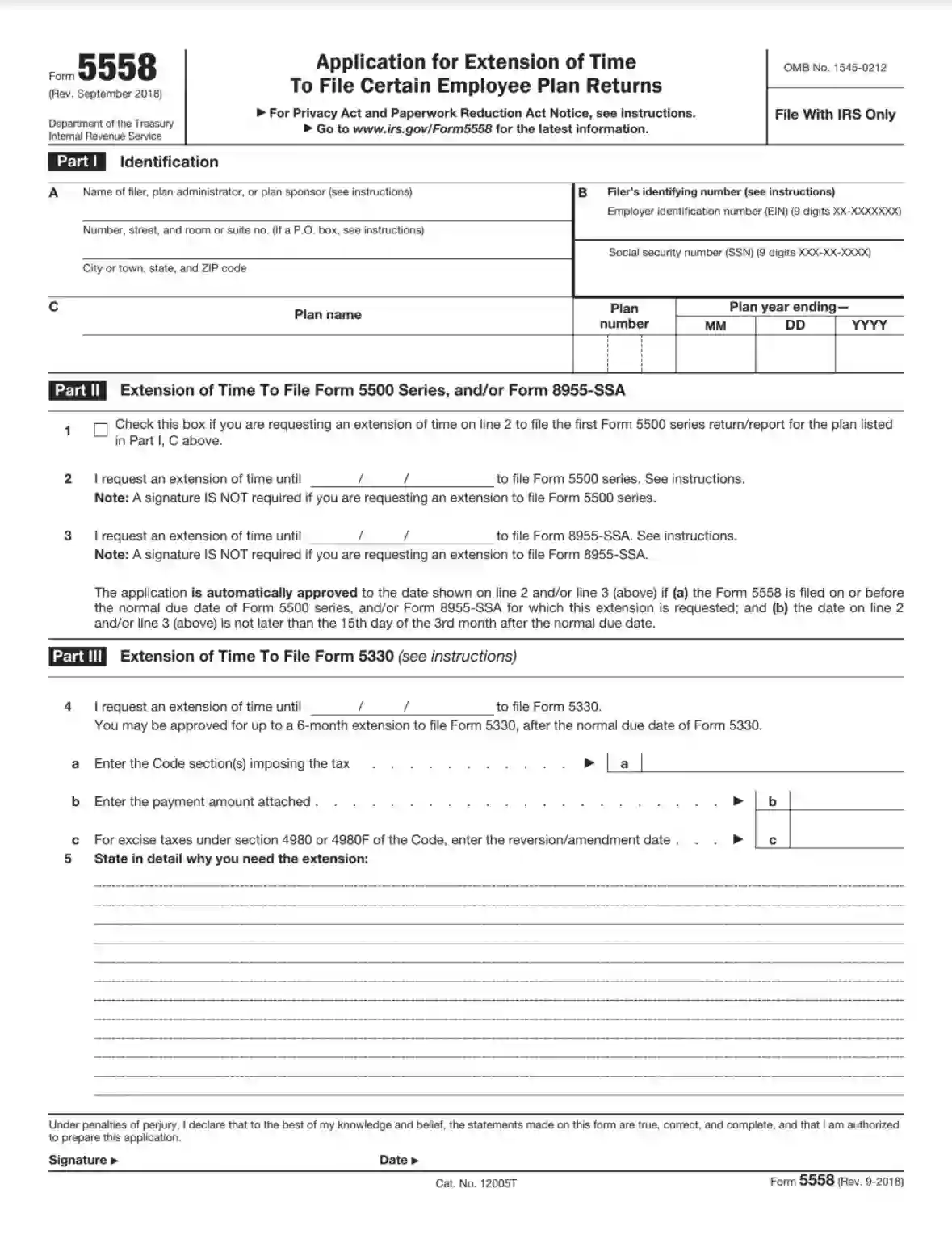

IRS Form 5558 is titled “Application for Extension of Time to File Certain Employee Plan Returns.” This form is used by employers who sponsor certain types of employee benefit plans, such as pension, profit-sharing, or retirement plans, to request an extension of time to file their annual returns with the IRS.

The primary purpose of Form 5558 is to provide employers with an additional time window to prepare and submit their required employee benefit plan returns. This extension helps ensure that employers have adequate time to compile the necessary information and accurately complete their filing obligations. Form 5558 allows employers to request an automatic extension of time to file certain employee benefit plan returns, providing flexibility while maintaining compliance with IRS regulations.

Other IRS Forms

The Form 5558 is valuable for those who need more time to provide employee plan returns. If your purpose is different, look through some other IRS forms that might fit your particular needs.

How to Fill out Form 5558

We suggest you make the process easier and use our form-building software to create this form. Thus, you will not miss essential lines and fill in everything faster.

Please find below illustrated step-by-step guide for completing the document.

Enter Identifying Information

On the first three lines in section A, fill in the placeholder name, address. Please do not abbreviate any part of the address, but enter it in full.

