Form 1099-S is a tax form used to report the sale or exchange of real estate. This form is issued by the person responsible for closing the transaction, an attorney, a title company, or a real estate broker. Form 1099-S details the gross proceeds from the real estate transaction and is essential for the seller to accurately report potential capital gains or losses on their tax returns. It applies to various properties, including land, residential, and commercial. The form ensures that all information related to the sale is recorded and properly taxed by the IRS.

The purpose of Form 1099-S is to assist the IRS in tracking real estate transactions and ensuring that all capital gains from these sales are reported for tax purposes. For individuals selling property, this form provides critical data that must be considered when completing their tax returns, especially in calculating any tax obligations or exclusions tied to the sale of real estate. Accurate completion of Form 1099-S helps prevent issues with underreporting income and aids taxpayers in complying with tax regulations associated with property transactions.

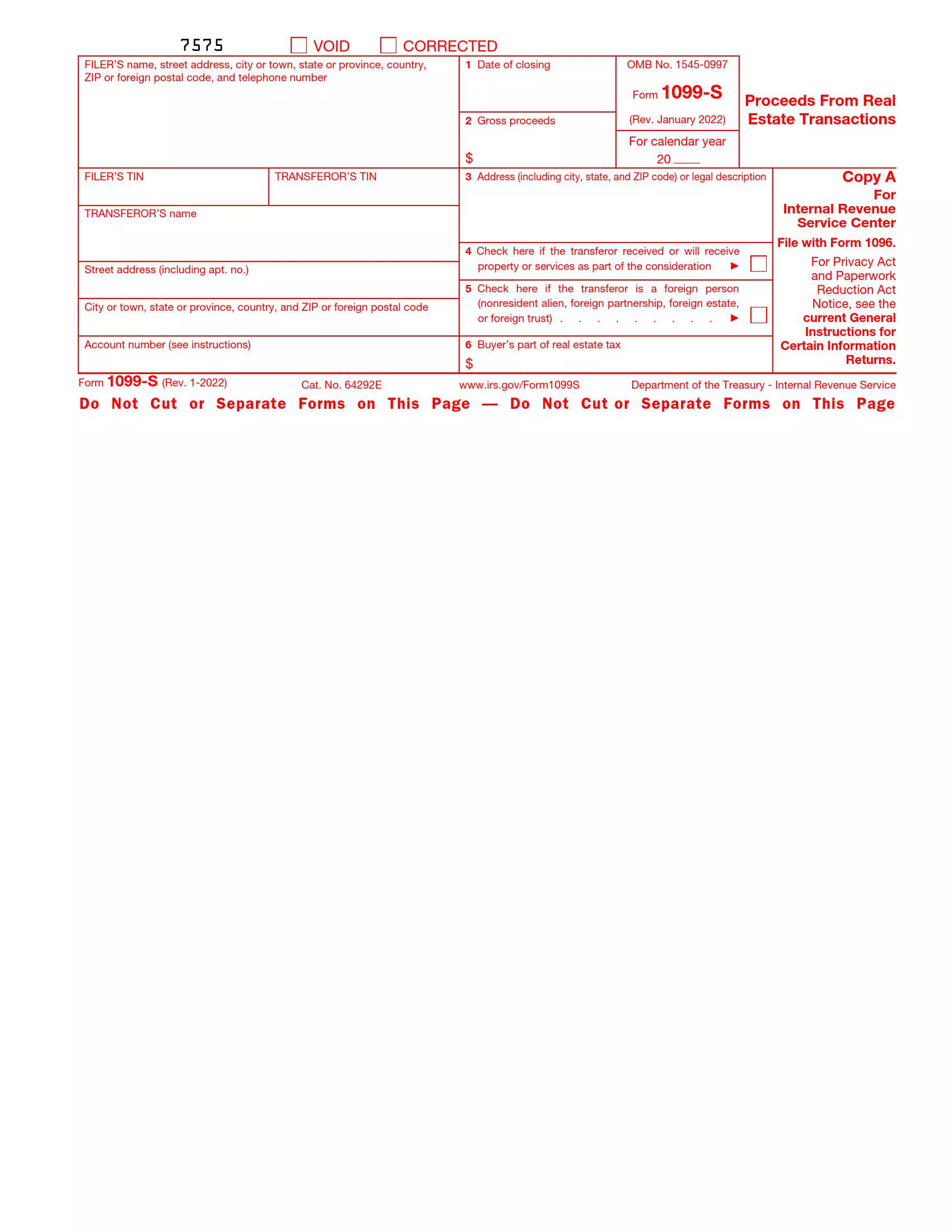

Filling Out IRS 1099-S

You can always use legal help to fill out the 1099-S paperwork, or you can use our latest software developments to tailor a corresponding form.

