IRS Form 8282 is a tax form organizations use to report information to the Internal Revenue Service (IRS) when they sell, exchange, or otherwise dispose of charitable deduction property or other similar items valued at more than $500. This form must be filed within 125 days after the disposition of the donated property. It serves as a way to notify the IRS that the item previously given as a charitable contribution has been transferred from the organization, and it ensures transparency regarding the ultimate fate of significant charitable donations.

Other IRS Forms for Charities and Nonprofits

Charities and nonprofits are obliged to report certain information to the IRS. Learn what other IRS forms might be necessary for your organization.

How to Fill out Form 8282

You should get the relevant form template before you proceed any further. We suggest you use our latest form-building software developments to create and customize the legal form you need. With our PDF editor, you will also be able to fill out the form online.

Please note that you have to meet the deadline for submitting the form: 125 days within the disposition of the granted property. If you fail to do so for whatever reason, you will be subject to a penalty.

Below, you will find a comprehensive guide on filling out the form. We will lead you through the process step by step so that you have minimum difficulties filling in and finding the required information.

Read the Filing Instructions

The form comes with two pages of detailed filing instructions, guidelines, and legal terms’ explanations. We highly recommend you read those before you start filling out the required information. You will find the instructions at the end of the form template (pages 3 and 4).

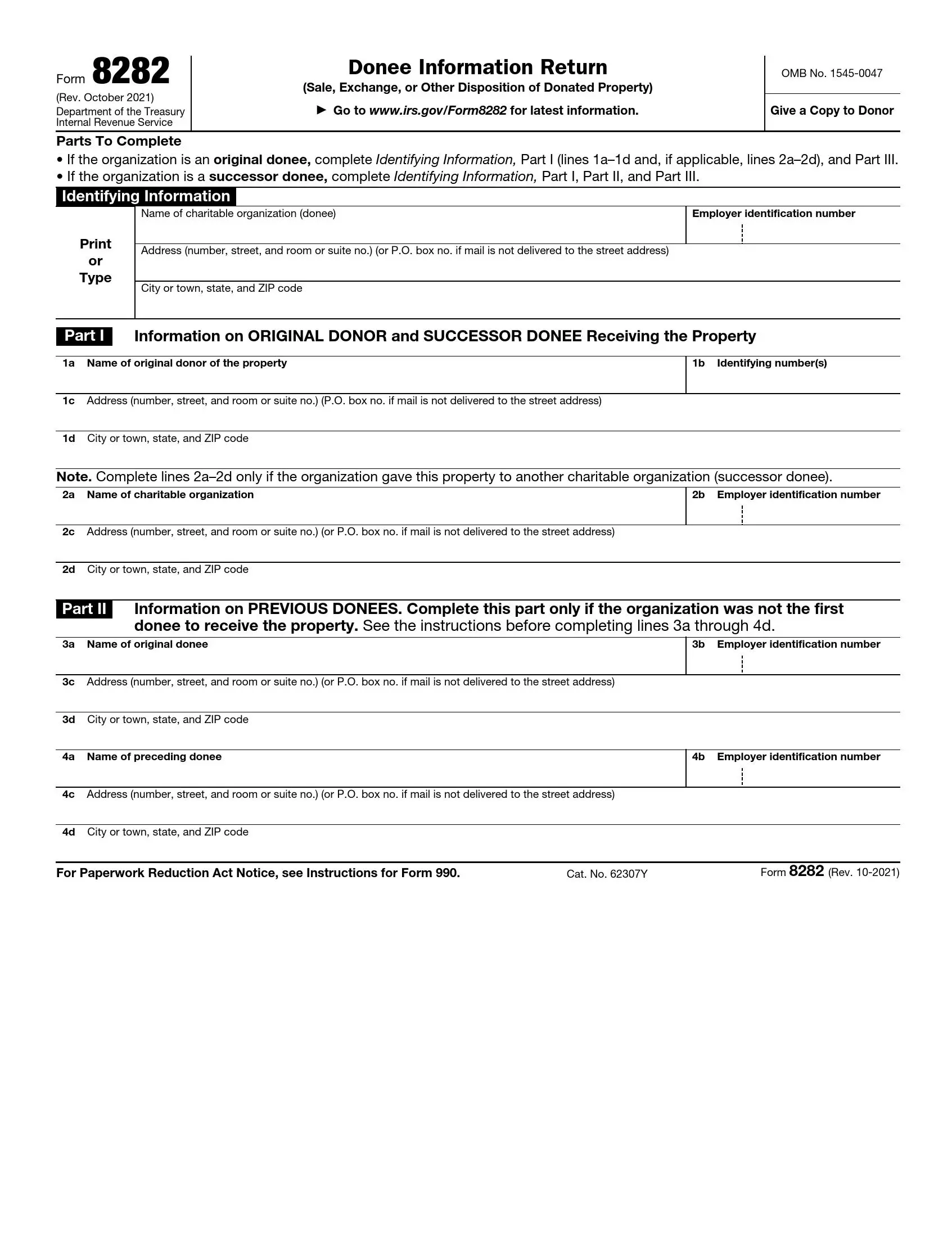

Identify the Recipient Organization

