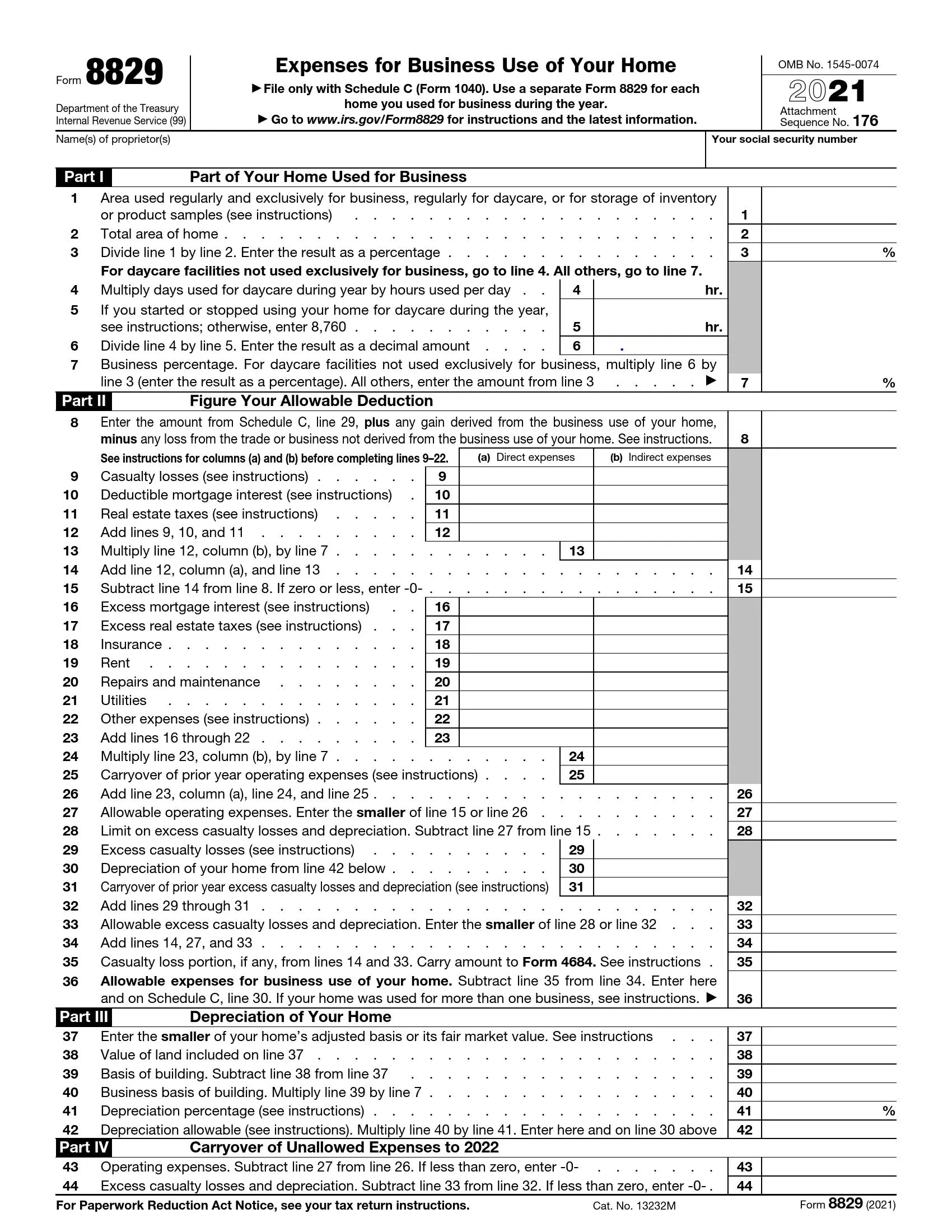

IRS Form 8829 is a form used by self-employed taxpayers who claim a deduction for the business use of their home. The form calculates the allowable expenses that can be deducted based on the portion of the home used regularly and exclusively for business activities. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation. This form is critical for accurately determining the amount of home office expenses that can be deducted from the taxpayer’s federal income tax return.

The purpose of Form 8829 is to ensure that taxpayers accurately calculate and substantiate the home office deduction, which can significantly reduce their taxable income. It provides a systematic way to allocate and apportion costs between personal and business use, helping taxpayers comply with IRS regulations while maximizing their eligible deductions.

Other IRS Forms for Self-employed

Since the pandemic started, there have been some changes to IRS forms that correspond to the new realities of the working environment. Learn whether other IRS forms have changed recently.

Step by Step Guide to Fill the Blank

Practice our instructions to fill out the application without too much difficulty.