Follow our guidelines:

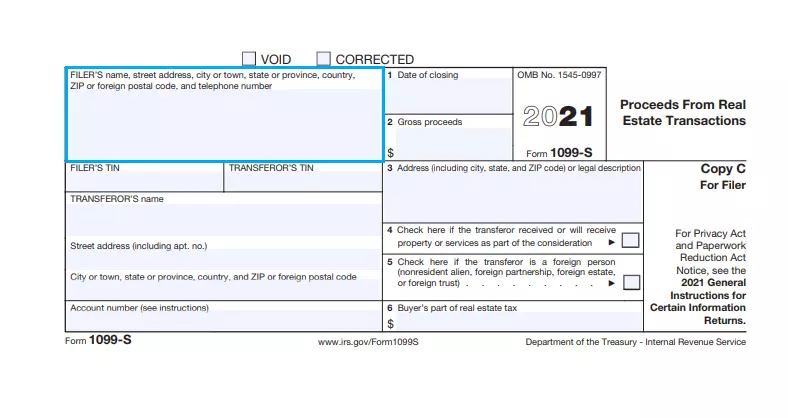

- Enter the Filer’s Data and Contact Info

In this section, insert the filer’s full name, physical address, contact cell-phone number of the reporting person.

- Enter the TIN of Both Signatories

Insert the Taxpayer ID Number of both the filer and the transferor in the corresponding sections (as shown below).

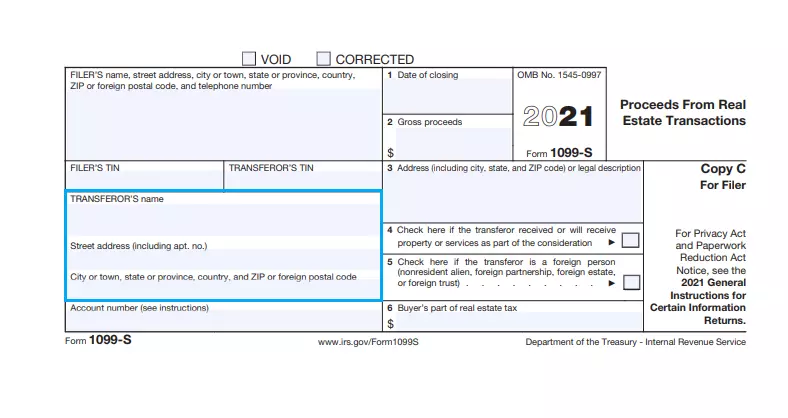

- Enter the Transferor’s Data and Contact Information

Fill in the seller’s full legal name and physical address. Remember that if you are acquiring the property from spouses, only one of them has to provide information.

- Provide Your Account Number

The IRS encourages the filers to provide their account numbers. Enter one account number per document if you happen to have several of them.

