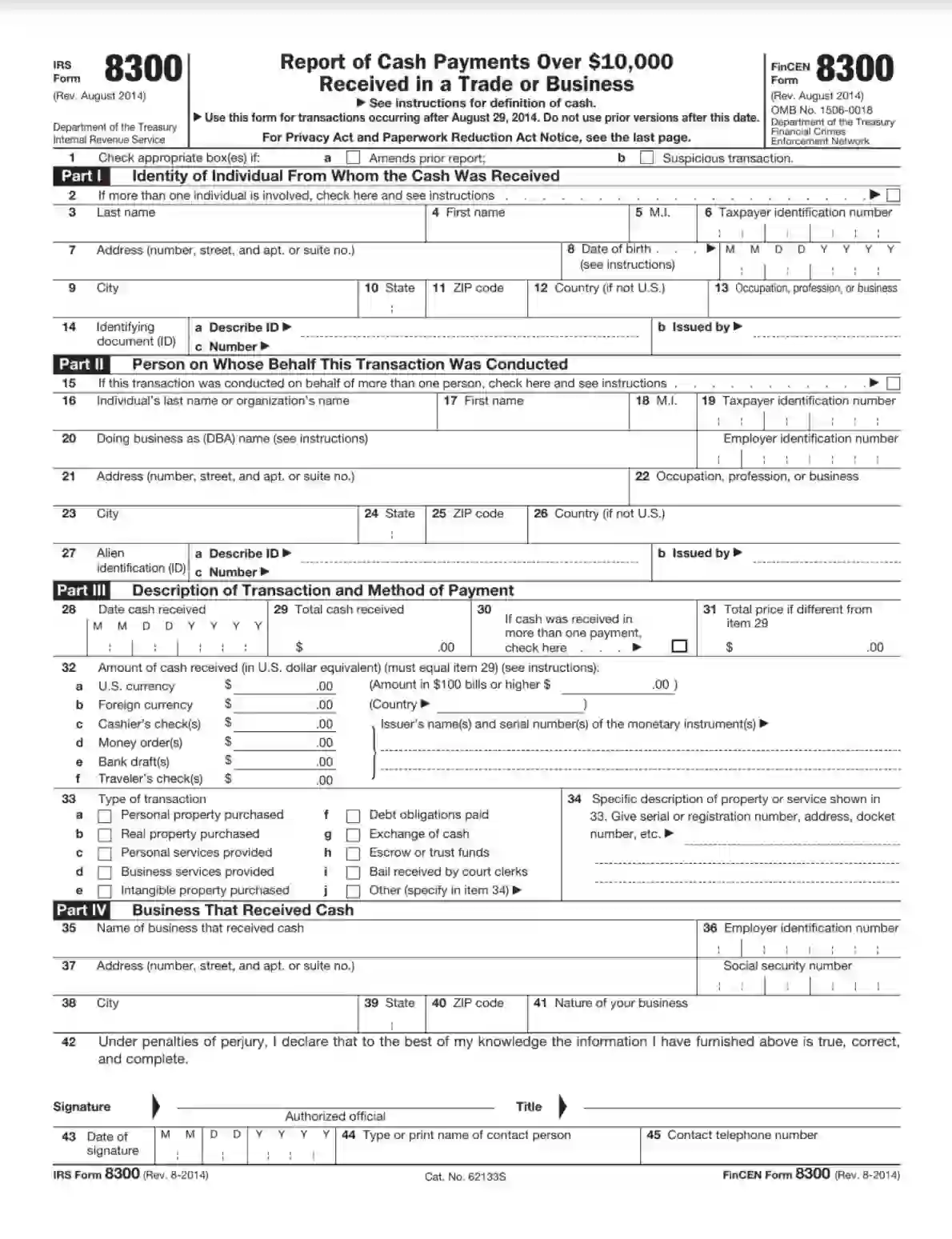

IRS Form 8300 is a critical document businesses and individuals use to report cash payments over $10,000 received in a single transaction or a series of related transactions. This reporting is mandated under the Bank Secrecy Act and the Internal Revenue Code to assist the government in tracking large sums of currency and prevent illegal activities such as money laundering. Form 8300 must be filed by any entity that receives more than $10,000 in cash in one transaction or two or more related transactions within a 24-hour.