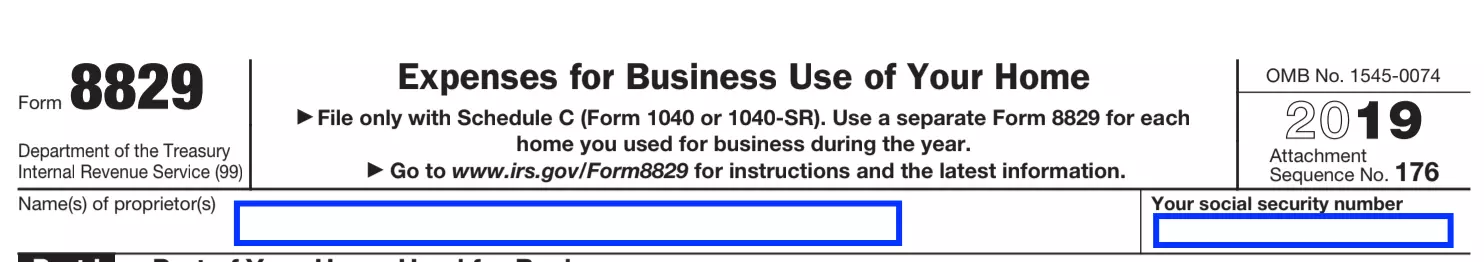

Identify yourself

Write your name and the number of social security on the space provided.

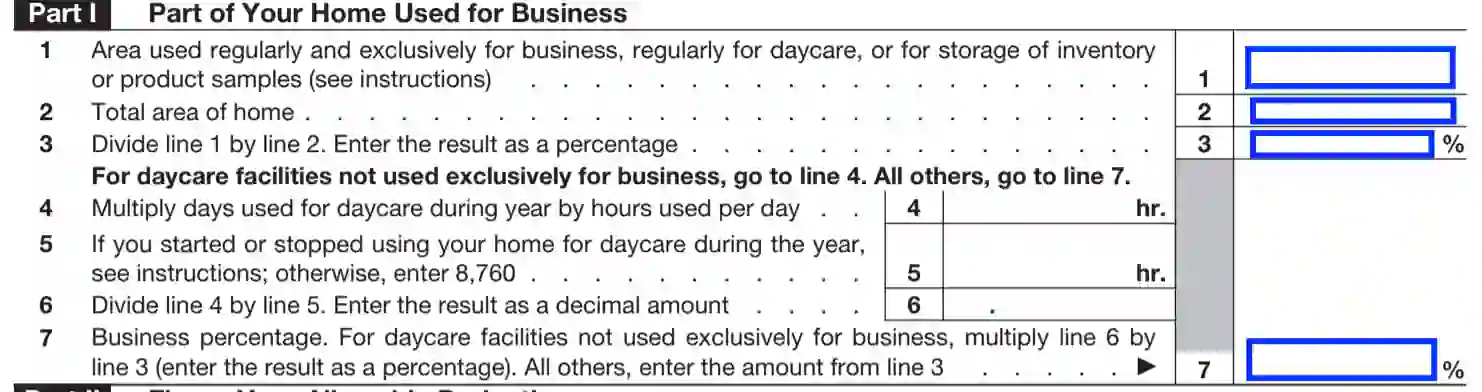

Indicate which part of the house is utilized as a home workplace

Applying a single measure of area (let’s say square feet), enter the square of your workplace in point 1. In line 2, write the whole square to get the percentage of the space allocated for your business.

If your business is not a daycare, then just duplicate the number from point 3 to point 7.

Continue to fill in Part 1 if your company is a daycare

In this case, you will go a bit deeper into the calculations. Let’s show with an example how to do this. If your daycare is running 9 hours 250 days a year, you need to multiply 250 by 9. You get 2250 hours. Enter this number in line 4. If during the year you always use your place as a daycare facility, then write down 8760 in line 5. But if you did not start using it as a daycare facility immediately or, for example, stopped it, then you need to multiply the number of days by 24 hours. For example, multiply 300 by 24 and get 7200 and write it on line 5.

Next, we divide the indicator from line 4 by the indicator in line 5, and the result is multiplied by the percentage in line 6, and we get the business percentage.

Enter the amount of profit

You can use the number you entered in Schedule C. If there is additional gain or loss from the home workplace, add or subtract it from this number and write it down in point 8.

If, in addition to your home workplace, you do part of the job elsewhere, then divide the number according to the rate of time you spend in your home office.

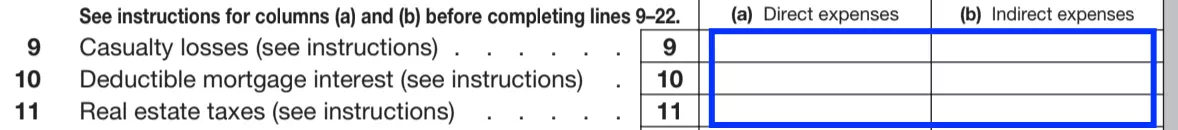

Start entering expenses

Next, we move on to listing costs. As we mentioned above, there are direct and indirect costs. Be careful to enter the costs into the correct column. Enter the amounts of the full expenses without reducing them.

Add up your first costs

In line 12, you need to get the sum of costs that you wrote above. If you had indirect expenses listed, then in line 13, you must enter the result that you will get from multiplying line 12 by the percentage indicated in line 7. This will give you the sum of expenses that relate specifically to your home office.