First of all, you need to the business name of the charitable recipient, then fill in its EIN and physical address, including city, state, ZIP code (or PO, if applicable), street, building, and office number. You are allowed to either print or type the information here.

Provide Details on the Donor

Pay special attention to this section, as there are two types of donors designated here. Fill out the first section if the original donor was any organization other than charitable (or non-commercial). Indicate the company’s business name, physical address, and ID.

If your organization’s donor was another charitable entity, you shall skip section 1 and proceed to section 2. These donors are actually called “successor donees” as they receive income money and form their budget based on other donations and free-of-charge contributions from third parties.

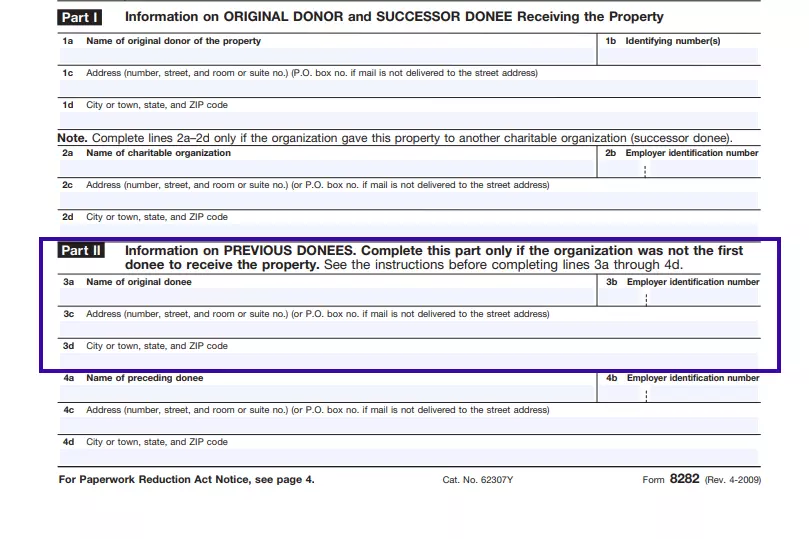

Indicate Previous Donees (if applicable)

It might occur that the recipient organization undergoes reforms, restructuring, or stops existing at all. For instance, the leadership or ownership of the recipient organization was changed (and thus its name or physical address). But at the same time, the essence of the company’s business and activity stays the same, and it continues receiving donations from the same donors; then, the new management needs to indicate the changes in the form.

Considering the information outlined above, fill in the relevant and updated info on the original and preceding donee (if applicable).

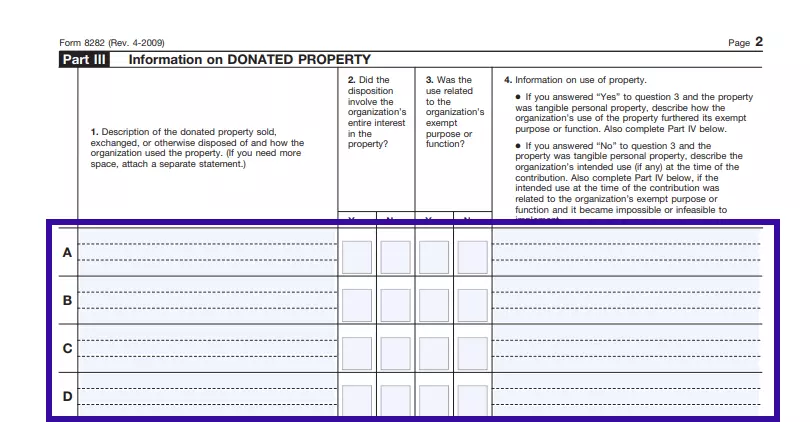

Supply the Granted Property Info

This part of the application form consists of three sections where you are supposed to fill in the information on the property type, its purpose of use, and answer some property-related questions. Insert the property type your charitable organization has disposed of in the first section. Then, proceed to answer some “Yes” or “No” questions about the disposition process. Finally, provide the required details on the purpose of using the granted assets in section three (as shown below).

