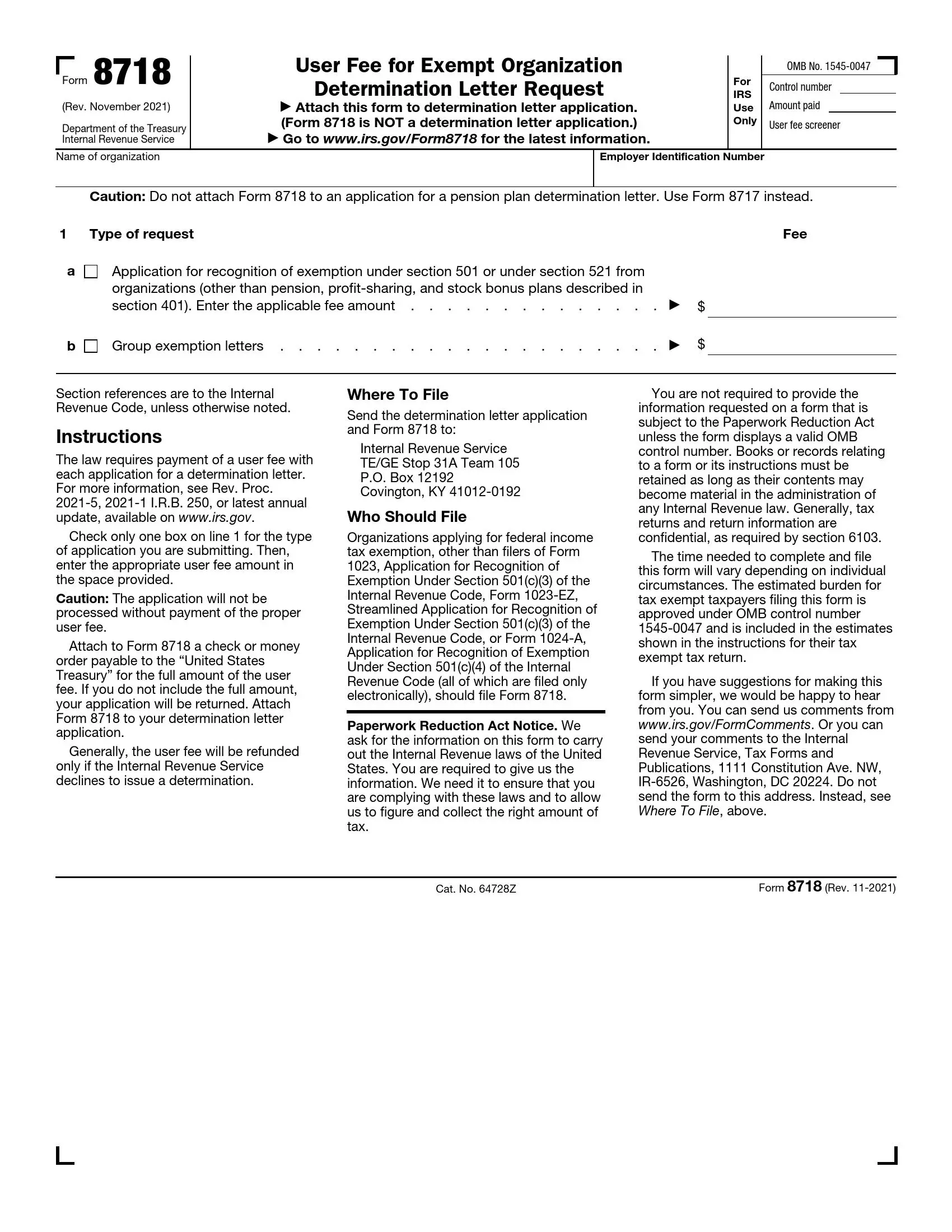

IRS Form 8718 is a tax document organizations use to apply for exemption from federal income tax under Section 501(c)(3) of the Internal Revenue Code. This tax code section provides tax-exempt status to charitable, religious, educational, and other nonprofit organizations. Form 8718 is specifically used by organizations seeking tax-exempt status as private foundations. Individuals, families, or corporations typically establish private foundations to support charitable causes and activities. Key information provided on Form 8718 includes:

- The organization’s name, address, and Employer Identification Number (EIN),

- Details about the organization’s structure, governance, and activities,

- Information about the organization’s financial resources and planned expenditures,

- Certification that the organization meets the requirements for tax-exempt status.

This form helps ensure that organizations meet the requirements for tax exemption and comply with federal tax laws governing private foundations.

Other IRS Forms for Charities and Nonprofits

As an owner of a non-profit organization, you need to know what IRS forms the Service expects from you. Here are some other forms that similar organizations commonly use.

How to Fill Out Form 8718

The language of legal forms is indeed tough and complicated and sometimes it might be really hard to complete certain forms. In case you want to successfully write out any legal document you can use our from-building software to ensure a brilliant result. For this form you can do the same, just follow some simple steps listed below:

Fill out the name of your organization

It is necessary that the form is filled out correctly and with utmost details. Please indicate the full name of the entity;

Provide FTIN or FEIN

In the box on the right side of the page fill out the Employer Identification Number (also called FTIN or FEIN, it is a nine-digit number that is given to the company by IRS);

Mark a box and enter the fee

In the ‘Type of Request section’ mark only the applicable box, only one box. Afterward, enter the dollar sum of the user fee in the space on the right side of the page.