IRS Form 5498 is a tax document used to report contributions made to Individual Retirement Arrangements (IRAs), including traditional, Roth, SEP, and SIMPLE IRAs and certain types of retirement accounts. It is typically issued by financial institutions, such as banks, brokerage firms, or mutual fund companies, to account holders who have made contributions to their IRA accounts during the tax year. The form provides important information to both taxpayers and the Internal Revenue Service (IRS) regarding the amount of contributions made to their retirement accounts, which may be eligible for tax benefits:

- The taxpayer’s name, address, and Social Security number (SSN),

- Details about the IRA account, including the type of IRA (traditional, Roth, SEP, SIMPLE) and the account number,

- The total amount of contributions made to the IRA during the tax year,

- And any rollover contributions or conversions made to the IRA.

Financial institutions help taxpayers accurately report their IRA contributions on their federal income tax returns by issuing Form 5498.

Other IRS Forms

The Internal Revenue Service gathers crucial information about various types of taxpayers using IRS forms. Make sure you’re familiar with all of the paperwork that can apply to your case.

How to Fill Out Form 5498

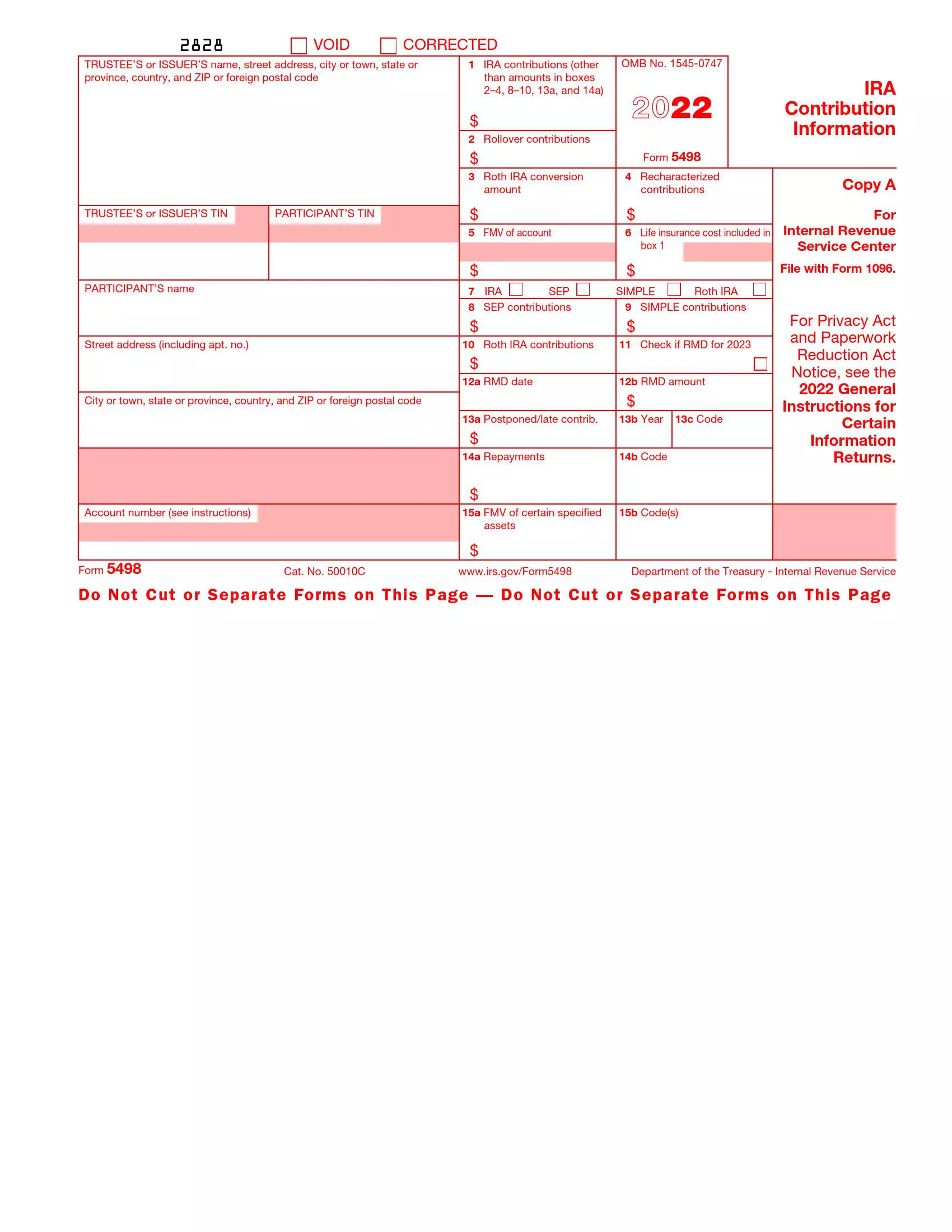

Your assigned trustee shall obtain the relevant Form template first. Usually, the responsible institution obtains the form template from the IRS directly and then sends one respective copy to the IRA participant for further record. As we have already mentioned above, the form template available on the IRS official website is only designed for information purposes (provided in red color).