The form requires details about the person or organization making the payment and the nature of the transaction. Timely filing of Form 8300 helps ensure compliance with federal regulations and aids law enforcement in monitoring and investigating financial transactions.

Other IRS Forms for Self-employed

Information about the financial transactions of businesses is gathered by the IRS through different forms. Learn more about other IRS forms you are expected to file.

How to Fill out Form 8300

The form is available both on the authorized IRS website (www.irs.gov), where you can download any official tax form with detailed instructions and on our website, in which we have incorporated our advanced form-building software. Our PDF-editor will assist you in completing the form, identifying and correcting possible mistakes. We always keep up with the latest updates and IRS demands, so you can rest assured that our guidelines are created based on the most relevant information.

The form under discussion consists of two pages. However, in the majority of cases, you will need to fill out only one of them. Read our instructions below to find out how many sections you are to complete. Besides, the instructions below contain a step-by-step guide on filling out each section correctly and information you are required to submit with the form. We encourage you to follow our recommendations to avoid penalties for incorrect filings.

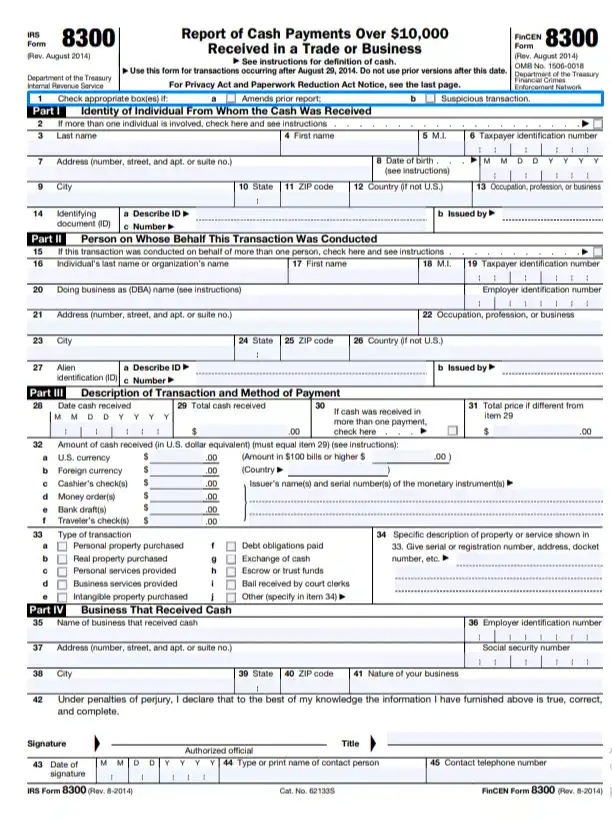

Check the Applicable Box

Before you proceed to the document parts, look at the first section, which requires you to select one of the two boxes. If you need to introduce changes in your original report, check box 1a. If you suspect a person trying to conceal certain information about the transaction or non-filing the form with the tax agency, choose the other box for reporting suspicious transactions. You can also inform the agency or FinCEN about such transactions by calling the number written in the form.

Identify the Payer

At the beginning of Part I, specify the number of the transaction participants. If there is more than one person making cash payments, check the box in Section 2. Mind that you will need to provide information about other participants on Page 2.

This part of the form is entirely dedicated to the payer’s personal information. Here, enter the individual’s full legal name, including their last and first name and middle initial (Sections 3-5), TIN consisting of nine digits (Section 6), the person’s physical address, including number, street, country, city, state, and ZIP code (Section 7, 9-12), date of birth in Section 8 (please, follow the order of the numerals). Also, you need to insert the type of occupation or business activity (Section 13) and details about the document identifying the individual’s personality in Section 14 (indicate the document type, its number, and issuing authority).

Please note that the document must be official (a passport, a driving license, or others).