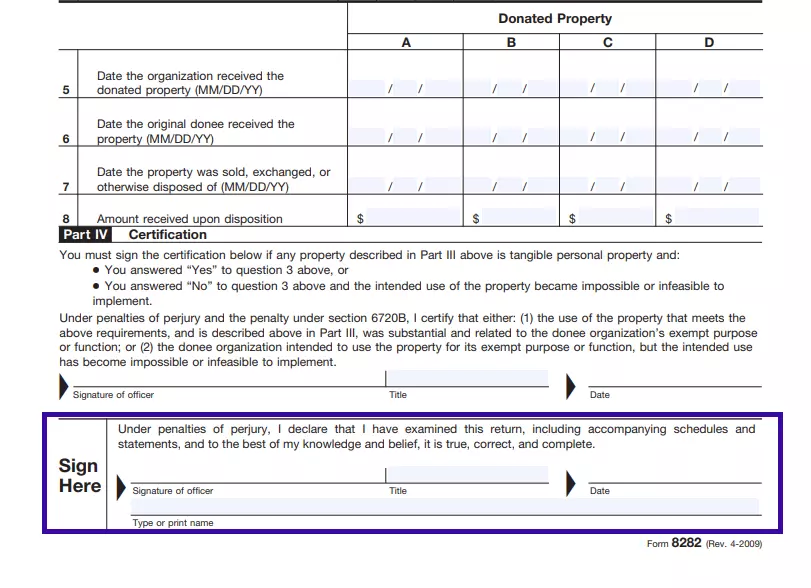

Insert Additional Info and Certification Details

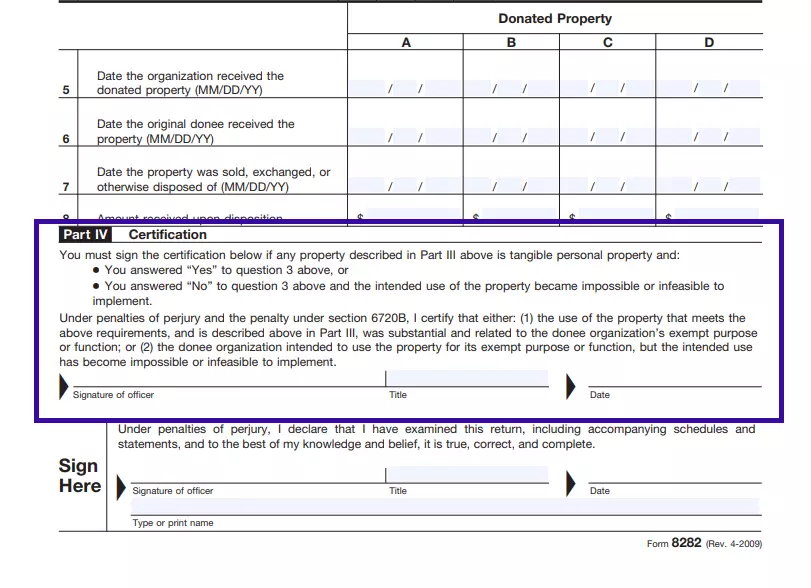

Here, you must enter the date when the granted property was first received (if there are an original and succeeding donee, insert the dates both of them have received the subject contributions). Below the designated dates, enter the amount (in US dollars) received upon the transaction (selling, exchanging, disposing of) involving the granted unit(s).

Once you have filled out the previous part, you need to certify that the subject property unit(s) meet all the necessary legal requirements. The responsible officer who fills out the form should put their signature, title, and the current calendar date.

Sign and Date the Form

Finally, as the sign of confirmation that all submitted information is accurate and true, the officer puts a signature, title, current date, and their printed name once again, thus, authorizing the application form.