Below, we have compiled a comprehensive guide on filling out the form. Ensure to follow it step by step to avoid any misunderstandings and to calculate the respective amounts accurately.

Read the Instructions for the Trustee

There are short instructions for the trustee provided at the end of the form. We strongly advise you to read these instructions before you proceed to fill out the form.

Check if the Form is Void or Corrected

As we have mentioned above, Copy A is only meant for the specialists to fill out and appears on the official website in red ink. Other copies are for the participant’s record. If you notice any mistakes in the official form, you can make corrections or ask the trustee to make amends. For either of these cases, check the “Void” or “Corrected” box at the top of the form.

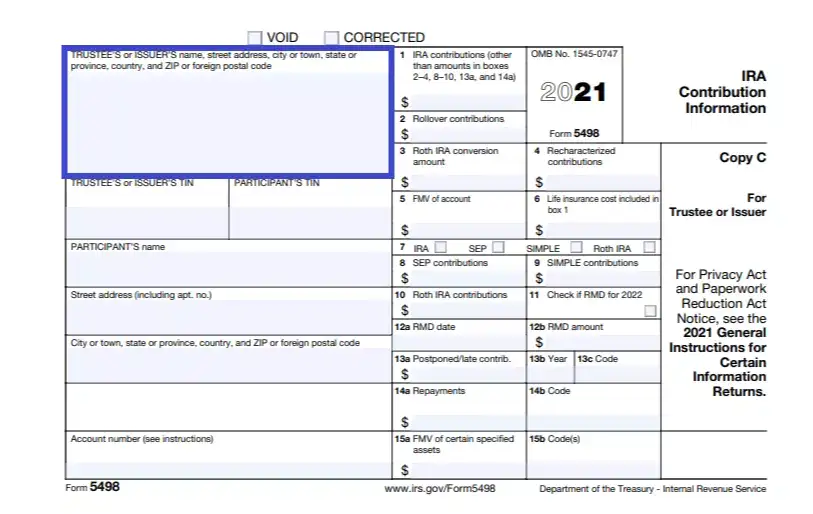

Enter the Trustee’s Personal Data

Enter the full legal name and physical (current mailing) address of the person issuing the record. The trustee acting on behalf of the participant must provide accurate contact info, including the state, city, ZIP (of FPO), street, building, and apartment number.

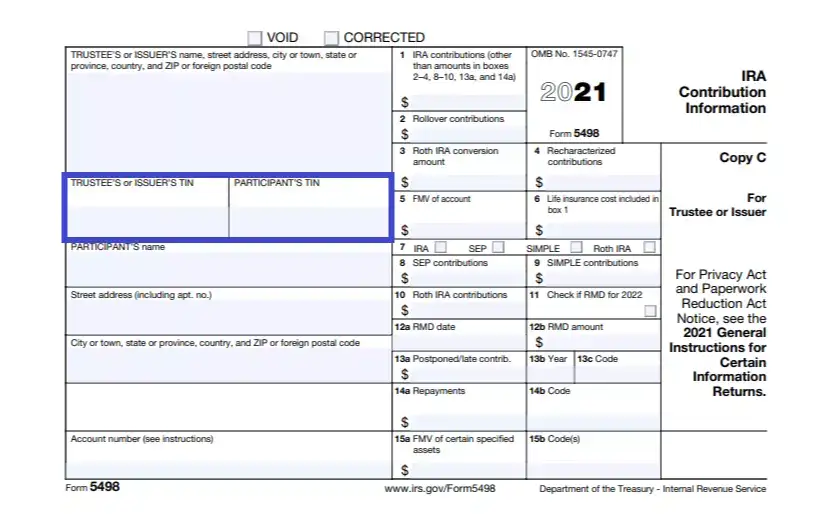

Provide the TIN of the Participant and the Trustee

In the following two boxes, you must enter the TIN of both the form issuer and the retirement program participant.