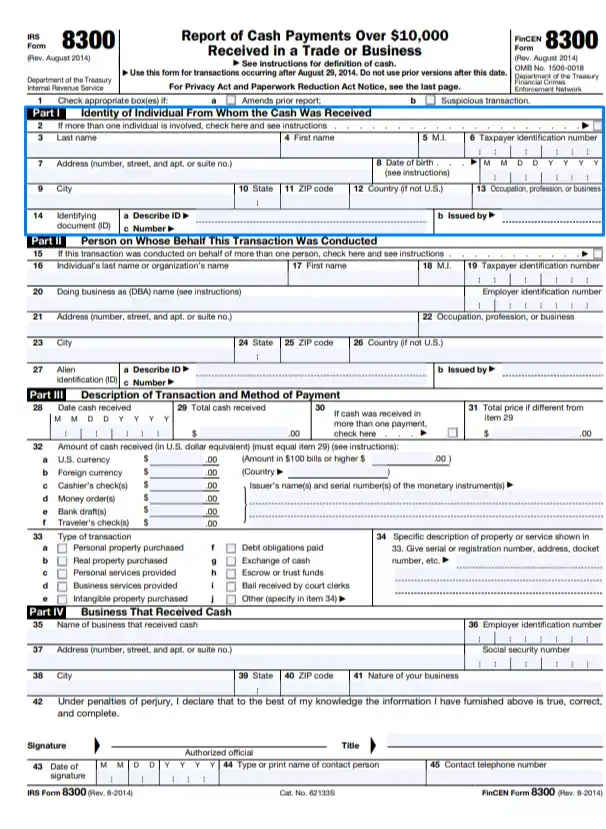

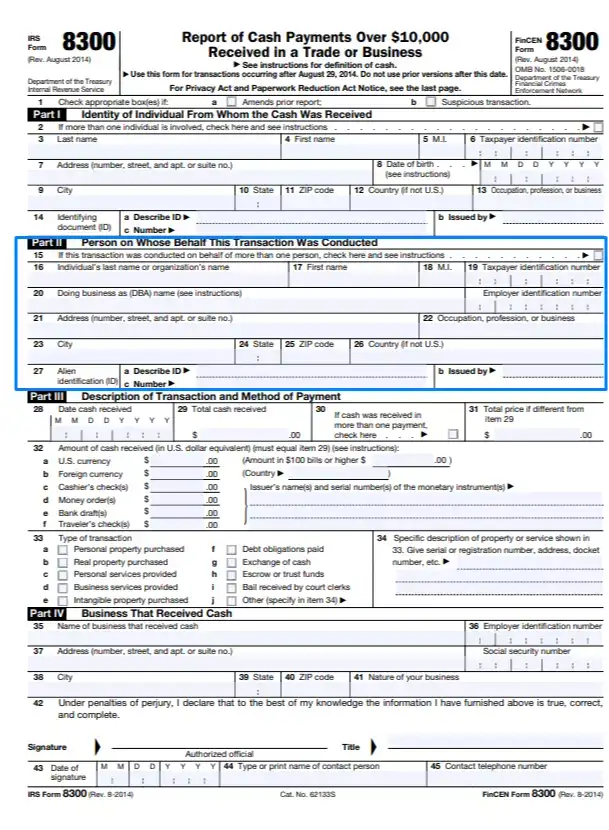

Introduce the Party Who Made the Payment

Now we can proceed to Part II. Mind that this part must be completed only if the payments are made on another person’s (or business entity’s) behalf. In other words, provide required information about the organization or individual benefiting from the funds.

If this party is represented by more than one individual, tick the box in Section 15.

- For business owners or sole proprietors:

Enter the full legal name of the entity and the DBA name (if the name under which the business operates is different from the registered name), EIN consisting of nine digits, complete physical address following the order in the previous step. Besides, specify the type of business activity.

- For individuals:

Insert the full legal name, Taxpayer ID number, Employer ID number (for self-employed), residential address, occupation, and alien identification card details (for non-citizens).

Provide the Transaction Details

Here, you must describe in detail the transaction and payment method used by the parties. In Sections 28-31, enter the calendar date when the payment was made, the total amount of cash the individual(s) introduced in Part I. Do not forget to Indicate if you have received several payments and input the total price of services, items, or cash if it does not match the amount in Section 29.

