Form 1023-EZ is a streamlined version of the IRS Form 1023, designed for smaller nonprofits seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is shorter and simpler than the standard Form 1023, intended to make the application process quicker and less burdensome for eligible small organizations. To use Form 1023-EZ, organizations must meet specific criteria, such as having gross receipts of $50,000 or less and assets totaling $250,000 or less.

The primary purpose of Form 1023-EZ is to facilitate a faster review and approval process by the IRS for smaller nonprofit organizations that meet the eligibility requirements. By reducing the complexity and amount of information required, Form 1023-EZ allows eligible organizations to obtain tax-exempt status more efficiently, focusing more on their core activities and less on administrative paperwork. This form helps these organizations receive tax-deductible contributions from donors sooner, furthering their development and community impact.

Other IRS Forms for Partnerships

If you have already filed the Form 1040, you might need to file more forms, depending on the complexity of your finances. Check what IRS forms are often filled out by our users along with the standard tax return form for individual taxpayers.

How to Fill Out the Form

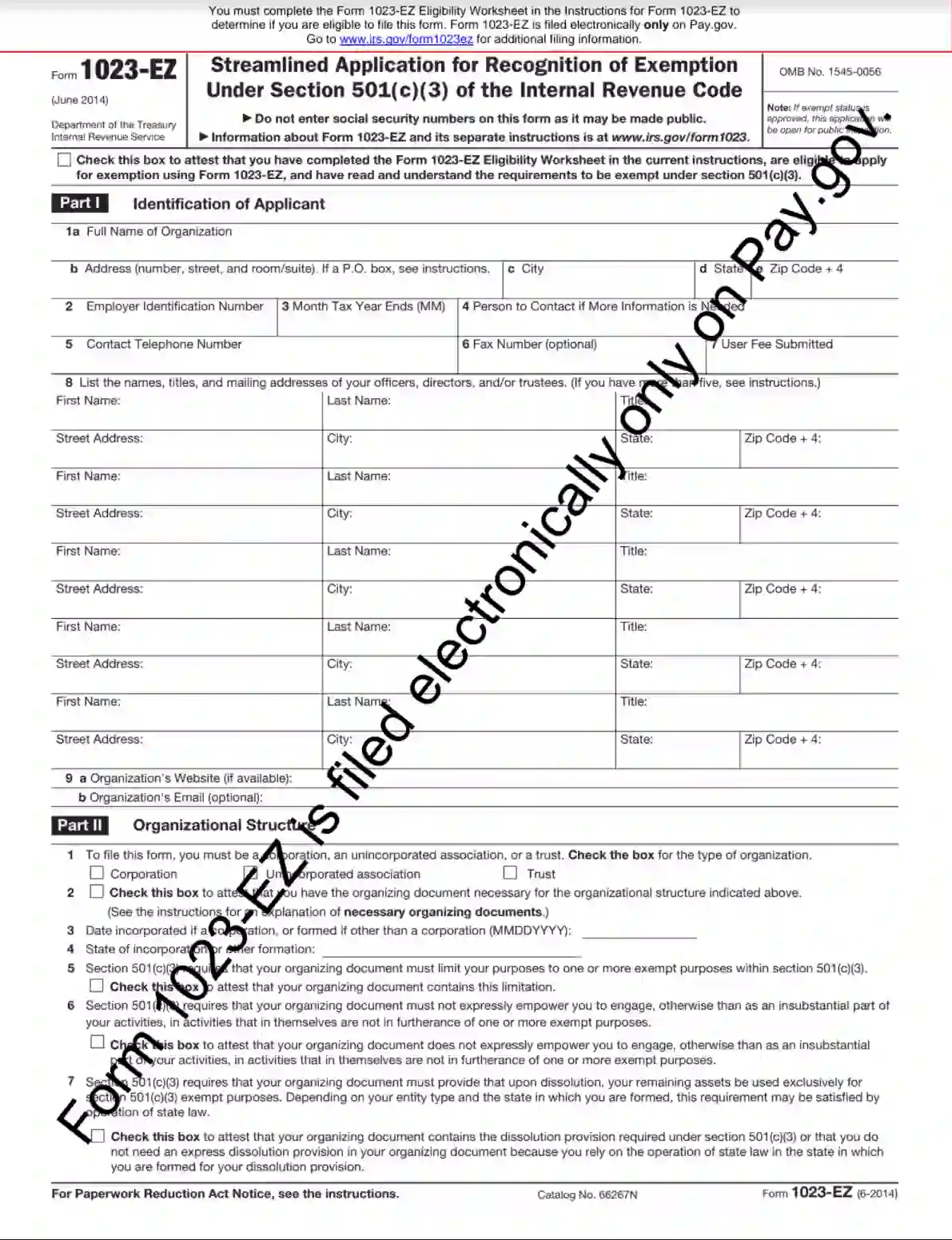

1. Identify the Applicant

In this section, an applicant should indicate the full legal name of their company, the address to establish a mailing process and the ID number of the employer. The number consists of nine digits. The EIN is a mandatory condition a company-applicant must meet.

After that, you should put in the month of the end of your tax year. To provide more security to the document development, you can indicate a person to contact should more info about the company be requested. Here you should leave a phone number, a fax number, the amount of the fee paid, and your directors, officers, and trustees listed out with their mailing information. Provide the official web page of the firm and its current email.

2. Indicate the Structure of the Company

Here is a list of plausible structures to indicate while filling out the form:

- Corporation

- Trust

- Unincorporated Association

Indicate the date of the company’s formation and provide a required list of documents.

In this section, input the jurisdiction of the laws under which you were formed as a legal entity and the state of formation.

Add some information concerning the purpose clause we have discussed earlier in the piece and input the prove that no private entity or a shareholder should receive benefits from your earnings.

After that, an applicant has to deal with the dissolution clause that is aimed to be used in the future if the company is dissolved and controls the distribution of the assets of the company. Here, state laws come into play largely, so you should do research to find out more information about your state or county.

3. Provide Information About Specific Activities

Here is a list of steps to take:

- Describe the mission of the company you own and provide a list of the most noticeable steps you’ve completed.

- Input the NTEE code consisting of three digits if the donors are concerned.

- Indicate the purposes of exempt: charitable, religious, educational, scientific, etc.

- List out the activities prohibited for your organization.

- Answer if you have attempted to affect the procedure.

- Input info concerning the compensation to directors, officers, etc.

- Provide information about the individual donation of funds.

- Provide information about your activities outside the USA.

- Include info about money transactions involving directors, trustees, etc.

- Put in information about gross income, which is not related to business.

- Gambling activities are to be indicated here, planned, or finished.

- Indicate if you have a plan concerning relief in case of a disaster.

4. Provide Information About Foundation Classification

Whether you are a charity or a public foundation, this section must be filled out to ease the determination of the tax rules applicable to your individual case.

There are certain types of revenue that affect the choice of the governing tax rules:

- Gifts, grants, etc.

- Unrelated activities.

- Exempt-related activities.

- Investment revenue

- Special grants

Here is a list of revenue sources which are appropriate for the business to have while applying for the form:

- Disqualified persons

- Family members

- General public

- Governmental unit

- Public Charity

5. Reinstatement

This step is required only if a company’s exempt status is revoked under section 6033(j)(1.) What matters during the reinstatement procedures is the size, number of previous revocations, etc.

6. Sign the Form

A person who has the authority to leave a signature on the document should do so to validate the form. It can be a director, officer, trustee, etc. Don’t forget to include the titles of the signer.