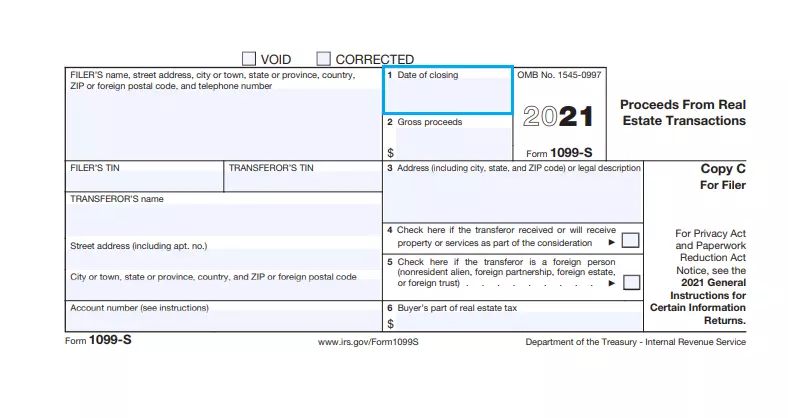

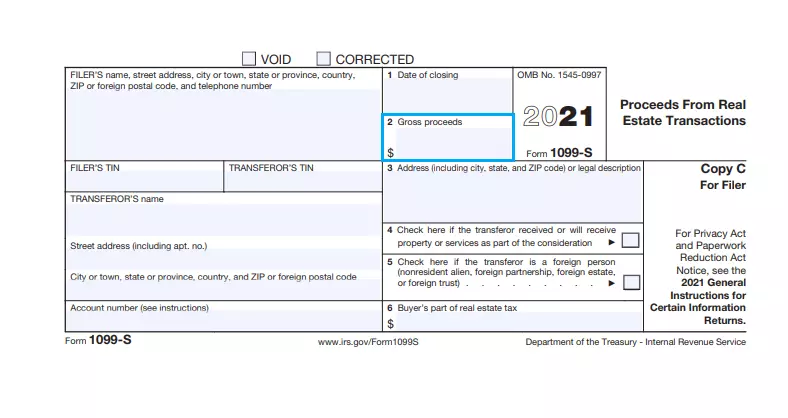

- Define the Deal’s Closing Date (Box 1)

In this section, enter the deal’s closing date. It may differ from the closing date on the Closing Disclosure.

- Fill Out Gross Proceeds Details (Box 2)

You should be very accurate in filling out this section. Enter the amount of gross profit that you have received from real estate. If you are reporting an equal property exchange, insert a “0” in this section and an “X” in Box number 4.

Please note that the gross real estate benefits amount does not include the costs of property-related services provided by the seller to the buyer (or the receiver). You may check with the instruction for filling out the details of a contingent payment deal.

- Enter the Physical Address or Legal Description of the Property (Box 3)

Enter the physical address or any other relevant legal description of the subject property. For referring to timber royalties, use the title “Timber Royalties” before the address.

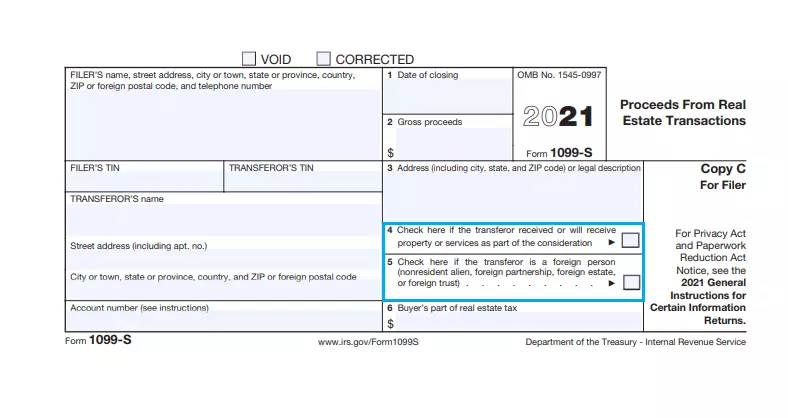

- Check the Corresponding Boxes for Relevant Services (Boxes 4 and 5)

Check Box 4 if the seller already has received or is about to receive real estate or property-related services as part of the deal (equal value exchange). Check Box 5 if the seller is a foreign citizen.

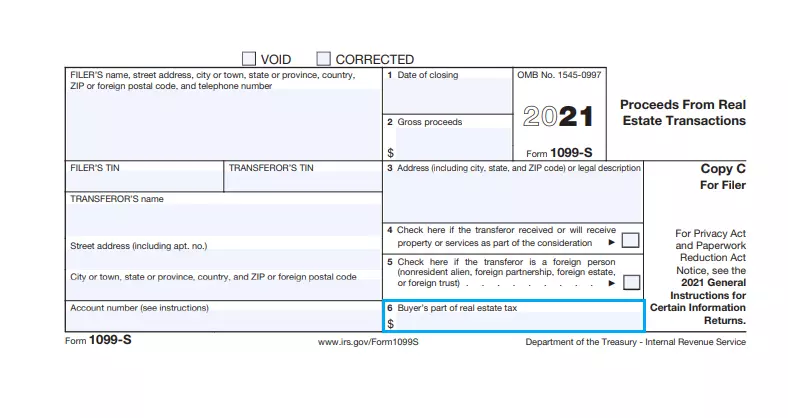

- Identify the Buyer’s Value of the Real Estate Tax (Box 6)

If the subject property is residential, the buyer must insert their share of the property tax in Box 6. It applies to cases when the real estate is paid in advance in the previous financial period. For example, sometimes people sell their residential property in a state or a county where the law requires them to pay the estate tax in advance annually.

You may also use the tax information indicated on the Closing Disclosure.