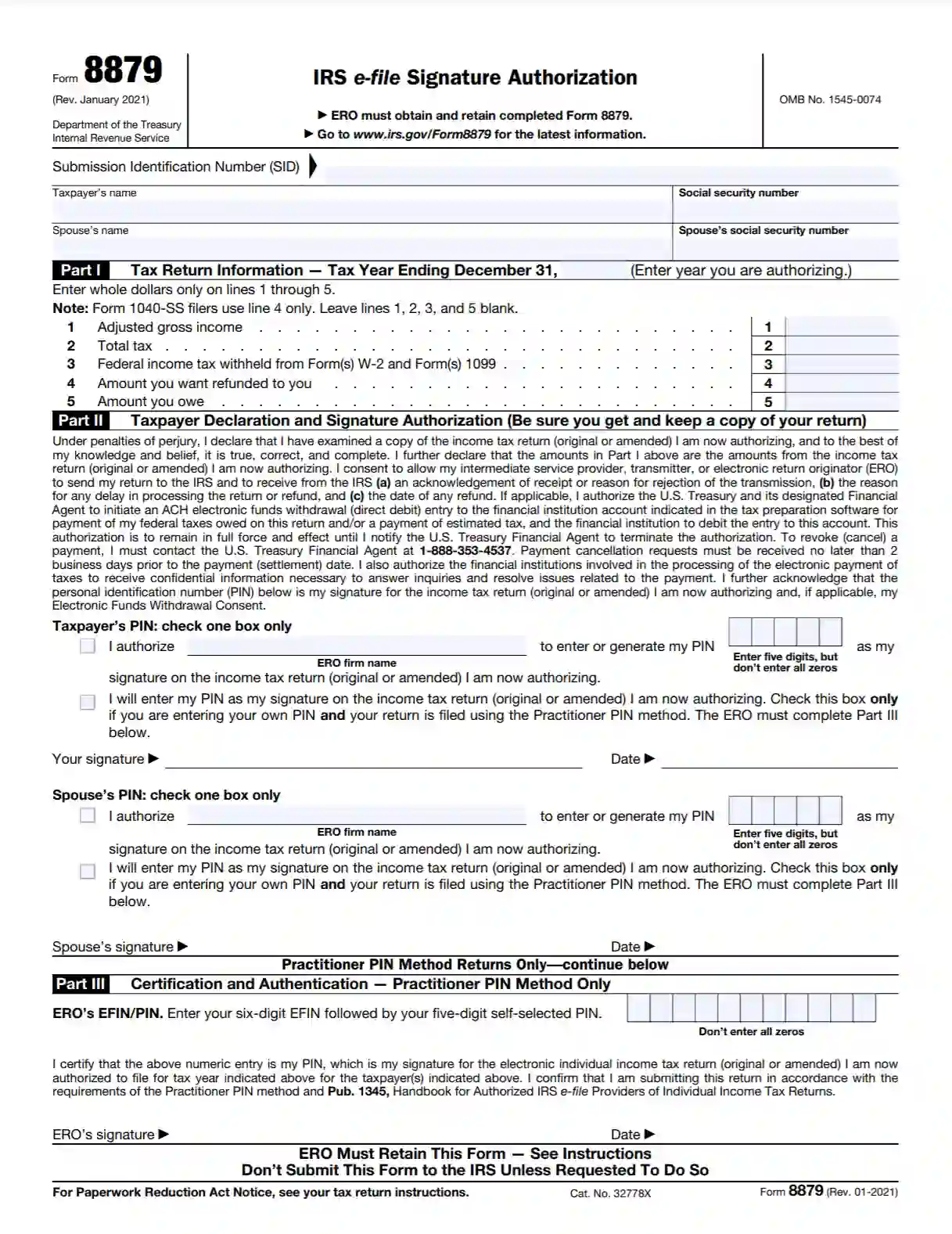

IRS Form 8879, titled “IRS e-file Signature Authorization,” is a form used to authorize an electronic return originator (ERO) to enter the taxpayers’ PINs on individual income tax returns filed electronically. The form states that the taxpayer has reviewed the return, the numbers are accurate, and the ERO can electronically submit the return to the IRS on their behalf. Form 8879 is necessary when the taxpayer chooses not to select their personal identification number (PIN) directly but instead agrees to the ERO entering it to e-file the return.

Form 8879 ensures that the taxpayer officially authorizes the tax return before it is electronically filed. This form provides a secure method for taxpayers to verify that their tax return information is correct and authorize the electronic submission process.

Other IRS Forms

If the information on this page isn’t what you’re looking for, go through some other IRS forms to see if there’s anything that fits your needs.

Form 8879 Completing Process

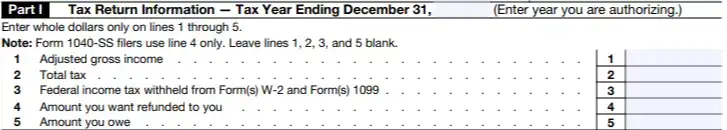

The Form is divided into three parts devoted to different aspects. The first part requires Tax Return Information and includes completing the adjusted gross income, the total tax, refund, and amount owed. In the second part, you can find the lines for Taxpayer Declaration and Signature Authorization. It also includes the individual’s signature and personal identification number, EGO entity’s name and signature, and refund. Then you should choose the PIN method, confirm the PIN, and put your signatures at the end of the page. You need to make sure that all parts of Form 8879 are completed and dated before you put your signature on the bottom. Now let’s move to the completing process itself.

Here are the step-by-step guidelines for the electronic return originator:

1. Firstly, EGO has to fill out the name and SSN of the client in the empty fields at the beginning of the Form. If the person is married, then you need to provide the same data about the spouse and write it on line number 3.

2. Rewrite the information from the taxpayer’s tax return to the first section. Filling this form in 2021, you should also enter the year that you are authorizing on the first line (previously, 2019 was automatically written there). Be careful and note that those who are using Form 1040-SS should enter the fourth line only and leave the other ones blank.

3. The next part is devoted to the taxpayer’s PIN, which the electronic return originator has to enter or generate in the special boxes.

4. Complete the name of the ERO firm on the line, keeping in mind that it cannot match the name of the taxpayer. This is accurate in the situations when this firm is authorized to fill out the client’s personal identification number into the Form.

5. Then you must deliver the document to the taxpayer personally or via email, fax, private delivery service, etc.