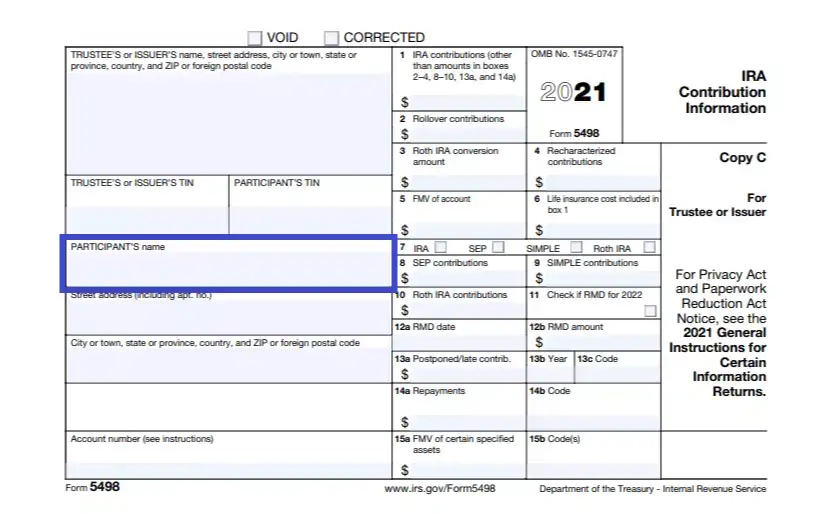

Insert the Participant’s Name

Here, the issuer must insert the full legal name of the retirement program participant (the one that makes contributions to the IRA).

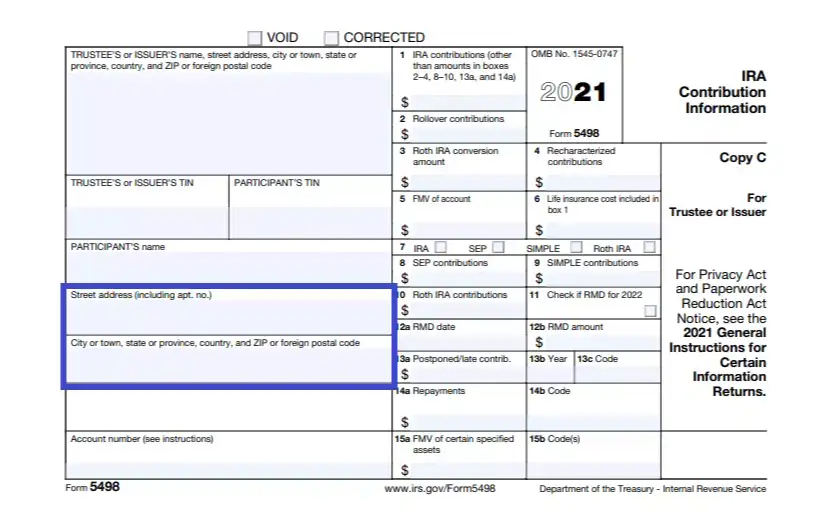

Provide the Participant’s Physical Address

Insert the physical address of the respected participant as it is shown in the example.