Sum up expenses

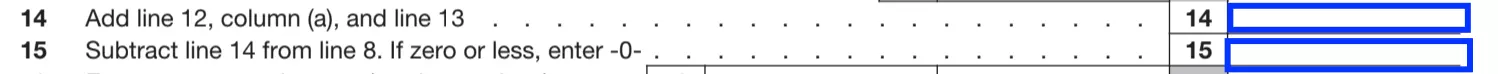

Next, you need to add both types of expenses; for this, add the numbers from lines 12 and 13.

Subtract the resulting amount from the number specified in line 8. If you get a negative value or 0, then enter “0”.

Keep adding expenses

Enter costs in the table, remembering to ensure that direct and indirect ones are entered in the appropriate column.

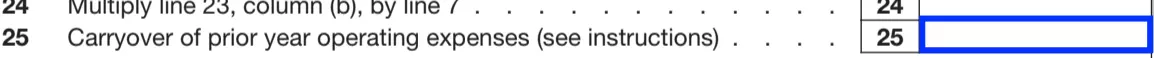

On line 23, get the sum in each type. Indirect expenses again need to be multiplied by the percentage specified in point 7.

Indicate last year’s operating expenses

Use the number shown on last year’s form in line 43.

Make calculations

In the next three lines, you just need to make the calculations indicated in the instructions.

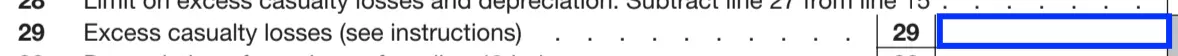

Calculate excess casualty

If you also had additional excess home losses specified in line 9, then in this paragraph, you must multiply the excess amount by the percentage from paragraph 7.

Continue making calculations

Transfer numbers and calculations by following clear instructions. Do not forget to pay attention to the explanations for some of the lines.

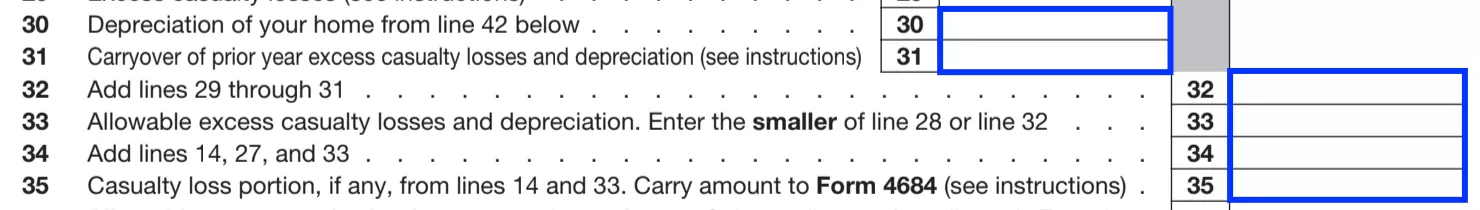

Get the number of eligible costs for commercial use of the home

We pass to the final point of the second part of the form, in which we get the number of allowable expenses. To do this, subtract the number specified in line 35 from the number in line 34.

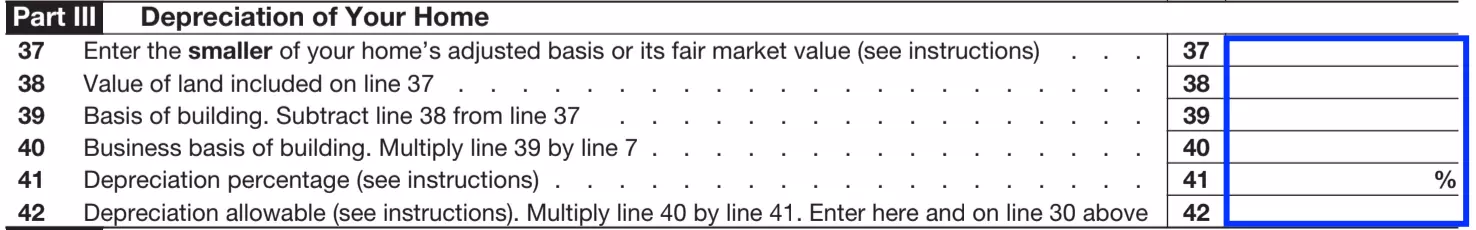

Calculate home depreciation

On the next lines, you will calculate the allowable depreciation percentage.

You need to know the following information to fill in these lines correctly:

the cost of your home on the first day of starting work from the home and its market price;

the price and fair market value of the land on the first day of your home place office. Lines 37 and 38 indicate lower figures. Applying the instructions for lines 41 and 42, enter the depreciation percentage and get depreciation allowable.

Carryover some of the costs to the coming year

If your costs have exceeded the allowable limit, then you can take the opportunity to transfer part of the costs to the coming year. If you get a “0” on lines 43 and 44, you have no carryover costs.

This form is not a difficult paper that is intimidating at first. If you follow the guidance, you will have no difficulty in filling it out and getting a deduction.