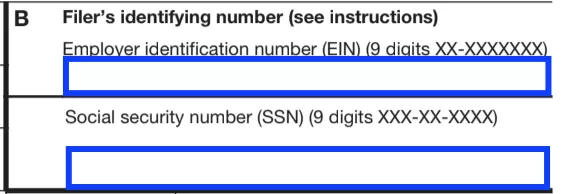

Enter EIN and SSN

In paragraph B, enter the EIN and SSN of the employer.

If the company does not have an EIN, then it must be obtained. To do this, you must fill out Form SS-4. In such a case, you will also need to attach this form when filing 5558.

Enter Plan Details

Next, you should write the details concerning the Plan:

- Its name

- Number

- Year of ending

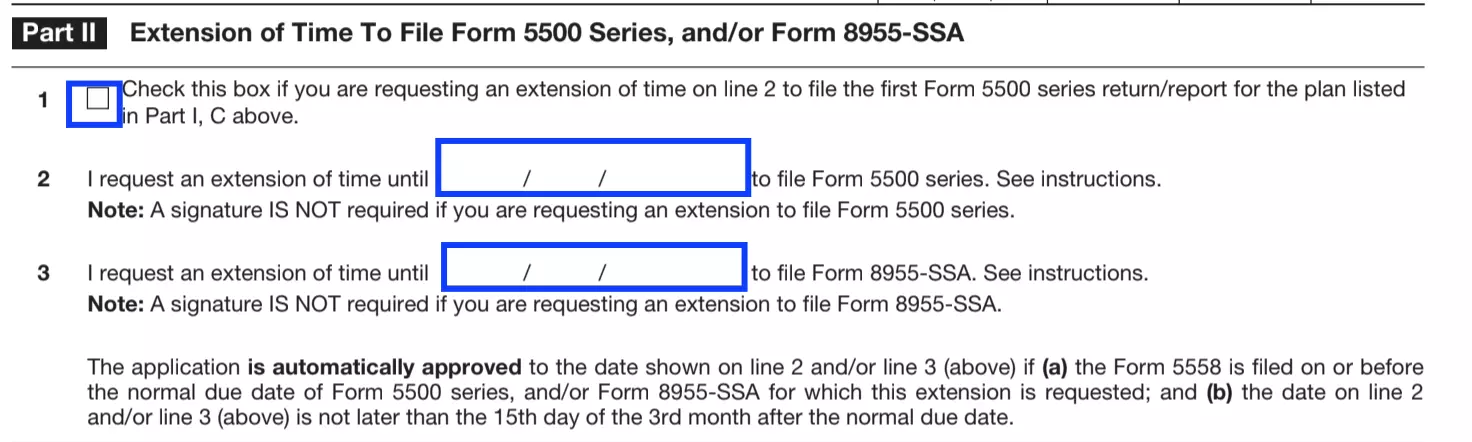

Complete Part 2

First, you need to determine if you need to check box 1. It only needs to be checked if this is your first time submitting Form 5500 for the following Plan.

Further, in points 2 and 3, you need to indicate the date until which you want to extend. The appointed date cannot exceed a delay period of 2.5 months.

Please note that if you have already violated the deadline for submitting the forms, then completing 5558 will not take effect. But if everything is completed correctly, then your renewal application will be automatically approved.

Enter the Extension Date for Form 5330

If you also need more time to complete 5330, then enter the date on line 4. Unlike previous applications, here, the period can be extended up to 6 months.

Complete 4a-4c

Fill in the appropriate information in lines 4a, 4b, 4c.

Describe the Reasons

Explain in detail why you need to increase the deadline for filing Form 5330. These reasons must be justified and not dependent on you. There is no point in fake reasons. If in the future it is found that the reasons were false, the extension may be invalidated. In this event, great fines will follow.

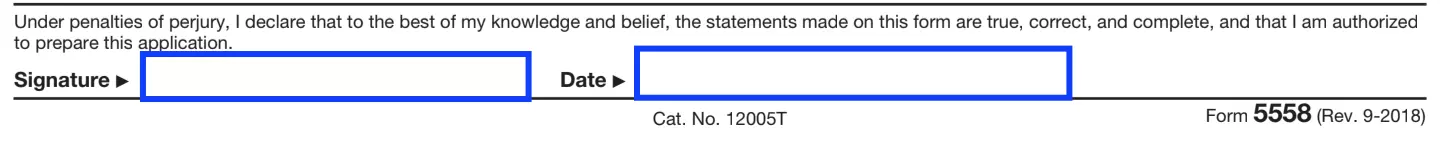

Sign and Date

Enter the date for filling out the application. A signature is not required in all circumstances. If you have completed only Part 2, then you do not need to sign. But if Part 3 is also completed, then an appropriate person has to sign it. They can be:

- Employer

- Plan administrator

- Plan sponsor

Submit the Form

Using private delivery services, send the application to the IRS Center.