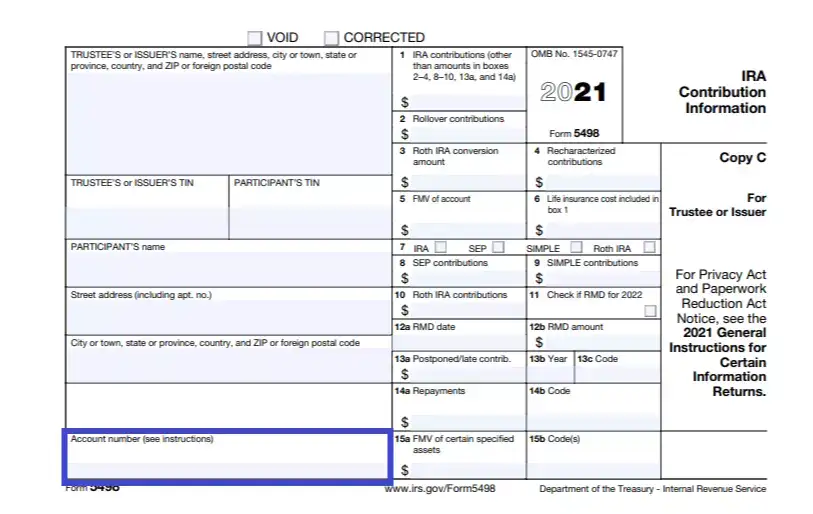

Enter the Account Number

Here, the issuer must provide the IRA details, specifically the account number, but there are certain peculiarities. Please refer to the instructions for more details, as it is indicated in the form.

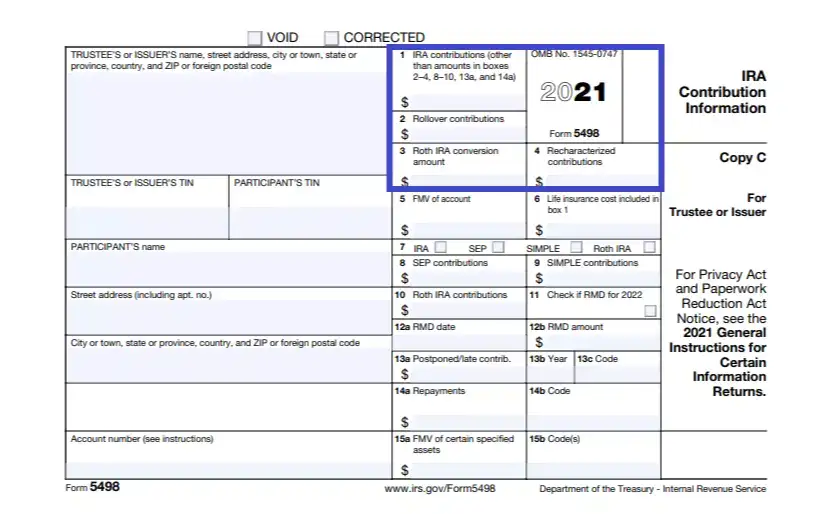

Insert All the IRA Contributions

The form then follows to define the precise contribution numbers, and that is where you have to be very careful and accurate. In box 2, you should indicate the revolver contribution amount; in box 3, indicate the Roth IRA conversion amount; in box 4, provide all recharacterized amounts (if applicable). Leave all other contributions made for box 1.

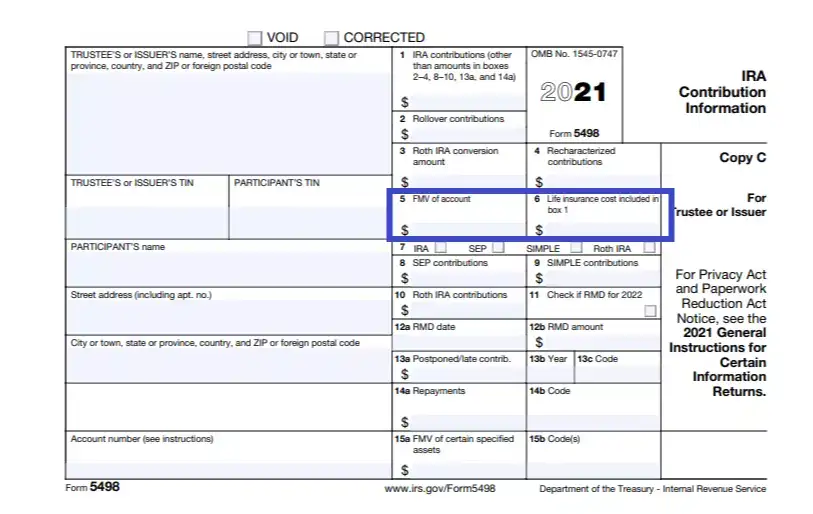

Enter the FMV and Life Insurance Cost

Let the issuer define the FMV of the respective IRA and designate the life insurance costs (usually, the latter are included in box 1 with the other contributions amounts).