In Section 32, provide the amount of all payments made in different forms of cash. If the payment is received in U.S. currency, enter the total amount paid in 100 USD bills or bills of a higher value. If the payer uses a foreign currency, enter the name of the corresponding country. For Items d-f, the required information may also include the drawer’s (or issuer’s) name and the serial number.

In Section 33-34, the IRS requires that you define the type of the conducted transaction. You are to choose one of the provided descriptions or provide your own one if neither of the types satisfies you (Section 34). Include the respective information about the service or property involved in the transaction.

Describe the Party Receiving Payments

Part IV includes Sections 35-38. Here, you need to fill in data with regard to your business. Regardless of the type of business, insert the registered name, current address and indicate the nature of your business. If you are a sole proprietor, you must enter your TIN and EIN (if you have any). It is mandatory for other business entities to enter their EIN.

Authorize the Form

A person who has the authority to place their signature on the document on behalf of the person (entity) receiving cash should do so to make the form valid. It is also necessary to include the titles of the signer.

Under the signature and the title, indicate the date the document is signed and leave the name and contact number of a person who can be called in case any issues arise. Mind that the name should be typed or printed rather than handwritten.

Introduce Other Parties

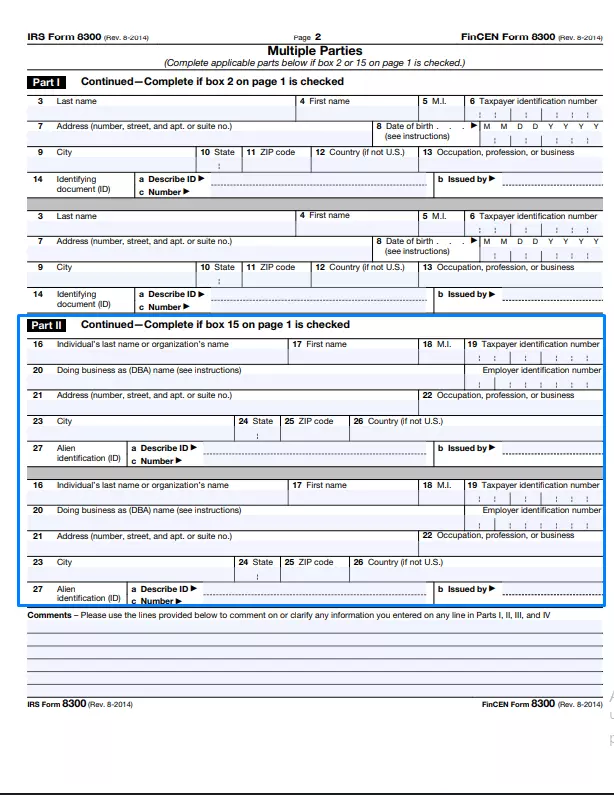

As we mentioned earlier, you should provide information about all payers and individuals (or entities) on whose behalf the payments were made. If you have more than one representative of each party, you can introduce them on Page 2.

The form allows you to provide personal data about three payers. In Part I, on the second page, insert the exact same details about the parties involved.

Part II is dedicated to other individuals and business organizations on whose behalf the transaction was made. The sections you are about to fill in look the same as those mentioned in the previous steps.

Provide the Additional Details

The comment section at the end of the document is meant to include additional information required for each of the four parts of the document. For instance, if more than three representatives of each party are involved in the transaction, you should provide their data in this section. If you check box 1b at the beginning of the document, you can write the reason in these blank lines.

As we mentioned in the previous chapters of the article, the IRS provides comprehensive instructions on how to fill out Form 8300. The instructions might seem complicated to those who find it difficult to understand legal terms. That’s why the agency provides definitions for terms that you can come across in the form, including “cash,” “transaction,” “recipient,” different types of transactions, and other relevant terms.

If you still have difficulties completing the form even after getting acquainted with the instructions outlined both in the form and in our article, we strongly advise you to hire a licensed legal professional to complete it on your behalf.