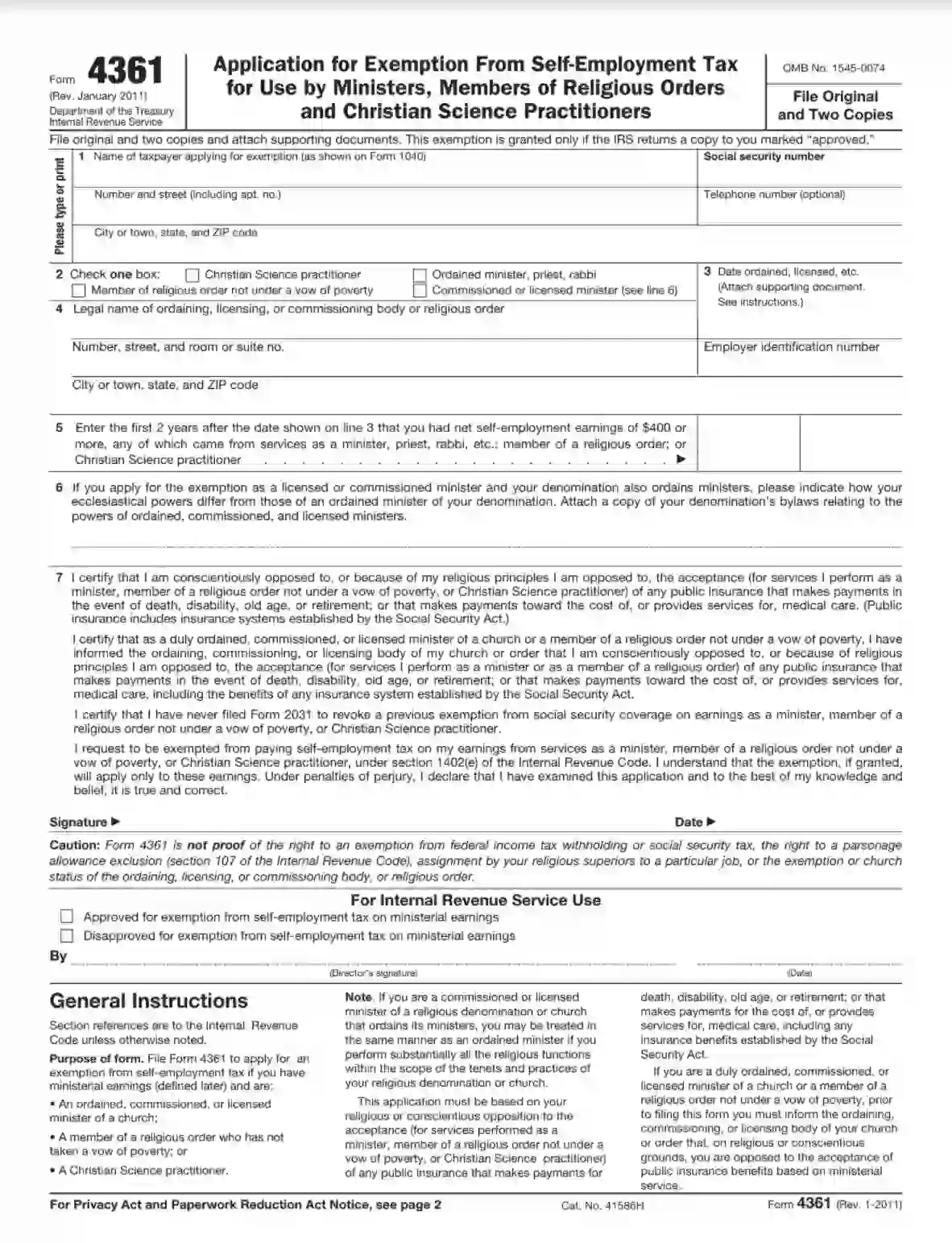

Form 4361 is a tax form used by ministers, members of religious orders, and Christian Science practitioners to apply for an exemption from self-employment tax. This exemption applies to individuals who have religious objections to receiving Social Security benefits and are therefore ineligible for them. IRS Form 4361 allows these individuals to request an exemption from paying self-employment tax on their income derived from ministerial services or the practice of their religion.

The primary purpose of Form 4361 is to allow eligible individuals to apply for an exemption from self-employment tax based on religious objections to receiving Social Security benefits. By completing and submitting this form to the Internal Revenue Service (IRS), ministers, members of religious orders, and Christian Science practitioners can seek relief from paying self-employment tax on income related to their religious services.

Other IRS Forms for Self-employed

Here are some IRS forms from the category of Others that you might want to familiarize yourself with.

Steps to Fill the Document Out

This paper is relatively short and easy to complete. That is why you may not wish to seek help from a legal professional. Use our form-building software to obtain a customized downloadable Form 4361. Here is how you are required to fill it out:

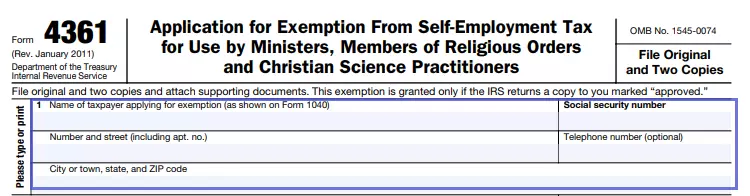

Provide Personal Data

Begin by indicating your full name. You must provide your name exactly as shown in Form 1040 in case you have sources of income other than ministerial earnings. Then, input your mailing address, including city, state, and zip. Do not forget to submit the Social Security Number. If you want, fill out the telephone number of yours (optional).

Indicate Your Religious Status

Check one box that identifies you as a church member.

Insert the Date of Authorization

You are required to enter the month, date, and year of when you have become an ordained, licensed, or commissioned minister, member of a religious order, or Christian Science practitioner. Please do not file the form until receiving a document that approves your certification. If you have already got one, attach it to the form you are submitting so that the IRS can verify the data.

Enter the Religious Organization Info

The organization that issues your license must be a church exempt from federal tax. If you are able to prove that, provide appropriate documentation along with the letter, you are mailing.

Insert the data of this church in Section 4. This will include its legal name, address, and EIN. After that, provide the two years subsequent authorization.

Input Additional Data

If you represent a non-standard denomination, provide information about its bylaws.

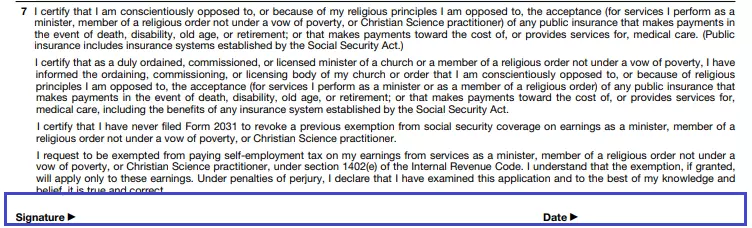

Sign the Form

Study the next Section carefully prior to appending your signature. Make sure that you understand all the terms and conditions and are ready to express your written consent. Sign and date the paper if you are.