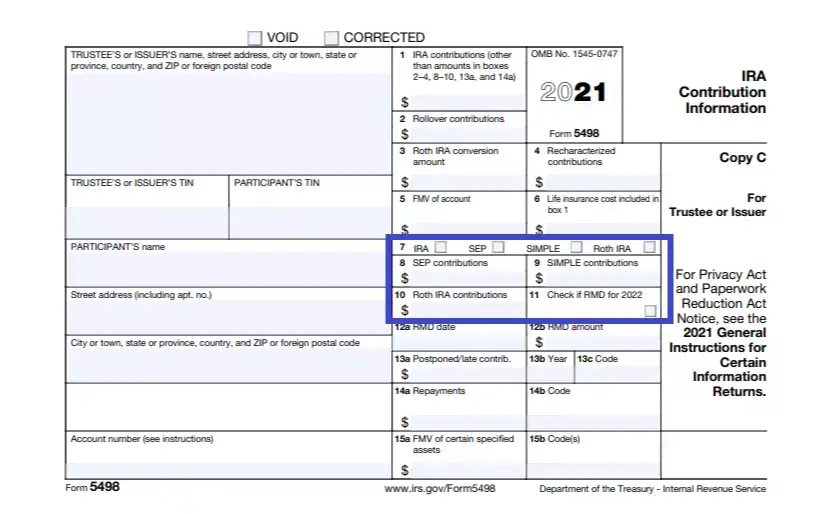

Provide the Retirement Plan Data

Indicate the type of the participant’s retirement program. Check the corresponding box to do so. Next up, insert the accurate contribution amount in US dollars depending on the program type you have chosen above. Also, ensure to indicate if the participant is RMD for the upcoming (2022) financial year.

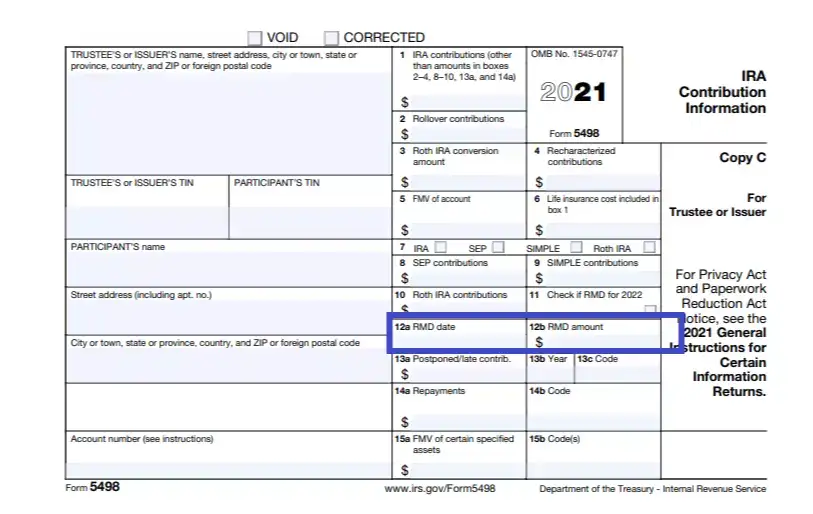

Insert the RMD Info

If you have checked box 11, then you need to enter the RMD date in box 12a and then the RMD amount in US dollars in box 12b.

Indicate Postponed Contributions

If the participant has made and late or postponed contributions during the current accounting period, the issuer must indicate this info in the form. Provide the delayed contribution amount in US dollars, the year, and the transaction code.

Designate Repayments and Codes

In the last couple of boxes, the issuer must indicate the number of repayments (if any), FMV of assets specified in the instructions, and their respective transaction codes in the corresponding blank lines.

The IRS provides comprehensive revised instructions on how to fill out the 5498 Form and the 1099-R form (as those two overlap). Again, the instruction is quite lengthy and complicated as it is meant for the specialists to operate. But if you are new to the business and want a better understanding of IRA accounting, you shall take your time and get acquainted with the full instructions on the IRS official website.